Wisp Template For Tax Professionals

Wisp Template For Tax Professionals - Talk with adp® sales today. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Making the wisp available to employees. Web our free information security plan template, which you can download for free by filling out the form, covers topics that range from: Web the written information security plan (wisp) is a special security plan that helps tax professionals protect their sensitive data and information. Publication 5708, creating a written information security plan for your tax & accounting. What should be included in the written information security plan (wisp)? Web the summit released a wisp template in august 2022. Web the wisp template is required for tax professionals by the irs and helps to ensure that important records are accurate and available, allowing the person filing their taxes the. Web once completed, tax professionals should keep their wisp in a format that others can easily read, such as pdf or word. Web once completed, tax professionals should keep their wisp in a format that others can easily read, such as pdf or word. Web creating a written information security plan or wisp is an often overlooked but critical component. Making the wisp available to employees. What should be included in the written information security plan (wisp)? Talk with adp® sales today. Making the wisp available to employees. All tax and accounting firms should do the following:. | natp and data security expert brad messner discuss the irs's newly released security. Include the name of all information. Web the irs also has a wisp template in publication 5708. Making the wisp available to employees. Web the irs also has a wisp template in publication 5708. Free to use and modify to fit your needs. Include the name of all information. Web creating a written information security plan or wisp is an often overlooked but critical component. Web creating a written information security plan or wisp is an often overlooked but critical component. Web our free information security plan template, which you can download for free by filling out the form, covers topics that range from: Include the name of all information. Web once completed, tax professionals should keep their wisp in a format that others can. Web our free information security plan template, which you can download for free by filling out the form, covers topics that range from: All tax and accounting firms should do the following:. Ad the irs requires written information security plans to protect data. Here are tips to keep a wisp effective: Web the written information security plan (wisp) is a. Web the wisp is a “guide to walk tax pros through the many considerations needed to create a written plan to protect their businesses and their clients, as well as. Once completed, tax professionals should keep their. Ad reliably fast and accurate payroll tax service by adp®. Web our free information security plan template, which you can download for free. Written information security plan (wisp) for. Web maintaining a wisp a good security plan requires regular maintenance and upkeep. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. Here are tips to keep a wisp effective: Not only is a wisp essential for your business and a good business. Web creating a plan tax professionals should make sure to do these things when writing and following their data security plans: Once completed, tax professionals should keep their. Web the irs also has a wisp template in publication 5708. Ad reliably fast and accurate payroll tax service by adp®. Free to use and modify to fit your needs. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. Web once completed, tax professionals should keep their wisp in a format that others can easily read, such as pdf or word. Publication 5708, creating a written information security plan for your tax & accounting. Download our free template today! Web. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. Web creating a written information security plan or wisp is an often overlooked but critical component. Once completed, tax professionals should keep their. What should be included in the written information security plan (wisp)? Web once completed, tax professionals should keep. Publication 5708, creating a written information security plan for your tax & accounting. Web the irs also has a wisp template in publication 5708. Web in conjunction with the security summit, irs has now released a sample security plan designed to help tax pros, especially those with smaller practices, protect their data and. Ad reliably fast and accurate payroll tax service by adp®. Web the wisp is a “guide to walk tax pros through the many considerations needed to create a written plan to protect their businesses and their clients, as well as. All tax and accounting firms should do the following:. Web creating a written information security plan or wisp is an often overlooked but critical component. Here are tips to keep a wisp effective: Free to use and modify to fit your needs. Web once completed, tax professionals should keep their wisp in a format that others can easily read, such as pdf or word. Web the wisp template is required for tax professionals by the irs and helps to ensure that important records are accurate and available, allowing the person filing their taxes the. Web maintaining a wisp a good security plan requires regular maintenance and upkeep. Web the written information security plan (wisp) is a special security plan that helps tax professionals protect their sensitive data and information. Once completed, tax professionals should keep their. Talk to adp® sales about payroll, tax, hr, & more! What should be included in the written information security plan (wisp)? This document is for general distribution and is available to all. Ad the irs requires written information security plans to protect data. Include the name of all information. Web once completed, tax professionals should keep their wisp in a format that others can easily read, such as pdf or word. Web once completed, tax professionals should keep their wisp in a format that others can easily read, such as pdf or word. Web once completed, tax professionals should keep their wisp in a format that others can easily read, such as pdf or word. Web creating a plan tax professionals should make sure to do these things when writing and following their data security plans: Talk with adp® sales today. Once completed, tax professionals should keep their. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Web the summit released a wisp template in august 2022. Web the written information security plan (wisp) is a special security plan that helps tax professionals protect their sensitive data and information. Download our free template today! Free to use and modify to fit your needs. Making the wisp available to employees. Publication 5708, creating a written information security plan for your tax & accounting. Here are tips to keep a wisp effective: Web maintaining a wisp a good security plan requires regular maintenance and upkeep. Web the wisp template is required for tax professionals by the irs and helps to ensure that important records are accurate and available, allowing the person filing their taxes the. Include the name of all information.Employee And Employer Social Security Contributions MPLOYERTA

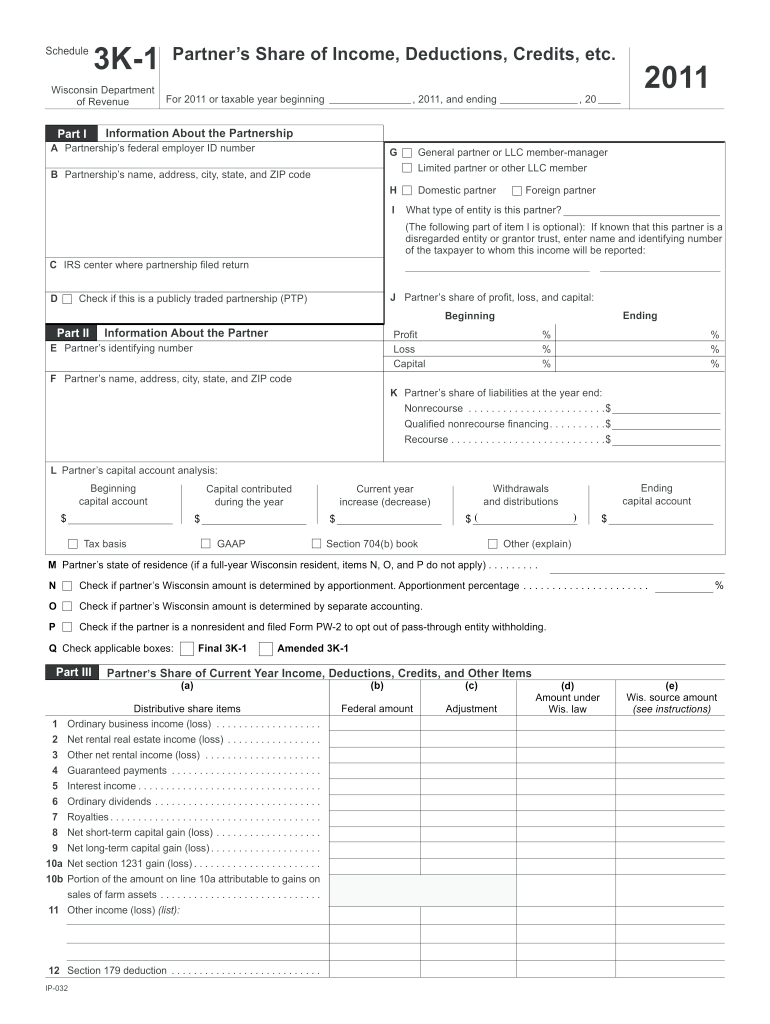

Wis Dept Revenue Partnership Form1065 Fill Out and Sign Printable PDF

Tax Prep Checklist 2022 Printable Printable World Holiday

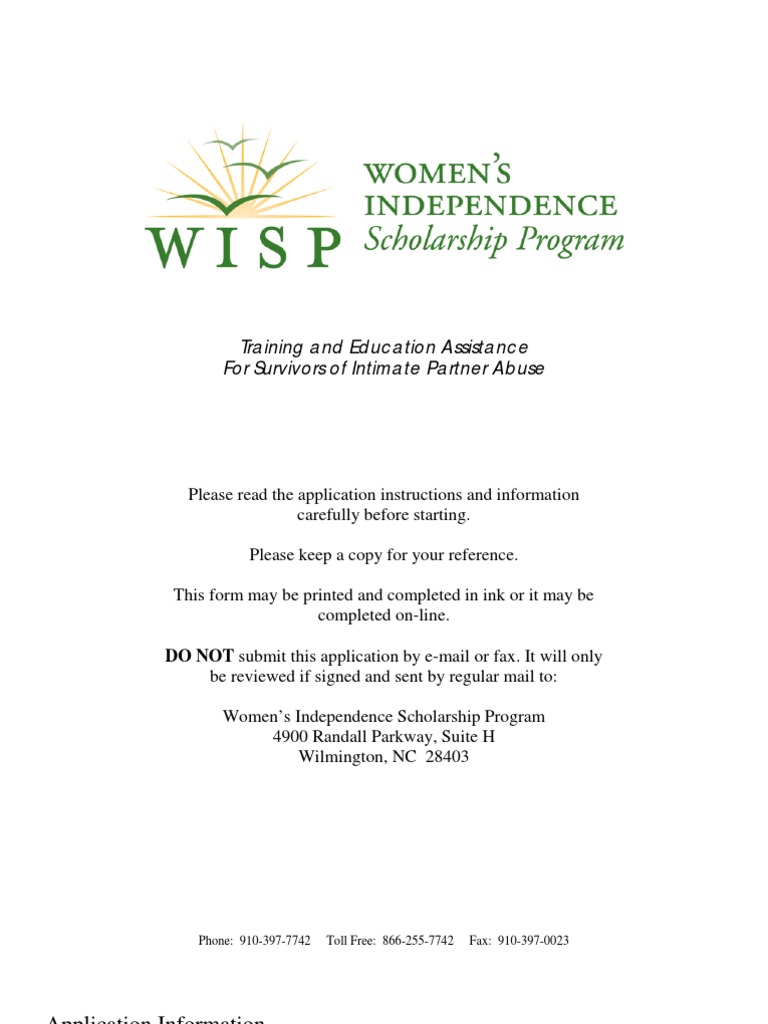

WISP Application Form Student Loan Irs Tax Forms

The Tax Preparation Checklist Your Accountant Wants You to Use in 2020

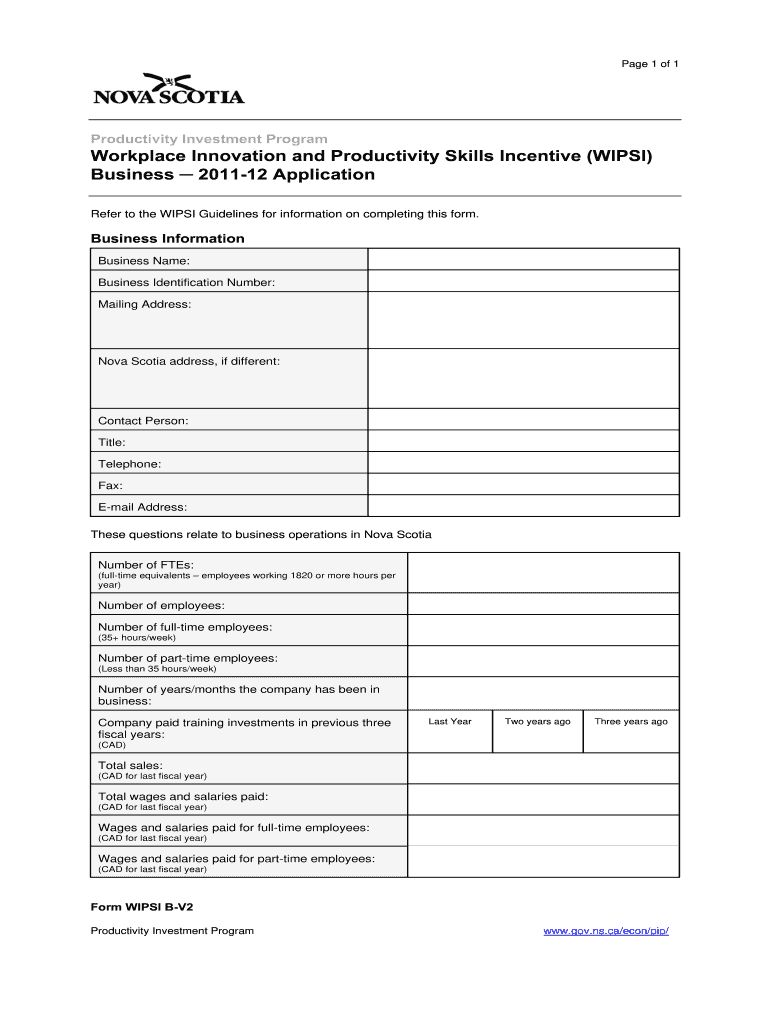

Wipsi Fill Out and Sign Printable PDF Template signNow

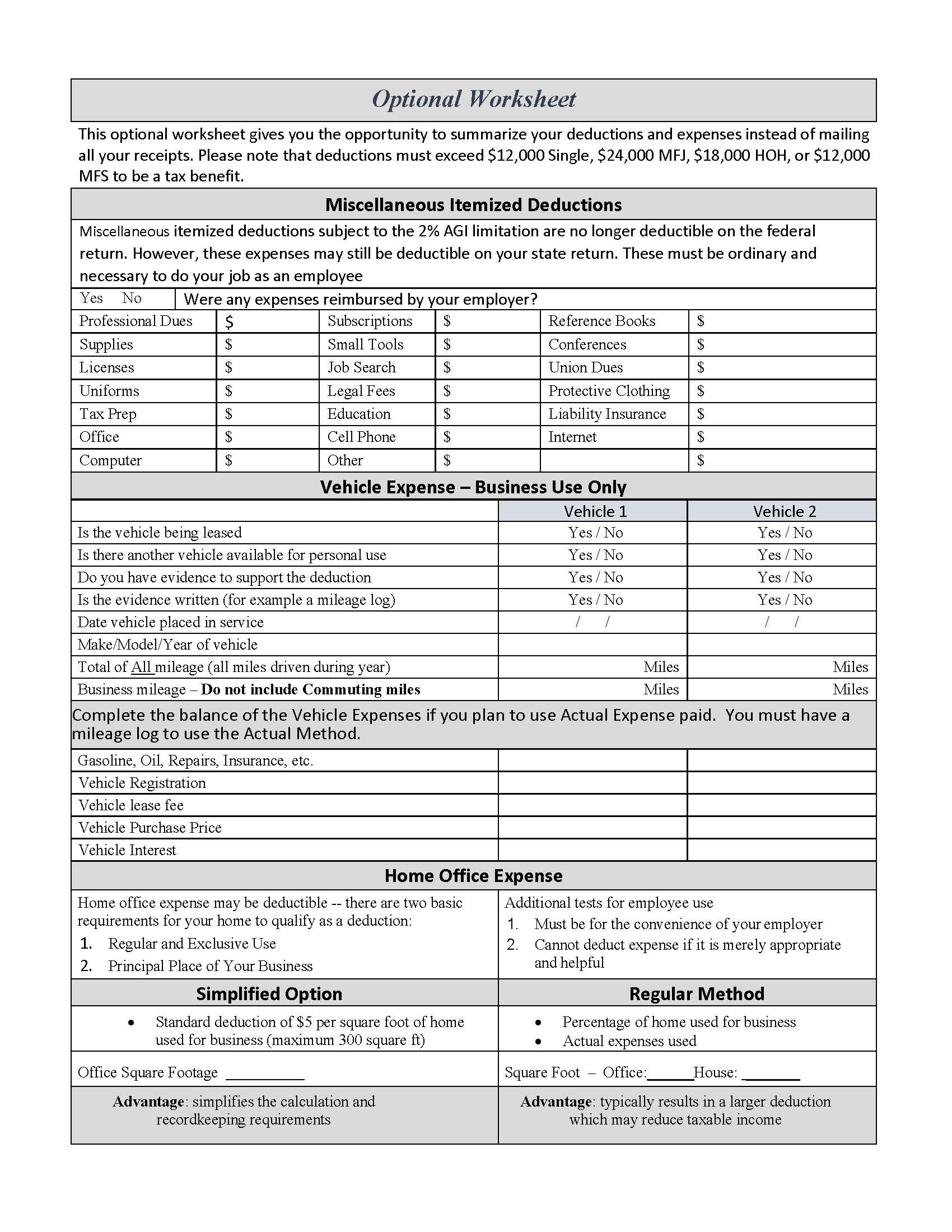

Tax Preparation Worksheet —

Irs Wisp Template

Tax Preparation Client Intake Form Template Master of

2162012 WISP Document From Vartel,LLC Personally Identifiable

Web Creating A Written Information Security Plan Or Wisp Is An Often Overlooked But Critical Component.

Web In Conjunction With The Security Summit, Irs Has Now Released A Sample Security Plan Designed To Help Tax Pros, Especially Those With Smaller Practices, Protect Their Data And.

| Natp And Data Security Expert Brad Messner Discuss The Irs's Newly Released Security.

Web The Irs Also Has A Wisp Template In Publication 5708.

Related Post: