Wacc Excel Template

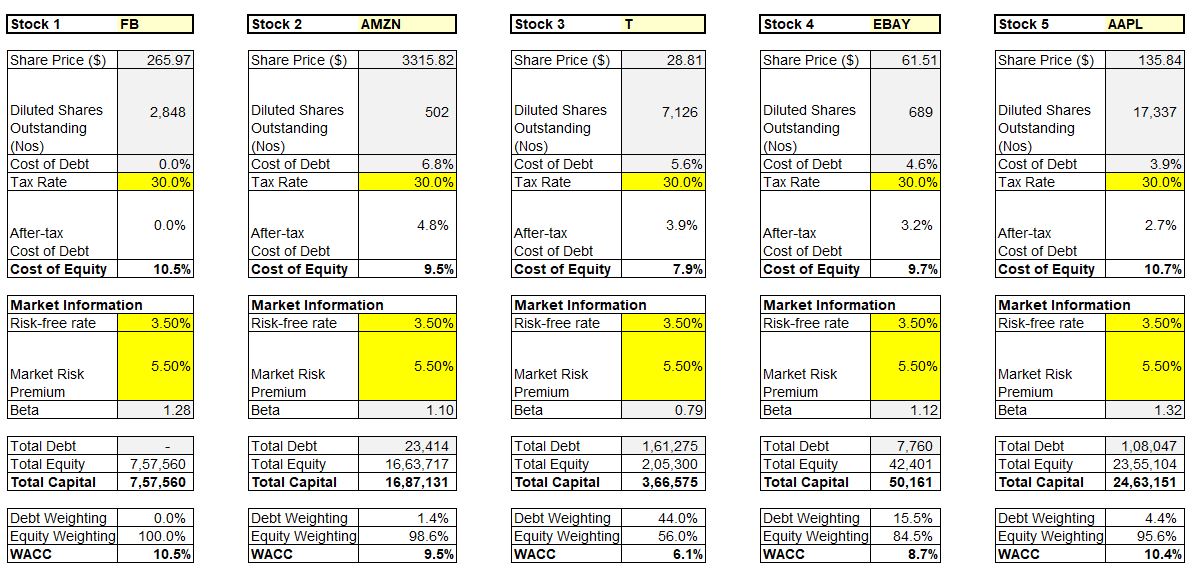

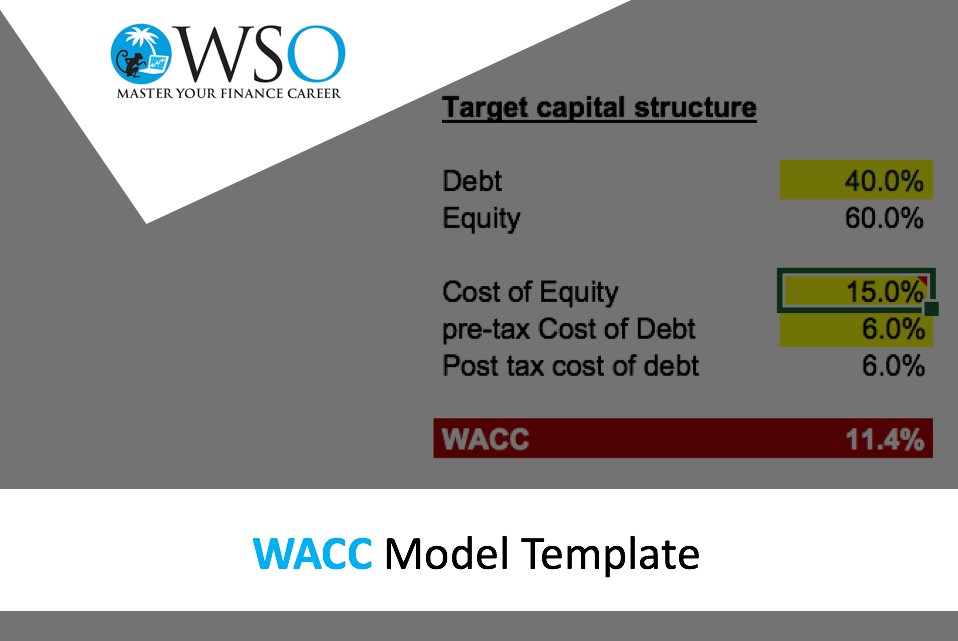

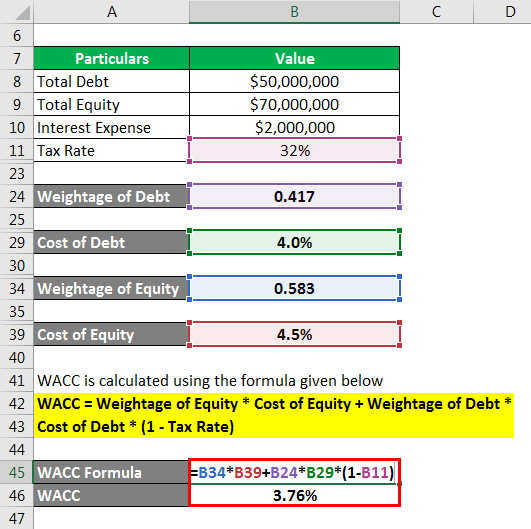

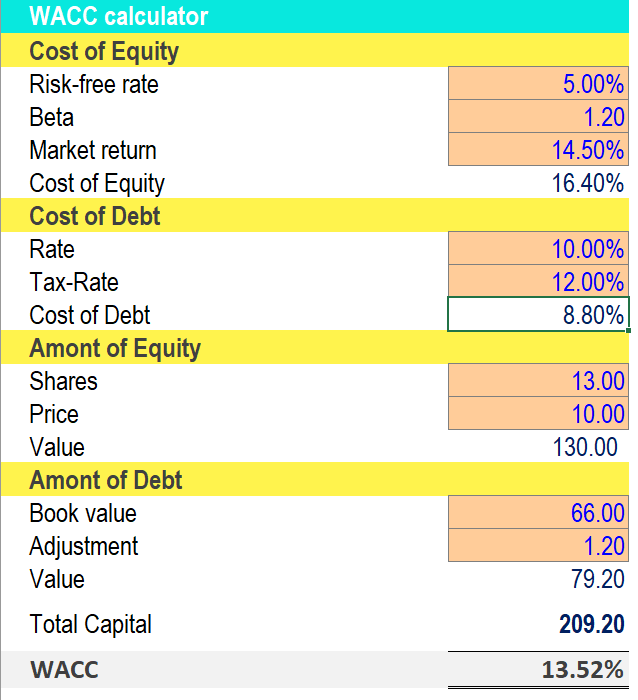

Wacc Excel Template - Video tutorial and excel templates if you’d prefer to watch rather than read, you can get this [very long] tutorial below: Web this wacc calculator helps you calculate wacc based on capital structure, cost of equity, cost of debt, and tax rate. Calculate the weight of debt and equity output the weighted average cost of capital (wacc) is. This simple wacc calculator is a free excel template for calculating weighted average cost of capital based on the proportions of capital structure,. Web the weighted average cost of capital (wacc) excel template is a dynamic financial tool that simplifies the calculation of your firm’s wacc. Web updated july 3, 2023 what is the wacc formula? Web this excel model is for educational purposes only. Web sheet1 4estimating the weighted average cost of capital input cells are in yellow. Web in this video, we show how to calculate the wacc (weighted average cost of capital) of a company in excel. To find the weight of the equity and debt,. Web what weighted average cost of capital formula firstly and most essentially, we need to understand the theoretical formula of wacc which is calculated as follows: Calculate the weight of debt and equity output the weighted average cost of capital (wacc) is. Web this excel model is for educational purposes only. Web the weighted average cost of capital (wacc) excel. Web to find the weighted average cost of capital, multiply the weight of value for the debt and equity with the cost of the debt and equity. Web updated july 3, 2023 what is the wacc formula? Calculate the weight of debt and equity output the weighted average cost of capital (wacc) is. This simple wacc calculator is a free. Comparable companies firm 1 firm 2 firm 3 average data amount of equity Web another way of looking at wacc is to see it as the minimum rate of return an enterprise should earn in order to create value for its investors. Web this wacc calculator helps you calculate wacc based on capital structure, cost of equity, cost of debt,. Video tutorial and excel templates if you’d prefer to watch rather than read, you can get this [very long] tutorial below: Web sheet1 4estimating the weighted average cost of capital input cells are in yellow. This simple wacc calculator is a free excel template for calculating weighted average cost of capital based on the proportions of capital structure,. Calculate the. Web the weighted average cost of capital (wacc) excel template is a dynamic financial tool that simplifies the calculation of your firm’s wacc. Weighted average cost of capital. Video tutorial and excel templates if you’d prefer to watch rather than read, you can get this [very long] tutorial below: Web to find the weighted average cost of capital, multiply the. Web sheet1 4estimating the weighted average cost of capital input cells are in yellow. The term “wacc” is the acronym for a weighted average cost of capital (wacc), a financial metric that helps. To find the weight of the equity and debt,. The wacc is the weighted average cost of capital or the discount. Web to find the weighted average. Web updated august 17, 2023 definition of wacc a firm’s weighted average cost of capital (wacc) represents its blended cost of capital across all sources,. Web this excel model calculates the weighted average cost of capital (wacc) or discount rate which is used when building a dcf model to discount future cash flows to firm to their. Comparable companies firm. Web this wacc calculator helps you calculate wacc based on capital structure, cost of equity, cost of debt, and tax rate. Web updated august 17, 2023 definition of wacc a firm’s weighted average cost of capital (wacc) represents its blended cost of capital across all sources,. Web this excel model is for educational purposes only. Weighted average cost of capital.. Web to find the weighted average cost of capital, multiply the weight of value for the debt and equity with the cost of the debt and equity. Video tutorial and excel templates if you’d prefer to watch rather than read, you can get this [very long] tutorial below: To find the weight of the equity and debt,. The term “wacc”. Web to find the weighted average cost of capital, multiply the weight of value for the debt and equity with the cost of the debt and equity. Calculate the weight of debt and equity output the weighted average cost of capital (wacc) is. Weighted average cost of capital. Web another way of looking at wacc is to see it as. Web another way of looking at wacc is to see it as the minimum rate of return an enterprise should earn in order to create value for its investors. Web this excel model is for educational purposes only. Web in this video, we show how to calculate the wacc (weighted average cost of capital) of a company in excel. Web the weighted average cost of capital (wacc) excel template is a dynamic financial tool that simplifies the calculation of your firm’s wacc. Video tutorial and excel templates if you’d prefer to watch rather than read, you can get this [very long] tutorial below: Comparable companies firm 1 firm 2 firm 3 average data amount of equity Web sheet1 4estimating the weighted average cost of capital input cells are in yellow. This simple wacc calculator is a free excel template for calculating weighted average cost of capital based on the proportions of capital structure,. Web updated july 3, 2023 what is the wacc formula? Web this wacc calculator helps you calculate wacc based on capital structure, cost of equity, cost of debt, and tax rate. Web what weighted average cost of capital formula firstly and most essentially, we need to understand the theoretical formula of wacc which is calculated as follows: Web this excel model calculates the weighted average cost of capital (wacc) or discount rate which is used when building a dcf model to discount future cash flows to firm to their. Weighted average cost of capital. To find the weight of the equity and debt,. Web updated august 17, 2023 definition of wacc a firm’s weighted average cost of capital (wacc) represents its blended cost of capital across all sources,. Web to find the weighted average cost of capital, multiply the weight of value for the debt and equity with the cost of the debt and equity. The term “wacc” is the acronym for a weighted average cost of capital (wacc), a financial metric that helps. Calculate the weight of debt and equity output the weighted average cost of capital (wacc) is. The wacc is the weighted average cost of capital or the discount. Web this wacc calculator helps you calculate wacc based on capital structure, cost of equity, cost of debt, and tax rate. Web what weighted average cost of capital formula firstly and most essentially, we need to understand the theoretical formula of wacc which is calculated as follows: Calculate the weight of debt and equity output the weighted average cost of capital (wacc) is. Comparable companies firm 1 firm 2 firm 3 average data amount of equity Web the weighted average cost of capital (wacc) excel template is a dynamic financial tool that simplifies the calculation of your firm’s wacc. Web sheet1 4estimating the weighted average cost of capital input cells are in yellow. Web in this video, we show how to calculate the wacc (weighted average cost of capital) of a company in excel. Video tutorial and excel templates if you’d prefer to watch rather than read, you can get this [very long] tutorial below: Web updated august 17, 2023 definition of wacc a firm’s weighted average cost of capital (wacc) represents its blended cost of capital across all sources,. Web updated july 3, 2023 what is the wacc formula? Web to find the weighted average cost of capital, multiply the weight of value for the debt and equity with the cost of the debt and equity. To find the weight of the equity and debt,. Web another way of looking at wacc is to see it as the minimum rate of return an enterprise should earn in order to create value for its investors. This simple wacc calculator is a free excel template for calculating weighted average cost of capital based on the proportions of capital structure,. Web this excel model calculates the weighted average cost of capital (wacc) or discount rate which is used when building a dcf model to discount future cash flows to firm to their.Wacc Excel Template templates.iesanfelipe.edu.pe

10 Wacc Excel Template Excel Templates

10 Wacc Excel Template Excel Templates

Wacc Excel Template templates.iesanfelipe.edu.pe

Weighted Average Cost of Capital (WACC) Template Free Excel Template

Wacc Excel Template templates.iesanfelipe.edu.pe

Wacc Excel Template templates.iesanfelipe.edu.pe

Wacc Excel Template templates.iesanfelipe.edu.pe

Wacc Excel Template templates.iesanfelipe.edu.pe

Wacc Excel Template templates.iesanfelipe.edu.pe

Weighted Average Cost Of Capital.

The Term “Wacc” Is The Acronym For A Weighted Average Cost Of Capital (Wacc), A Financial Metric That Helps.

The Wacc Is The Weighted Average Cost Of Capital Or The Discount.

Web This Excel Model Is For Educational Purposes Only.

Related Post: