W4 Form Printable

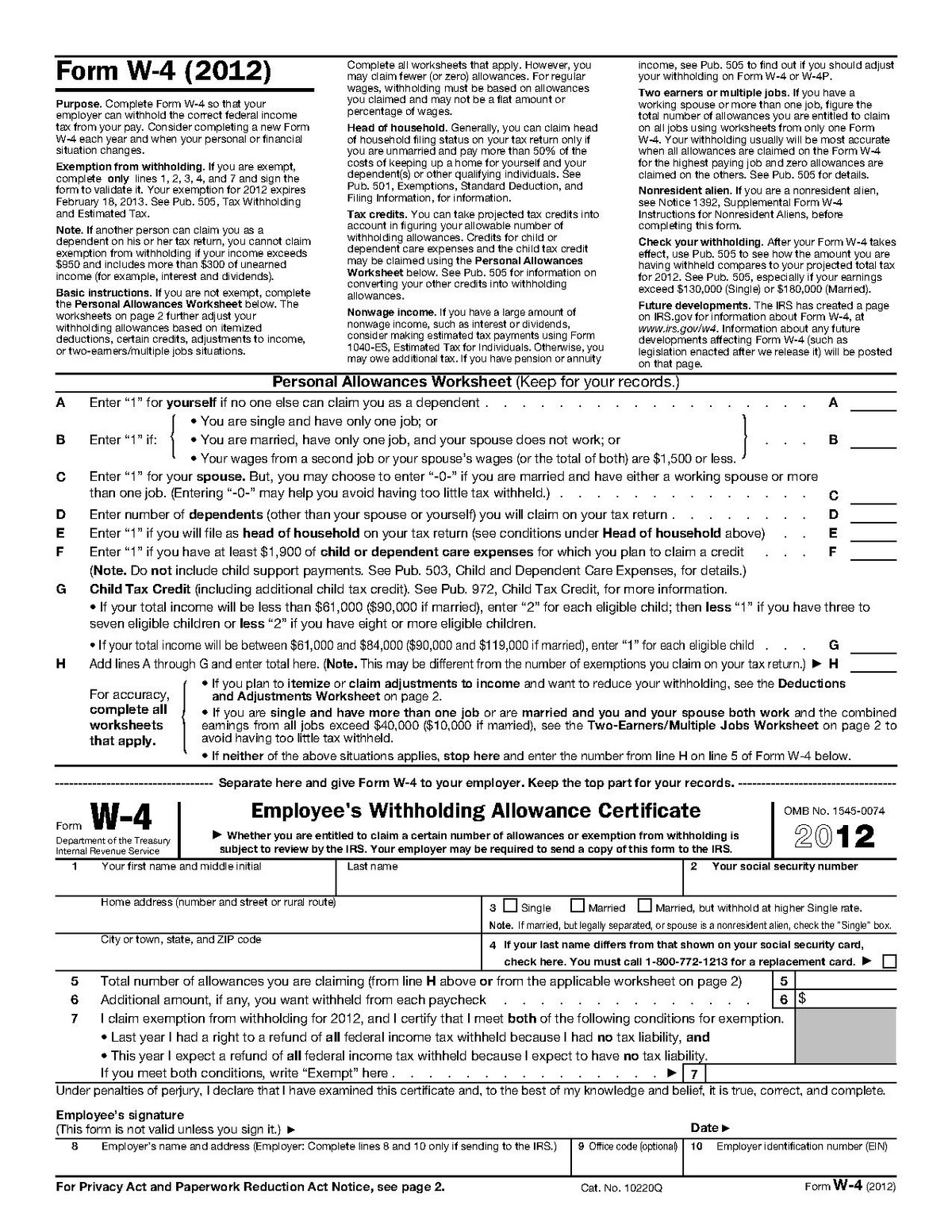

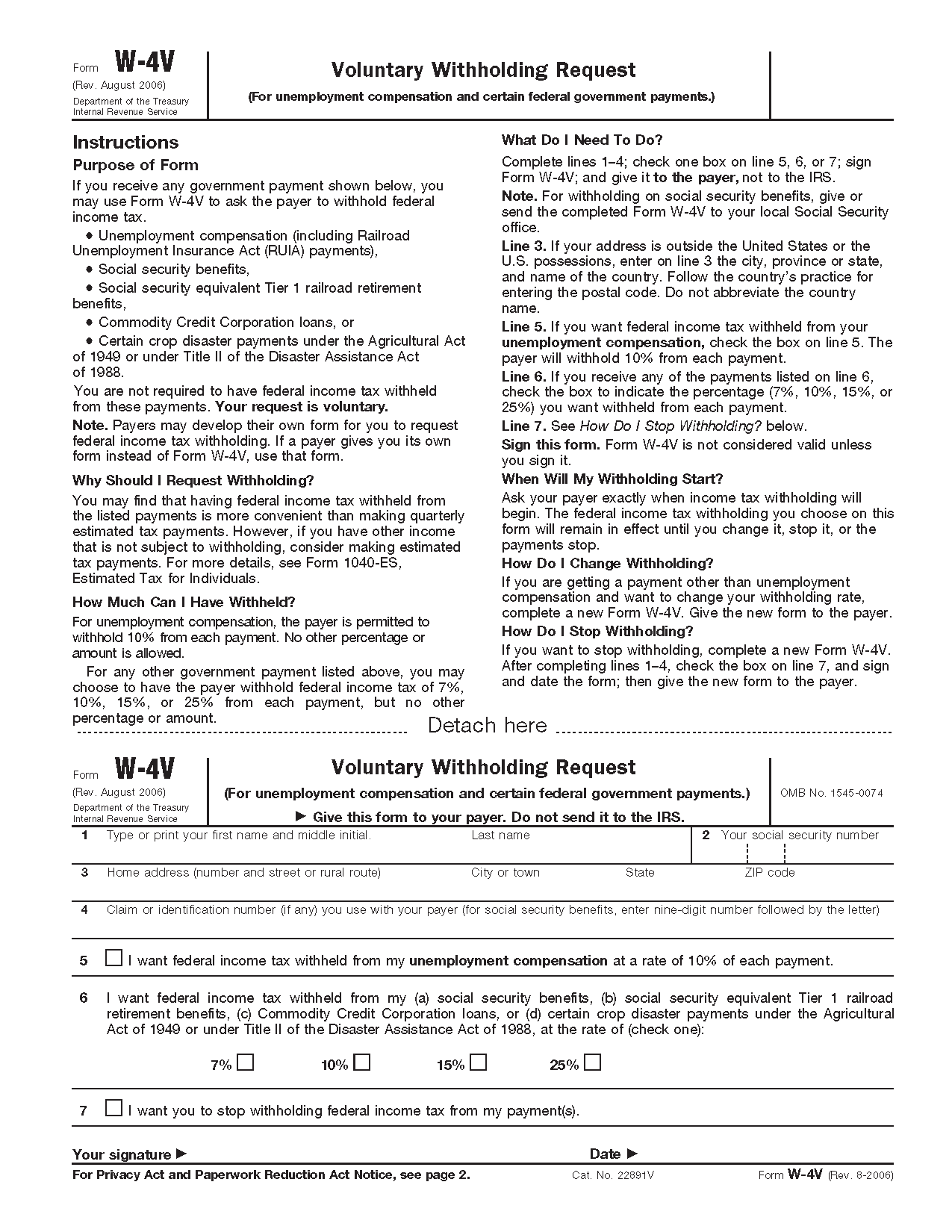

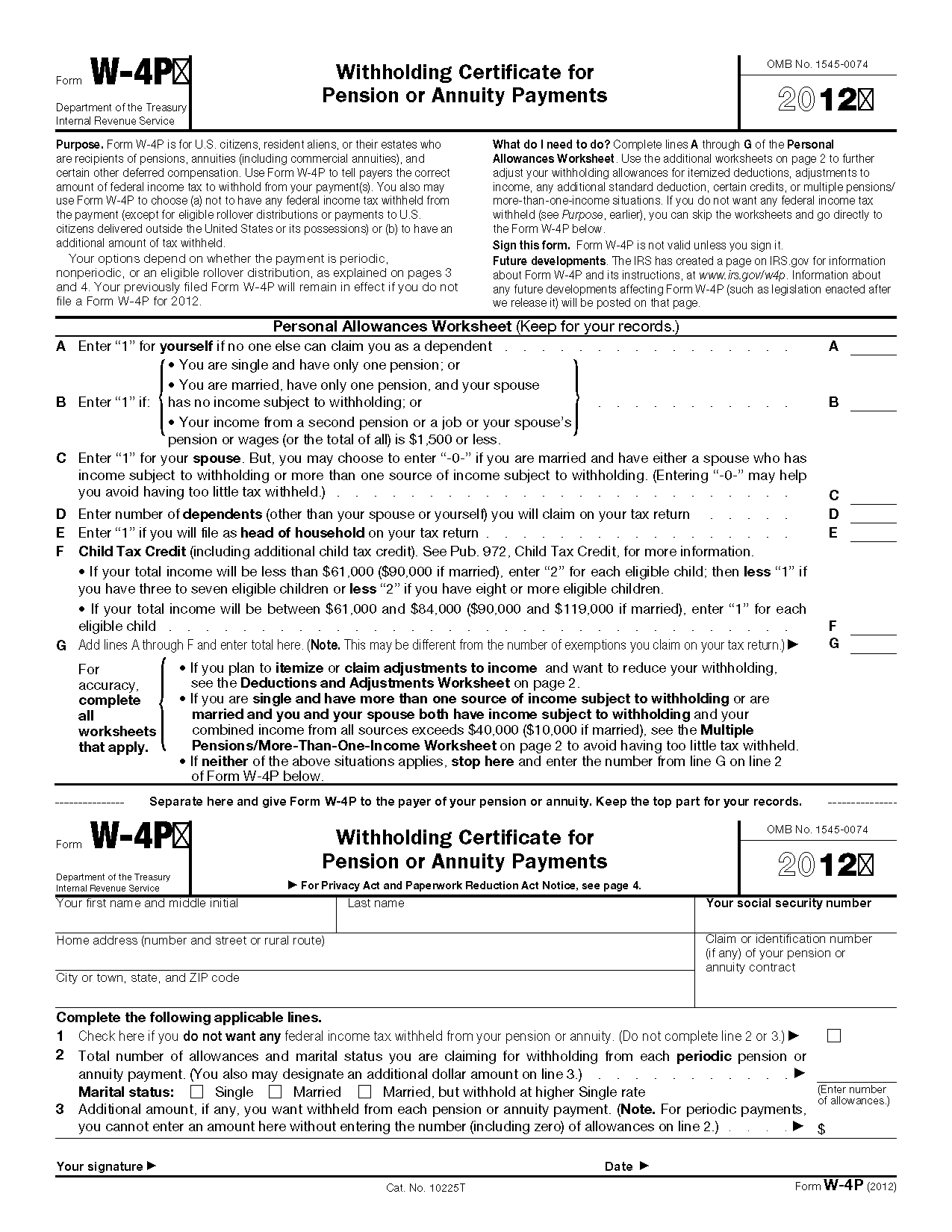

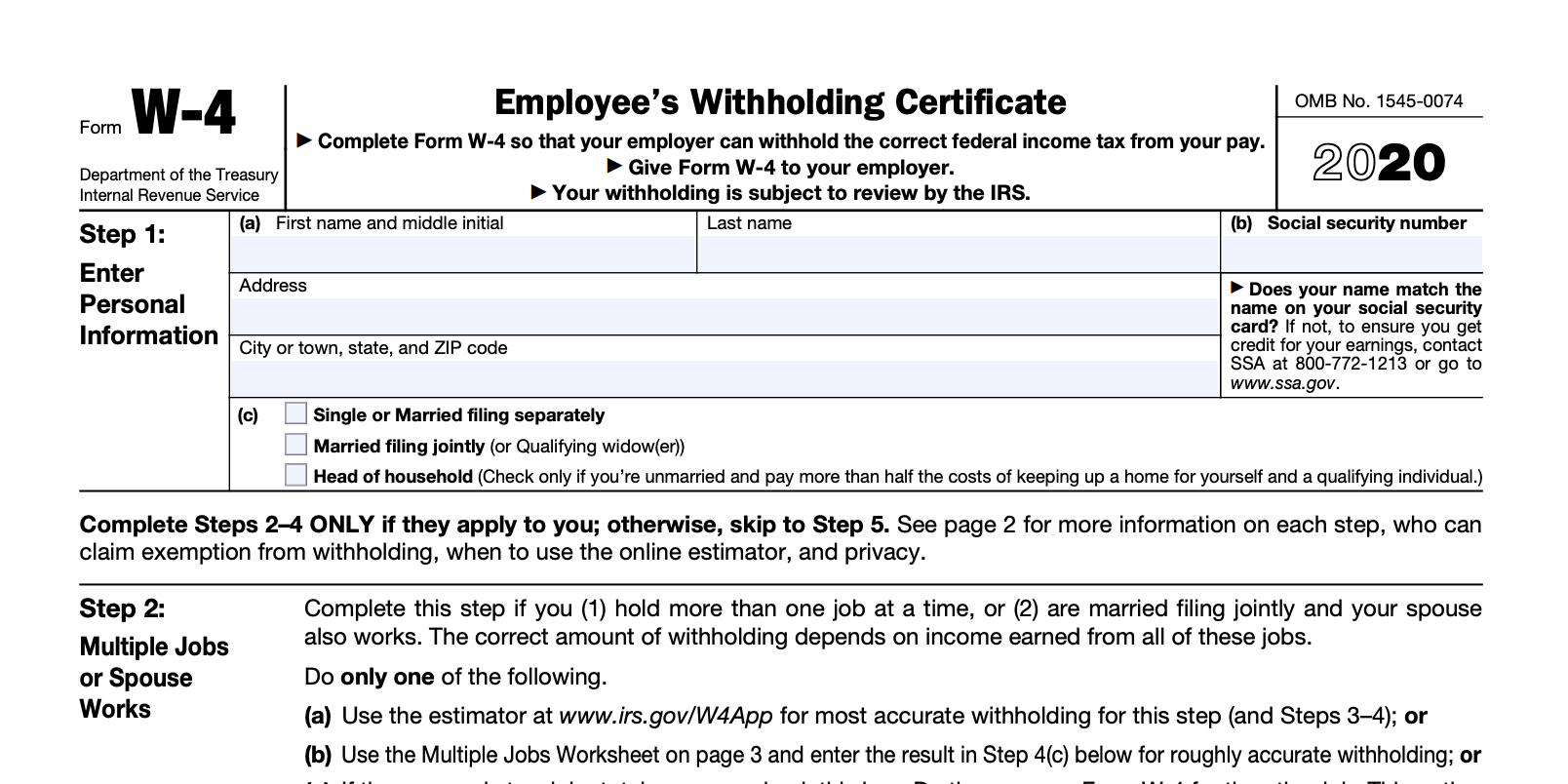

W4 Form Printable - Employers engaged in a trade or business. Web updated august 05, 2023. Web filed withholding form, add that amount to the amount on line 9b of worksheet 2 and enter the total on line 3 of your new withholding form. Enter all other required information. If too little is withheld, you will generally owe tax when you file your tax return. You have to submit only the 1st page that includes the aforementioned 5 steps. Department of the treasury internal revenue service. Then, find the social security office closest to your home. Your withholding is subject to review by the. December 2020) department of the. If too little is withheld, you will generally owe tax when you file your tax return. December 2020) department of the. Then, find the social security office closest to your home. Web filed withholding form, add that amount to the amount on line 9b of worksheet 2 and enter the total on line 3 of your new withholding form. Web. Web updated august 05, 2023. You have to submit only the 1st page that includes the aforementioned 5 steps. Amazon.com has been visited by 1m+ users in the past month Employee's withholding certificate form 941; For maryland state government employees only. Web filed withholding form, add that amount to the amount on line 9b of worksheet 2 and enter the total on line 3 of your new withholding form. Web mail or fax us a request to withhold taxes. Enter all other required information. Amazon.com has been visited by 1m+ users in the past month For maryland state government employees only. For maryland state government employees only. Amazon.com has been visited by 1m+ users in the past month Web mail or fax us a request to withhold taxes. You have to submit only the 1st page that includes the aforementioned 5 steps. Enter all other required information. Enter all other required information. Use the 2nd page for calculations to. Web mail or fax us a request to withhold taxes. See page 2 for more information on each step, who can claim. If too little is withheld, you will generally owe tax when you file your tax return. Web updated august 05, 2023. Amazon.com has been visited by 1m+ users in the past month Then, find the social security office closest to your home. You have to submit only the 1st page that includes the aforementioned 5 steps. December 2020) department of the. Employee's withholding certificate form 941; Otherwise, skip to step 5. Amazon.com has been visited by 1m+ users in the past month Department of the treasury internal revenue service. Employers engaged in a trade or business. You have to submit only the 1st page that includes the aforementioned 5 steps. Employers engaged in a trade or business. Employee's withholding certificate form 941; If too little is withheld, you will generally owe tax when you file your tax return. Department of the treasury internal revenue service. See page 2 for more information on each step, who can claim. December 2020) department of the. Web updated august 05, 2023. Voluntary withholding request from the irs' website. Enter all other required information. Then, find the social security office closest to your home. You have to submit only the 1st page that includes the aforementioned 5 steps. Amazon.com has been visited by 1m+ users in the past month Department of the treasury internal revenue service. Employers engaged in a trade or business. Voluntary withholding request from the irs' website. Your withholding is subject to review by the. Web filed withholding form, add that amount to the amount on line 9b of worksheet 2 and enter the total on line 3 of your new withholding form. If too little is withheld, you will generally owe tax when you file your tax return. Enter all other required information. December 2020) department of the. Otherwise, skip to step 5. Web updated august 05, 2023. Employers engaged in a trade or business. For maryland state government employees only. Department of the treasury internal revenue service. Employee's withholding certificate form 941; Web mail or fax us a request to withhold taxes. If too little is withheld, you will generally owe tax when you file your tax return. Then, find the social security office closest to your home. You have to submit only the 1st page that includes the aforementioned 5 steps. Amazon.com has been visited by 1m+ users in the past month Use the 2nd page for calculations to. See page 2 for more information on each step, who can claim. Voluntary withholding request from the irs' website. Otherwise, skip to step 5. Your withholding is subject to review by the. You have to submit only the 1st page that includes the aforementioned 5 steps. Use the 2nd page for calculations to. Department of the treasury internal revenue service. Web updated august 05, 2023. Then, find the social security office closest to your home. If too little is withheld, you will generally owe tax when you file your tax return. Web mail or fax us a request to withhold taxes. Enter all other required information. Amazon.com has been visited by 1m+ users in the past month Employee's withholding certificate form 941; If too little is withheld, you will generally owe tax when you file your tax return. For maryland state government employees only.What you should know about the new Form W4 Atlantic Payroll Partners

How To Correctly Fill Out Your W4 Form Youtube Free Printable W 4

W4v Form 2022 Printable Printable World Holiday

Il W 4 2020 2022 W4 Form

Irs Form W4V Printable Form W 4v Identification Or Claim Number Fill

Federal W 4 Worksheet 2020 Printable & Fillable Online Blank

Free Printable W 4 Form For Employees Printable Templates

2022 Printable Irs Forms W 4 New Blank Tax PDF

Free Printable W 4 Forms 2022 W4 Form

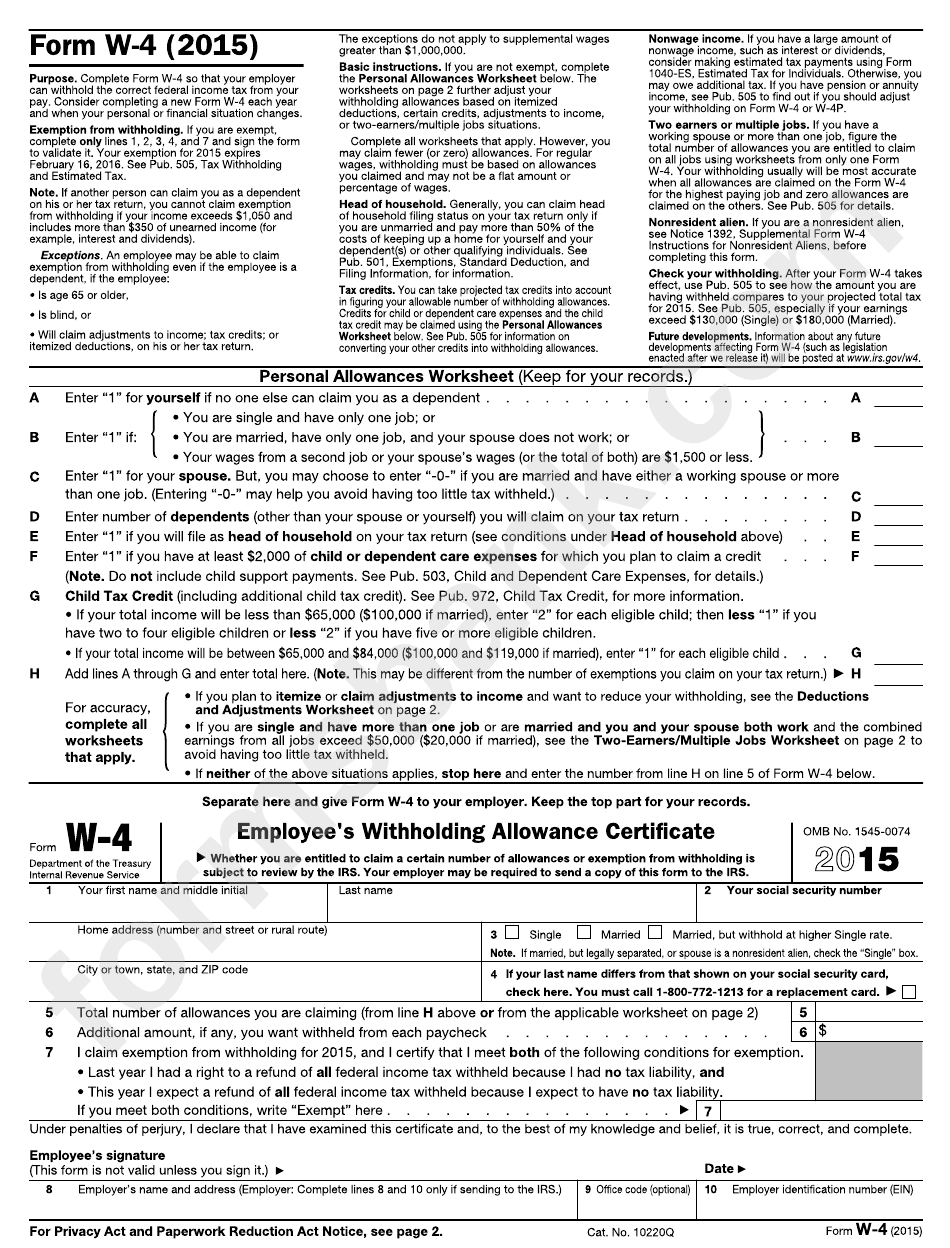

Form W4 Employee'S Withholding Allowance Certificate 2015

See Page 2 For More Information On Each Step, Who Can Claim.

December 2020) Department Of The.

Employers Engaged In A Trade Or Business.

Web Filed Withholding Form, Add That Amount To The Amount On Line 9B Of Worksheet 2 And Enter The Total On Line 3 Of Your New Withholding Form.

Related Post: