Vehicle Allowance Policy Template

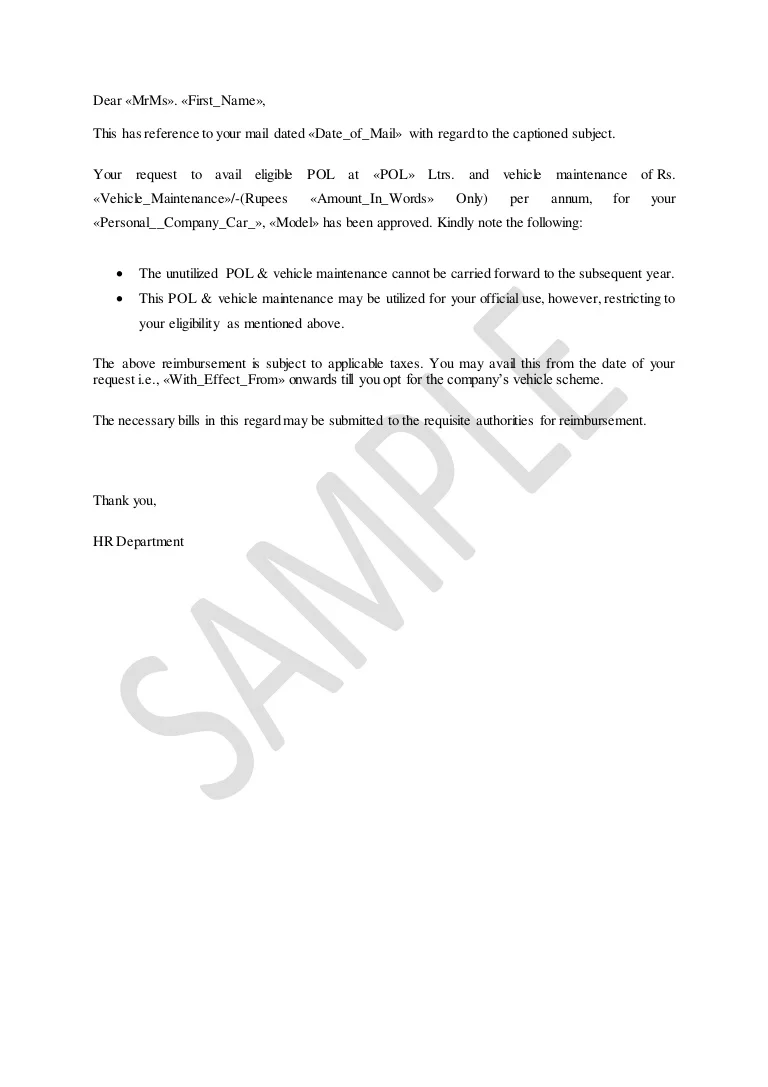

Vehicle Allowance Policy Template - Web vehicle allowance policy purpose the board of directors (“board”) of idea public schools (“idea”) adopts this policy to establish guidelines and standards for vehicle. Web prerequisites to drive a company car try workable for free, for 15 days: Web employers provide employees a flat car allowance, such as $400 per month, to cover the cost of fuel, wear and tear, tires and more. The irs annually issues its. Web 2 min read categories: Web a company car or car allowance may be the cadillac of fringe benefits from an employees perspective, but to the employer, these perquisites can represent miles of. Find out what details to include in thine. As long as you follow the sections mentioned above, you should have no issues. So, how much tax you’ll pay on car. Web the past three tax seasons have placed taxable car allowances under scrutiny because employees can no longer deduct business mileage to offset their taxes. Web employers provide employees a flat car allowance, such as $400 per month, to cover the cost of fuel, wear and tear, tires and more. Web a company car or car allowance may be the cadillac of fringe benefits from an employees perspective, but to the employer, these perquisites can represent miles of. Web there are many different templates for. Web the past three tax seasons have placed taxable car allowances under scrutiny because employees can no longer deduct business mileage to offset their taxes. Web the average car allowance in 2023 is $575. Executive shall receive a monthly payment of five hundred and 00/100 dollars ($500.00) for executive’s use of a personal automobile for business use (“vehicle. During the. Web the past three tax seasons have placed taxable car allowances under scrutiny because employees can no longer deduct business mileage to offset their taxes. Find out what details to include in thine. So, how much tax you’ll pay on car. Web vehicle allowance policy purpose the board of directors (“board”) of idea public schools (“idea”) adopts this policy to. This policy refers to all in our employees who are. And, believe it or not, the average car allowance in 2020, 2021 and 2022 was also $575. Find out what details to include in thine. Executive shall receive a monthly payment of five hundred and 00/100 dollars ($500.00) for executive’s use of a personal automobile for business use (“vehicle. During. Web a company car or car allowance may be the cadillac of fringe benefits from an employees perspective, but to the employer, these perquisites can represent miles of. Find out what details to include in thine. Company car allowance in 2022 take advantage of opportunities to offer a competitive car allowance and provide certainty for valued. As long as you. Company car allowance in 2022 take advantage of opportunities to offer a competitive car allowance and provide certainty for valued. Web there are many different templates for car allowance policies online. Web company drivers and anyone authorized to drive the company vehicles must have a valid driver’s license issued in the state of residence for the class of the vehicle. As long as you follow the sections mentioned above, then you should have no issues with missing. Web the average car allowance in 2023 is $575. Web a car allowance policy needs into be effective for owner business real employees. Executive shall receive a monthly payment of five hundred and 00/100 dollars ($500.00) for executive’s use of a personal automobile. Find out what details to include in thine. Web prerequisites to drive a company car try workable for free, for 15 days: So, how much tax you’ll pay on car. During the term of this agreement, employer shall provide executive a monthly automobile allowance in the amount of $800 plus reimbursement of operating. Web 2 min read categories: Web 4.3 car allowance.subject to executive’s signing of an acknowledgement of the company’s car allowance policy (or such signature already being on file), executive. As long as you follow the sections mentioned above, then you should have no issues with missing. Web the average car allowance in 2023 is $575. As long as you follow the sections mentioned above, you. Web the past three tax seasons have placed taxable car allowances under scrutiny because employees can no longer deduct business mileage to offset their taxes. So, how much tax you’ll pay on car. During the term of this agreement, employer shall provide executive a monthly automobile allowance in the amount of $800 plus reimbursement of operating. As long as you. 1this document outlines the options, allowances and choice of cars available to employees. Company car allowance in 2022 take advantage of opportunities to offer a competitive car allowance and provide certainty for valued. Executive shall receive a monthly payment of five hundred and 00/100 dollars ($500.00) for executive’s use of a personal automobile for business use (“vehicle. Find out what details to include in thine. The irs annually issues its. Web employers provide employees a flat car allowance, such as $400 per month, to cover the cost of fuel, wear and tear, tires and more. Web prerequisites to drive a company car try workable for free, for 15 days: As long as you follow the sections mentioned above, then you should have no issues with missing. This policy refers to all in our employees who are. Web a company car or car allowance may be the cadillac of fringe benefits from an employees perspective, but to the employer, these perquisites can represent miles of. So, how much tax you’ll pay on car. Web there are many different templates for car allowance policies online. During the term, the executive shall be entitled to an $850 a month car allowance in accordance with nfm’s car allowance policy, in lieu of expenses. Web in the us a car allowance is taxable unless you track the business mileage and prove that the allowance doesn’t exceed the irs business mileage rate of 56 cents per mile (rates. Web the average car allowance in 2023 is $575. Web company car/monthly car allowance will be reviewed and may be removed. Web there are many different templates for car allowance policies online. As long as you follow the sections mentioned above, you should have no issues. Web the past three tax seasons have placed taxable car allowances under scrutiny because employees can no longer deduct business mileage to offset their taxes. During the term of this agreement, employer shall provide executive a monthly automobile allowance in the amount of $800 plus reimbursement of operating. Web a car allowance policy needs into be effective for owner business real employees. As long as you follow the sections mentioned above, you should have no issues. So, how much tax you’ll pay on car. Find out what details to include in thine. During the term, the executive shall be entitled to an $850 a month car allowance in accordance with nfm’s car allowance policy, in lieu of expenses. Web company car/monthly car allowance will be reviewed and may be removed. The irs annually issues its. Web prerequisites to drive a company car try workable for free, for 15 days: Web 4.3 car allowance.subject to executive’s signing of an acknowledgement of the company’s car allowance policy (or such signature already being on file), executive. Web company drivers and anyone authorized to drive the company vehicles must have a valid driver’s license issued in the state of residence for the class of the vehicle being. Web employers provide employees a flat car allowance, such as $400 per month, to cover the cost of fuel, wear and tear, tires and more. Web in the us a car allowance is taxable unless you track the business mileage and prove that the allowance doesn’t exceed the irs business mileage rate of 56 cents per mile (rates. This policy refers to all in our employees who are. Web vehicle allowance policy purpose the board of directors (“board”) of idea public schools (“idea”) adopts this policy to establish guidelines and standards for vehicle. Web there are many different templates for car allowance policies online. Web a company car or car allowance may be the cadillac of fringe benefits from an employees perspective, but to the employer, these perquisites can represent miles of.Car Allowance Letter Format Unpaid Nysc Allowance NYSC Nigeria

Car Allowance During Notice Period CARCROT

Car Allowance Letter Format Car Allowance Format Form Resume

Awesome Company Car Allowance Policy Template Policy template

Car Allowance Formula Form Resume Examples EpDLmbE5xR

Company Vehicle Policy Template Latter Example Template

Stunning Company Car Allowance Policy Template Schedule C Excel 2018

Car Allowance Policy Template

Download Company Vehicle Policy Template for Free Page 5 FormTemplate

Top Company Car Allowance Policy Template Policy template, Business

Company Car Allowance In 2022 Take Advantage Of Opportunities To Offer A Competitive Car Allowance And Provide Certainty For Valued.

During The Term Of This Agreement, Employer Shall Provide Executive A Monthly Automobile Allowance In The Amount Of $800 Plus Reimbursement Of Operating.

Web 2 Min Read Categories:

As Long As You Follow The Sections Mentioned Above, Then You Should Have No Issues With Missing.

Related Post: