Valuation Excel Templates

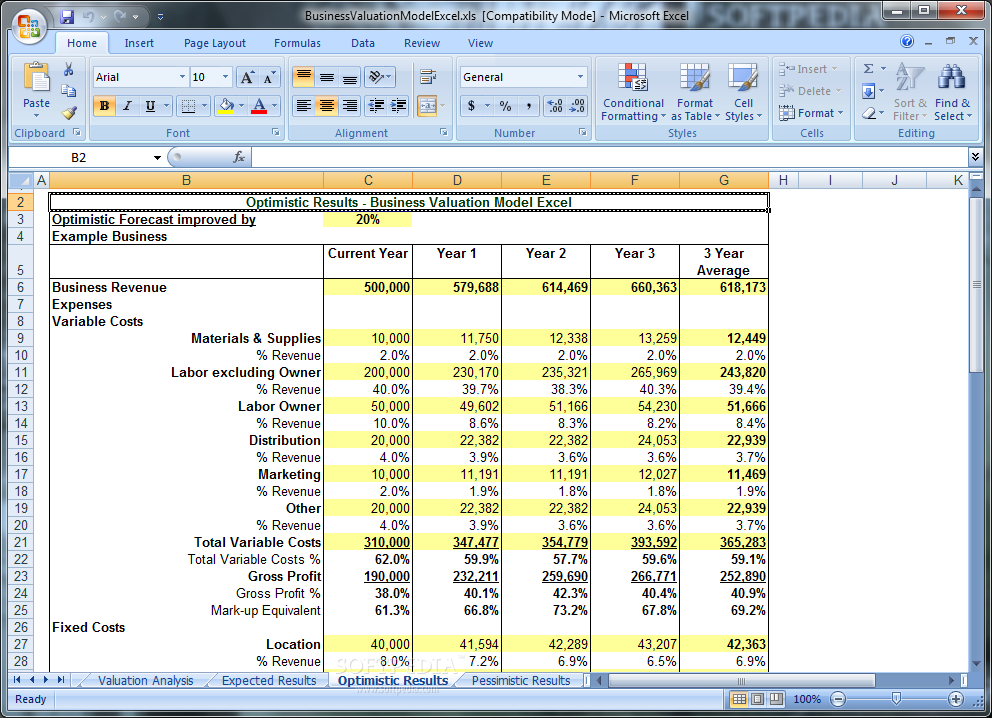

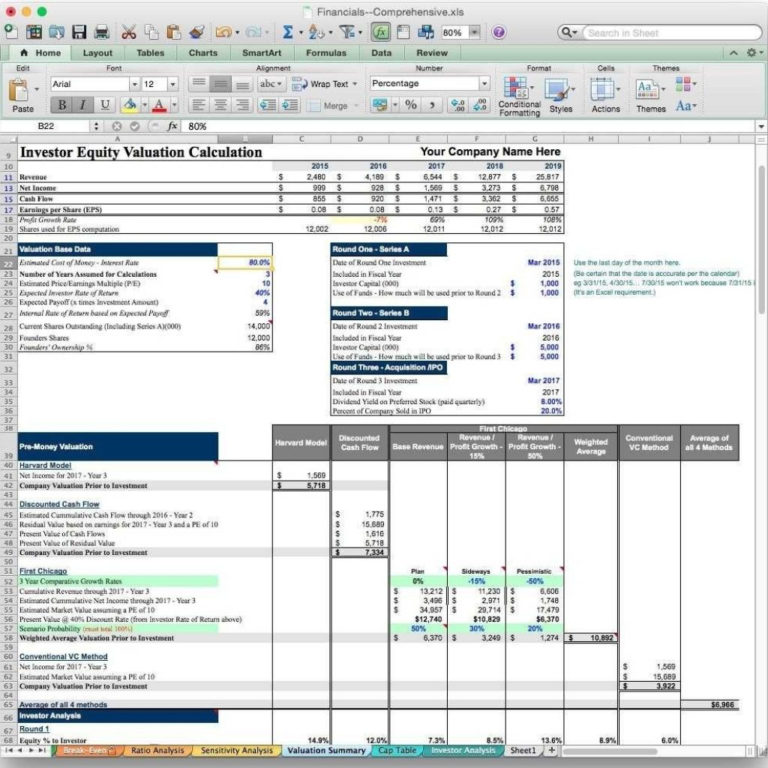

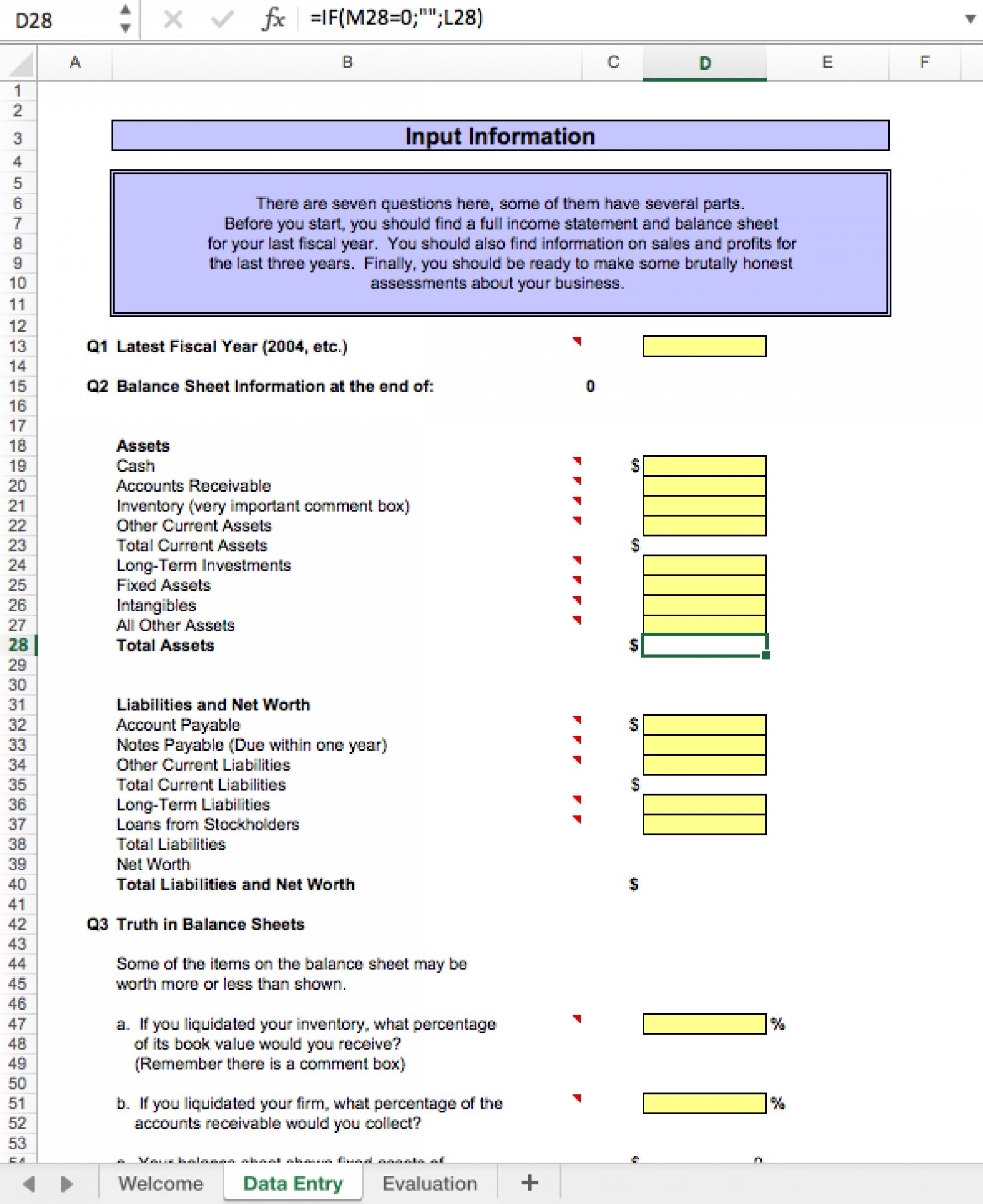

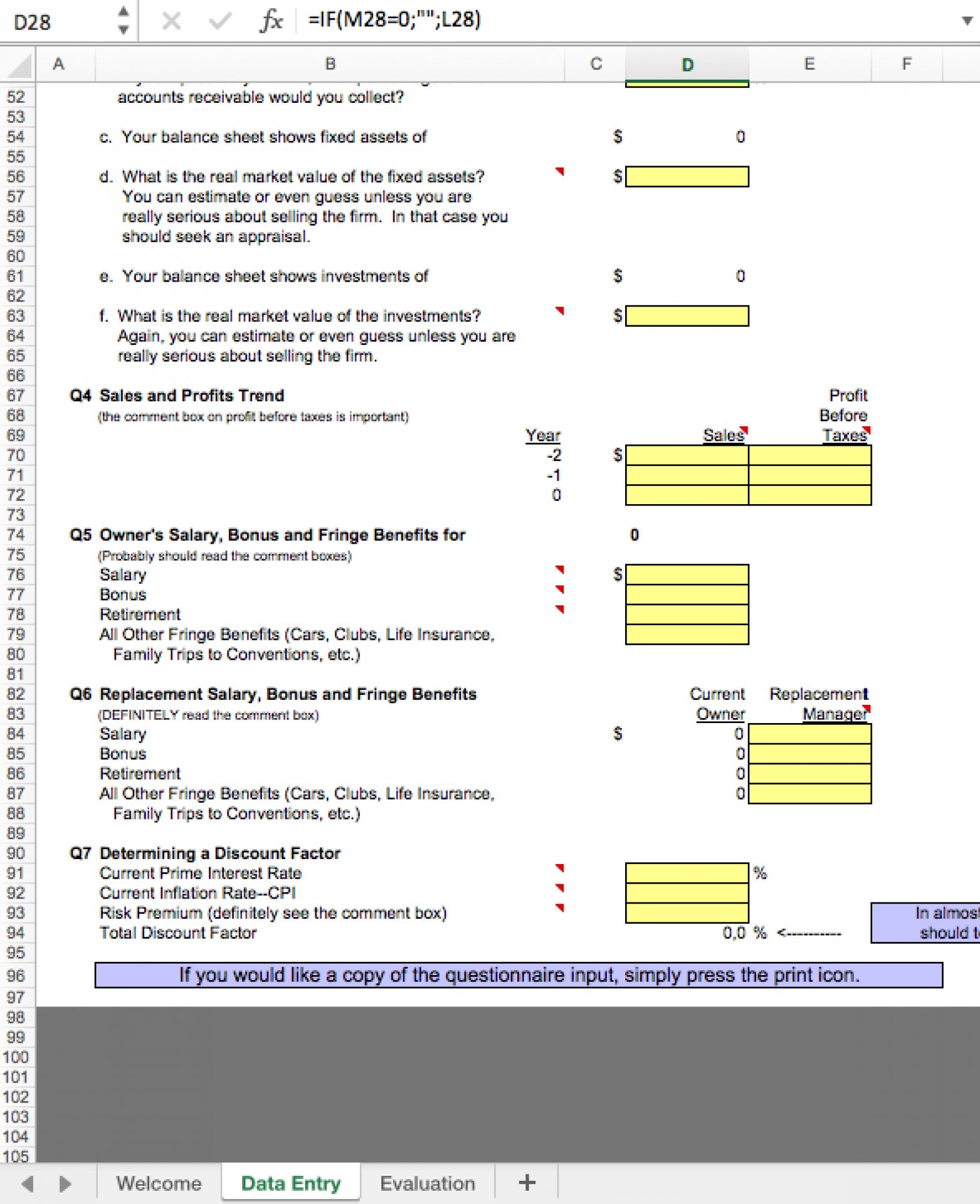

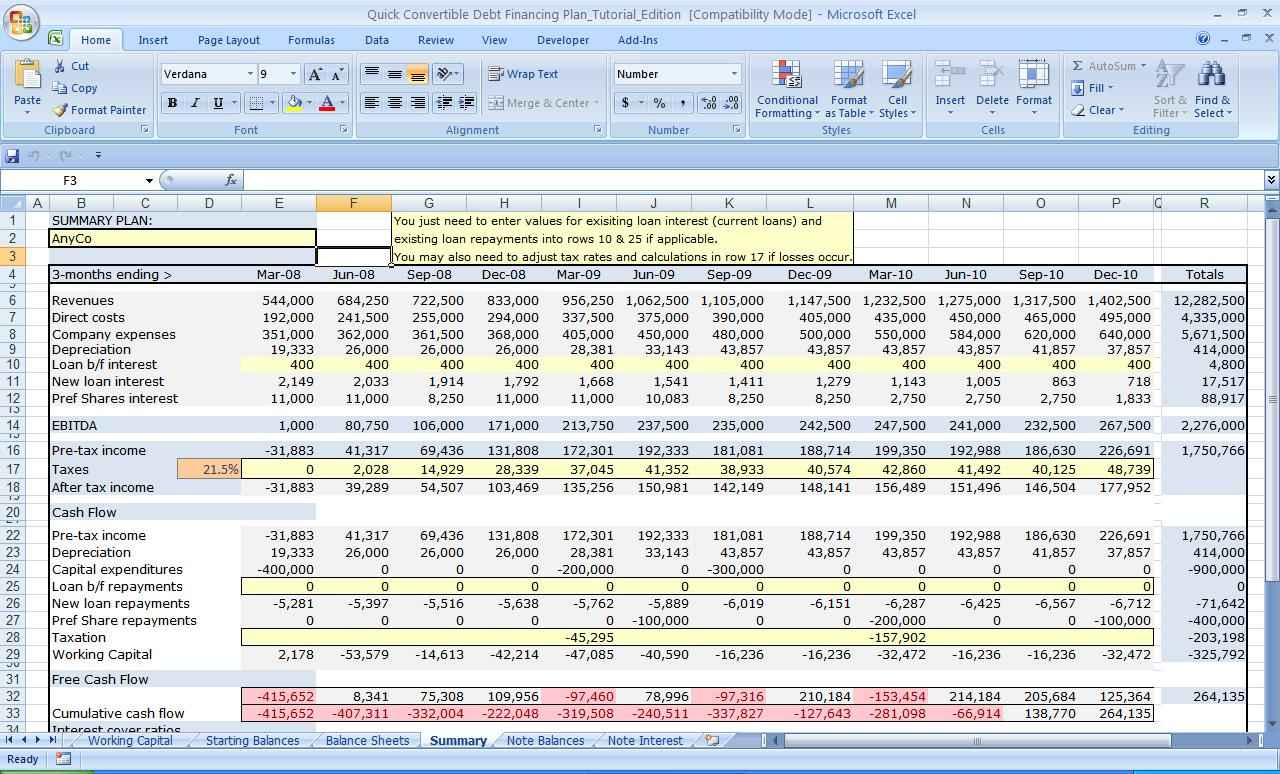

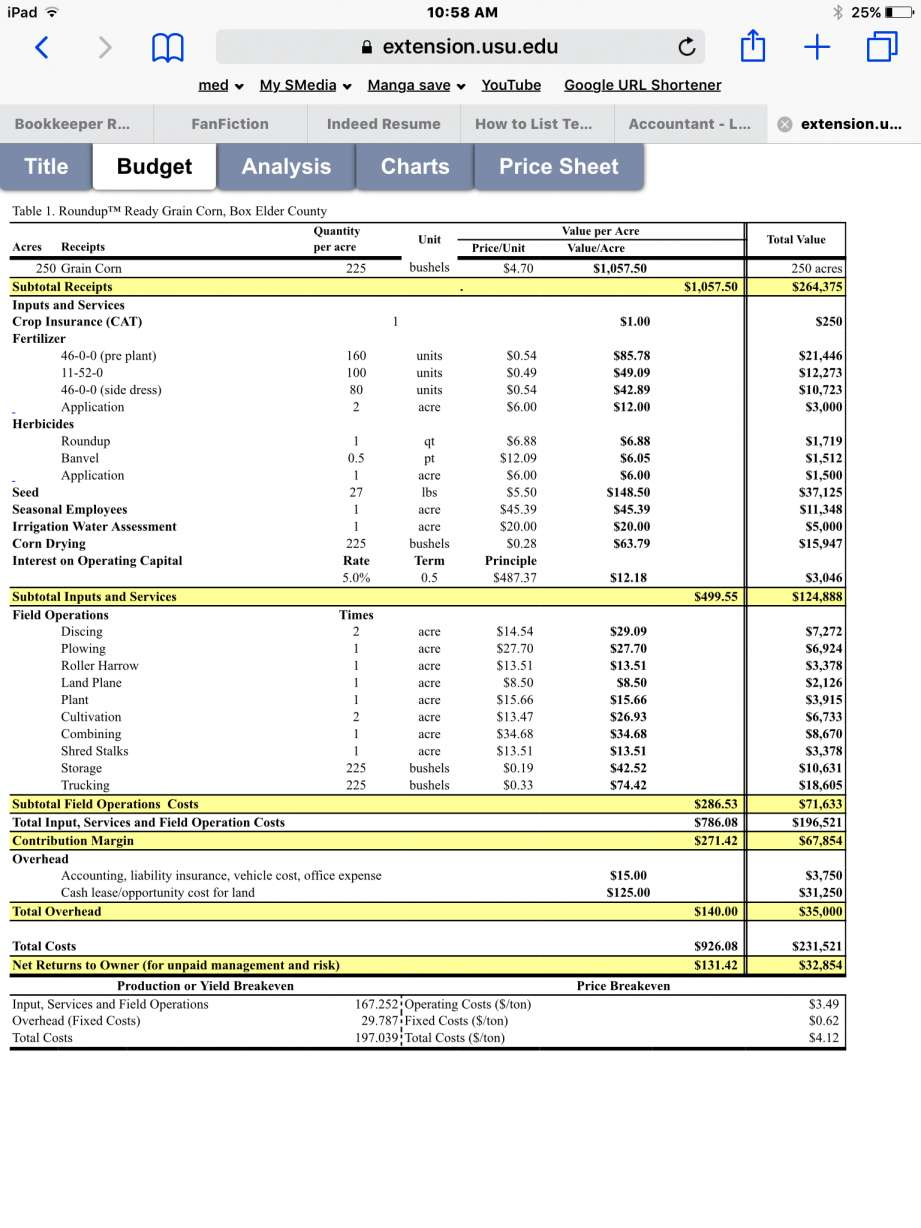

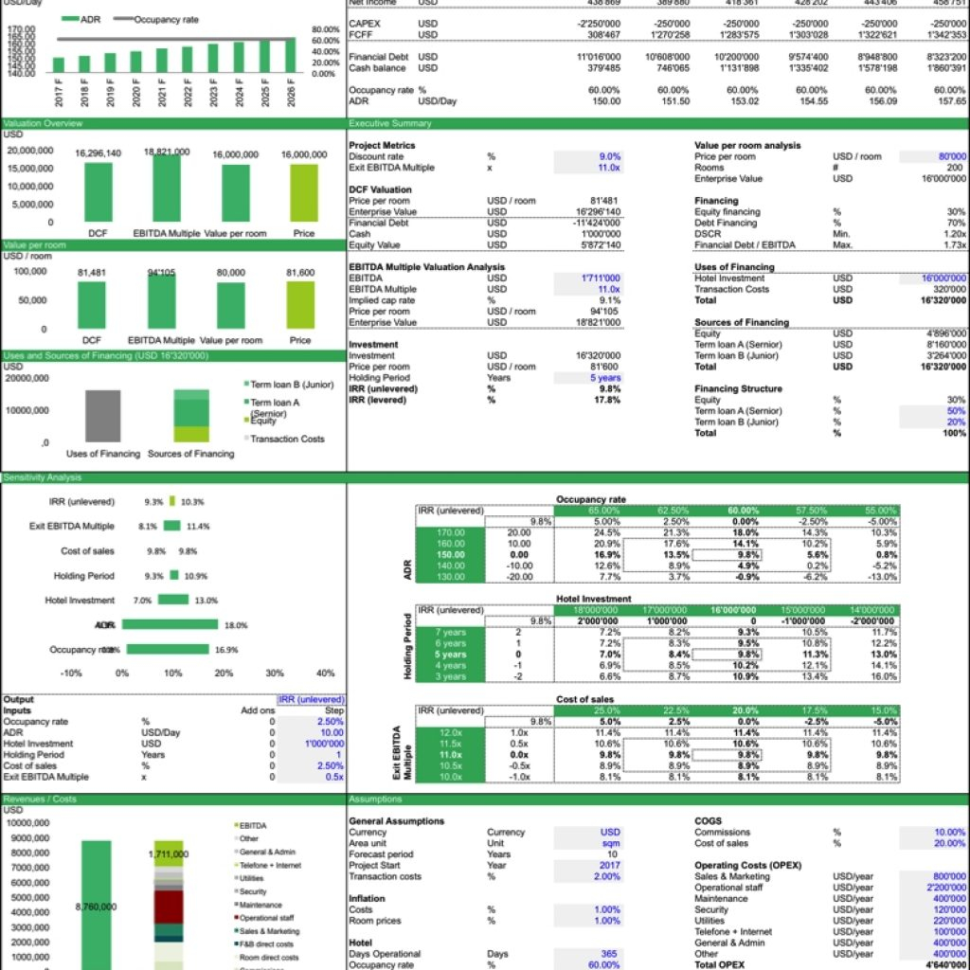

Valuation Excel Templates - Determine the timing of exit ( ipo, m&a, etc.) calculate. This template allows you to create your own adjusted present value. It may be either a business valuation calculator or an excel template. Web explore and download our free excel financial modeling templates below, designed to be flexible and help you perform various kinds of financial analysis and build. In part 2, we entered our assumptions, generated our estimate, and compared that to the market. Smartsheet.com has been visited by 100k+ users in the past month Below is a description of how to perform each type of modeling. Web business valuation excel template: Web a brand valuation template is a tool that helps you determine brand value as an intangible asset. Web get free smartsheet templates. Web explore and download our free excel financial modeling templates below, designed to be flexible and help you perform various kinds of financial analysis and build. This template allows you to create your own adjusted present value. Web business valuation excel template: This dcf model template provides you with a foundation to build your own discounted cash flow model with. Download wso's free apv valuation model template below! This template allows you to create your own adjusted present value. Web fortunately, quantic has published a free template to help. In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from. Web dcf model template. Web the venture capital (vc) method is comprised of six steps: As noted above, there are three primary methods for valuing a company. I am always amazed how many business owners. This template allows you to create your own adjusted present value. This dcf model template provides you with a foundation to build your own discounted cash flow model with. Adjusting the model to get the market price. In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from. Web a brand valuation template is a tool that helps you determine brand value as an intangible asset. As noted above, there are three primary methods for valuing a company. Web. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Web adjusted present value template. This adjusted present value template guides you through the calculation of apv starting with the value of the unlevered project. Determine the timing of exit ( ipo, m&a, etc.) calculate. Smartsheet.com has been visited by. Web identify a business' health and future based on profitability and other key metrics with our business valuation template for excel and google sheets. This adjusted present value template guides you through the calculation of apv starting with the value of the unlevered project. Web explore and download our free excel financial modeling templates below, designed to be flexible and. Web a brand valuation template is a tool that helps you determine brand value as an intangible asset. Discounted cash flow, or dcf, analysis is the most detailed method, and often the most relied upon approach. Web identify a business' health and future based on profitability and other key metrics with our business valuation template for excel and google sheets.. This template allows you to create your own adjusted present value. Discounted cash flow, or dcf, analysis is the most detailed method, and often the most relied upon approach. Web identify a business' health and future based on profitability and other key metrics with our business valuation template for excel and google sheets. As noted above, there are three primary. As noted above, there are three primary methods for valuing a company. Web get free smartsheet templates. Web explore and download our free excel financial modeling templates below, designed to be flexible and help you perform various kinds of financial analysis and build. Web fortunately, quantic has published a free template to help. Web cheat sheet central. In part 2, we entered our assumptions, generated our estimate, and compared that to the market. Web explore and download our free excel financial modeling templates below, designed to be flexible and help you perform various kinds of financial analysis and build. Below is a description of how to perform each type of modeling. Web fortunately, quantic has published a. Smartsheet.com has been visited by 100k+ users in the past month In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from. Download wso's free apv valuation model template below! Web the venture capital (vc) method is comprised of six steps: Web adjusted present value template. Web dcf model template. Web fortunately, quantic has published a free template to help. Determine the timing of exit ( ipo, m&a, etc.) calculate. Web a brand valuation template is a tool that helps you determine brand value as an intangible asset. 10 simple steps to success 1: This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. It may be either a business valuation calculator or an excel template. Web business valuation excel template: This adjusted present value template guides you through the calculation of apv starting with the value of the unlevered project. I am always amazed how many business owners. Discounted cash flow, or dcf, analysis is the most detailed method, and often the most relied upon approach. Calculate ebitda of your company. In part 2, we entered our assumptions, generated our estimate, and compared that to the market. As noted above, there are three primary methods for valuing a company. Web explore and download our free excel financial modeling templates below, designed to be flexible and help you perform various kinds of financial analysis and build. Web business valuation excel template: Web explore and download our free excel financial modeling templates below, designed to be flexible and help you perform various kinds of financial analysis and build. Web dcf model template. Smartsheet.com has been visited by 100k+ users in the past month I am always amazed how many business owners. Discounted cash flow, or dcf, analysis is the most detailed method, and often the most relied upon approach. Web the venture capital (vc) method is comprised of six steps: Web identify a business' health and future based on profitability and other key metrics with our business valuation template for excel and google sheets. Web in this article, we’ve researched and collected the top inventory management templates for excel to help you streamline your inventory tracking process. Adjusting the model to get the market price. Web adjusted present value template. In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from. Web a brand valuation template is a tool that helps you determine brand value as an intangible asset. Download wso's free apv valuation model template below! This adjusted present value template guides you through the calculation of apv starting with the value of the unlevered project. Web fortunately, quantic has published a free template to help.Download Business Valuation Model Excel 60

Free Excel Business Valuation Spreadsheet within Business Valuation

Business Valuation Template Excel Free Printable Templates

Business Valuation Excel Template for Private Equity Eloquens

Business Valuation Template Excel Free Printable Templates

Business Valuation Spreadsheet Excel Pertaining To Business Valuation

Stock Valuation Calculator »

Business Valuation Template Excel Free Printable Templates

Download Microsoft Excel Business Valuation Template Fr...

Business Valuation Template Excel Free Printable Templates

Below Is A Description Of How To Perform Each Type Of Modeling.

This Template Allows You To Create Your Own Adjusted Present Value.

10 Simple Steps To Success 1:

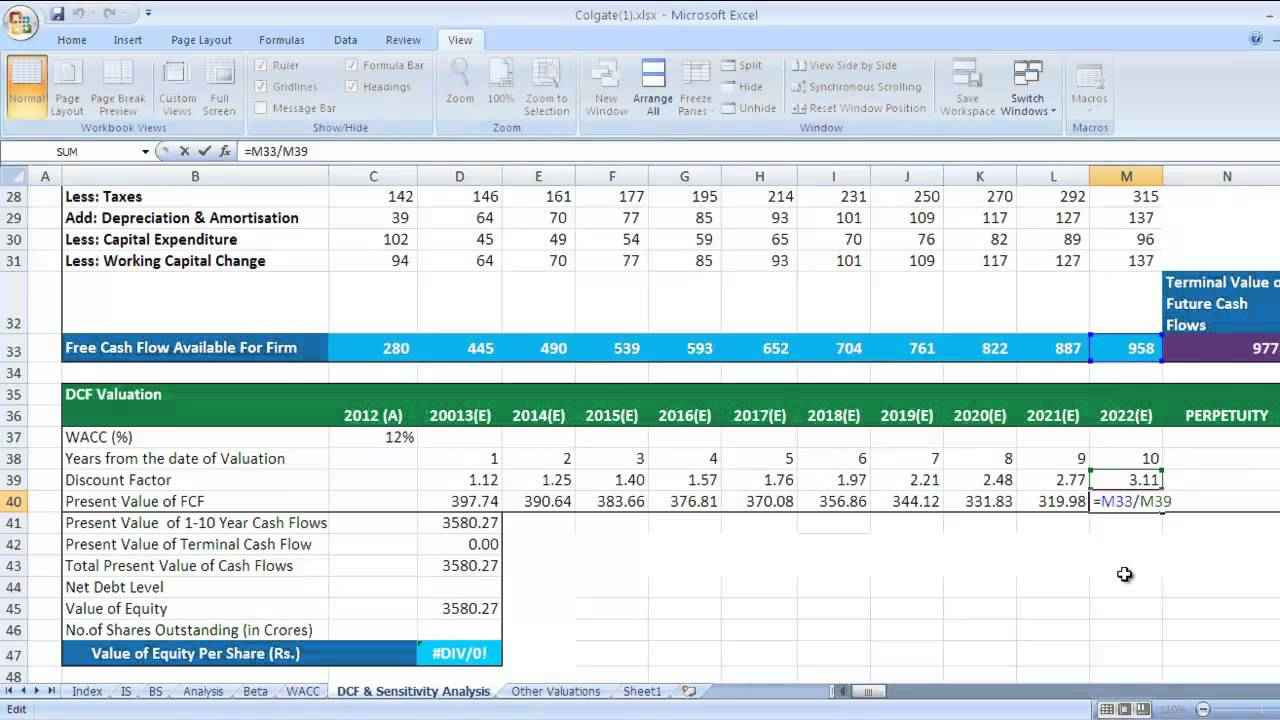

This Dcf Model Template Provides You With A Foundation To Build Your Own Discounted Cash Flow Model With Different Assumptions.

Related Post: