Tax Form Template

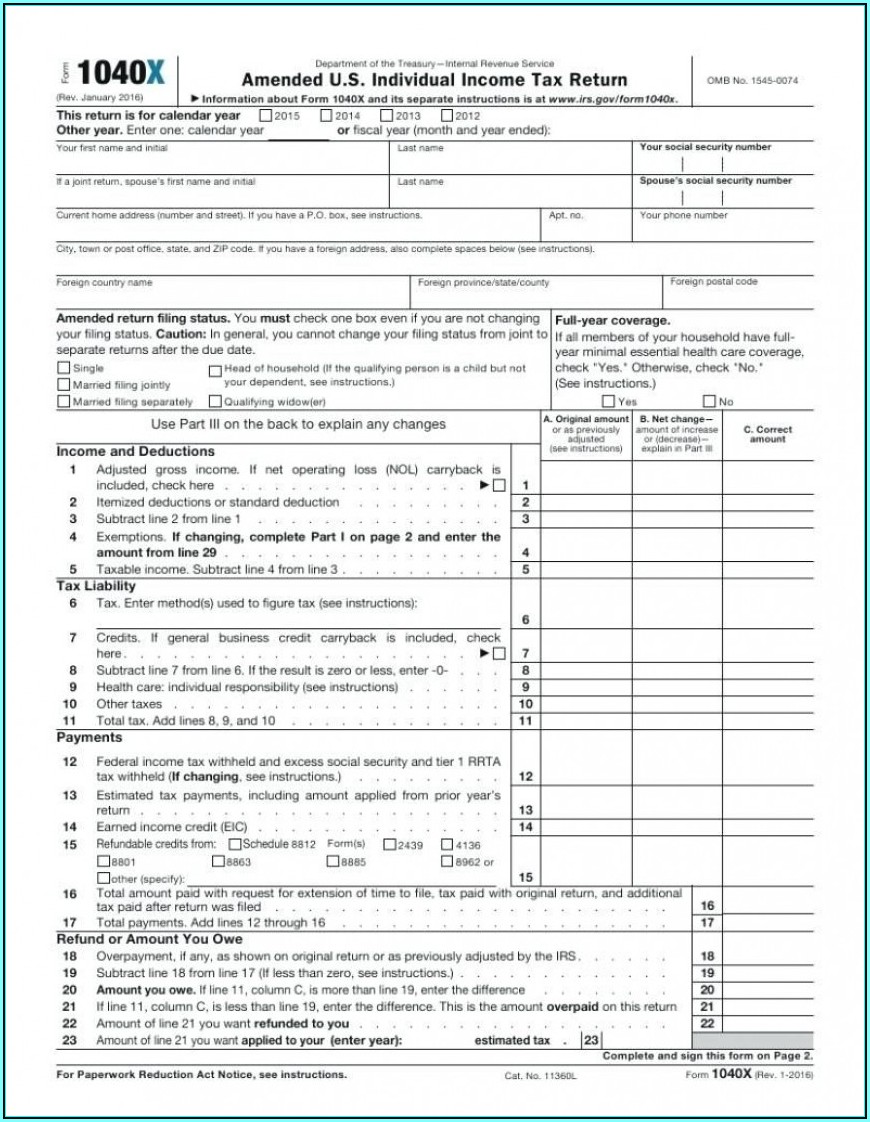

Tax Form Template - Web 43 rows forms for corporations. Pdfquick.com has been visited by 10k+ users in the past month Use this form to —. Web find the 2022 federal tax forms you need. Web instructions for recipient recipient’s taxpayer identification number (tin). The advanced tools of the editor will guide you through the editable pdf template. Web free file fillable forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. As a sole proprietor, however, you’ll need to complete additional form 1040 schedules to file this annual return. Form 1096, annual summary and transmittal of u.s. Get the current year income tax forms today! Web free file fillable forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Official irs income tax forms are printable and can be downloaded for free. Report wages, tips, and other compensation, and withheld income, social security, and medicare taxes. Pdfquick.com has been. Get tax form (1099/1042s) update direct deposit. Web find the 2022 federal tax forms you need. The advanced tools of the editor will guide you through the editable pdf template. Form 1096, annual summary and transmittal of u.s. Print your return for recordkeeping. Web get federal tax return forms and file by mail. Complete, edit or print tax forms instantly. Web find the 2022 federal tax forms you need. Get tax form (1099/1042s) update direct deposit. Web this amount includes the 1.45% medicare tax withheld on all medicare wages and tips shown in box 5, as well as the 0.9% additional medicare tax. Web 43 rows forms for corporations. Sign online button or tick the preview image of the blank. Complete, edit or print tax forms instantly. Web free file fillable forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Web this amount includes the 1.45% medicare tax withheld on all medicare wages and. Web get federal tax return forms and file by mail. Electronically sign and file your return. Irs form 1040 is used to file your individual income tax return. This amount is not included in box 1, 3, 5, or 7. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Choose the income tax form you need. Web 43 rows forms for corporations. This amount is not included in box 1, 3, 5, or 7. Ad complete irs tax forms online or print government tax documents. Certificate of compliance for letter of good standing. Sign online button or tick the preview image of the blank. Filing status check only one box. As a sole proprietor, however, you’ll need to complete additional form 1040 schedules to file this annual return. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Instruction 8804 (schedule a) title. Web get federal tax return forms and file by mail. Complete, edit or print tax forms instantly. To start the blank, utilize the fill camp; This amount is not included in box 1, 3, 5, or 7. If too much is withheld, you will generally be due a refund. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Get tax form (1099/1042s) update direct deposit. Complete, edit or print tax forms instantly. Report wages, tips, and other compensation, and withheld income, social security, and medicare taxes. Web find the 2022 federal tax forms you need. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. This form is for filing periods beginning on or after june 1, 2016. Sign online button or tick the preview image of the blank. Web find the 2022 federal tax forms you need. Instruction 8804 (schedule a) title. Choose the income tax form you need. Single married filing jointly married filing separately. To start the blank, utilize the fill camp; Web find the 2022 federal tax forms you need. Use this form to —. Filing status check only one box. Identify someone to manage benefits for you. Instructions for schedule a (form 8804), penalty for underpayment of. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. This amount is not included in box 1, 3, 5, or 7. Sign online button or tick the preview image of the blank. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Ad complete irs tax forms online or print government tax documents. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Get the current year income tax forms today! Report wages, tips, and other compensation, and withheld income, social security, and medicare taxes. Communicate changes to personal situation. As a sole proprietor, however, you’ll need to complete additional form 1040 schedules to file this annual return. Complete, edit or print tax forms instantly. Report wages, tips, and other compensation, and withheld income, social security, and medicare taxes. Filing status check only one box. Single married filing jointly married filing separately. Use this form to —. Official irs income tax forms are printable and can be downloaded for free. The advanced tools of the editor will guide you through the editable pdf template. Print your return for recordkeeping. Electronically sign and file your return. Get tax form (1099/1042s) update direct deposit. List of taxable business activities. Instruction 8804 (schedule a) title. Enter your tax information online. Pdfquick.com has been visited by 10k+ users in the past month As a sole proprietor, however, you’ll need to complete additional form 1040 schedules to file this annual return. Complete, edit or print tax forms instantly. Form 1096, annual summary and transmittal of u.s.Printable Federal Tax Forms knowhowaprendizagem

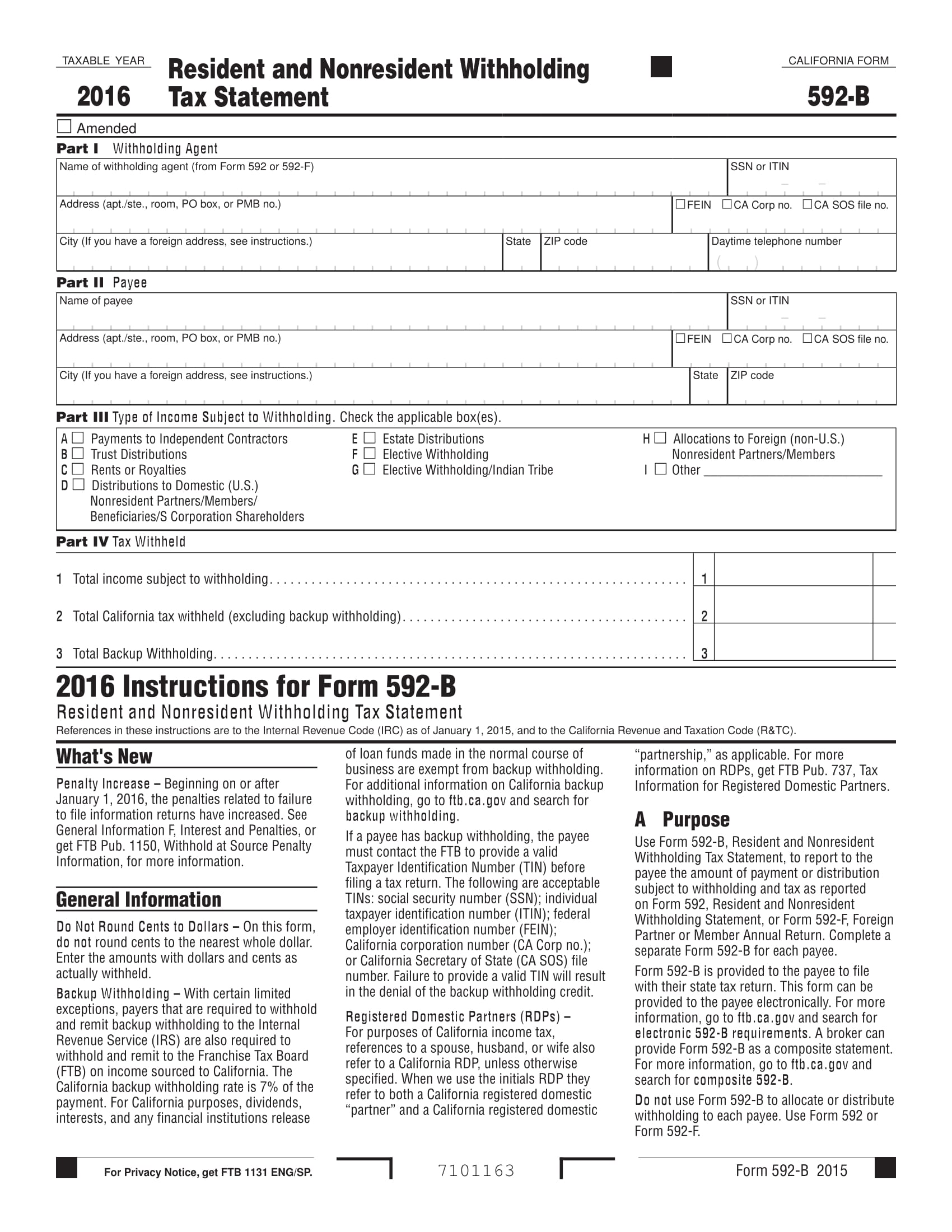

FREE 14+ Tax Statement Forms in PDF MS Word

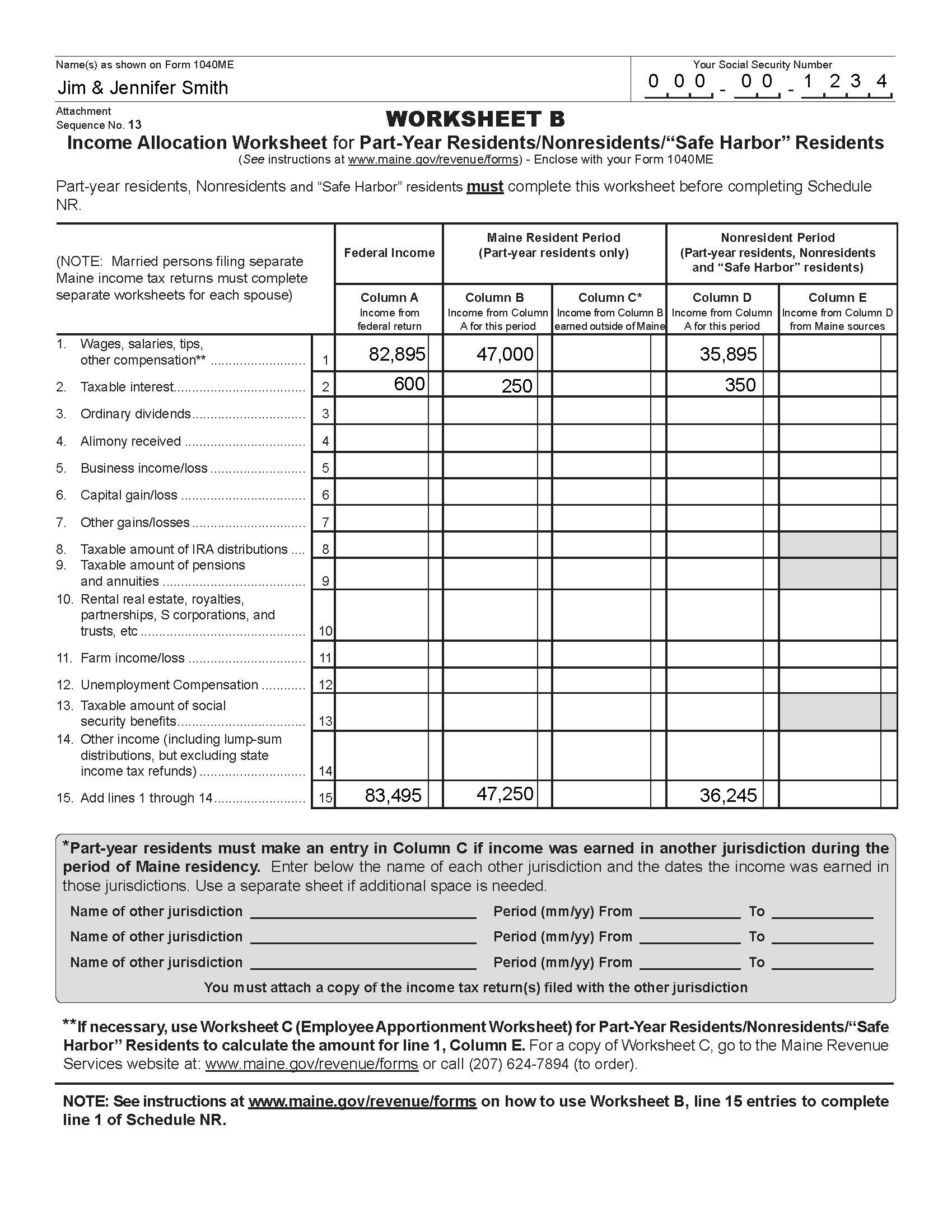

Federal Tax Worksheet —

Tax Leaders Inc Tax Client Information Sheet Fill and Sign Printable

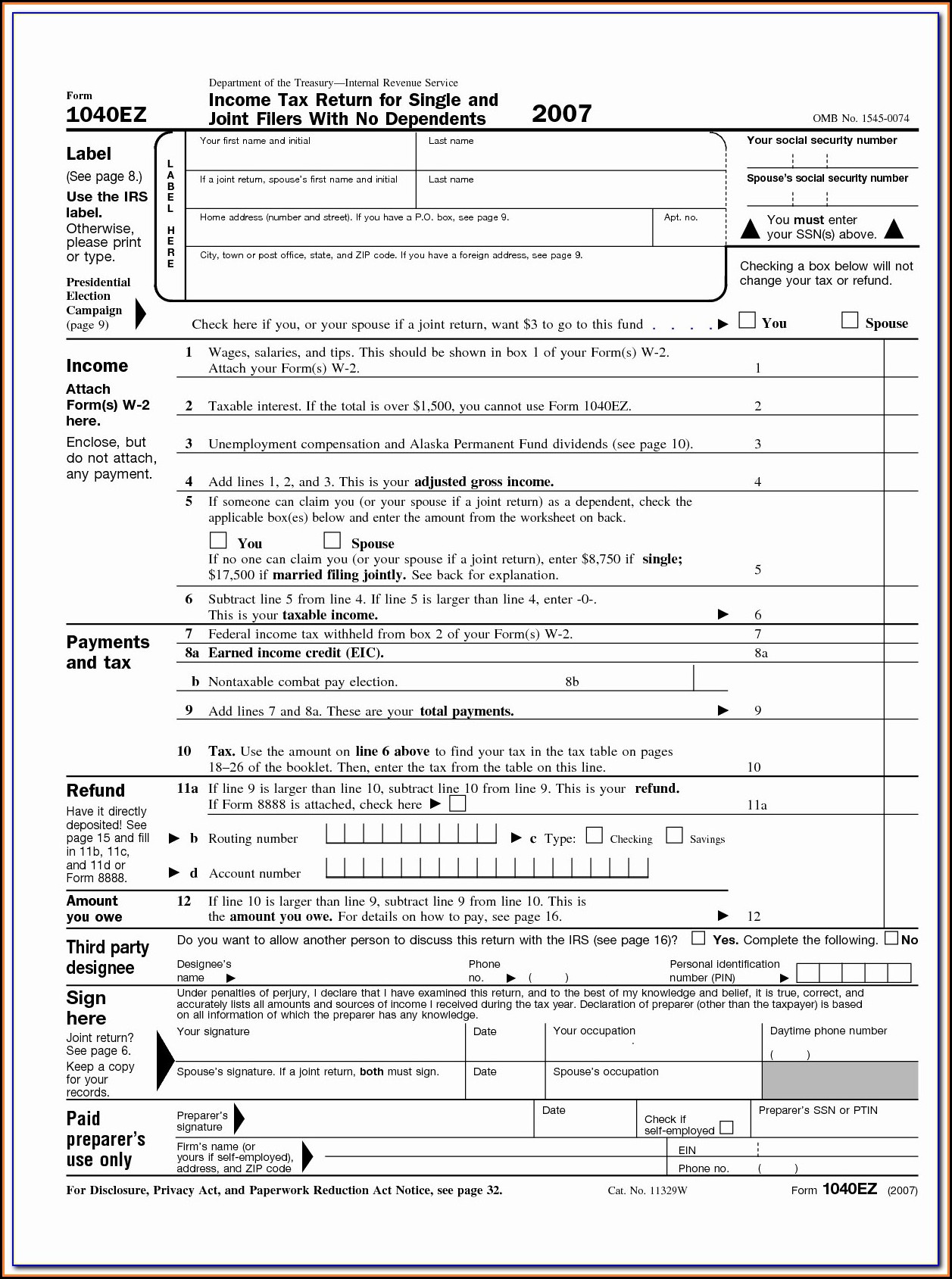

Irs Printable Forms 1040ez Form Resume Examples xz204Nm2ql

FREE 7+ Sample Tax Forms in PDF

Irs Printable Forms 1040ez Form Resume Examples xz204Nm2ql

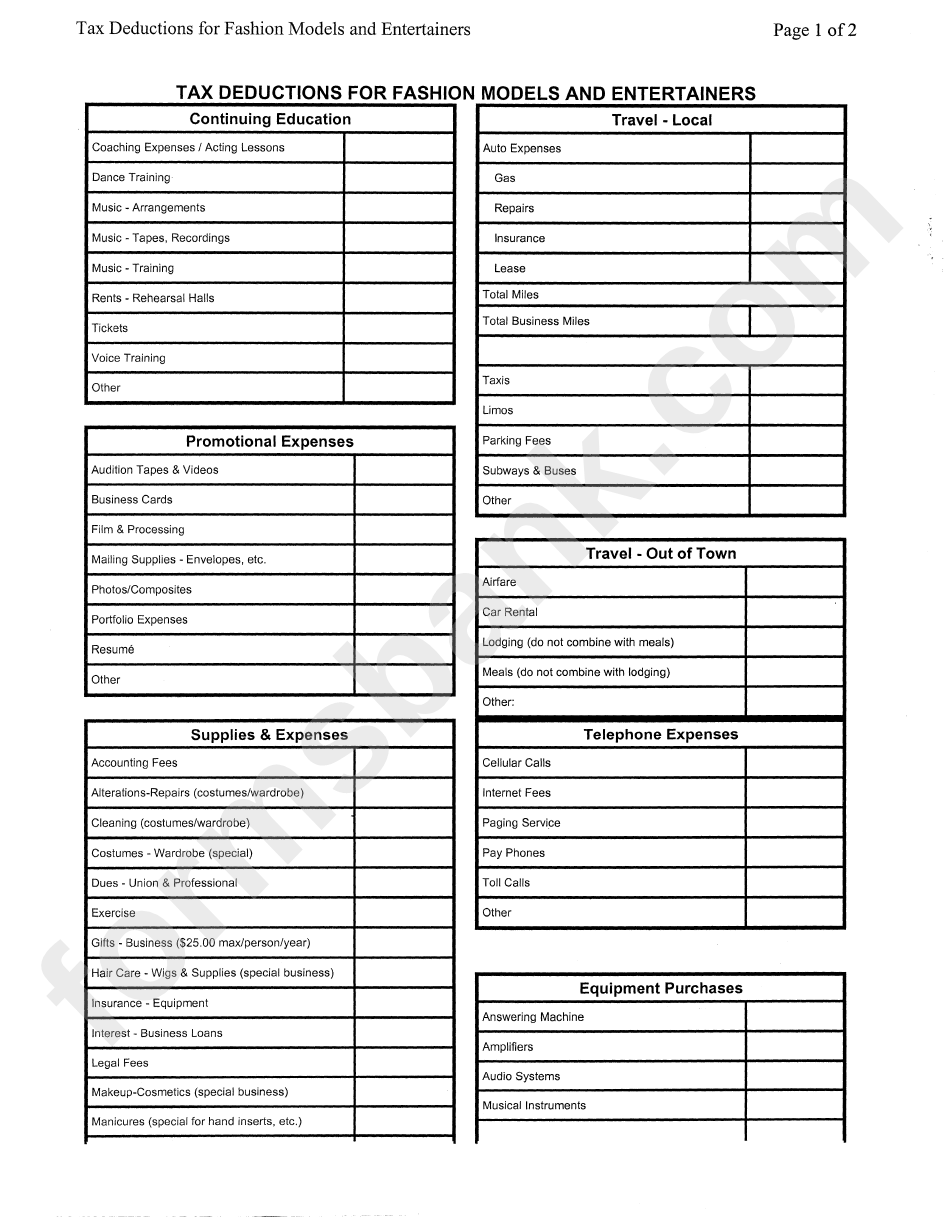

Tax Deductions Sheet For Fashion Models And Entertainers printable pdf

Printable Tax Forms for Your Budget Binder

Tax Client Information Sheet Template Fill Online, Printable

Ad Complete Irs Tax Forms Online Or Print Government Tax Documents.

Irs Form 1040 Is Used To File Your Individual Income Tax Return.

Communicate Changes To Personal Situation.

Web This Amount Includes The 1.45% Medicare Tax Withheld On All Medicare Wages And Tips Shown In Box 5, As Well As The 0.9% Additional Medicare Tax On Any Of Those Medicare Wages And Tips Above $200,000.

Related Post: