Statement Of Final Return 941 Template

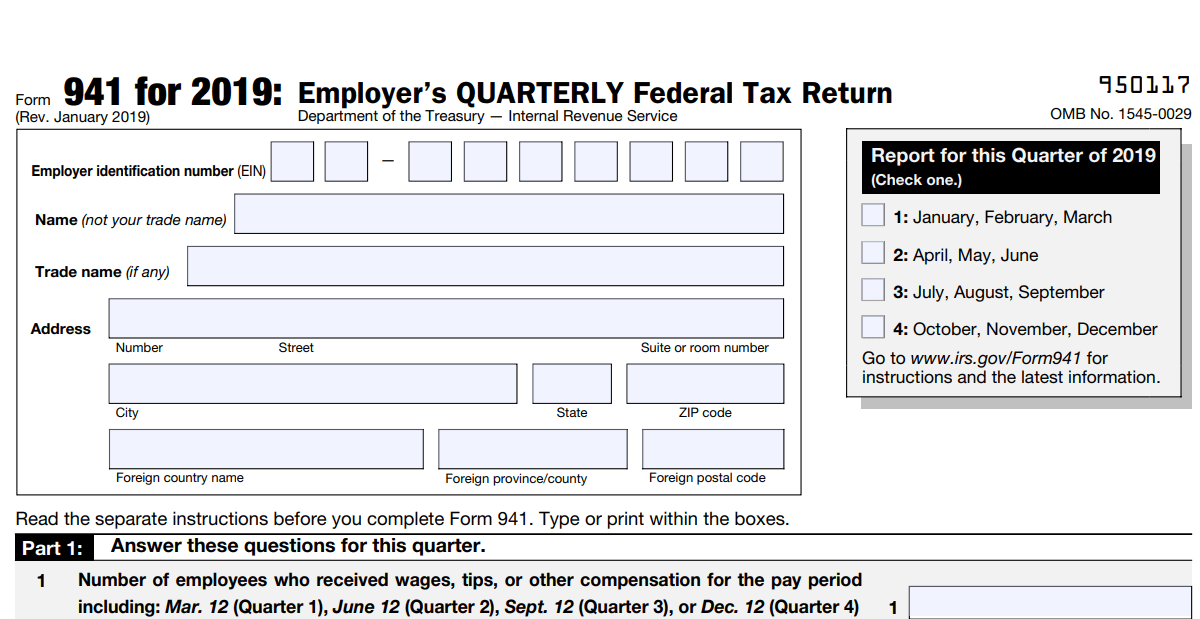

Statement Of Final Return 941 Template - It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. 3 enter deposit schedule & tax. Click the final statement button. Web had one or more employees working for your company for at least some part of a day in any 20 different weeks during the calendar year (or the preceding calendar. Web forms and instructions about form 941, employer's quarterly federal tax return employers use form 941 to: Web your total taxes after adjustments and credits (form 941, line 12) for either the current quarter or the preceding quarter are less than $2,500, you didn't incur a $100,000 next. Web type of final return. Ad get ready for tax season deadlines by completing any required tax forms today. Corporations also need to file irs form 966, corporate dissolution or. Try it for free now! Web form 941 for 2021: It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. Click the final statement button. Web i can share some information on how to process an employee's final payroll and generate a statement of final return. You must file a final return for the year. It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Web up to 25% cash back this form must be filed by the 15th day of the fourth month after you close. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Click the final statement button. Web you can handle your final payments and filings yourself, print your forms and submit it directly to the irs and state agencies along with your tax payments. Try it for free now! Check the box on line 16,. July 2021) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web i can share some information on how to process an employee's final payroll and generate a statement of final return. Upload, modify or create forms. Web up to 25% cash back this form must be filed by. In the forms section, click the additional information button for the federal 94x form. Web to tell the irs that form 941 for a particular quarter is your final return, check the box on line 17 and enter the final date you paid wages. Report income taxes, social security tax, or medicare tax. 3 enter deposit schedule & tax. Web. Web your total taxes after adjustments and credits (form 941, line 12) for either the current quarter or the preceding quarter are less than $2,500, you didn't incur a $100,000 next. July 2021) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web print the federal 941, check the. Under forms, click the quarterly forms link. Web type of final return. Web print the federal form 941. Form 941 shall previously by. Web you can handle your final payments and filings yourself, print your forms and submit it directly to the irs and state agencies along with your tax payments. Web print the federal form 941. Web to tell the irs that form 941 for a particular quarter is your final return, check the box on line 17 and enter the final date you paid wages. Web print the federal 941, check the box on line 16, and enter the date final wages were paid, indicating that your business has. Ad get ready for tax season deadlines by completing any required tax forms today. There are two ways to generate the form. Ad get ready for tax season deadlines by completing any required tax forms today. Web type of final return. Annual amounts from payroll records should match the total amounts reported on all forms 941 for the year. Web form 941 for 2021: March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Web had one or more employees working for your company for at least some part of a day in any 20 different weeks during the calendar year (or the preceding calendar. Web print the federal form 941. Annual amounts. Web type of final return. Complete, edit or print tax forms instantly. Check the box on line 16, and enter the date final wages were paid indicating that your business has closed and that you do not need to file returns in. Web you can handle your final payments and filings yourself, print your forms and submit it directly to the irs and state agencies along with your tax payments. Corporations also need to file irs form 966, corporate dissolution or. Web had one or more employees working for your company for at least some part of a day in any 20 different weeks during the calendar year (or the preceding calendar. 2 enter social security & medicare taxes. Form 941 shall previously by. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web information around form 941, employer's annually federal tax return, including recent updates, related forms, and instructions on how to file. Web print the federal form 941. Web forms and instructions about form 941, employer's quarterly federal tax return employers use form 941 to: July 2021) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. 3 enter deposit schedule & tax. Ad get ready for tax season deadlines by completing any required tax forms today. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Under forms, click the quarterly forms link. It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. Web up to 25% cash back this form must be filed by the 15th day of the fourth month after you close your business. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Complete, edit or print tax forms instantly. 1 choose tax year & quarter. Form 941 shall previously by. Web to tell the irs that form 941 for a particular quarter is your final return, check the box on line 17 and enter the final date you paid wages. Ad get ready for tax season deadlines by completing any required tax forms today. You must file a final return for the year you close your business. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Web i can share some information on how to process an employee's final payroll and generate a statement of final return. Click the final statement button. In the forms section, click the additional information button for the federal 94x form. July 2021) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. 3 enter deposit schedule & tax. But then i found out that i forgot to mark it as final in part 3 of the. Choose the reason this will be the final return (closed, sale, or transfer). Enter the date on which the new information takes effect.Form 941 Employer's Quarterly Federal Tax Return

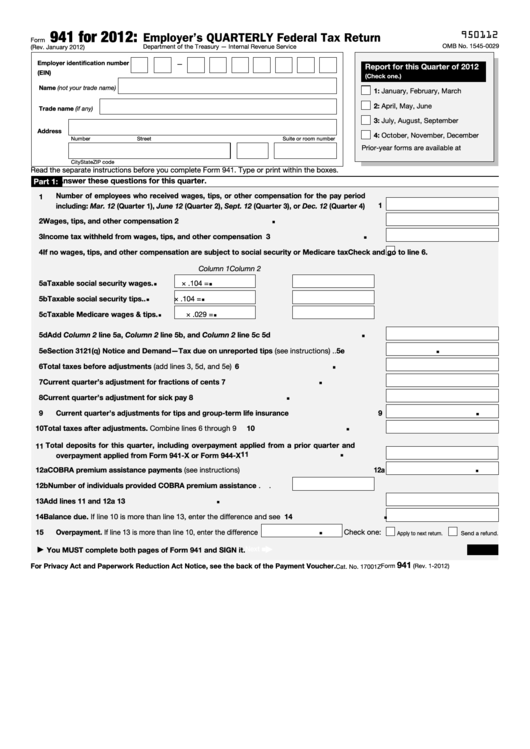

Form 941 Employer'S Quarterly Federal Tax Return 2012 printable pdf

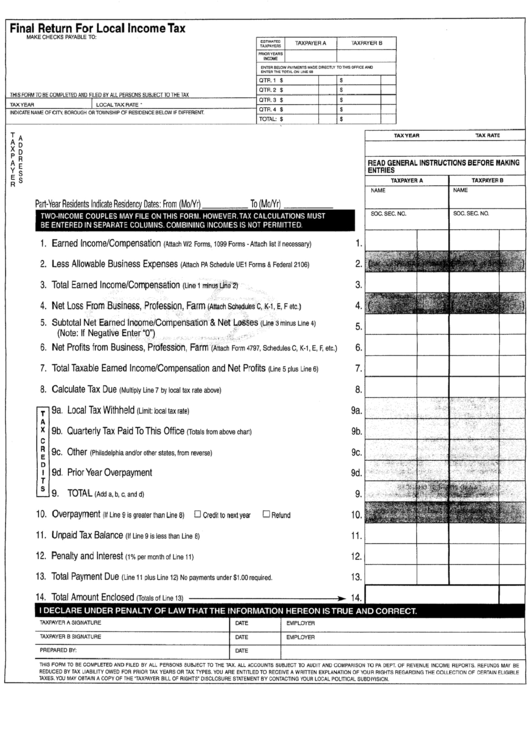

Final Return For Local Tax Template printable pdf download

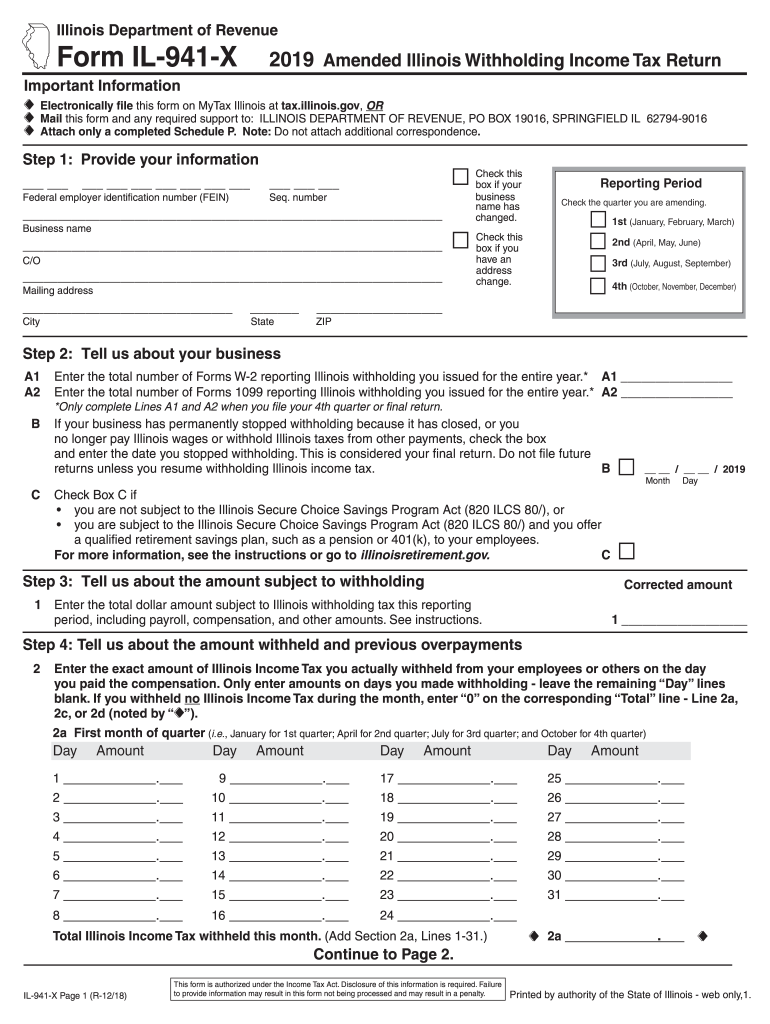

Form Il 941 X Fill Out and Sign Printable PDF Template signNow

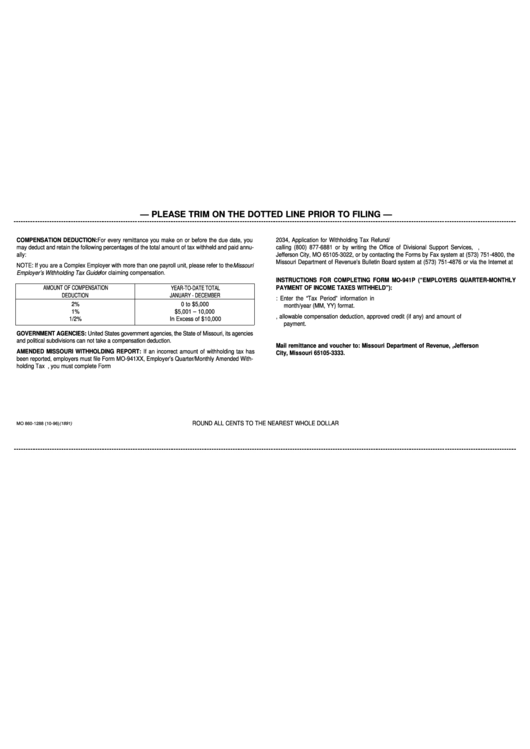

9 Missouri Mo941 Forms And Templates free to download in PDF

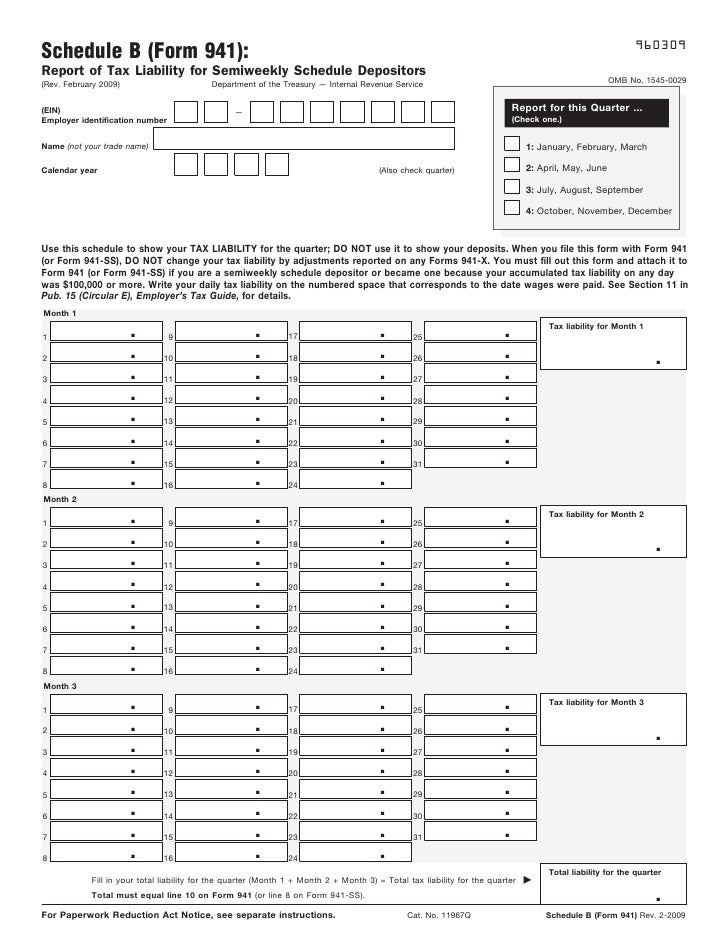

Form 941 (Schedule B) Report of Tax Liability for Semiweekly Schedul…

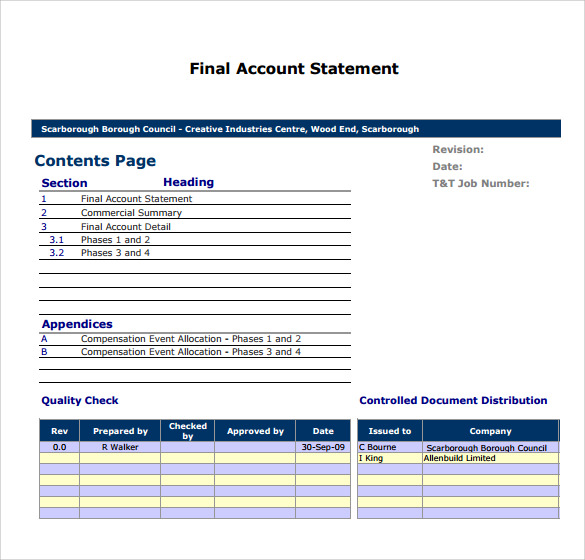

FREE 10+ Sample Statement of Account in PDF

How do you mark a 941 return FINAL in QBO

20062022 Form IRS 941c Fill Online, Printable, Fillable, Blank pdfFiller

What Employers Need to Know about 941 Quarterly Tax Return?

Web Final 941 Form But Forget To Mark It As Final Hi, I Just Filed My 941 For Q2 2022 And It Was Accepted.

Corporations Also Need To File Irs Form 966, Corporate Dissolution Or.

Check The Box On Line 16, And Enter The Date Final Wages Were Paid Indicating That Your Business Has Closed And That You Do Not Need To File Returns In.

Web Print The Federal 941, Check The Box On Line 16, And Enter The Date Final Wages Were Paid, Indicating That Your Business Has Closed And That You Do Not Need To File Returns In The.

Related Post: