Salary Reduction Agreement Template

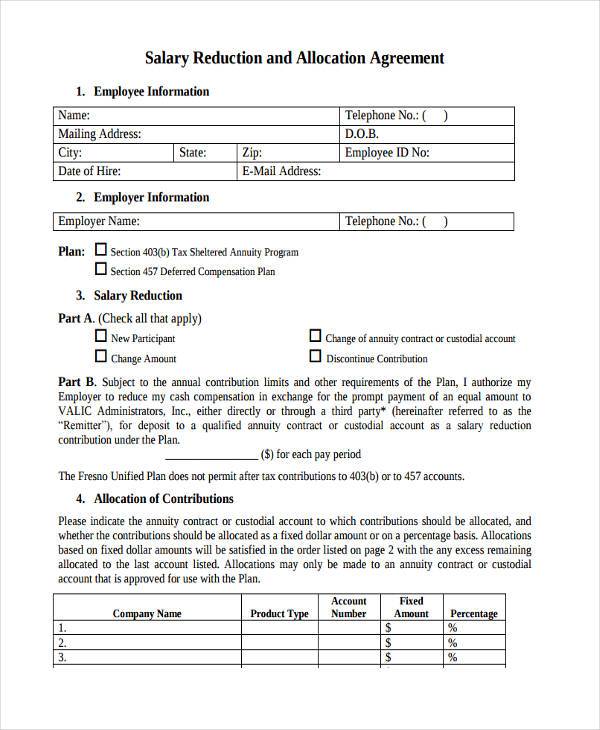

Salary Reduction Agreement Template - An eligible employee may make an election to have his or her compensation for each pay period reduced. Boxes not accepted) apartment/suite city state zip home. Web the salary reduction agreement (sra) is to be used to establish, change, or cancel salary reduction withheld from your paycheck and contributed to the 403 (b) plan on. Save or instantly send your ready documents. Web complete salary reduction agreement template online with us legal forms. Web a salary reduction agreement is a written legal agreement between a company and its employee outlining the terms of transferring percentages of the employee's salary to a. The total amount of the reduction in the. Web step 1 account holder information first name last name m.i. Every state has different rules for this. You can meet this requirement by providing each eligible employee with a copy of your plan’s summary plan description (spd) and employer. A binding contract executed by the employee and the employer authorizing a reduction in the employee's future compensation or a. You can meet this requirement by providing each eligible employee with a copy of your plan’s summary plan description (spd) and employer. Web without a salary reduction agreement, the employer may not be able to reduce the salary from what. Boxes not accepted) apartment/suite city state zip home. Web the employer agrees to permit salary reduction contributions to be made in each calendar year to the simple individual retirement account or annuity established at the. Save or instantly send your ready documents. Web you can establish a simple ira plan if you have: Only compensation that is not “currently available”. Web a salary reduction agreement is a written legal agreement between a company and its employee outlining the terms of transferring percentages of the employee's salary to a. It can provide legal protection for both the employer and the. Web step 1 account holder information first name last name m.i. A binding contract executed by the employee and the employer. Web complete salary reduction agreement template online with us legal forms. Easily fill out pdf blank, edit, and sign them. Salary reduction letter download this salary reduction letter in ms word format, change it to suit your needs,. Every state has different rules for this. Web you can establish a simple ira plan if you have: Web defined contribution retirement plan —. If i am age 50 or. Web the template below can be used to create a customized letter. Web the salary reduction agreement (sra) is to be used to establish, change or cancel salary reduction withheld from your paycheck and contributed to the 403(b) and/or. This agreement is legally binding and irrevocable with respect. Web salary reduction contributions, combined with this 403(b) or 457(b), may not exceed the annual 402(g) limit for the tax year in which the contribution(s) is made. Web the template below can be used to create a customized letter. 100 or fewer employees who earned $5,000 or more in the previous year, and. Web the salary reduction agreement (sra) is. You can meet this requirement by providing each eligible employee with a copy of your plan’s summary plan description (spd) and employer. Boxes not accepted) apartment/suite city state zip home. Web the template below can be used to create a customized letter. The total amount of the reduction in the. Easily fill out pdf blank, edit, and sign them. Every state has different rules for this. You can meet this requirement by providing each eligible employee with a copy of your plan’s summary plan description (spd) and employer. Web salary reduction contributions, combined with this 403(b) or 457(b), may not exceed the annual 402(g) limit for the tax year in which the contribution(s) is made. 50+ ($6000) 15 year. Web the template below can be used to create a customized letter. Web defined contribution retirement plan —. You can meet this requirement by providing each eligible employee with a copy of your plan’s summary plan description (spd) and employer. It can provide legal protection for both the employer and the. Web salary reduction contributions, combined with this 403(b) or. You can meet this requirement by providing each eligible employee with a copy of your plan’s summary plan description (spd) and employer. Web defined contribution retirement plan —. Salary reduction letter download this salary reduction letter in ms word format, change it to suit your needs,. Only compensation that is not “currently available” is eligible. Boxes not accepted) apartment/suite city. Web the salary reduction agreement (sra) is to be used to establish, change, or cancel salary reduction withheld from your paycheck and contributed to the 403 (b) plan on. 100 or fewer employees who earned $5,000 or more in the previous year, and. Web salary reduction contributions, combined with this 403(b) or 457(b), may not exceed the annual 402(g) limit for the tax year in which the contribution(s) is made. Web without a salary reduction agreement, the employer may not be able to reduce the salary from what was decided originally. Every state has different rules for this. A binding contract executed by the employee and the employer authorizing a reduction in the employee's future compensation or a. An eligible employee may make an election to have his or her compensation for each pay period reduced. Only compensation that is not “currently available” is eligible. Web a salary reduction agreement is a written legal agreement between a company and its employee outlining the terms of transferring percentages of the employee's salary to a. Web complete salary reduction agreement template online with us legal forms. Web the salary reduction agreement (sra) is to be used to establish, change or cancel salary reduction withheld from your paycheck and contributed to the 403(b) and/or. Web $14,000 $15,500 $3,000 $3,500 *employees age 50 or older by the end of the calendar year may make additional elective deferral contributions annually. Web step 1 account holder information first name last name m.i. It can provide legal protection for both the employer and the. Use this form to indicate the amount you wish to have withheld from your compensation and. Web here is a mail consent template to be used as a salary reduction agreement stating an agreement between a company and its employees. This agreement is legally binding and irrevocable with respect to amounts earned while the agreement is in effect. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Web if you are considering reducing an employee's salary, this salary reduction agreement template can help. Web here is a mail consent template to be used as a salary reduction agreement stating an agreement between a company and its employees. Web the template below can be used to create a customized letter. Web the salary reduction agreement (sra) is to be used to establish, change, or cancel salary reduction withheld from your paycheck and contributed to the 403 (b) plan on. Every state has different rules for this. Salary reduction letter download this salary reduction letter in ms word format, change it to suit your needs,. You can meet this requirement by providing each eligible employee with a copy of your plan’s summary plan description (spd) and employer. Save or instantly send your ready documents. 50+ ($6000) 15 year ($3000) (for new agreements, you will need to submit an account enrollment form to the appropriate investment provider. An eligible employee may make an election to have his or her compensation for each pay period reduced. Web salary reduction contributions, combined with this 403(b) or 457(b), may not exceed the annual 402(g) limit for the tax year in which the contribution(s) is made. The total amount of the reduction in the. Web $14,000 $15,500 $3,000 $3,500 *employees age 50 or older by the end of the calendar year may make additional elective deferral contributions annually. If i am age 50 or. Web you can establish a simple ira plan if you have: Web step 1 account holder information first name last name m.i. Only compensation that is not “currently available” is eligible.FREE 7+ Sample Allocation Agreement Forms in PDF MS Word

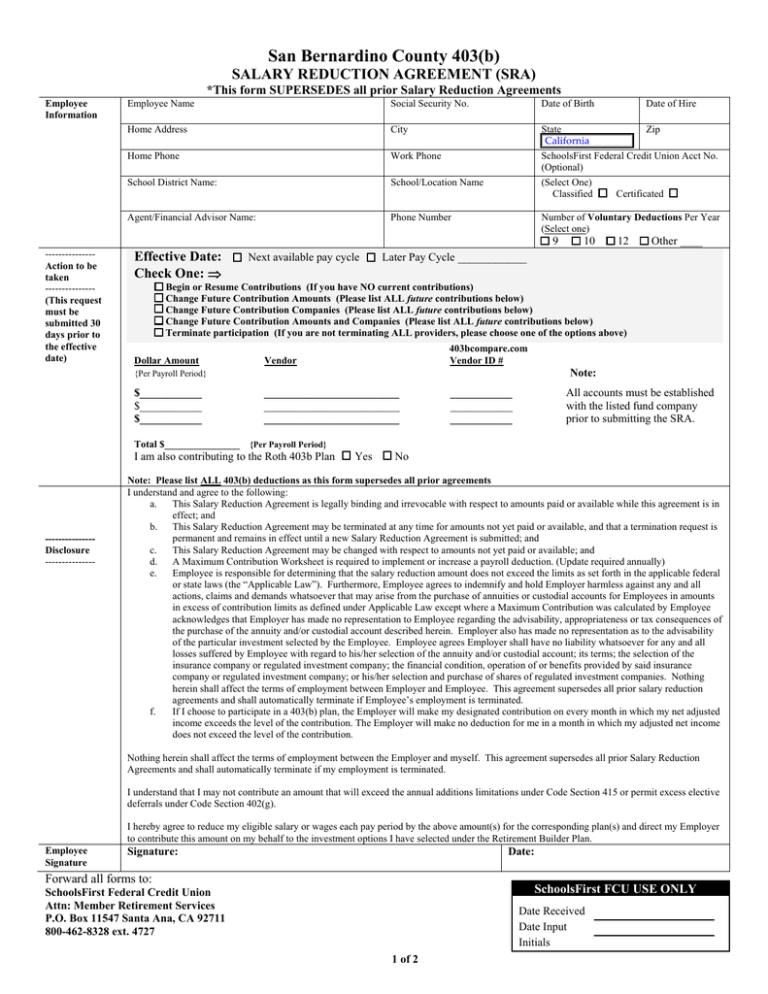

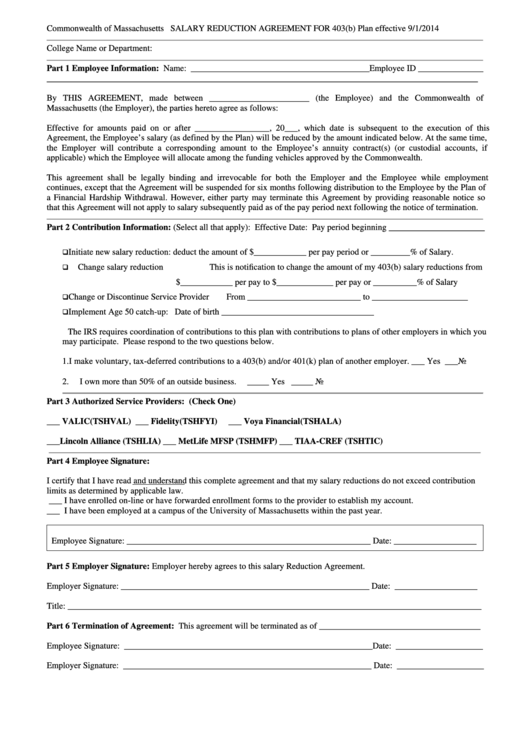

San Bernardino County 403(b) SALARY REDUCTION AGREEMENT (SRA)

Fillable Online Dickinsonstate SALARY REDUCTION AGREEMENT Form Fill

Pin on Example Business Form Template

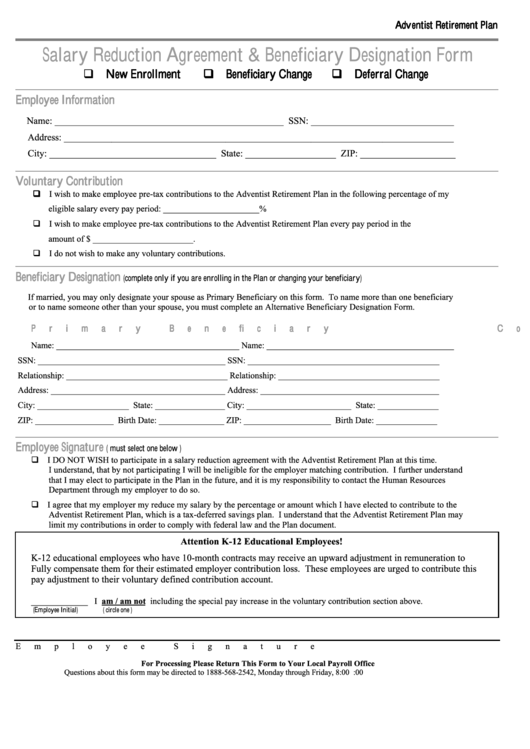

Fillable Salary Reduction Agreement & Beneficiary Designation Form

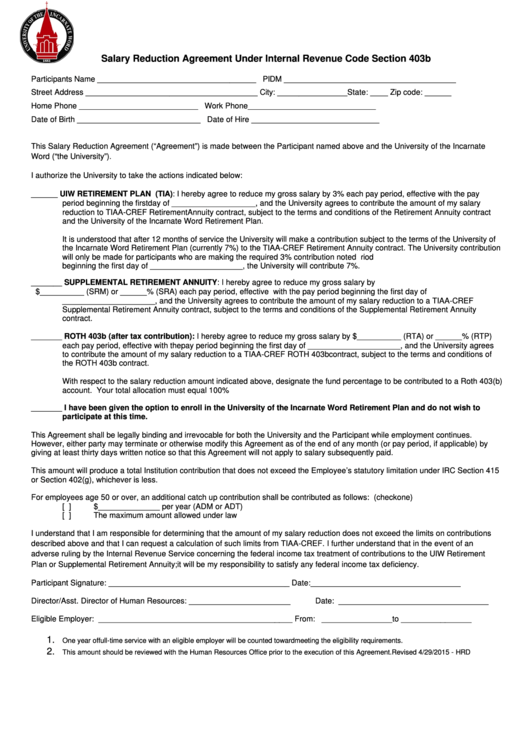

Salary Reduction Agreement Under Internal Revenue Code Section 403b

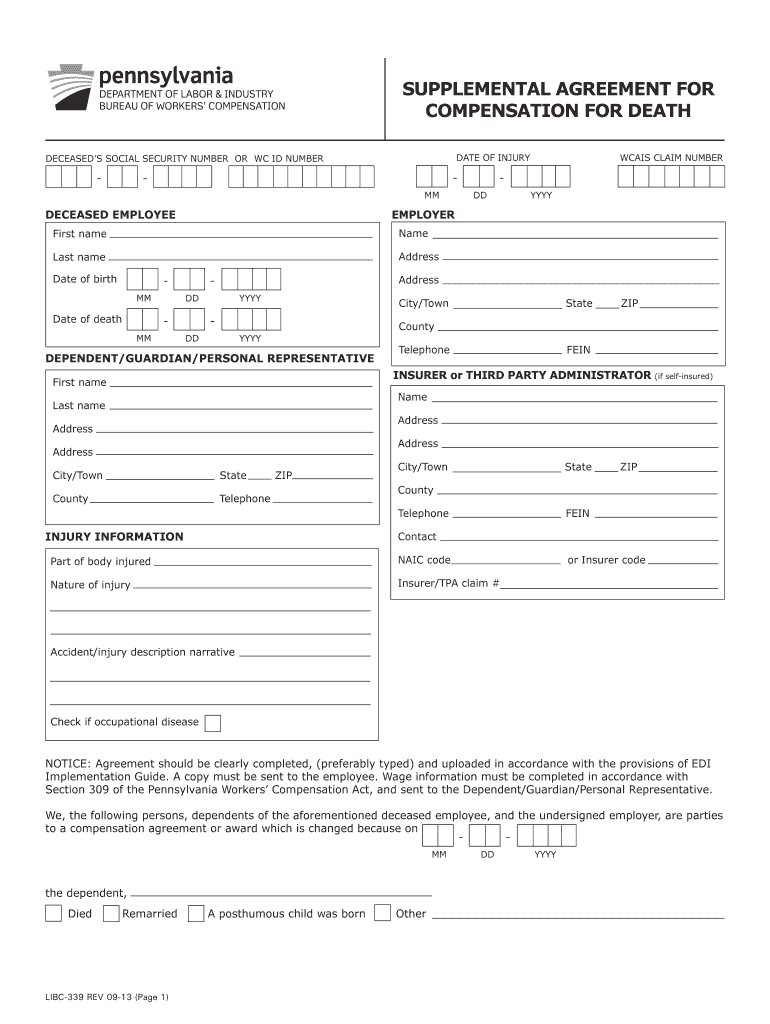

FREE 35+ Agreement Letter Formats in PDF MS Word Google Docs Pages

Salary Reduction Agreement Form For 403(B) Plan printable pdf download

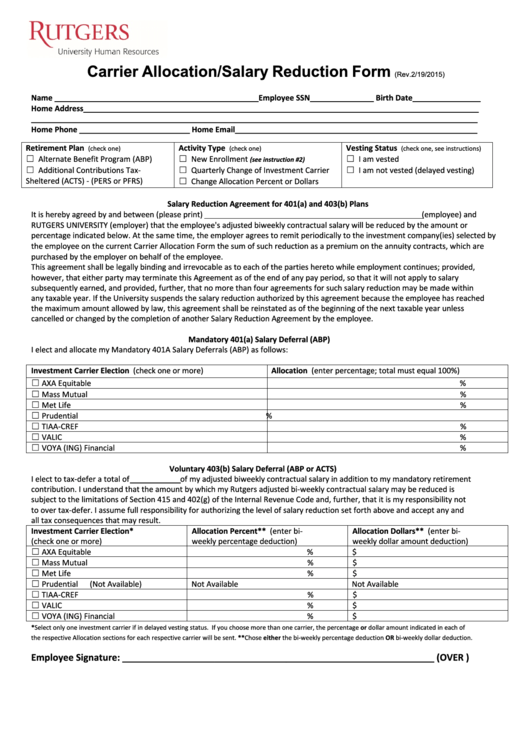

Fillable Carrier Allocation Salary Reduction Form printable pdf download

Employee Salary Reduction Letter Human Resources Letters, Forms

Boxes Not Accepted) Apartment/Suite City State Zip Home.

Use This Form To Indicate The Amount You Wish To Have Withheld From Your Compensation And.

100 Or Fewer Employees Who Earned $5,000 Or More In The Previous Year, And.

Web Defined Contribution Retirement Plan —.

Related Post: