Response Letter To Irs Template

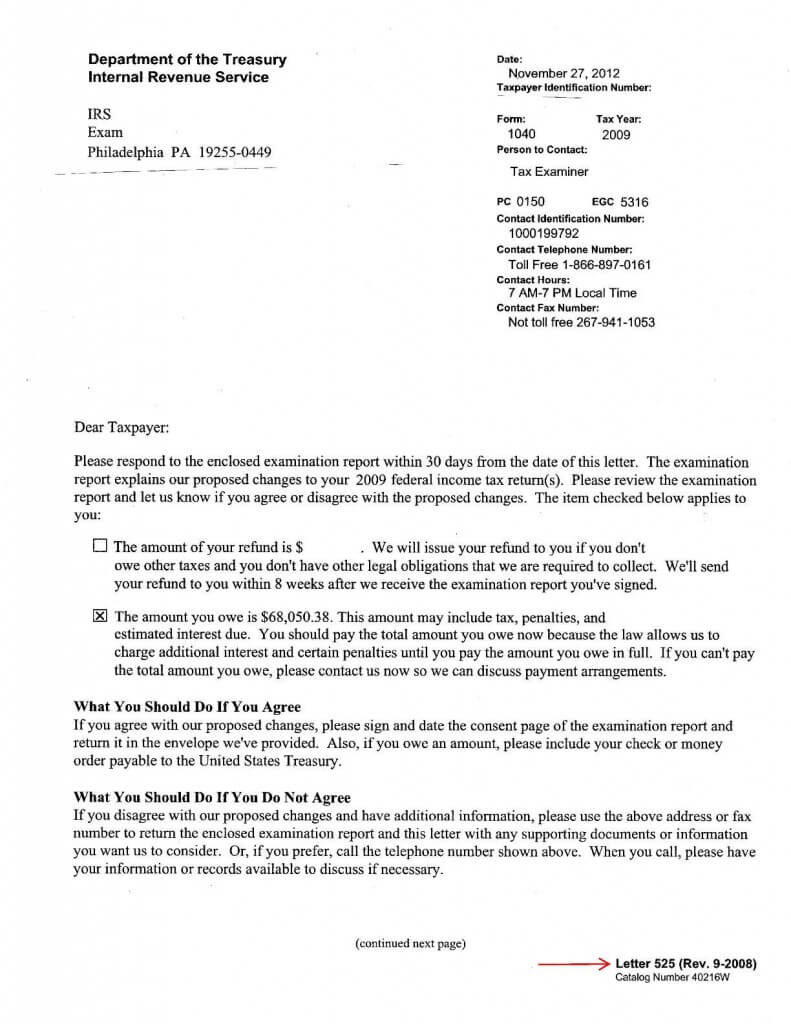

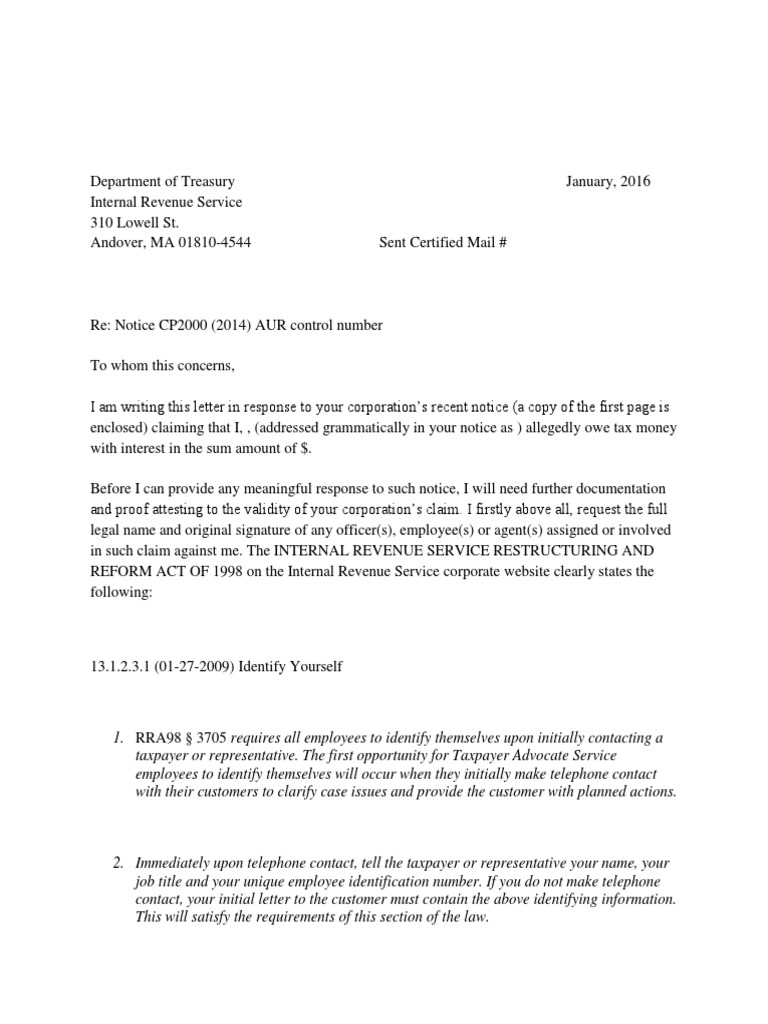

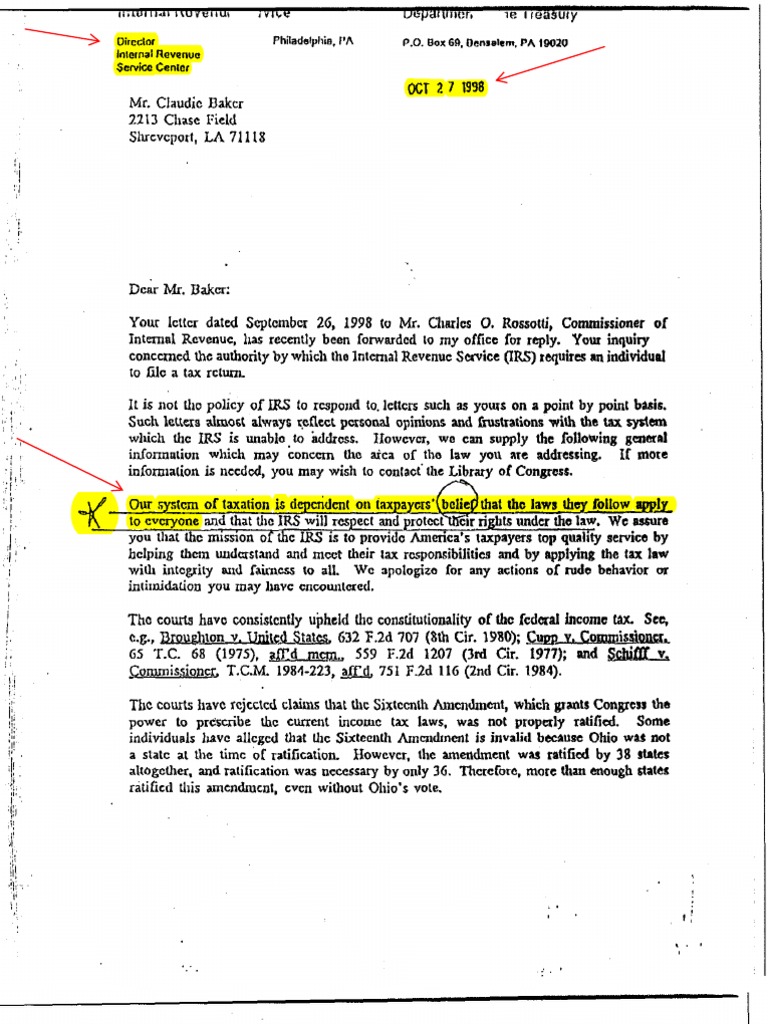

Response Letter To Irs Template - The irs mails letters or notices to taxpayers for a variety of reasons including if: • you are due a larger refund; If for any reason you cannot respond by the deadline, call the number included with the irs audit letter. Web full name and spouse's full name if applicable ssn here (if you and your spouse filed jointly, use the ssn that appears first on your return) address 1 address 2 city, state zip. They have a balance due. Get free, competing quotes from leading irs tax issue experts. Web you should reply as indicated on your letter or notice that could include mail, fax, or digitally through the irs’ documentation upload tool, when available, by using. Get a free irs tax issue consultation. Taxpayers don't need to reply to a notice unless specifically told to do so. Web the irs generally asks for a response within 30 days. The irs independent office of appeals seeks to. Web do to respond. Web up to $3 cash back 1. Web reply only if instructed to do so. The irs mails letters or notices to taxpayers for a variety of reasons including if: Web that letter and includes information that will help the taxes identify the source of the penalty and the causes why it should be savings. Web reply only if instructed to do so. If for any reason you cannot respond by the deadline, call the number included with the irs audit letter. We offer a comprehensive selection of affordable precisely. Web if you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to the irs in a clear and concise manner. Web reply only if instructed to do so. November 4, 2020 | last updated: Ad get your irs response letter today. Web up to $3 cash back 1. It doesn’t need to be complicated, but it should. • you are due a larger refund; Web do to respond. November 4, 2020 | last updated: The irs mails letters or notices to taxpayers for a variety of reasons including if: Get free, competing quotes from leading irs tax issue experts. Or • the irs is requesting payment or needs additional. Web up to $3 cash back 1. Web if you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to the irs in a clear and concise manner. There is usually no need to call the. Web if you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to the irs in a clear and concise manner. Rra98 § 3705 requires all employees to identify themselves upon initially contacting a taxpayer or representative. Web you should reply as indicated on your letter or notice that could include mail, fax, or digitally through. The irs independent office of appeals seeks to. There is usually no need to call the irs. Ad don't face the irs alone. Web if you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to the irs in a clear and concise manner. We have covered a few types of irs notices here, including a. Web full name of the person or business requesting the review of an irs penalty, known going forward as the requester ? Web up to $3 cash back 1. Web full name and spouse's full name if applicable ssn here (if you and your spouse filed jointly, use the ssn that appears first on your return) address 1 address 2. Web reply only if instructed to do so. Web if you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to the irs in a clear and concise manner. Web you should reply as indicated on your letter or notice that could include mail, fax, or digitally through the irs’ documentation upload tool, when available, by. • you are due a larger refund; Web full name of the person or business requesting the review of an irs penalty, known going forward as the requester ? We have covered a few types of irs notices here, including a notice of deficiency. Web the irs generally asks for a response within 30 days. Web that letter and includes. February 4, 2022 letter 4383 collection due process/equivalent hearing withdrawal acknowledgement view our. It doesn’t need to be complicated, but it should. Web up to $3 cash back 1. Web full name and spouse's full name if applicable ssn here (if you and your spouse filed jointly, use the ssn that appears first on your return) address 1 address 2 city, state zip. Ad don't face the irs alone. Web remember, there are many different types of irs tax notices. Ad get your irs response letter today. • you owe additional tax; Different formats and samples are. Web reply only if instructed to do so. The first opportunity for taxpayer advocate. Web order the ultimate communicator now the letters you write on behalf of your clients make a huge difference in the results you can achieve for them. Generally, the irs sends a letter if: They have a balance due. There is usually no need to call the irs. Web you should reply as indicated on your letter or notice that could include mail, fax, or digitally through the irs’ documentation upload tool, when available, by using. In addition to the documents the irs has requested, you should send a letter. Get free, competing quotes from leading irs tax issue experts. Get a free irs tax issue consultation. Rra98 § 3705 requires all employees to identify themselves upon initially contacting a taxpayer or representative. We offer a comprehensive selection of affordable precisely written letters for response to any irs correspondence you may have. Web full name and spouse's full name if applicable ssn here (if you and your spouse filed jointly, use the ssn that appears first on your return) address 1 address 2 city, state zip. They have a balance due. • you owe additional tax; It doesn’t need to be complicated, but it should. Ad don't face the irs alone. Web up to $3 cash back 1. Rra98 § 3705 requires all employees to identify themselves upon initially contacting a taxpayer or representative. The first opportunity for taxpayer advocate. Web you should reply as indicated on your letter or notice that could include mail, fax, or digitally through the irs’ documentation upload tool, when available, by using. The irs independent office of appeals seeks to. In addition to the documents the irs has requested, you should send a letter. If for any reason you cannot respond by the deadline, call the number included with the irs audit letter. The irs mails letters or notices to taxpayers for a variety of reasons including if: Or • the irs is requesting payment or needs additional. Web the irs generally asks for a response within 30 days.Letter to the IRS IRS Response Letter Form (with Sample)

Irs Cp2000 Example Response Letter amulette

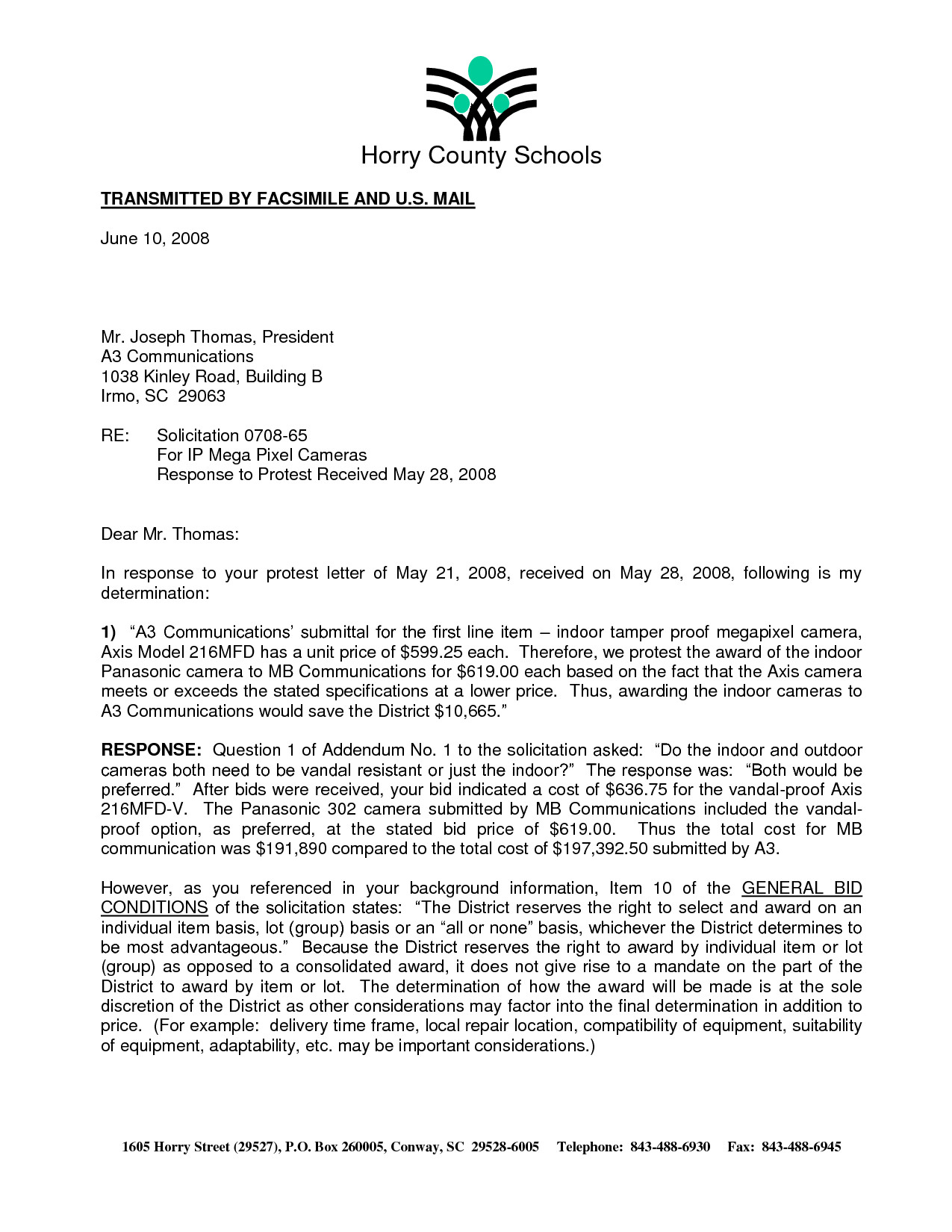

Irs Response Letter Template 11+ Professional Templates Ideas

Sample Letter To Irs Free Printable Documents

IRS Audit Letter CP134B Sample 1

Irs Response Letter Template in 2022 Letter templates, Business

IRS Response Letter Template Federal Government Of The United States

Cp2000 Response Letter Template Samples Letter Template Collection

Irs Cp2000 Example Response Letter amulette

IRS response Letter Internal Revenue Service Ratification

There Is Usually No Need To Call The Irs.

Web Reply Only If Instructed To Do So.

• You Are Due A Larger Refund;

We Have Covered A Few Types Of Irs Notices Here, Including A Notice Of Deficiency.

Related Post: