R&D Tax Credit Claim Template For Smes

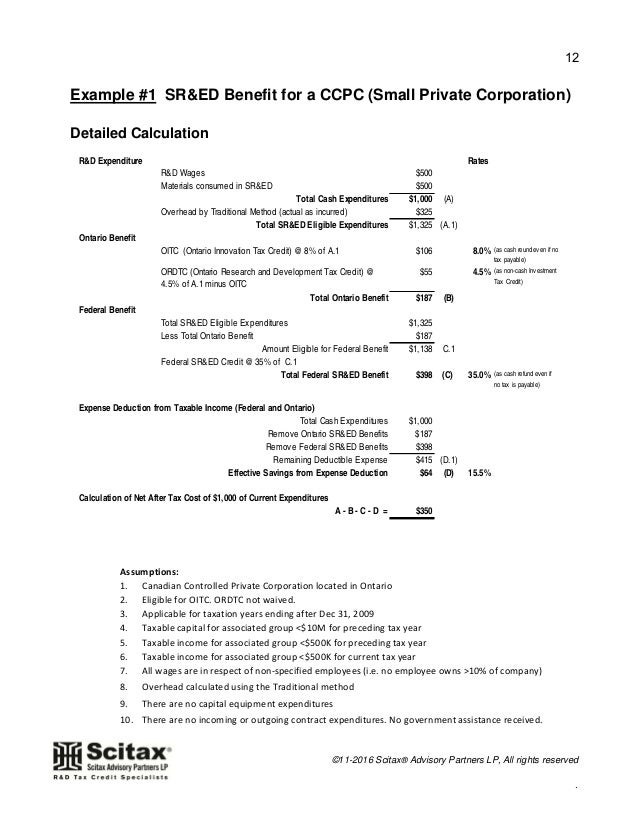

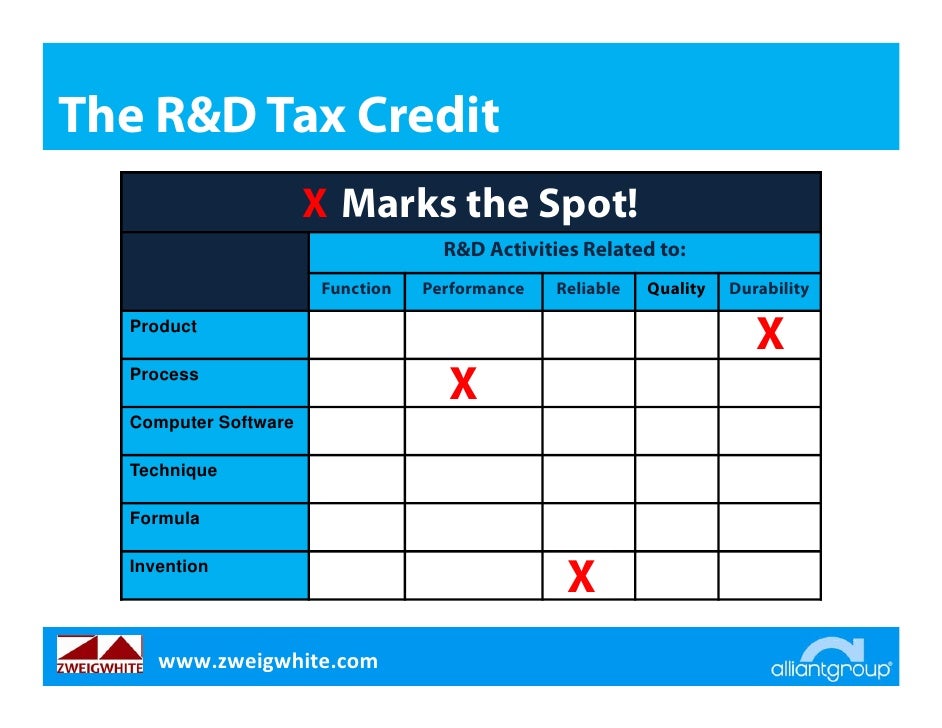

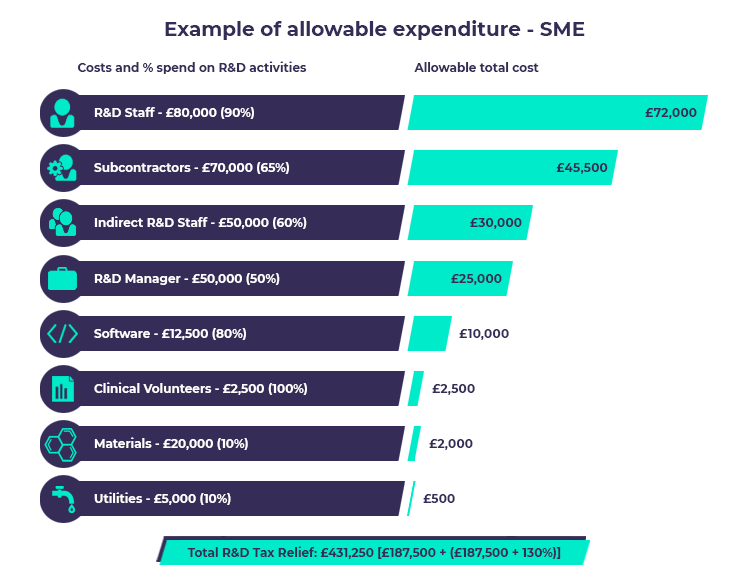

R&D Tax Credit Claim Template For Smes - Form 6765, credit for increasing research activities. Web for expenditure incurred up to and including 31 july 2008 smes can deduct 150% in respect of their qualifying r&d expenditure and the payable tax credit can. Sme includes companies with staff under the count of 500 or less, a turnover of no more than €100, or else having gross assets up to €86 million, that. Web the r&d tax claim needs to be submitted with your annual corporate tax filing. Web deduct an extra 86% of their qualifying costs from their yearly profit, as well as the normal 100% deduction, to make a total of 186% deduction. Web identify qualifying r&d expenditure, on the basis of when it was incurred, between fy 2022 and fy2023 apply the relevant rate of relief (130% or 86%) to the qualifying expenditure. Web your research and development (r&d) tax credit claim is filed via your corporation tax return (ct600). Web the research and experimentation tax credit is also known as the research and development tax credit, or r&d tax credit. Web sme r&d tax credit: Find deals and low prices on master tax guide 2021 at amazon.com Web you can claim sme r&d tax relief if you’re a sme with both of the following: Web the r&d tax claim needs to be submitted with your annual corporate tax filing. Ad free shipping on qualified orders. Web 5 may 2023 — see all updates contents r&d tax relief guidance tell hmrc before you make a claim submit detailed. There are some circumstances, however,. Web find out how to calculate r&d tax credit rates in our ultimate guide to r&d. Reduce your tax liability with r&d tax credit Here are all the necessities: Web the r&d tax claim needs to be submitted with your annual corporate tax filing. As part of the u.s. Reduce your tax liability with r&d tax credit There are some circumstances, however,. Web the r&d tax claim needs to be submitted with your annual corporate tax filing. Qualified research activities (qras) — sometimes called qualified research. Web sme r&d tax credit: As part of the u.s. Web identify qualifying r&d expenditure, on the basis of when it was incurred, between fy 2022 and fy2023 apply the relevant rate of relief (130% or 86%) to the qualifying expenditure. Web for expenditure incurred up to and including 31 july 2008 smes can deduct 150% in respect of their. Find deals and low prices on master tax guide 2021 at amazon.com Web find out how to calculate r&d tax credit rates in our ultimate guide to r&d. There is no standard format for supplying your. Tax code, the r&d tax. Less than 500 staff a turnover of under 100 million euros or a balance sheet total under. Web you can claim sme r&d tax relief if you’re a sme with both of the following: Web find out how to calculate r&d tax credit rates in our ultimate guide to r&d. Less than 500 staff a turnover of under 100 million euros or a balance sheet total under. Web the r&d tax claim needs to be submitted with. Web the research and experimentation tax credit is also known as the research and development tax credit, or r&d tax credit. Web types of r&d schemes. Free, easy returns on millions of items. As part of the u.s. There are some circumstances, however,. Find deals and low prices on master tax guide 2021 at amazon.com Ad free shipping on qualified orders. There is no standard format for supplying your. Sme includes companies with staff under the count of 500 or less, a turnover of no more than €100, or else having gross assets up to €86 million, that. Web find out how to. Web for expenditure incurred up to and including 31 july 2008 smes can deduct 150% in respect of their qualifying r&d expenditure and the payable tax credit can. Web 5 may 2023 — see all updates contents r&d tax relief guidance tell hmrc before you make a claim submit detailed information before you make a claim r&d tax. Web r&d. As part of the u.s. Crowe.com has been visited by 10k+ users in the past month Tax code, the r&d tax. Web types of r&d schemes. Web sme r&d tax credit: As part of the u.s. Find deals and low prices on master tax guide 2021 at amazon.com There are some circumstances, however,. Qualified research activities (qras) — sometimes called qualified research. Form 6765, credit for increasing research activities. Web you can claim sme r&d tax relief if you’re a sme with both of the following: Sme includes companies with staff under the count of 500 or less, a turnover of no more than €100, or else having gross assets up to €86 million, that. There is no standard format for supplying your. Web the r&d tax claim needs to be submitted with your annual corporate tax filing. Web identify qualifying r&d expenditure, on the basis of when it was incurred, between fy 2022 and fy2023 apply the relevant rate of relief (130% or 86%) to the qualifying expenditure. Crowe.com has been visited by 10k+ users in the past month Gusto.com has been visited by 10k+ users in the past month Web 5 may 2023 — see all updates contents r&d tax relief guidance tell hmrc before you make a claim submit detailed information before you make a claim r&d tax. The sme scheme is dependent entirely on making new advances and. Web types of r&d schemes. Reduce your tax liability with r&d tax credit The sme scheme gives relief by way of an additional. Web r&d is a corporation tax (ct) tax relief that may reduce your company’s tax bill if your company is liable for ct or, in some circumstances, you may receive a payable tax. Ad free shipping on qualified orders. Less than 500 staff a turnover of under 100 million euros or a balance sheet total under. Find deals and low prices on master tax guide 2021 at amazon.com Sme includes companies with staff under the count of 500 or less, a turnover of no more than €100, or else having gross assets up to €86 million, that. There are some circumstances, however,. Web humanities social sciences, including economics r&d expenditure credit (rdec) expenditure credit is a tax credit and can be claimed if you’re either a: Web can i use an r&d tax credit claim template for smes? Form 6765, credit for increasing research activities. As part of the u.s. Crowe.com has been visited by 10k+ users in the past month Web types of r&d schemes. Web you can claim sme r&d tax relief if you’re a sme with both of the following: Tax code, the r&d tax. Web the r&d tax claim needs to be submitted with your annual corporate tax filing. Web deduct an extra 86% of their qualifying costs from their yearly profit, as well as the normal 100% deduction, to make a total of 186% deduction. The sme scheme is dependent entirely on making new advances and. There are two broad categoriesof activities that a business can claim towards the r&d tax credit: Qualified research activities (qras) — sometimes called qualified research.Introduction to R&D Tax Credits in Canada with Worked Examples for Sm…

Ohio R&d Tax Credit Form Form Resume Examples K75P0KE5l2

Navigating the R&D Tax Credit

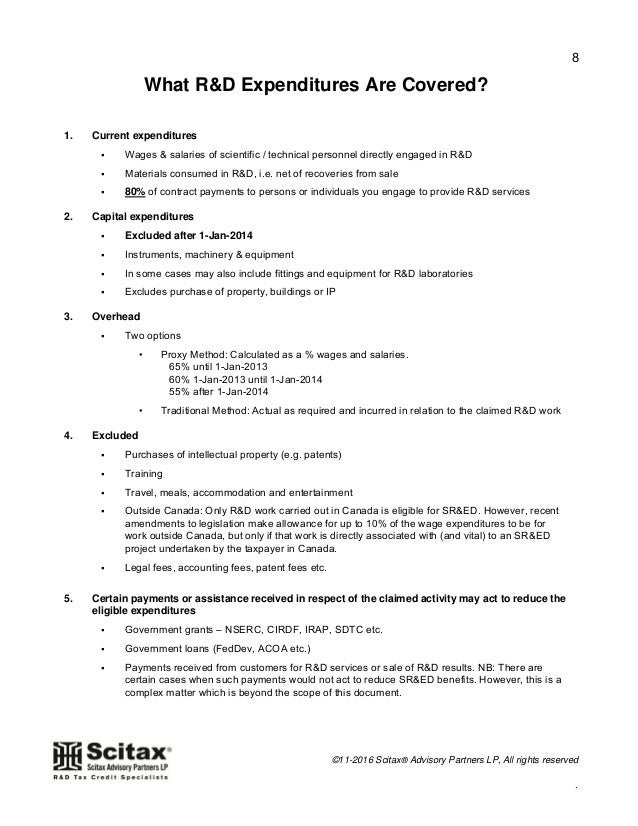

Introduction to R&D Tax Credits in Canada with Worked Examples for Sm…

R&D Tax Credit Expense Privacy

R&D Tax CreditsR & D Tax CreditsClaim what you deserve

R&D Tax Credits The Essential Guide (2020)

Introduction to R&D Tax Credits in Canada with Worked Examples for Sm…

Ach Credit Authorization Form Form Resume Examples qQ5M8VXDXg

R&D Tax Credit Rates For SME Scheme ForrestBrown

Web Identify Qualifying R&D Expenditure, On The Basis Of When It Was Incurred, Between Fy 2022 And Fy2023 Apply The Relevant Rate Of Relief (130% Or 86%) To The Qualifying Expenditure.

Here Are All The Necessities:

There Is No Standard Format For Supplying Your.

The Sme Scheme Gives Relief By Way Of An Additional.

Related Post: