Printable W 4

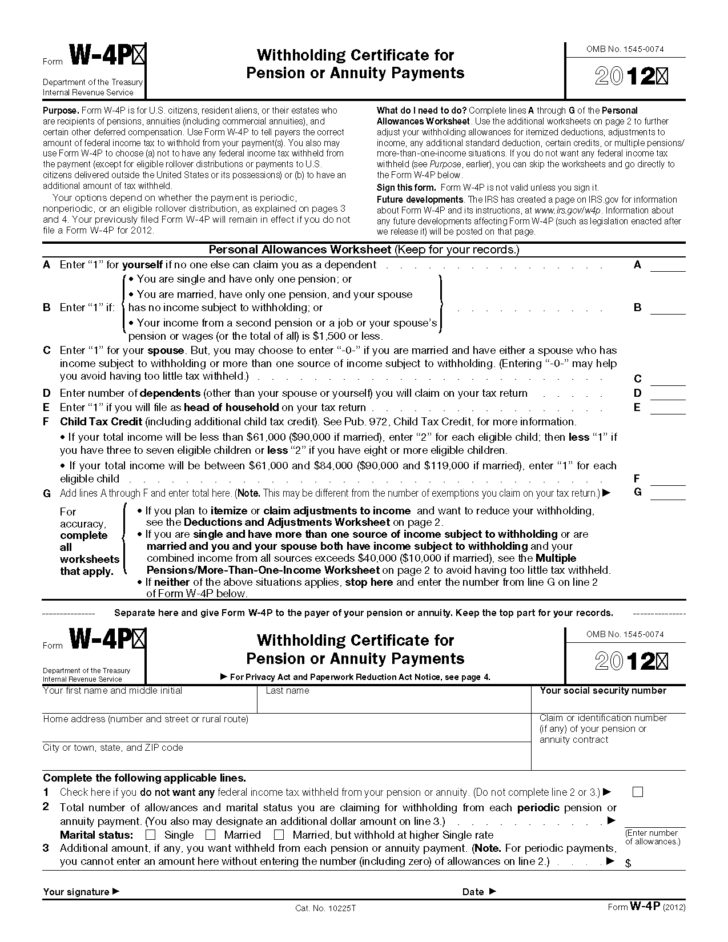

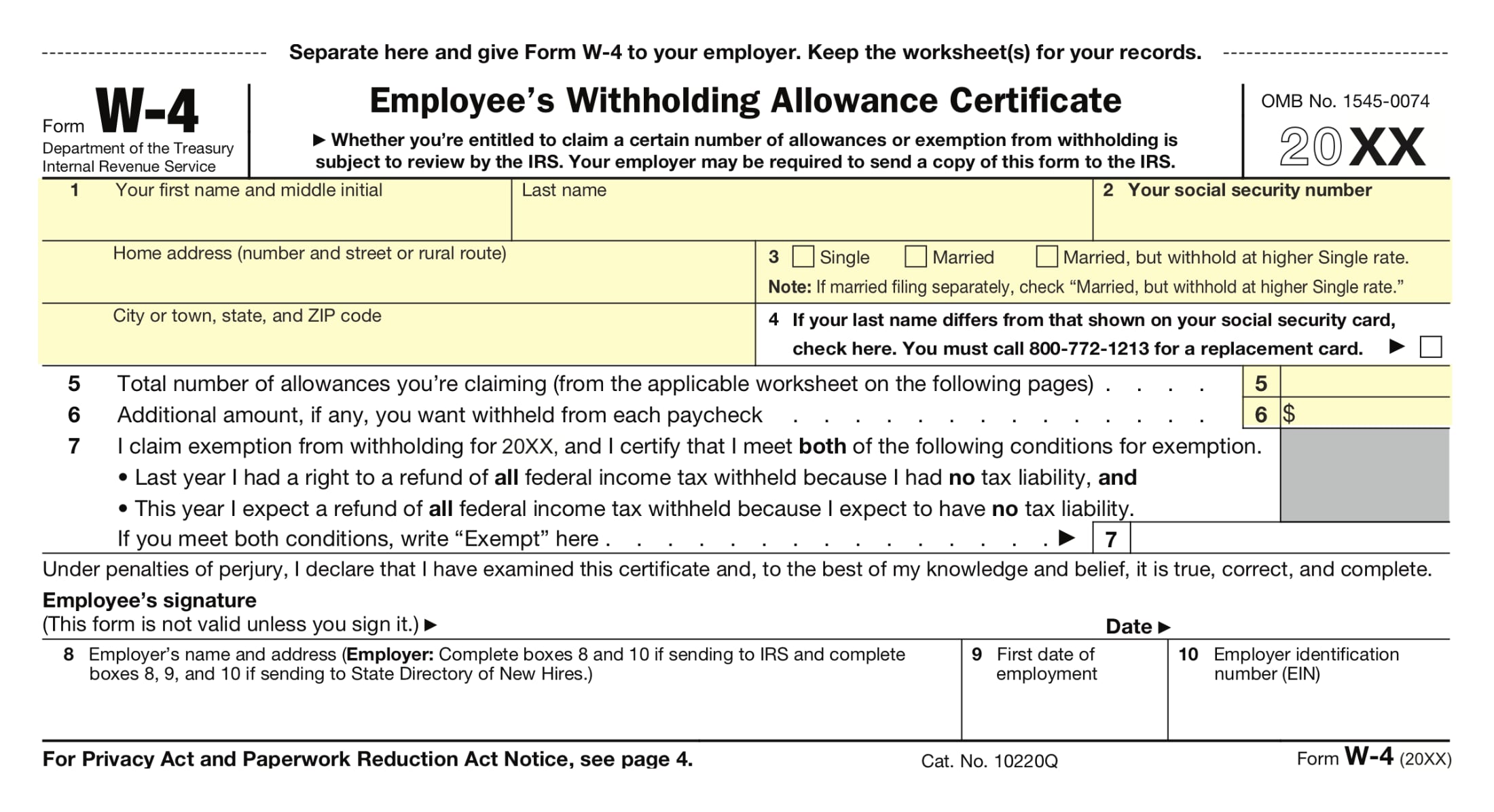

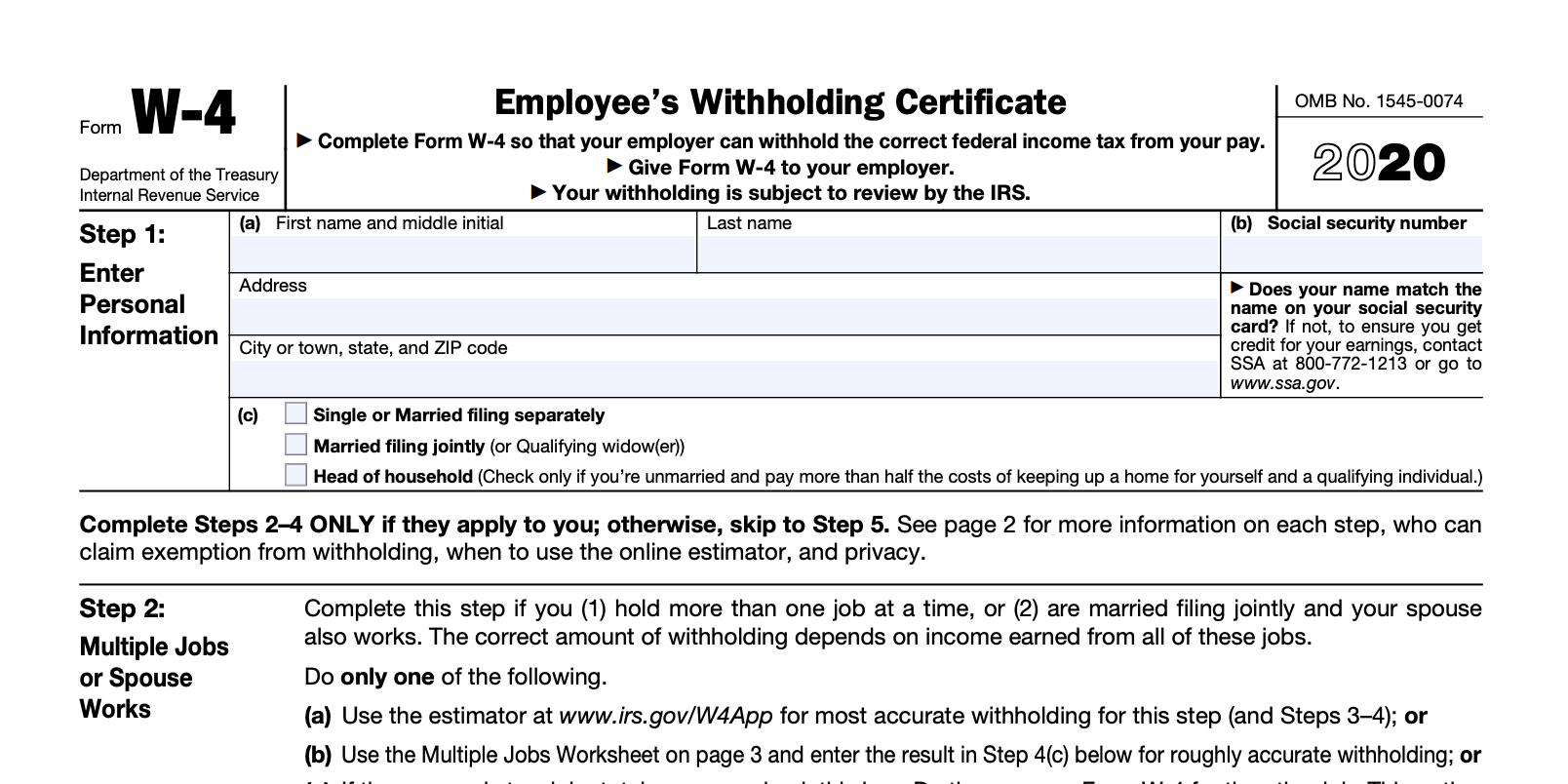

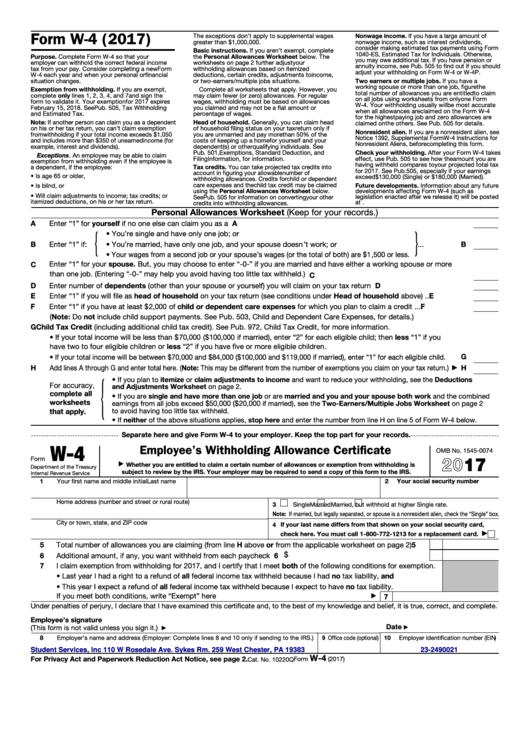

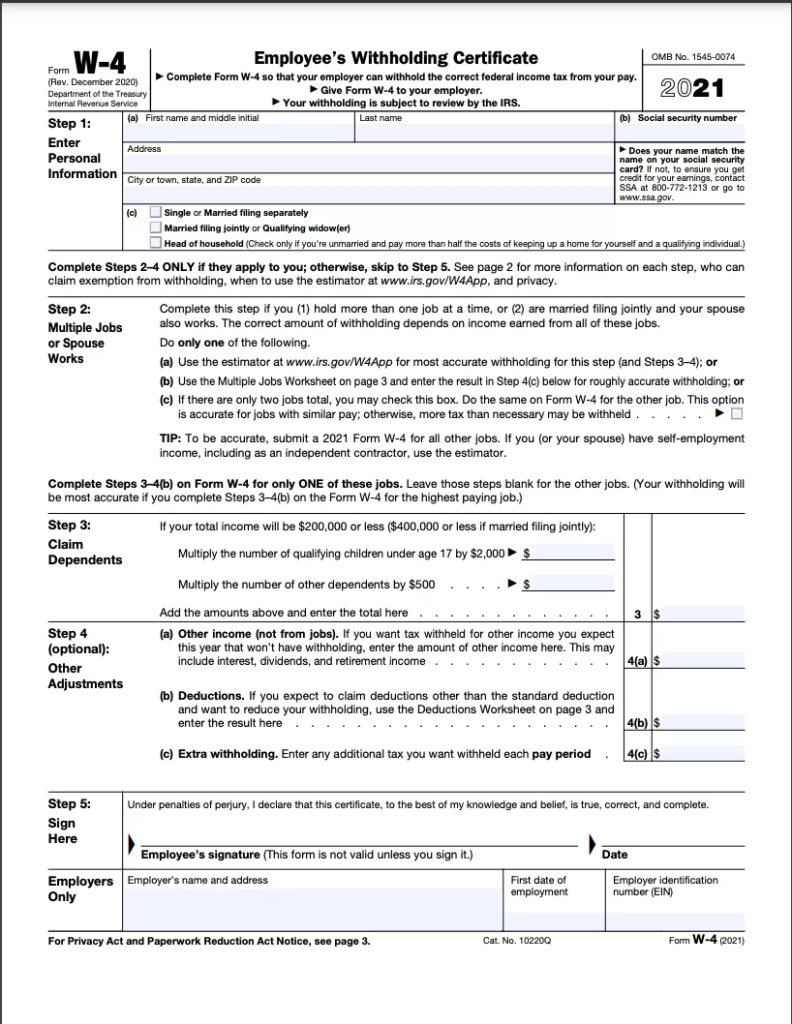

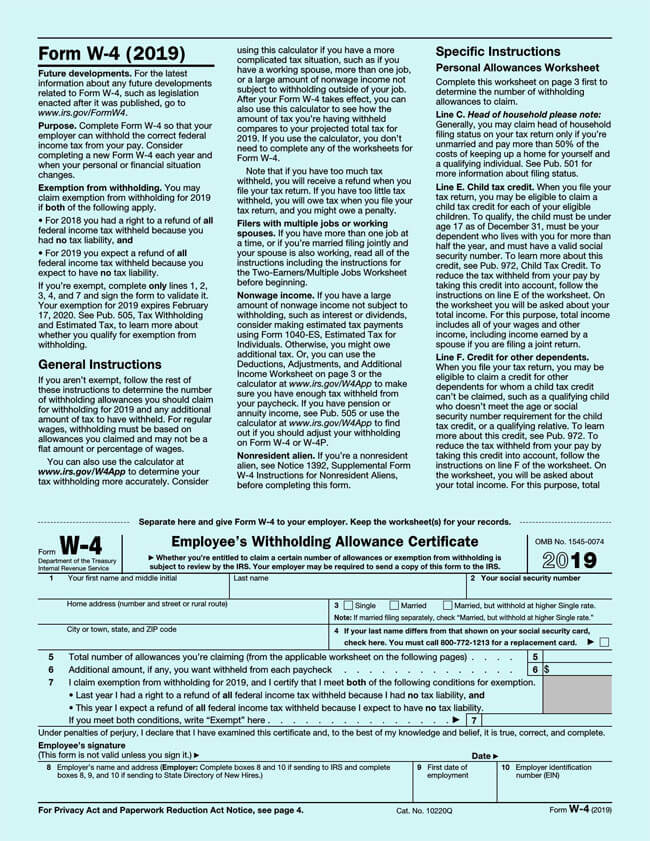

Printable W 4 - With 20 teams vying for the title. Web 4) bthis meeting point indicates the withholding table that best reflects your income situation. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. The new design is simple, accurate, and gives employees privacy while minimizing the burden on employers and the payroll process. Otherwise, skip to step 5. See page 2 for more information on each step, who can claim. Web for maryland state government employees only. Web physical address 3514 bush street raleigh, nc 27609 map it! 5) if you have chosen this method, enter the “letter” of the withholding rate. The amount withheld from your. 5) if you have chosen this method, enter the “letter” of the withholding rate. It tells the employer how much to withhold from an employee’s paycheck for taxes. Web updated august 05, 2023. With 20 teams vying for the title. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois. With 20 teams vying for the title. See page 2 for more information on each step, who can claim. Otherwise, skip to step 5. Web for maryland state government employees only. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file. Web 4) bthis meeting point indicates the withholding table that best reflects your income situation. Use the 2nd page for calculations to. Web updated august 05, 2023. Amazon.com has been visited by 1m+ users in the past month It tells the employer how much to withhold from an employee’s paycheck for taxes. If too little is withheld, you will generally owe tax when you file your tax return. See page 2 for more information on each step, who can claim. Amazon.com has been visited by 1m+ users in the past month If too little is withheld, you will. Web 4) bthis meeting point indicates the withholding table that best reflects your income situation. It tells the employer how much to withhold from an employee’s paycheck for taxes. If too little is withheld, you will generally owe tax when you file. The new design is simple, accurate, and gives employees privacy while minimizing the burden on employers and the. Otherwise, skip to step 5. The amount withheld from your. Web the storm could produce heavy rainfall in some areas, with the heaviest rain starting sunday afternoon and increasing substantially from 6 p.m. Web the 2023 little league world series has kicked off in williamsport, pa. If too little is withheld, you will generally owe tax when you file. Otherwise, skip to step 5. The amount withheld from your. Web 4) bthis meeting point indicates the withholding table that best reflects your income situation. You have to submit only the 1st page that includes the aforementioned 5 steps. Use the 2nd page for calculations to. If too little is withheld, you will generally owe tax when you file your tax return. It tells the employer how much to withhold from an employee’s paycheck for taxes. Web for maryland state government employees only. The new design is simple, accurate, and gives employees privacy while minimizing the burden on employers and the payroll process. The amount withheld. Use the 2nd page for calculations to. See page 2 for more information on each step, who can claim. If too little is withheld, you will generally owe tax when you file your tax return. Web physical address 3514 bush street raleigh, nc 27609 map it! If too little is withheld, you will generally owe tax when you file your. Web the 2023 little league world series has kicked off in williamsport, pa. The new design is simple, accurate, and gives employees privacy while minimizing the burden on employers and the payroll process. Web for maryland state government employees only. The event kicks off on wednesday, aug. If too little is withheld, you will generally owe tax when you file. The amount withheld from your. Web physical address 3514 bush street raleigh, nc 27609 map it! Otherwise, skip to step 5. See page 2 for more information on each step, who can claim. You have to submit only the 1st page that includes the aforementioned 5 steps. If too little is withheld, you will generally owe tax when you file. Use the 2nd page for calculations to. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. With 20 teams vying for the title. Web 4) bthis meeting point indicates the withholding table that best reflects your income situation. Web the storm could produce heavy rainfall in some areas, with the heaviest rain starting sunday afternoon and increasing substantially from 6 p.m. Amazon.com has been visited by 1m+ users in the past month If too little is withheld, you will generally owe tax when you file your tax return. The event kicks off on wednesday, aug. 5) if you have chosen this method, enter the “letter” of the withholding rate. Web the 2023 little league world series has kicked off in williamsport, pa. Web updated august 05, 2023. The new design is simple, accurate, and gives employees privacy while minimizing the burden on employers and the payroll process. If too little is withheld, you will generally owe tax when you file your tax return. It tells the employer how much to withhold from an employee’s paycheck for taxes. Use the 2nd page for calculations to. With 20 teams vying for the title. Amazon.com has been visited by 1m+ users in the past month Web the storm could produce heavy rainfall in some areas, with the heaviest rain starting sunday afternoon and increasing substantially from 6 p.m. Web updated august 05, 2023. The new design is simple, accurate, and gives employees privacy while minimizing the burden on employers and the payroll process. 5) if you have chosen this method, enter the “letter” of the withholding rate. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. The amount withheld from your. Otherwise, skip to step 5. You have to submit only the 1st page that includes the aforementioned 5 steps. If too little is withheld, you will generally owe tax when you file. Web physical address 3514 bush street raleigh, nc 27609 map it! Web for maryland state government employees only. If too little is withheld, you will generally owe tax when you file your tax return. Web 4) bthis meeting point indicates the withholding table that best reflects your income situation.How should you fill out the W4 form and think about federal taxes when

W4 Form 2018 Printable Ezzy W4 Form 2021 Printable

W4

Printable W4 Form For Employees Free Printable Templates

2019 W4 Form How To Fill It Out and What You Need to Know

Irs Form W4V Printable / Irs New Form W 4 For 2021 Employee Tax

Free Printable W 4 Forms 2022 W4 Form

Top20 US Tax Forms in 2022 Explained PDF.co

Form W4 Complete Guide How to Fill (with Examples)

What you should know about the new Form W4 Atlantic Payroll Partners

If Too Little Is Withheld, You Will Generally Owe Tax When You File Your Tax Return.

The Event Kicks Off On Wednesday, Aug.

See Page 2 For More Information On Each Step, Who Can Claim.

It Tells The Employer How Much To Withhold From An Employee’s Paycheck For Taxes.

Related Post: