Printable W 4 Forms

Printable W 4 Forms - Voluntary withholding request from the irs' website. Department of the treasury internal revenue service. Uslegalforms.com has been visited by 100k+ users in the past month Web mail or fax us a request to withhold taxes. Web for maryland state government employees only. If too little is withheld, you will generally owe tax when you file your tax return. Then, find the social security office closest to your home. Check the appropriate filling status below. Pdffiller.com has been visited by 1m+ users in the past month Single or married spouse works r or married filing separate r married (spouse does not work) r head of household 2. You can do everything online on the site and also benefit from other features of. When to use a w4. Pdffiller.com has been visited by 1m+ users in the past month Department of the treasury internal revenue service. Leave those steps blank for the other jobs. Web 2022 form w4. Then, find the social security office closest to your home. When to use a w4. Pdffiller.com has been visited by 1m+ users in the past month If too little is withheld, you will generally owe tax when you file your tax return. Voluntary withholding request from the irs' website. Web 2022 form w4. You can do everything online on the site and also benefit from other features of. Department of the treasury internal revenue service. Leave those steps blank for the other jobs. Web for maryland state government employees only. Check the appropriate filling status below. Web 2022 form w4. Web in this video you’ll learn: Single or married spouse works r or married filing separate r married (spouse does not work) r head of household 2. Uslegalforms.com has been visited by 100k+ users in the past month If too little is withheld, you will generally owe tax when you file your tax return. Web mail or fax us a request to withhold taxes. Web physical address 3514 bush street raleigh, nc 27609 map it! Web for maryland state government employees only. Web for maryland state government employees only. If too little is withheld, you will generally owe tax when. Then, find the social security office closest to your home. Web in this video you’ll learn: Uslegalforms.com has been visited by 100k+ users in the past month You can do everything online on the site and also benefit from other features of. Department of the treasury internal revenue service. When to use a w4. If too little is withheld, you will generally owe tax when you file your tax return. Web mail or fax us a request to withhold taxes. If too little is withheld, you will generally owe tax when you file your tax return. Web physical address 3514 bush street raleigh, nc 27609 map it! If too little is withheld, you will generally owe tax when you file your tax return. Web for maryland state government employees only. Then, find the social security office closest to your home. It tells the employer how much to withhold from an employee’s paycheck for taxes. When to use a w4. If too little is withheld, you will generally owe tax when you file your tax return. Web physical address 3514 bush street raleigh, nc 27609 map it! Pdffiller.com has been visited by 1m+ users in the past month Then, find the social security office closest to your home. Web mail or fax us a request to withhold taxes. Department of the treasury internal revenue service. Pdffiller.com has been visited by 1m+ users in the past month If too little is withheld, you will generally owe tax when. Web in this video you’ll learn: If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. Web for maryland state government employees only. It tells the employer how much to withhold from an employee’s paycheck for taxes. Uslegalforms.com has been visited by 100k+ users in the past month You can do everything online on the site and also benefit from other features of. Pdffiller.com has been visited by 1m+ users in the past month When to use a w4. Single or married spouse works r or married filing separate r married (spouse does not work) r head of household 2. Leave those steps blank for the other jobs. Web physical address 3514 bush street raleigh, nc 27609 map it! Web 2022 form w4. Web mail or fax us a request to withhold taxes. If too little is withheld, you will generally owe tax when. Check the appropriate filling status below. Then, find the social security office closest to your home. Voluntary withholding request from the irs' website. Department of the treasury internal revenue service. Pdffiller.com has been visited by 1m+ users in the past month Web in this video you’ll learn: Web for maryland state government employees only. Leave those steps blank for the other jobs. Then, find the social security office closest to your home. If too little is withheld, you will generally owe tax when. When to use a w4. You can do everything online on the site and also benefit from other features of. Department of the treasury internal revenue service. Web mail or fax us a request to withhold taxes. It tells the employer how much to withhold from an employee’s paycheck for taxes. Web 2022 form w4. If too little is withheld, you will generally owe tax when you file your tax return. Voluntary withholding request from the irs' website. Check the appropriate filling status below.W4

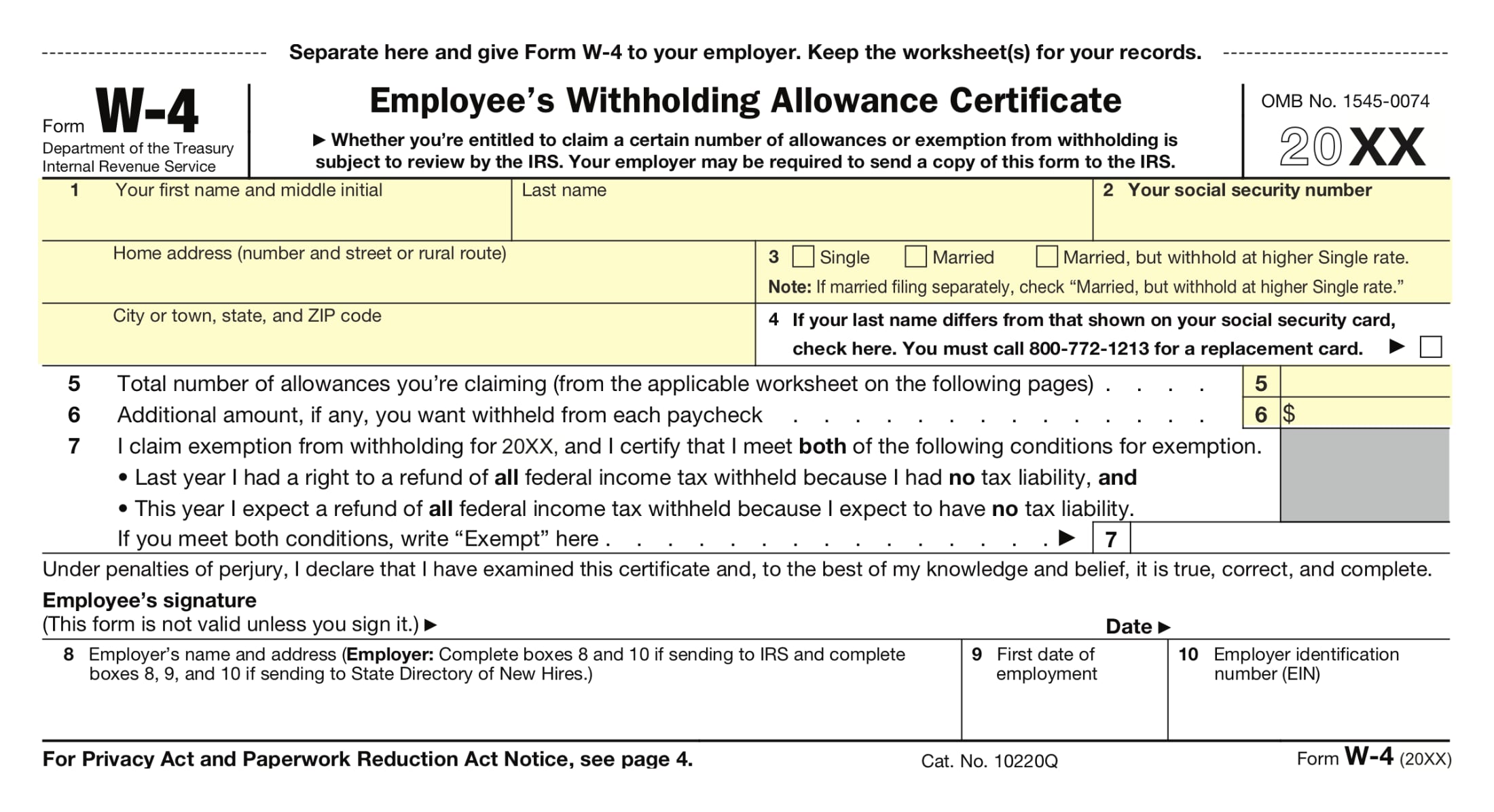

Free Printable W 4 Forms 2022 W4 Form

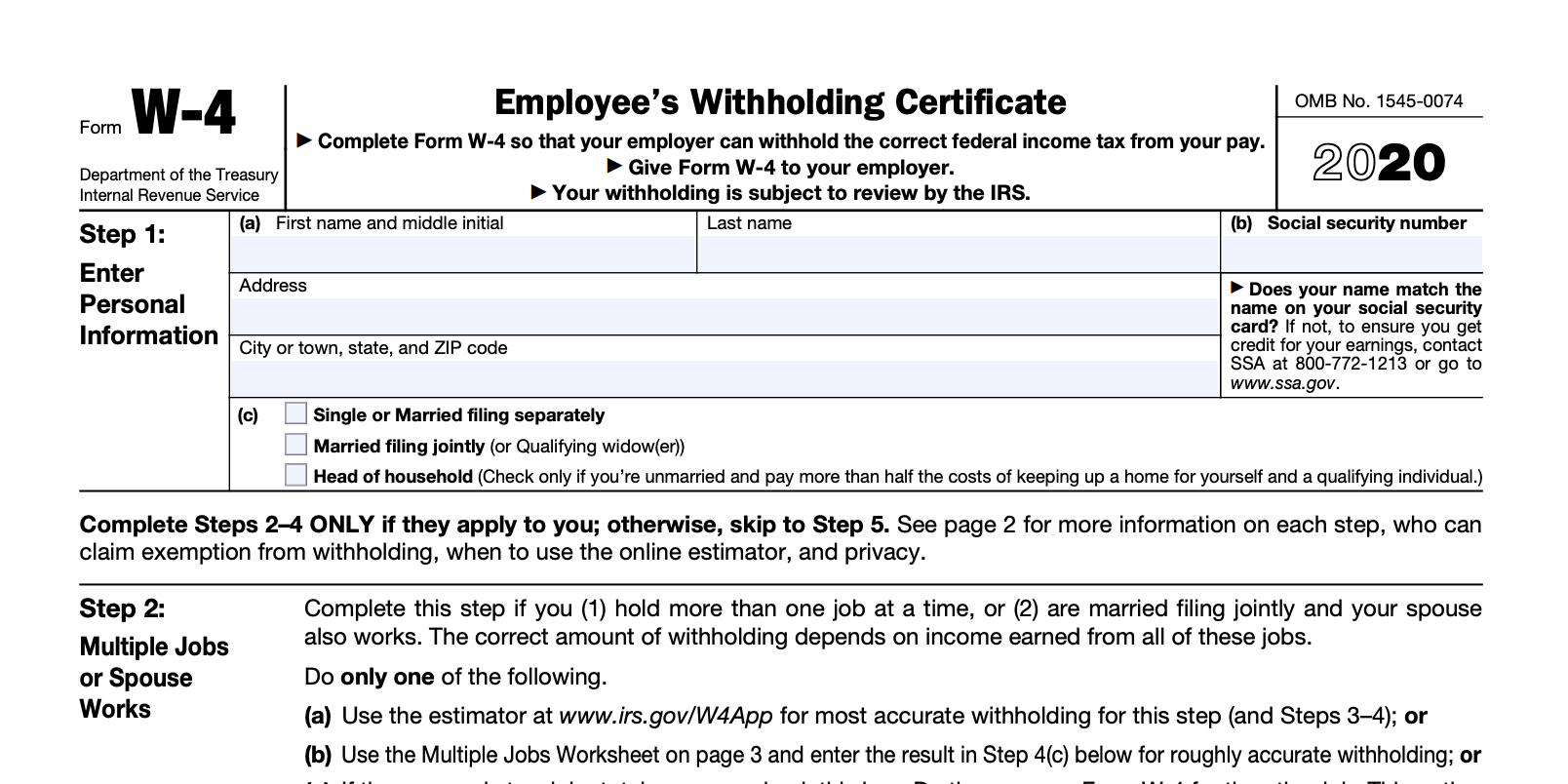

Il W 4 2020 2022 W4 Form

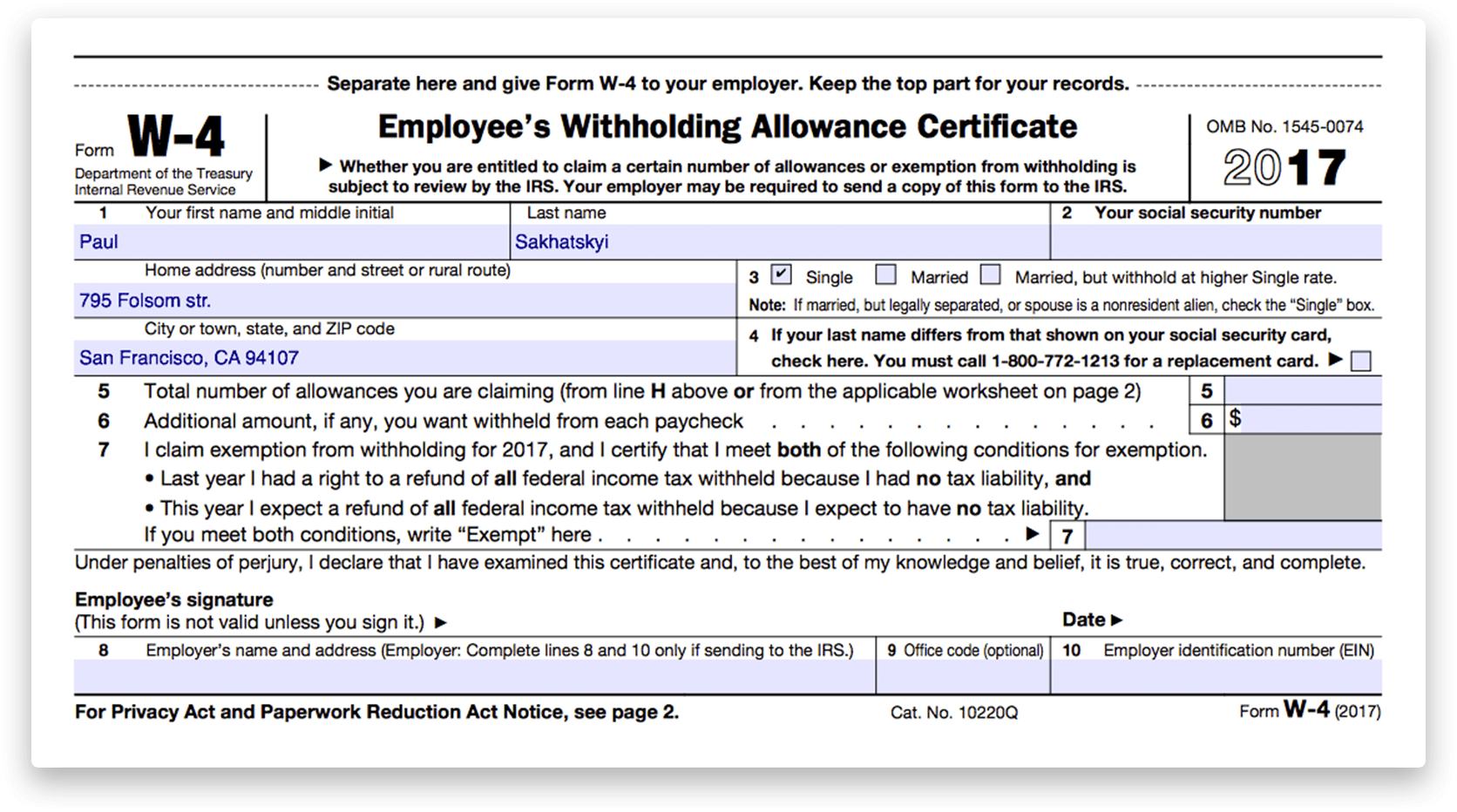

IRS W4 Federal Tax Form 2018 2019 Printable & Fillable Online

Free Printable W 4 Form For Employees Printable Templates

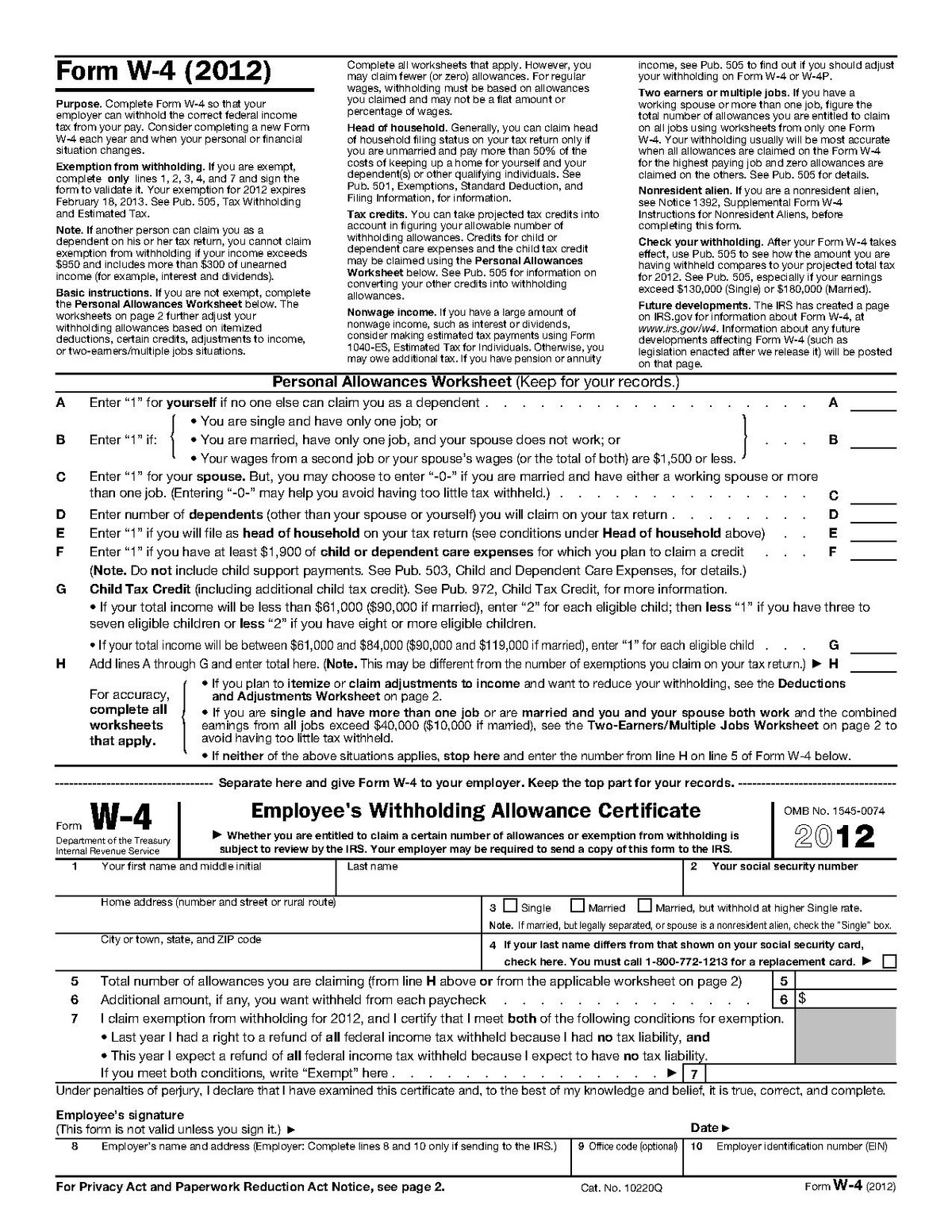

Federal W 4 Worksheet 2020 Printable & Fillable Online Blank

Printable W4 Form For Employees Free Printable Templates

How to fill out 2018 IRS Form W4 PDF Expert

How To Correctly Fill Out Your W4 Form Youtube Free Printable W 4

What you should know about the new Form W4 Atlantic Payroll Partners

Uslegalforms.com Has Been Visited By 100K+ Users In The Past Month

Single Or Married Spouse Works R Or Married Filing Separate R Married (Spouse Does Not Work) R Head Of Household 2.

Web Physical Address 3514 Bush Street Raleigh, Nc 27609 Map It!

If Too Little Is Withheld, You Will Generally Owe Tax When You File Your Tax Return.

Related Post: