Printable Tax Forms For 2017

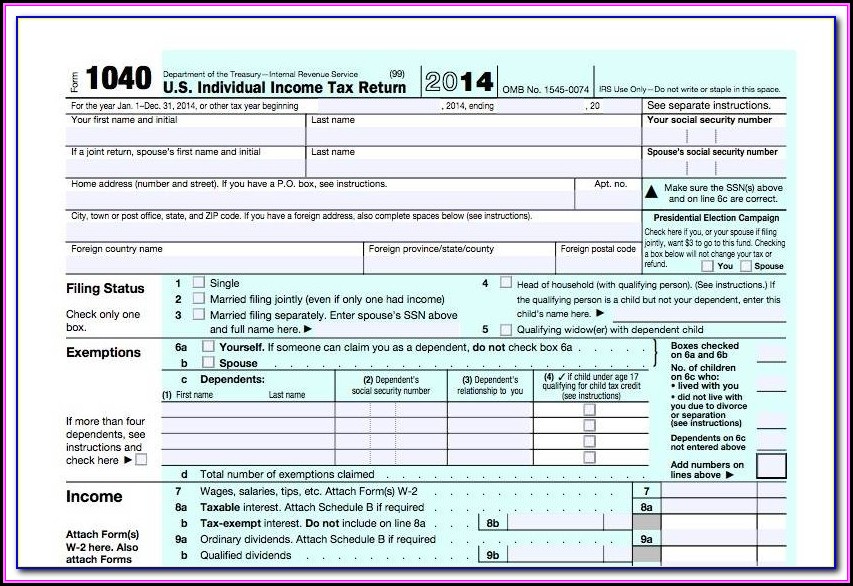

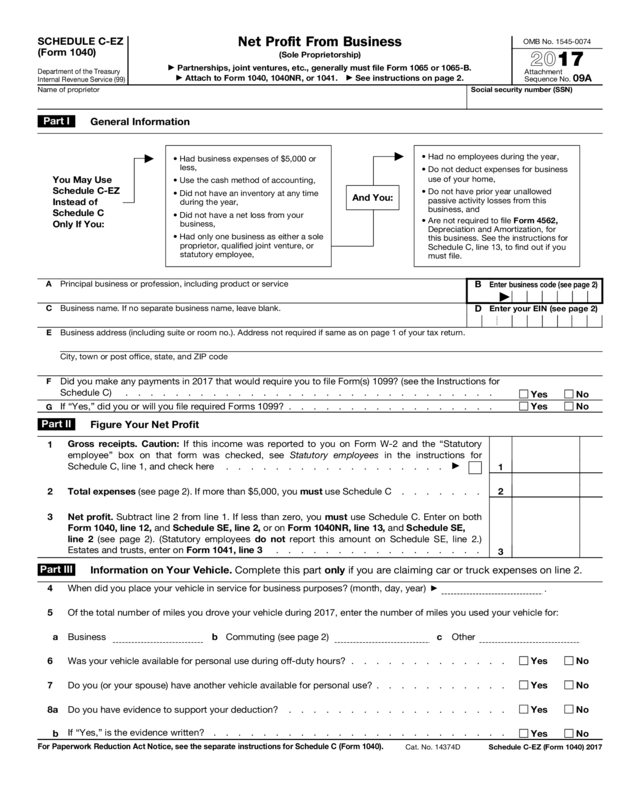

Printable Tax Forms For 2017 - Many of these items are explained in more detail later in. Massachusetts resident income tax return (english, pdf 228.3 kb) 2017 form 1 instructions. Complete, edit or print tax forms instantly. Web to file 2017 state taxes, select your state (s), click on any of the state form links, then complete, sign the form online, and select one of the save options. Enter spouse’s/rdp’s ssn or itin. Your social security number income statement details. Ad access irs tax forms. Ad access irs tax forms. Individual income tax return 2017 omb no. Download or email irs 1040 & more fillable forms, register and subscribe now! Checking a box below will not change your tax or refund. Web find the 2017 federal tax forms you need. Individual income tax return 2017 omb no. Web 2 married/rdp filing jointly. Instructions for form 1040 (2021) pdf. (m m / d d / y y y y) (m m / d d / y y y y) rp. Web to file 2017 state taxes, select your state (s), click on any of the state form links, then complete, sign the form online, and select one of the save options. Download or email irs 1040 & more fillable. Get the current year income tax forms today! Get ready for tax season deadlines by completing any required tax forms today. Checking a box below will not change your tax or refund. May help you file your 2017 tax return. Web attach to form 1040. Official irs income tax forms are printable and can be downloaded for free. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line 28. Individual income tax return 2017 omb no. Massachusetts resident income tax return. Individual income tax return 2017 omb no. Checking a box below will not change your tax or refund. Individual income tax return 2017 omb no. (m m / d d / y y y y) (m m / d d / y y y y) rp. Instructions for form 1040 (2021) pdf. Enter year spouse/rdp died 3 married/rdp filing separately. Ad access irs tax forms. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. If the total is over $1,500, you cannot use form. Use fill to complete blank online irs pdf forms for free. Instructions for form 1040 (2021) pdf. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Pay a bill or notice (notice required) sales and use tax file and pay. Instructions for form 1040 (2021) pdf. Complete, edit or print tax forms instantly. Web 1040 department of the treasury—internal revenue service (99) u.s. Individual tax return form 1040 instructions; Web popular forms & instructions; Get the current year income tax forms today! May help you file your 2017 tax return. Web get federal tax return forms and file by mail. May help you file your 2017 tax return. For calendar year 2017 or fiscal year beginning and ending. Web annual income tax return filed by citizens or residents of the united states. Pay a bill or notice (notice required) sales and use tax file and pay. Massachusetts resident income tax return. Complete, edit or print tax forms instantly. Web to file 2017 state taxes, select your state (s), click on any of the state form links, then complete, sign the form online, and select one of the save options. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line. Web 1040 department of the treasury—internal revenue service (99) u.s. For calendar year 2017 or fiscal year beginning and ending. Get ready for tax season deadlines by completing any required tax forms today. Web get federal tax return forms and file by mail. If the total is over $1,500, you cannot use form. Ad access irs tax forms. Web 1 wages, salaries, and tips. Download or email irs 1040 & more fillable forms, register and subscribe now! (m m / d d / y y y y) (m m / d d / y y y y) rp. Web 2 married/rdp filing jointly. Complete, edit or print tax forms instantly. Web popular forms & instructions; Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web annual income tax return filed by citizens or residents of the united states. Ad access irs tax forms. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line 28. Individual income tax return 2017 omb no. Individual income tax return 2017 omb no. Enter year spouse/rdp died 3 married/rdp filing separately. Pay a bill or notice (notice required) sales and use tax file and pay. Web get federal tax return forms and file by mail. Use fill to complete blank online irs pdf forms for free. 5 qualifying widow(er) with dependent child. Web presidential election campaign check here if you, or your spouse if filing jointly, want $3 to go to this fund. Web popular forms & instructions; Enter spouse’s/rdp’s ssn or itin. Complete, edit or print tax forms instantly. Web 1040 department of the treasury—internal revenue service (99) u.s. Individual income tax return 2017 omb no. Your social security number income statement details. Massachusetts resident income tax return (english, pdf 228.3 kb) 2017 form 1 instructions. Ad access irs tax forms. Get the current year income tax forms today! If the total is over $1,500, you cannot use form. Web attach to form 1040. (m m / d d / y y y y) (m m / d d / y y y y) rp.Pension IUPAT

20172019 Form IL DoR IL1040 Fill Online, Printable, Fillable, Blank

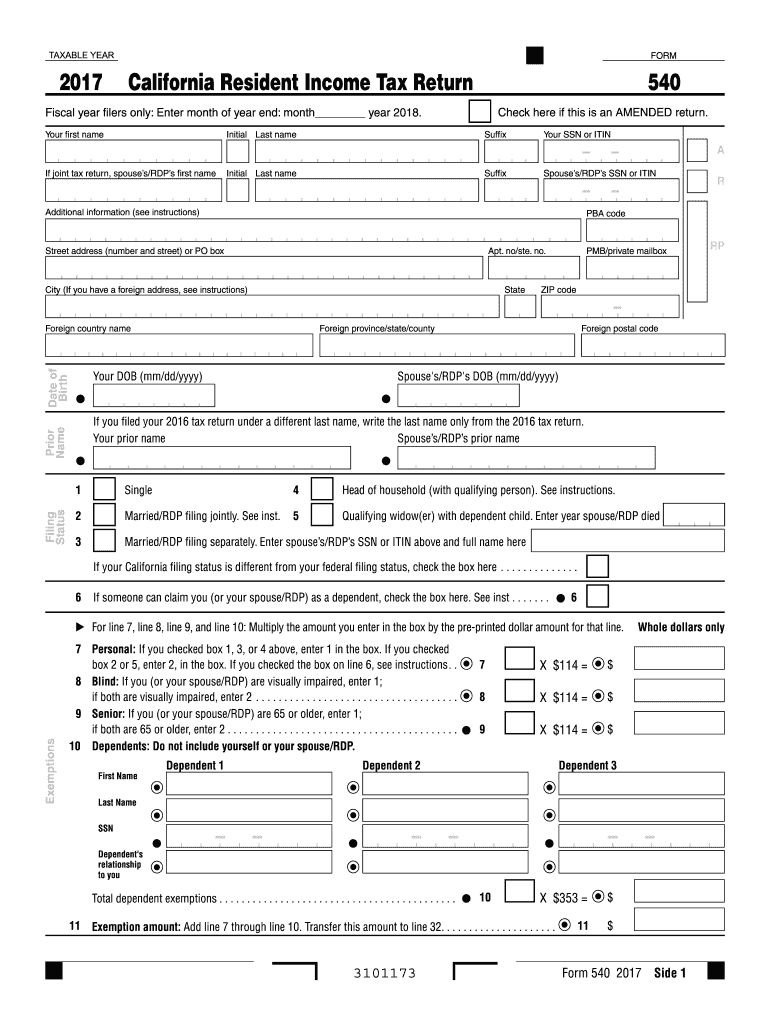

2017 California State Tax Fill Out and Sign Printable PDF Template

2017 Tax Form 1040ez Form Resume Examples A19X8je94k

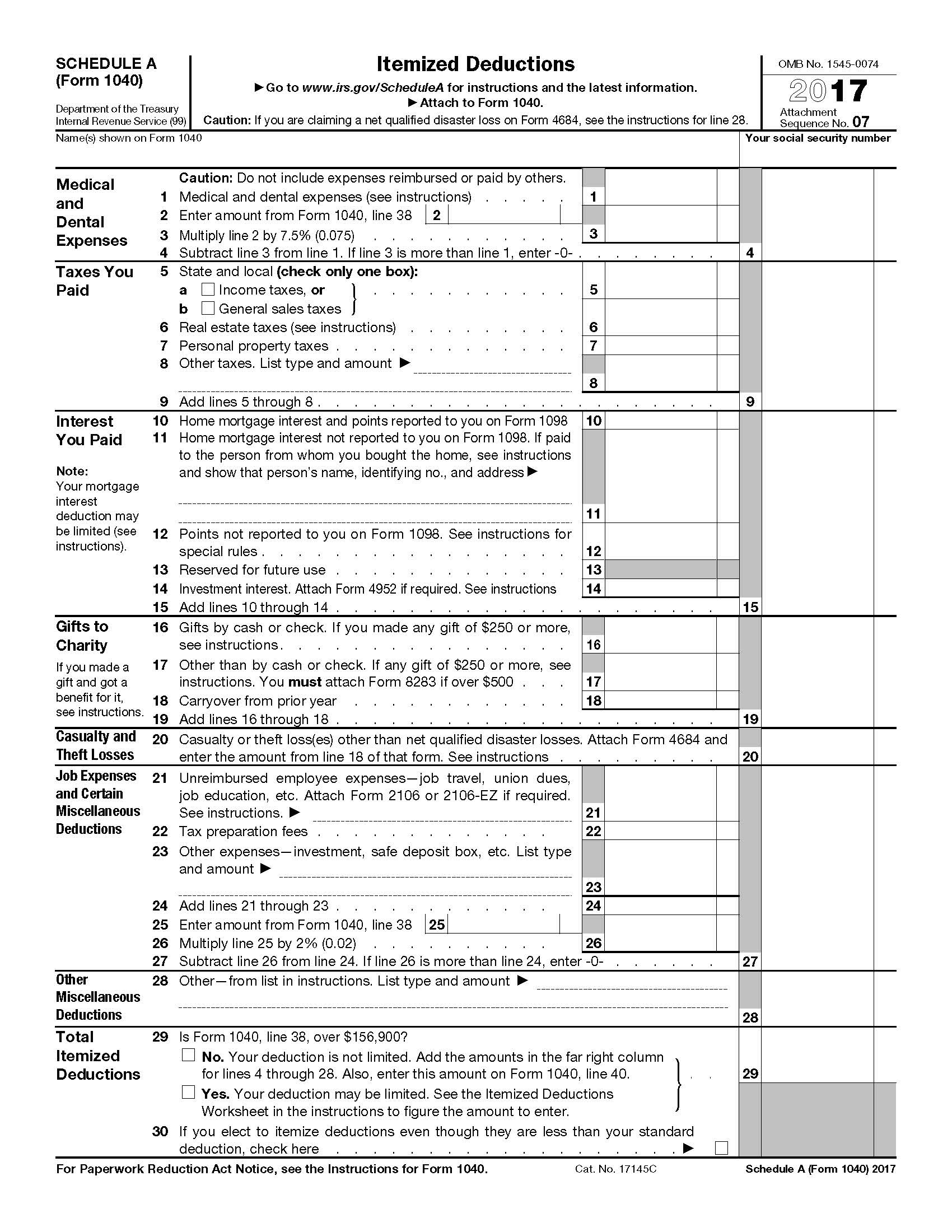

2017 Irs Tax Forms 1040 Schedule A Itemized Deductions 1040 Form

2017 1040 Tax Form PDF

Nj 1040 Tax Form 2017 Form Resume Examples EVKYdBz106

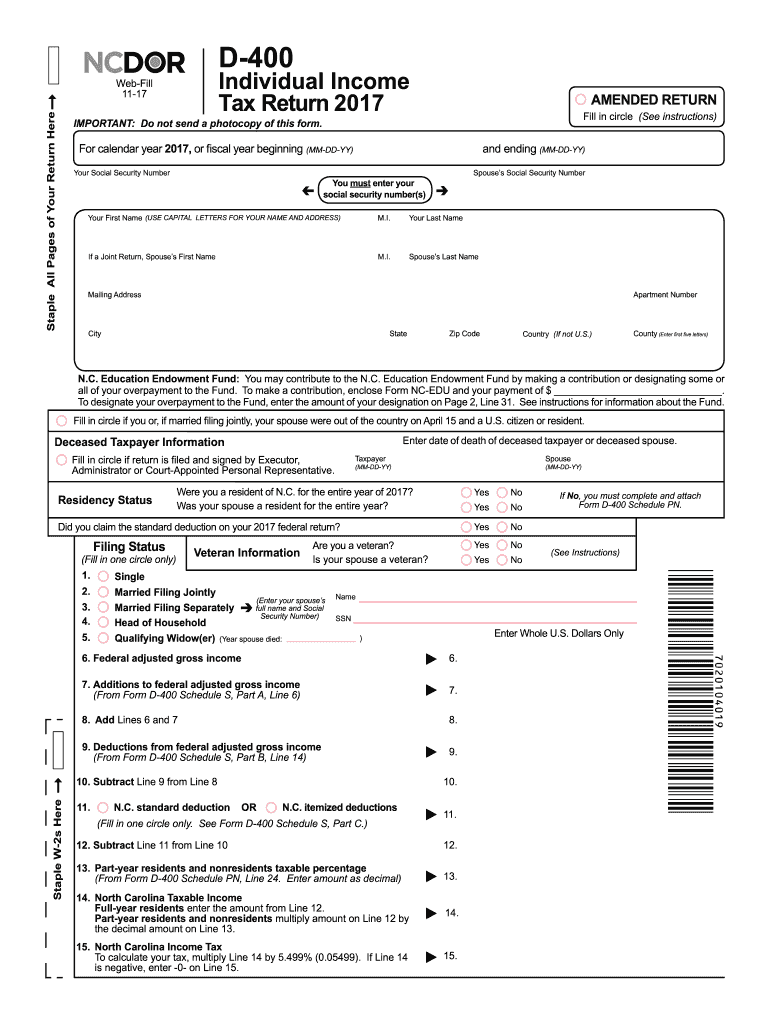

2017 Form NC DoR D400 Fill Online, Printable, Fillable, Blank pdfFiller

Federal Tax Forms 1040ez 2017 Form Resume Examples emVKwnAVrX

2017 Form 1040 (Schedule CEz) Edit, Fill, Sign Online Handypdf

Web 1 Wages, Salaries, And Tips.

31, 2017, Or Other Tax Year Beginning ,.

Web To File 2017 State Taxes, Select Your State (S), Click On Any Of The State Form Links, Then Complete, Sign The Form Online, And Select One Of The Save Options.

Enter Year Spouse/Rdp Died 3 Married/Rdp Filing Separately.

Related Post: