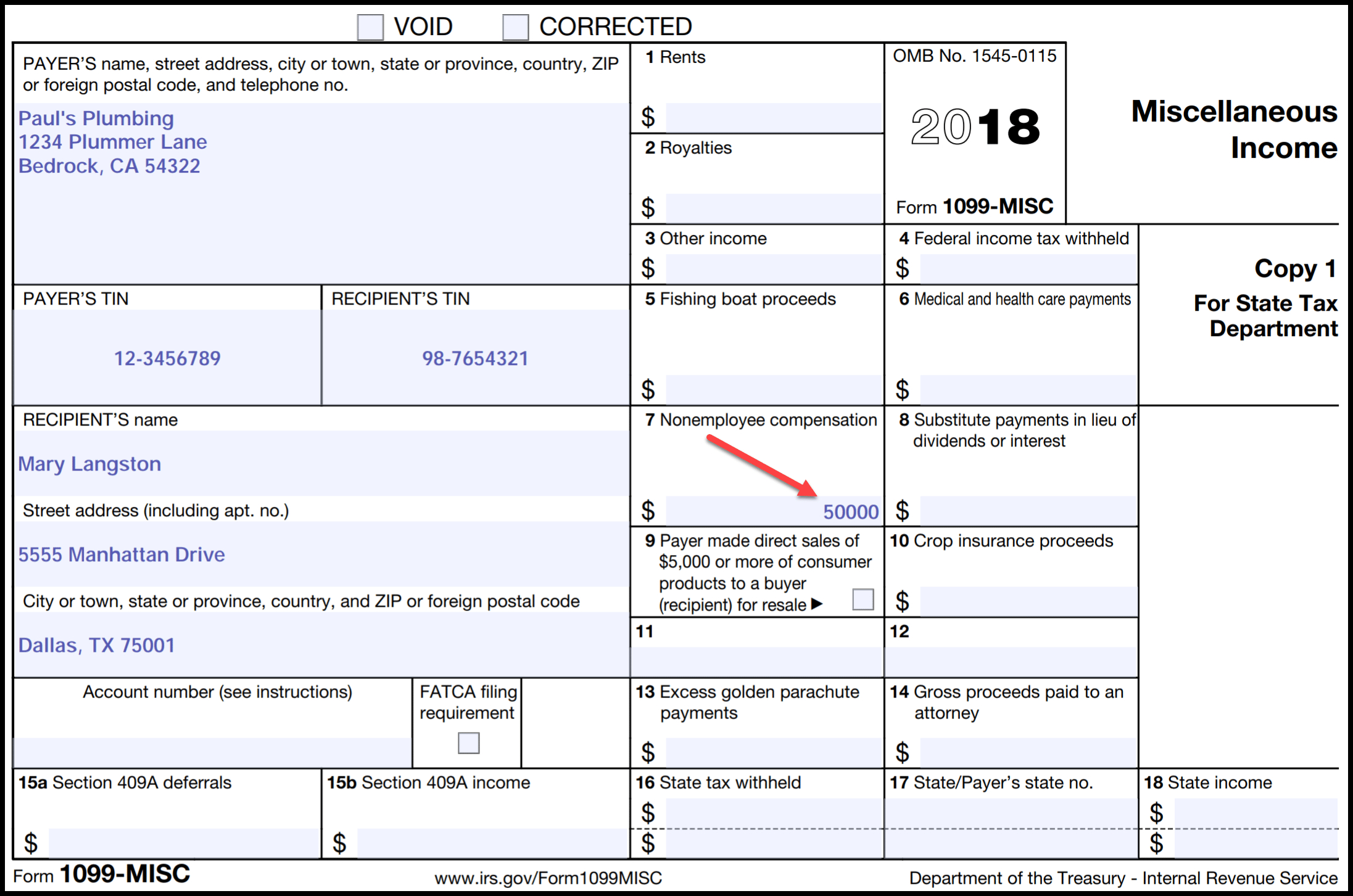

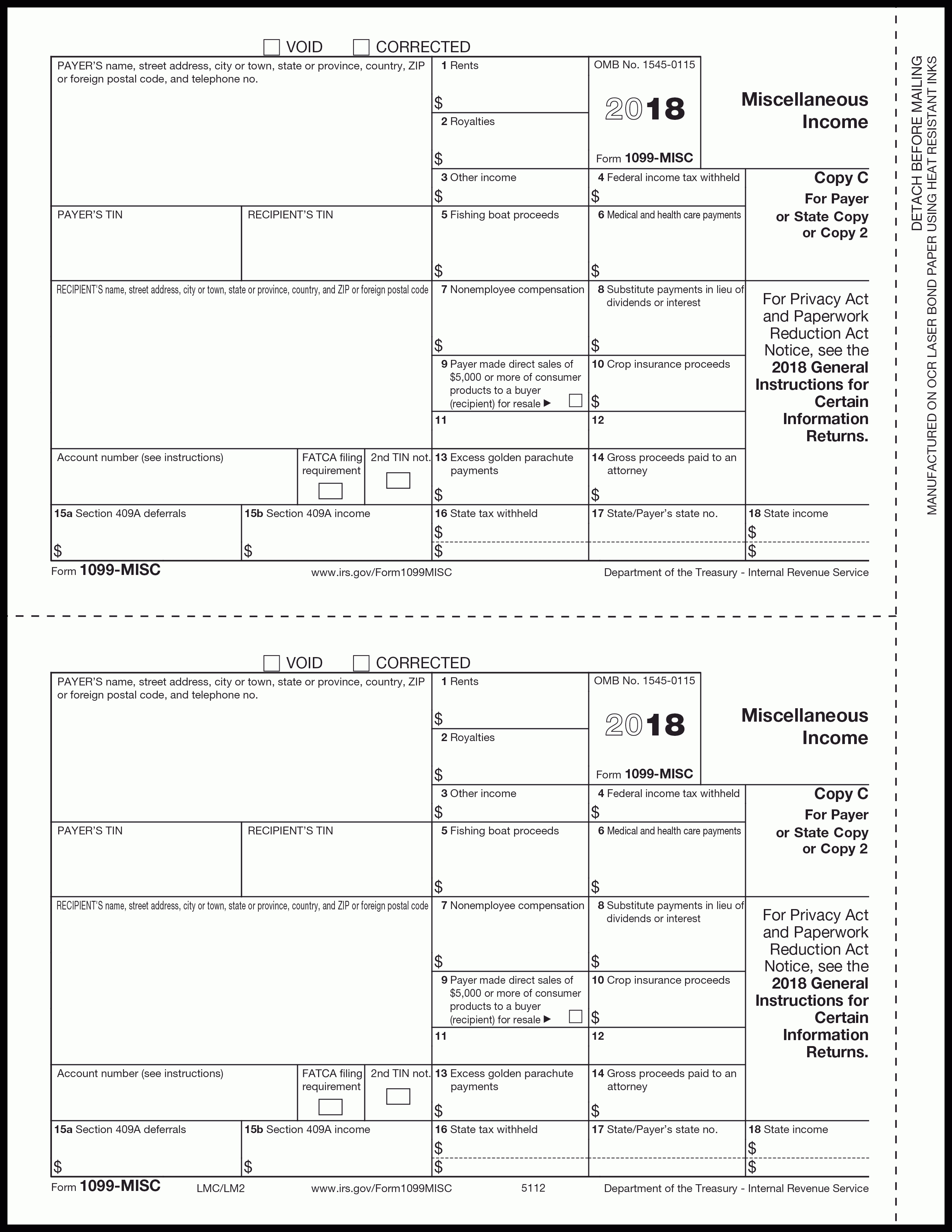

Printable 1099 Misc Forms

Printable 1099 Misc Forms - Web print and file copy a downloaded from this website; Simple software to manage hr, payroll & benefits. Create, edit, and print your business and legal documents quickly and easily! Web quickbookshelp intuit print your 1099 and 1096 forms solved • by quickbooks • 900 • updated june 22, 2023 if you have quickbooks online, quickbooks. At least $10 in royalties. If you are required to. Go to www.irs.gov/freefile to see if you. A penalty may be imposed for filing with the irs. Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker. Ad simply the best payroll service for small business. Api client id (a2a filers only) sign in to iris for system. Ad simply the best payroll service for small business. Simple software to manage hr, payroll & benefits. Get tax form (1099/1042s) update direct deposit. Web federal income tax withheld $ nonqualified deferred compensation copy b for recipient this is important tax information and is being furnished to the. If you are required to. Web quickbookshelp intuit print your 1099 and 1096 forms solved • by quickbooks • 900 • updated june 22, 2023 if you have quickbooks online, quickbooks. Web what you need employer identification number (ein) iris transmitter control code (tcc). A penalty may be imposed for filing with the irs. At least $10 in royalties. Web quickbookshelp intuit print your 1099 and 1096 forms solved • by quickbooks • 900 • updated june 22, 2023 if you have quickbooks online, quickbooks. Simple software to manage hr, payroll & benefits. Sign up & make payroll a breeze. A penalty may be imposed for filing with the irs. Miscellaneous income (aka miscellaneous information) is completed and sent. Web what you need employer identification number (ein) iris transmitter control code (tcc). Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker. Go to www.irs.gov/freefile to see if you. Web quickbookshelp intuit print your 1099 and 1096 forms solved • by quickbooks • 900 • updated june. All blank 1099 misc forms meet. At least $10 in royalties. Sign up & make payroll a breeze. Web quickbookshelp intuit print your 1099 and 1096 forms solved • by quickbooks • 900 • updated june 22, 2023 if you have quickbooks online, quickbooks. Start by gathering all the necessary information, such as your taxpayer. Go to www.irs.gov/freefile to see if you. Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker. Must be removed before printing. Web what you need employer identification number (ein) iris transmitter control code (tcc). Start by gathering all the necessary information, such as your taxpayer. Ad simply the best payroll service for small business. Sign up & make payroll a breeze. Web quickbookshelp intuit print your 1099 and 1096 forms solved • by quickbooks • 900 • updated june 22, 2023 if you have quickbooks online, quickbooks. At least $10 in royalties. Start by gathering all the necessary information, such as your taxpayer. All blank 1099 misc forms meet. Api client id (a2a filers only) sign in to iris for system. Create, edit, and print your business and legal documents quickly and easily! Go to www.irs.gov/freefile to see if you. At least $10 in royalties. Web what you need employer identification number (ein) iris transmitter control code (tcc). Web federal income tax withheld $ nonqualified deferred compensation copy b for recipient this is important tax information and is being furnished to the irs. Simple software to manage hr, payroll & benefits. Get tax form (1099/1042s) update direct deposit. Miscellaneous income (aka miscellaneous information) is completed. Web federal income tax withheld $ nonqualified deferred compensation copy b for recipient this is important tax information and is being furnished to the irs. Web what you need employer identification number (ein) iris transmitter control code (tcc). Get tax form (1099/1042s) update direct deposit. Must be removed before printing. A penalty may be imposed for filing with the irs. Sign up & make payroll a breeze. Simple software to manage hr, payroll & benefits. If you are required to. A penalty may be imposed for filing with the irs. Api client id (a2a filers only) sign in to iris for system. Start by gathering all the necessary information, such as your taxpayer. Ad simply the best payroll service for small business. All blank 1099 misc forms meet. Web quickbookshelp intuit print your 1099 and 1096 forms solved • by quickbooks • 900 • updated june 22, 2023 if you have quickbooks online, quickbooks. Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker. Web what you need employer identification number (ein) iris transmitter control code (tcc). Web federal income tax withheld $ nonqualified deferred compensation copy b for recipient this is important tax information and is being furnished to the irs. Must be removed before printing. Web print and file copy a downloaded from this website; Go to www.irs.gov/freefile to see if you. Create, edit, and print your business and legal documents quickly and easily! At least $10 in royalties. Get tax form (1099/1042s) update direct deposit. If you are required to. Start by gathering all the necessary information, such as your taxpayer. Create, edit, and print your business and legal documents quickly and easily! Sign up & make payroll a breeze. Web print and file copy a downloaded from this website; Go to www.irs.gov/freefile to see if you. Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker. Web federal income tax withheld $ nonqualified deferred compensation copy b for recipient this is important tax information and is being furnished to the irs. Web quickbookshelp intuit print your 1099 and 1096 forms solved • by quickbooks • 900 • updated june 22, 2023 if you have quickbooks online, quickbooks. Must be removed before printing. A penalty may be imposed for filing with the irs. Web what you need employer identification number (ein) iris transmitter control code (tcc). Get tax form (1099/1042s) update direct deposit. All blank 1099 misc forms meet.1099MISC Pressure Seal Form (1099MISC)

Printable 1099 Misc Tax Form Template Printable Templates

What is a 1099Misc Form? Financial Strategy Center

Irs Form 1099 Misc Printable Printable Forms Free Online

1099MISC Form Printable and Fillable PDF Template

1099MISC 3Part Continuous 1" Wide Formstax

Free Printable 1099 Misc Forms Free Printable

6 mustknow basics form 1099MISC for independent contractors Bonsai

Free Printable 1099 Misc Form 2013 Free Printable

Form 1099MISC Miscellaneous Definition

At Least $10 In Royalties.

Api Client Id (A2A Filers Only) Sign In To Iris For System.

Ad Simply The Best Payroll Service For Small Business.

Simple Software To Manage Hr, Payroll & Benefits.

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)