Printable 1099 Misc Form

Printable 1099 Misc Form - Ad tin matching is essential to eliminate errors in the 1099 reporting process. Web print and file copy a downloaded from this website; Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker. Web instructions for recipient recipient’s taxpayer identification number (tin). For your protection, this form may show only the last four digits of your social security number. Utilizing a printable version, which can be easily accessed online,. Read customer reviews & find best sellers. To order these instructions and additional forms, go to www.irs.gov/employerforms. Pricing starts as low as. Ad accurate & dependable 1099 right to your email quickly and easily. Businesses that make more than $600 payments to independent contractors or freelancers within a year; Get tax form (1099/1042s) update direct deposit. Click and type in each field to fill out your form. In a few easy steps, you can create your own 1099 forms and have them sent to your email. Ad tin matching is essential to eliminate errors. Get tax form (1099/1042s) update direct deposit. Ad tin matching is essential to eliminate errors in the 1099 reporting process. Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker. Buy now and receive instantly. Learn how to proactively identify & correct inaccurate tins before filing 1099s to. Ad tin matching is essential to eliminate errors in the 1099 reporting process. Pricing starts as low as. In a few easy steps, you can create your own 1099 forms and have them sent to your email. Web instructions for recipient recipient’s taxpayer identification number (tin). Quick & secure online filing. To order these instructions and additional forms, go to www.irs.gov/employerforms. Learn how to proactively identify & correct inaccurate tins before filing 1099s to the irs Web get 📝 printable 1099 form 🟢 instructions for filling form 1099 misc 🟢 fill form online or download in pdf format 🟢 detailed online guide & blank templates. Miscellaneous income (aka miscellaneous information) is. For your protection, this form may show only the last four digits of your social security number. Learn how to proactively identify & correct inaccurate tins before filing 1099s to the irs To order these instructions and additional forms, go to www.irs.gov/employerforms. Want to file us taxes? In a few easy steps, you can create your own 1099 forms and. Pricing starts as low as. To order these instructions and additional forms, go to www.irs.gov/employerforms. Web instructions for recipient recipient’s taxpayer identification number (tin). Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker. Utilizing a printable version, which can be easily accessed online,. Businesses that make more than $600 payments to independent contractors or freelancers within a year; Web get 📝 printable 1099 form 🟢 instructions for filling form 1099 misc 🟢 fill form online or download in pdf format 🟢 detailed online guide & blank templates. A penalty may be imposed for filing with the irs. Pricing starts as low as. Get. To order these instructions and additional forms, go to www.irs.gov/employerforms. Pricing starts as low as. Quick & secure online filing. Must be removed before printing. Ad tin matching is essential to eliminate errors in the 1099 reporting process. Learn how to proactively identify & correct inaccurate tins before filing 1099s to the irs Read customer reviews & find best sellers. Find deals on 1099 tax forms on amazon Quick & secure online filing. Web print and file copy a downloaded from this website; Read customer reviews & find best sellers. Learn how to proactively identify & correct inaccurate tins before filing 1099s to the irs A penalty may be imposed for filing with the irs. Pricing starts as low as. Find deals on 1099 tax forms on amazon Pricing starts as low as. A penalty may be imposed for filing with the irs. In a few easy steps, you can create your own 1099 forms and have them sent to your email. Click and type in each field to fill out your form. Starting at $59 for unlimited w2 1099 filing. Web get 📝 printable 1099 form 🟢 instructions for filling form 1099 misc 🟢 fill form online or download in pdf format 🟢 detailed online guide & blank templates. To order these instructions and additional forms, go to www.irs.gov/employerforms. Get tax form (1099/1042s) update direct deposit. Must be removed before printing. For your protection, this form may show only the last four digits of your social security number. Web instructions for recipient recipient’s taxpayer identification number (tin). Want to file us taxes? Ad tin matching is essential to eliminate errors in the 1099 reporting process. Businesses that make more than $600 payments to independent contractors or freelancers within a year; Miscellaneous income (aka miscellaneous information) is completed and sent out by someone who has paid at least $10 in royalties or broker. Read customer reviews & find best sellers. Learn how to proactively identify & correct inaccurate tins before filing 1099s to the irs Download, print, efile, or save your work. Quick & secure online filing. At least $10 in royalties or broker payments in lieu of dividends or. Learn how to proactively identify & correct inaccurate tins before filing 1099s to the irs At least $10 in royalties or broker payments in lieu of dividends or. Utilizing a printable version, which can be easily accessed online,. Quick & secure online filing. Ad tin matching is essential to eliminate errors in the 1099 reporting process. Get tax form (1099/1042s) update direct deposit. Ad accurate & dependable 1099 right to your email quickly and easily. Want to file us taxes? A penalty may be imposed for filing with the irs. Ad browse & discover thousands of brands. To order these instructions and additional forms, go to www.irs.gov/employerforms. Want to file us taxes? Businesses that make more than $600 payments to independent contractors or freelancers within a year; Buy now and receive instantly. Web print and file copy a downloaded from this website; In a few easy steps, you can create your own 1099 forms and have them sent to your email.Free Printable 1099 Misc Forms Free Printable

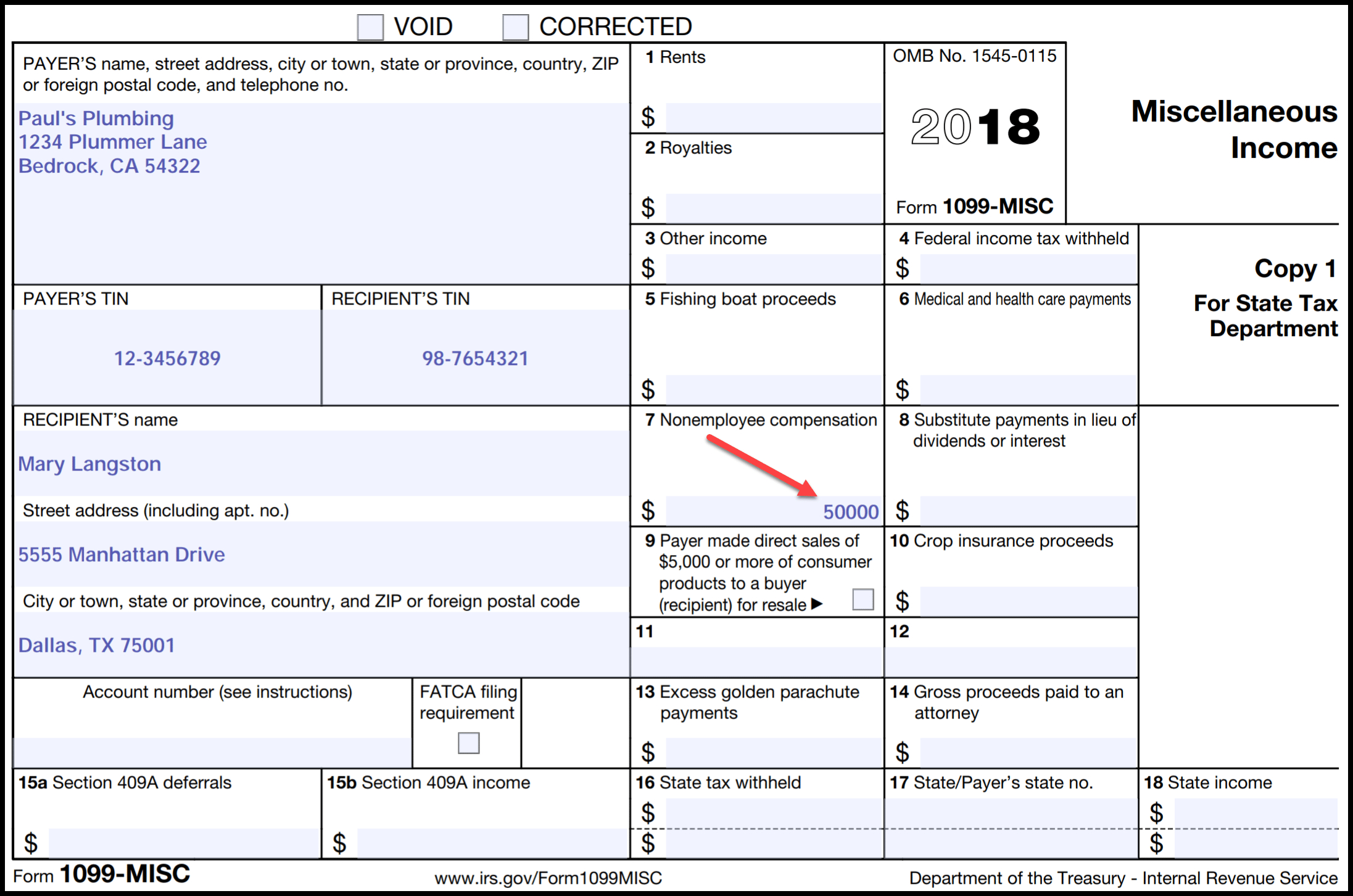

When is tax form 1099MISC due to contractors? GoDaddy Blog

Printable 1099 Misc Tax Form Template Printable Templates

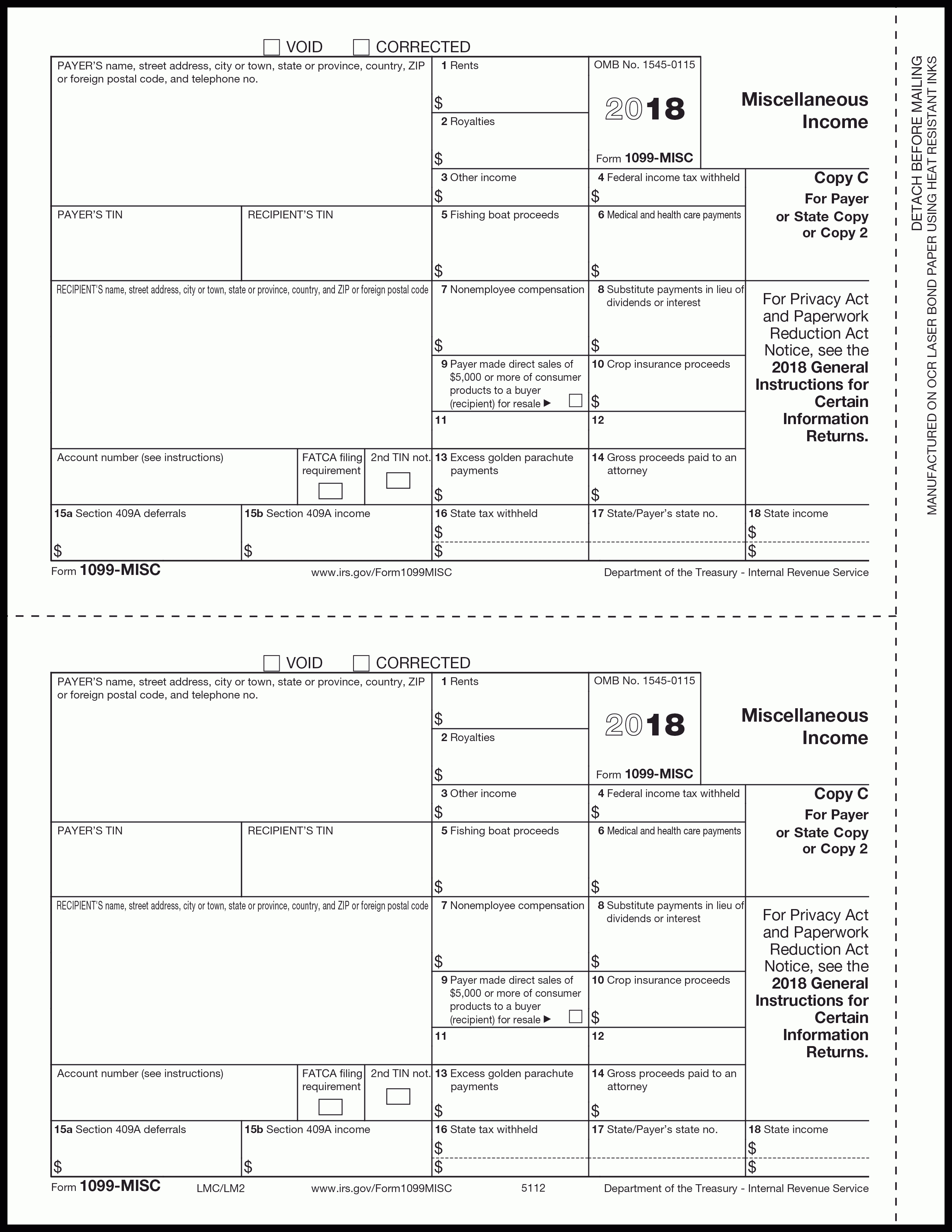

1099MISC 3Part Continuous 1" Wide Formstax

1099MISC Form Printable and Fillable PDF Template

What is a 1099Misc Form? Financial Strategy Center

1099MISC tax form DIY guide ZipBooks

Form 1099MISC Miscellaneous Definition

6 mustknow basics form 1099MISC for independent contractors Bonsai

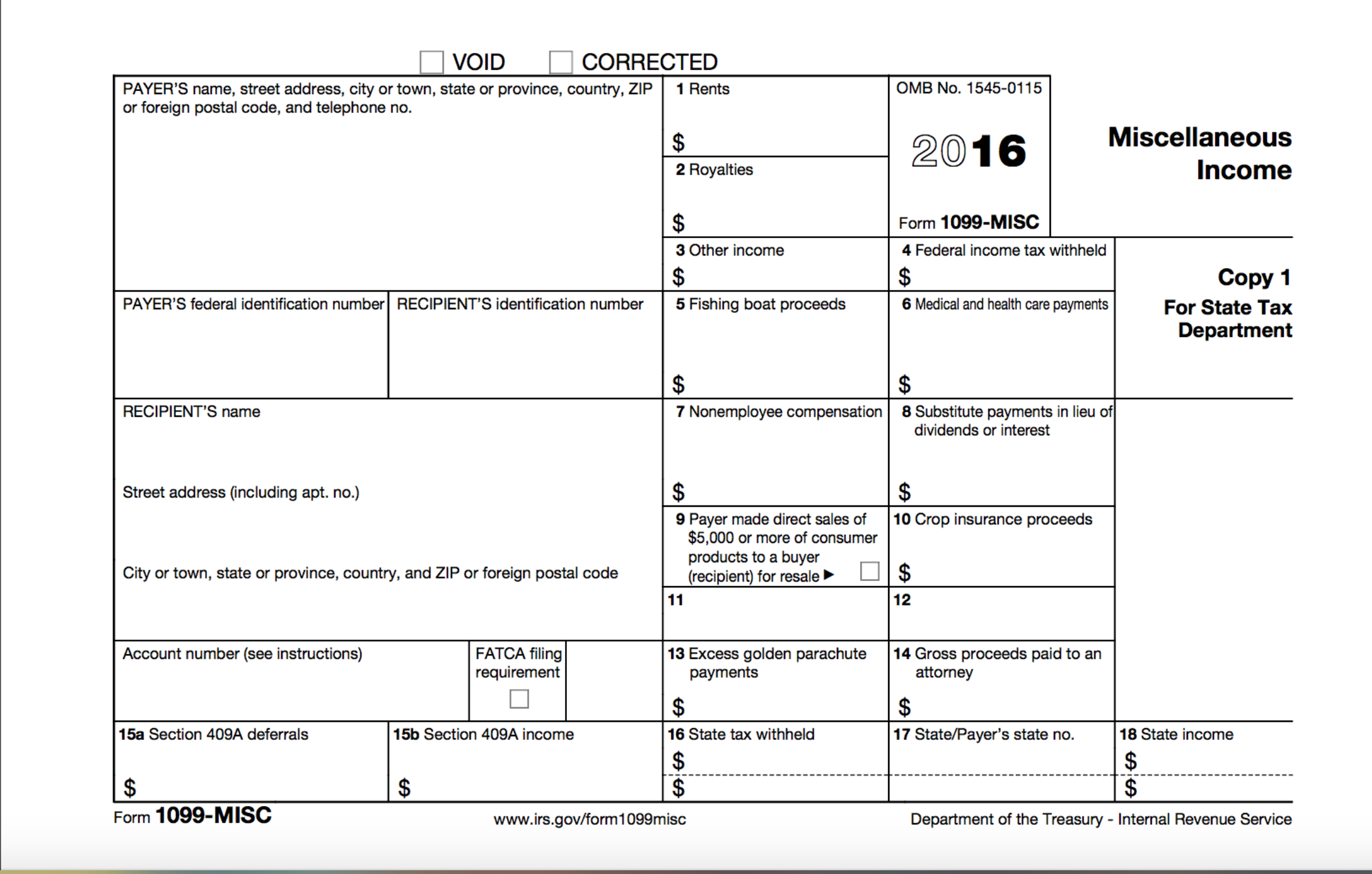

Free Printable 1099 Misc Form 2013 Free Printable

Must Be Removed Before Printing.

Learn How To Proactively Identify & Correct Inaccurate Tins Before Filing 1099S To The Irs

Miscellaneous Income (Aka Miscellaneous Information) Is Completed And Sent Out By Someone Who Has Paid At Least $10 In Royalties Or Broker.

Web Get 📝 Printable 1099 Form 🟢 Instructions For Filling Form 1099 Misc 🟢 Fill Form Online Or Download In Pdf Format 🟢 Detailed Online Guide & Blank Templates.

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)