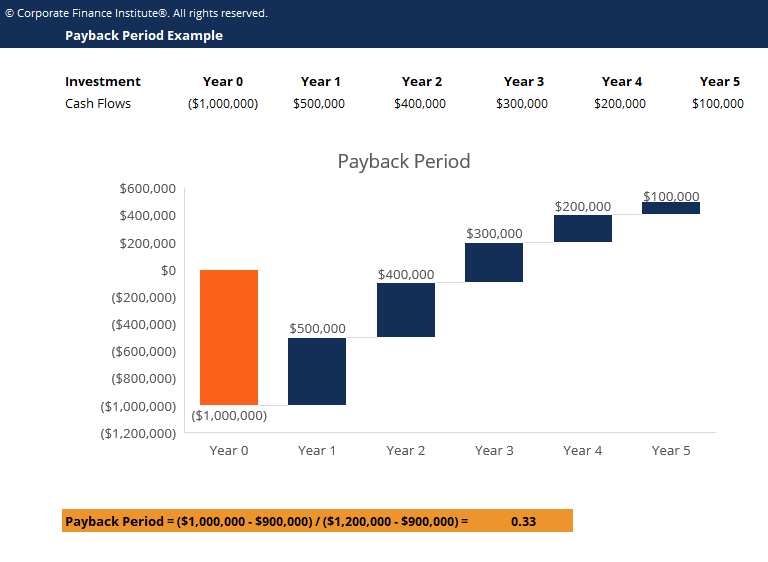

Payback Period Excel Template

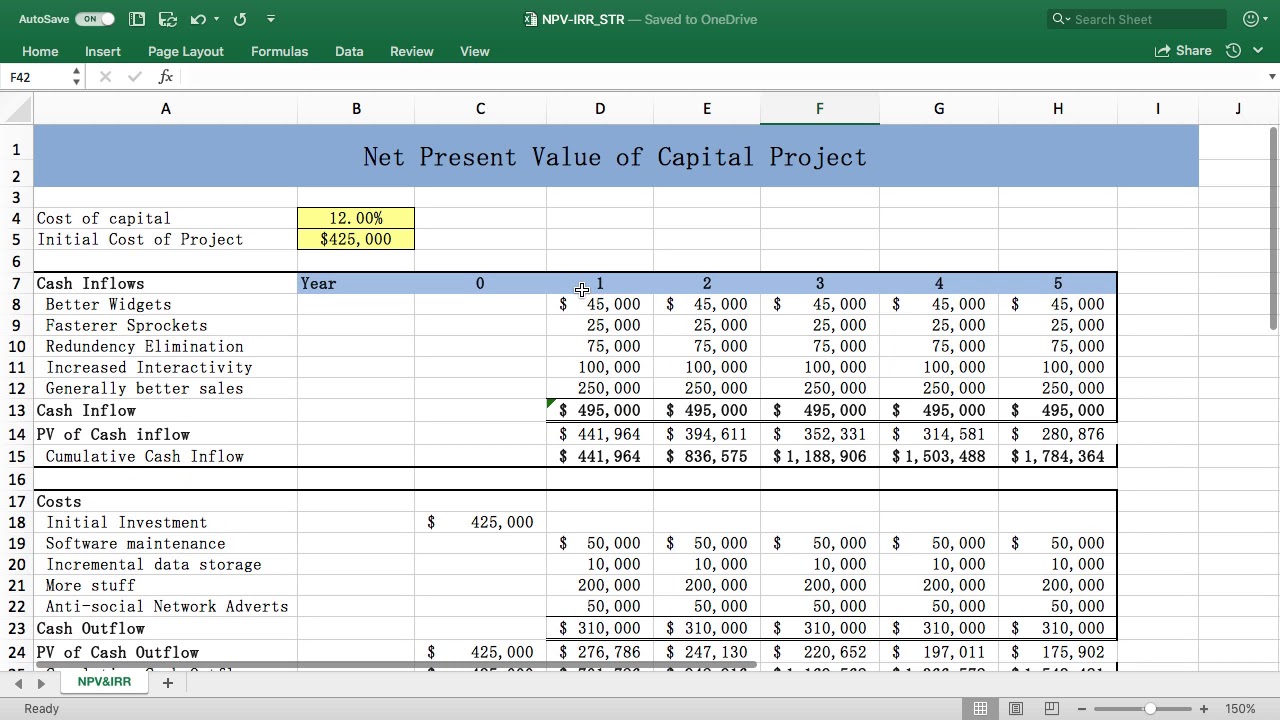

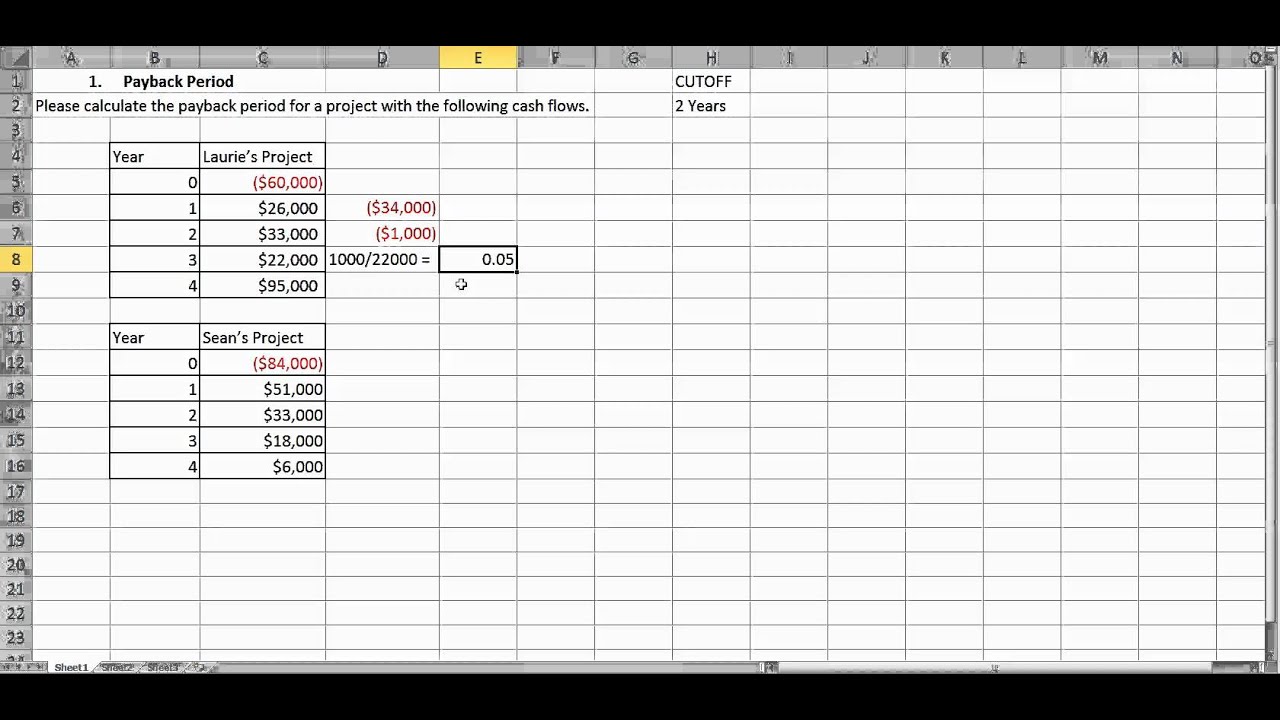

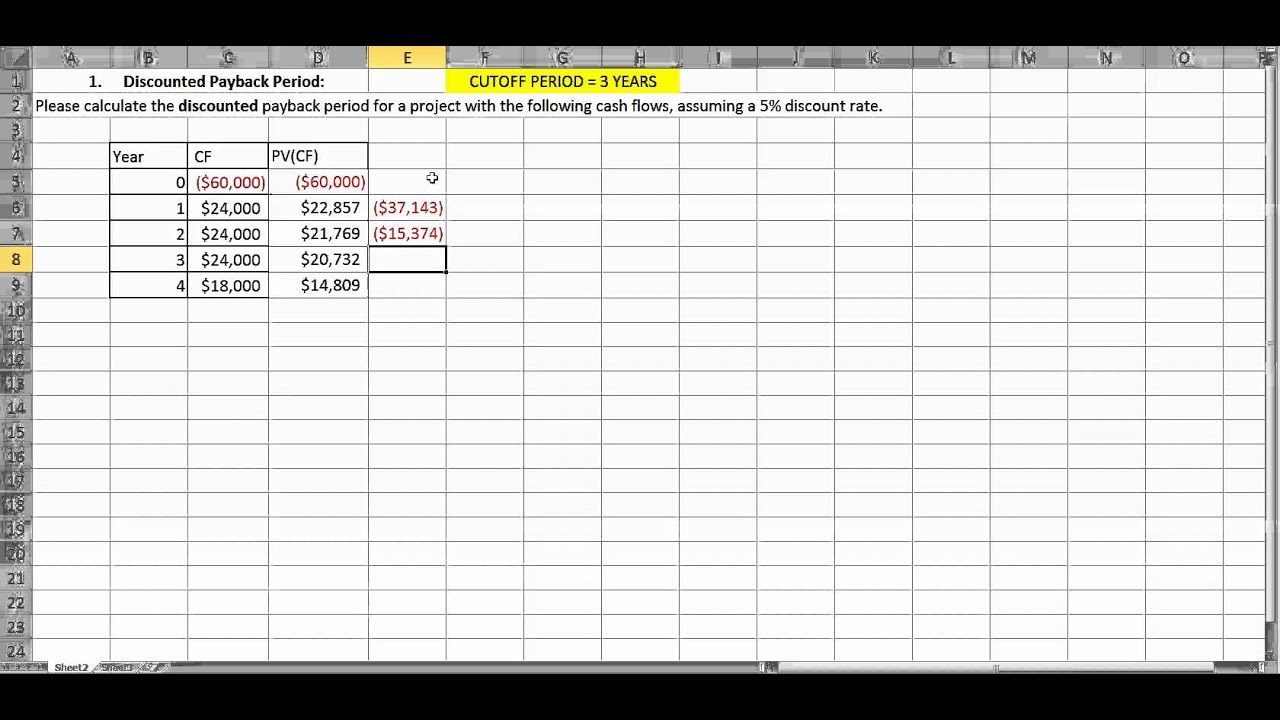

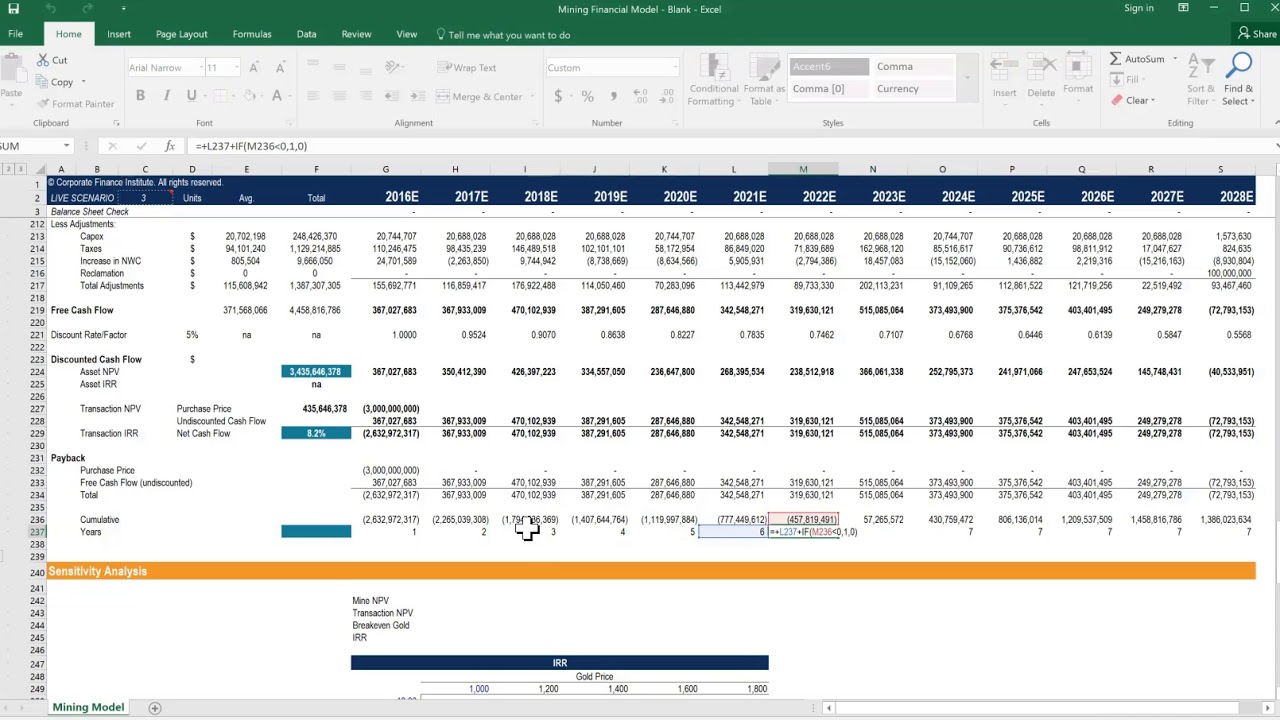

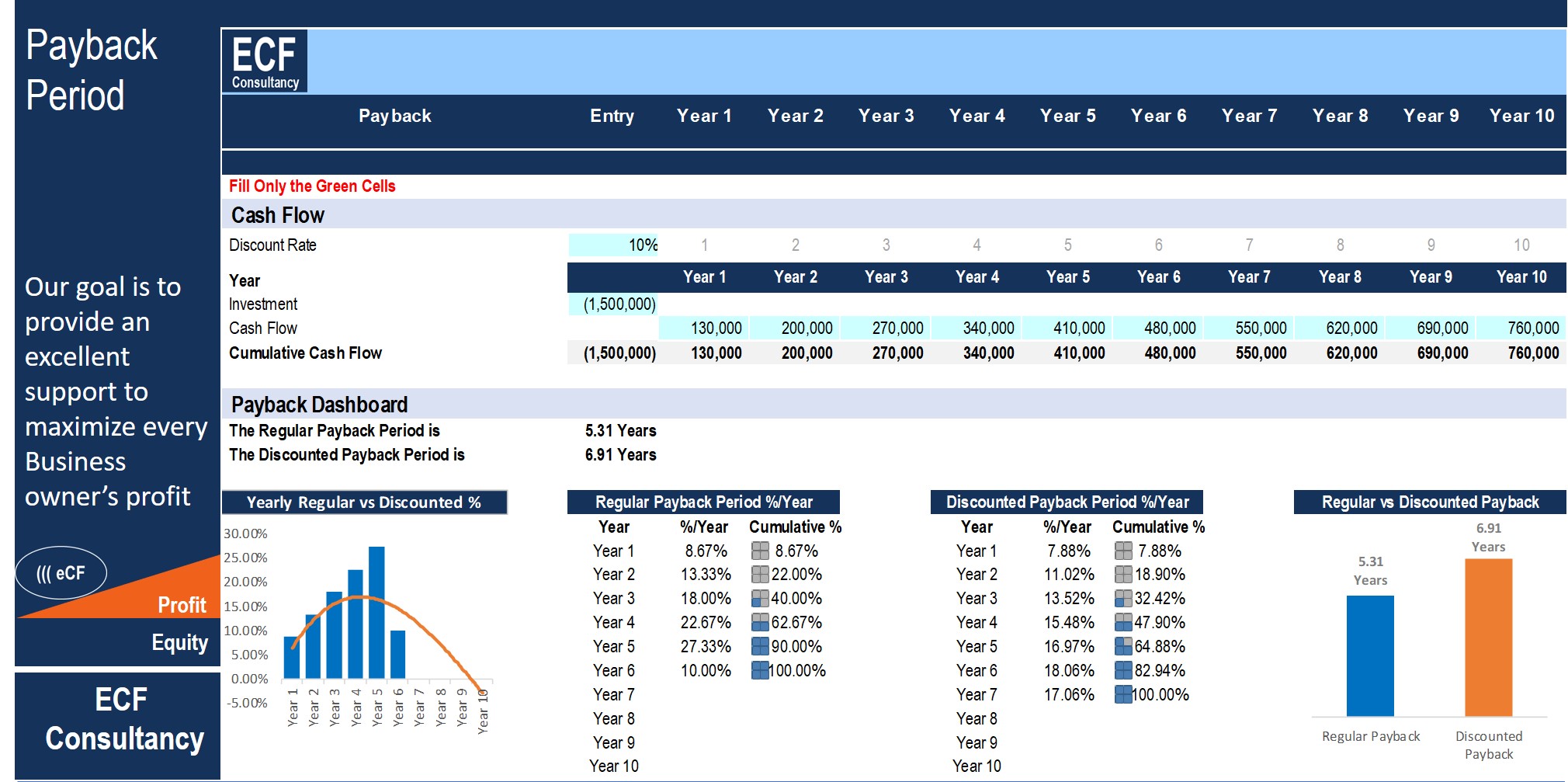

Payback Period Excel Template - Quickly calculate your investment return. Enter your name and email in the form below and download the free. The regular payback period is number of years necessary to recover the funds invested without taking the. Web determine the net present value using cash flows that occur at irregular intervals. Web feasibility metrics (npv, irr and payback period) excel template this excel file will allow to calculate the net present value, internal rate of return and payback period from. Web use the formula “ if ”. The payback period is the amount of time (usually measured in years) it takes to recover an initial investment. Build the dataset enter financial data in your excel worksheet. The rest is calculated automatically. This payback period template will help you visualize and determine the period of time a company takes to recoup its investment. Web payback period excel template: Quickly calculate your investment return. Web types of payback period. To get the exact payback period, sum. Web katrina munichiello what is a payback period? Each cash flow, specified as a value, occurs at a scheduled payment date. As such, the payback period for this project is 2.33 years. Enter your name and email in the form below and download the free. The decision rule using the payback period is to minimize the. The payback period is the amount of time (usually measured in years). As such, the payback period for this project is 2.33 years. Web $400k ÷ $200k = 2 years The rest is calculated automatically. The regular payback period is number of years necessary to recover the funds invested without taking the. Enter your name and email in the form below and download the free. The rest is calculated automatically. Web $400k ÷ $200k = 2 years If your data contains both cash inflows and cash outflows, calculate “net cash flow” or. Web payback period excel template: As such, the payback period for this project is 2.33 years. The payback period is the amount of time (usually measured in years) it takes to recover an initial investment. Here is a preview of the payback period template: Web this payback period calculator shows how many years it will take to pay off a loan, as well as irr and npv. Web feasibility metrics (npv, irr and payback period) excel. Web use the formula “ if ”. Build the dataset enter financial data in your excel worksheet. This payback period template will help you visualize and determine the period of time a company takes to recoup its investment. As such, the payback period for this project is 2.33 years. Find the fraction needed, using the number of years with negative. Web use the formula “ if ”. The payback period is the amount of time (usually measured in years) it takes to recover an initial investment. Find the fraction needed, using the number of years with negative cash flow as index. Build the dataset enter financial data in your excel worksheet. Web katrina munichiello what is a payback period? Web applying the formula provides the following: Quickly calculate your investment return. This payback period template will help you visualize and determine the period of time a company takes to recoup its investment. Find the fraction needed, using the number of years with negative cash flow as index. Web feasibility metrics (npv, irr and payback period) excel template this excel. Web use the formula “ if ”. Web $400k ÷ $200k = 2 years Use the formula “ index ”. The regular payback period is number of years necessary to recover the funds invested without taking the. Web payback period excel template: Web use the formula “ if ”. Here is a preview of the payback period template: Web payback period excel template: Find the fraction needed, using the number of years with negative cash flow as index. Web katrina munichiello what is a payback period? Enter your name and email in the form below and download the free. Web applying the formula provides the following: The regular payback period is number of years necessary to recover the funds invested without taking the. Web payback period excel template: Each cash flow, specified as a value, occurs at a scheduled payment date. Build the dataset enter financial data in your excel worksheet. To get the exact payback period, sum. Web use the formula “ if ”. Web this free template can calculate payback period calculator in excel, which will be used for making decisions on whether the organization will take a particular. Here is a preview of the payback period template: Quickly calculate your investment return. Web this payback period calculator shows how many years it will take to pay off a loan, as well as irr and npv. As such, the payback period for this project is 2.33 years. The decision rule using the payback period is to minimize the. This payback period template will help you visualize and determine the period of time a company takes to recoup its investment. The rest is calculated automatically. Web types of payback period. Web katrina munichiello what is a payback period? Web the template includes regular and discount payback. The payback period is the amount of time (usually measured in years) it takes to recover an initial investment. Quickly calculate your investment return. To get the exact payback period, sum. Web use the formula “ if ”. Web this payback period calculator shows how many years it will take to pay off a loan, as well as irr and npv. The payback period is the amount of time (usually measured in years) it takes to recover an initial investment. Web types of payback period. Payback period excel template to help you calculate the time required to recoup the. Web katrina munichiello what is a payback period? Enter your name and email in the form below and download the free. Web feasibility metrics (npv, irr and payback period) excel template this excel file will allow to calculate the net present value, internal rate of return and payback period from. The decision rule using the payback period is to minimize the. Web $400k ÷ $200k = 2 years Web this free template can calculate payback period calculator in excel, which will be used for making decisions on whether the organization will take a particular. This payback period template will help you visualize and determine the period of time a company takes to recoup its investment. Find the fraction needed, using the number of years with negative cash flow as index. Use the formula “ index ”.Payback Time Formula Excel BHe

How to Calculate Accounting Payback Period or Capital Budgeting Break

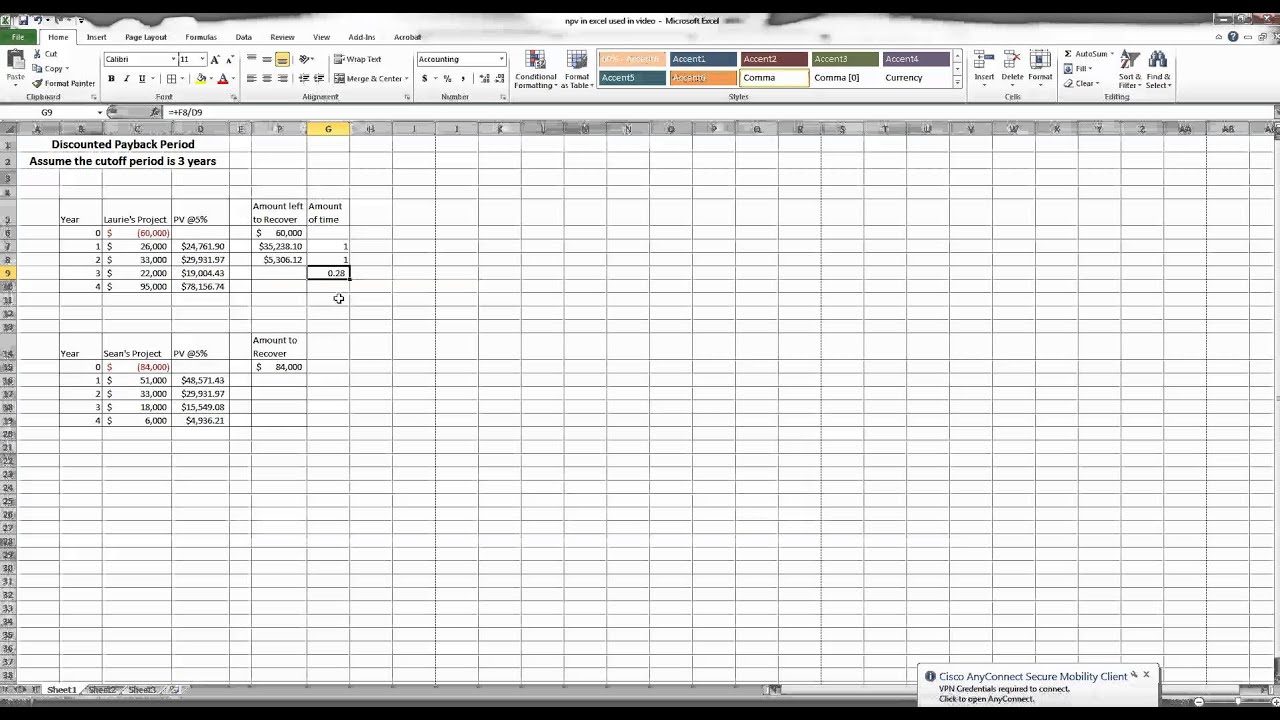

Video on how to do discounted payback period in Excel YouTube

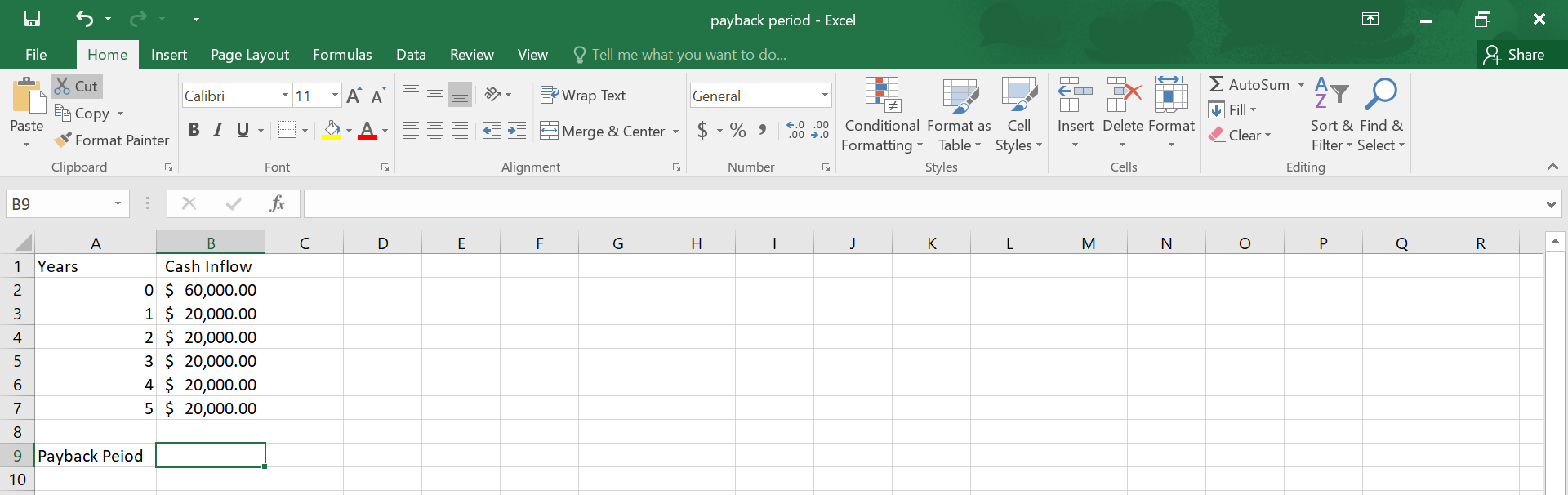

How to Calculate Payback Period in Excel.

Payback Period Calculator Double Entry Bookkeeping

Rumus Payback Period Excel kabarmedia.github.io

Payback Period Template Download Free Excel Template

Payback Period Excel Template PDF Template

Download How to calculate PAYBACK PERIOD in MS Excel Spread

Payback Period Excel Model Eloquens

Users Fill In The Blue Boxes;

Web The Template Includes Regular And Discount Payback.

If Your Data Contains Both Cash Inflows And Cash Outflows, Calculate “Net Cash Flow” Or.

Web Payback Period Excel Template:

Related Post: