Npv Excel Template

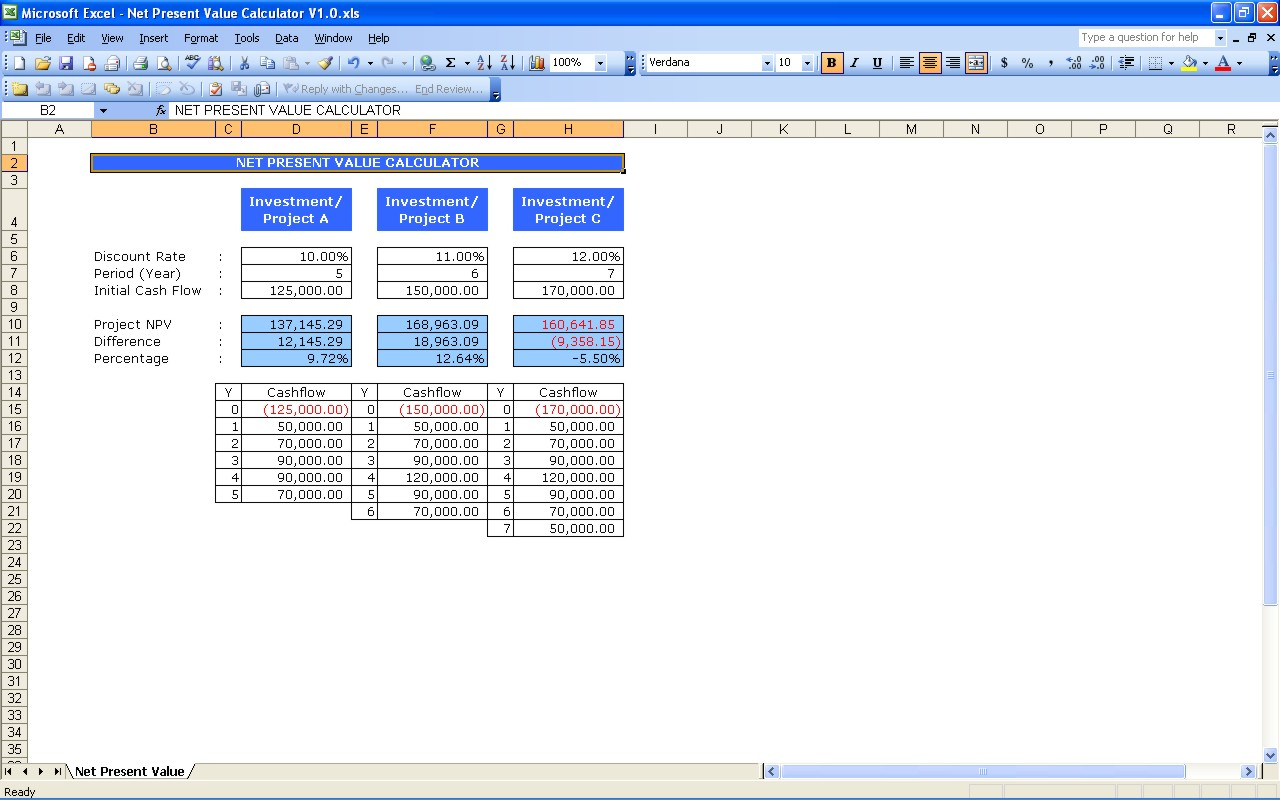

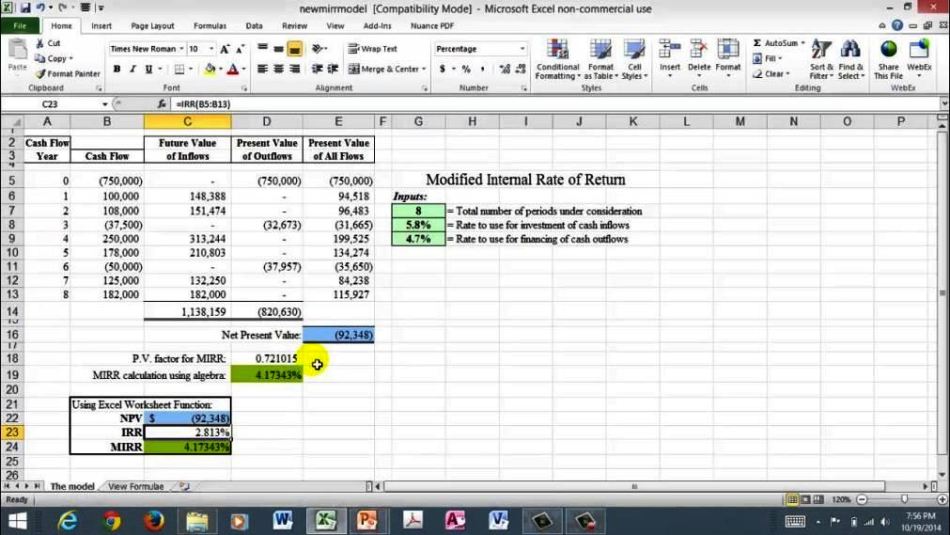

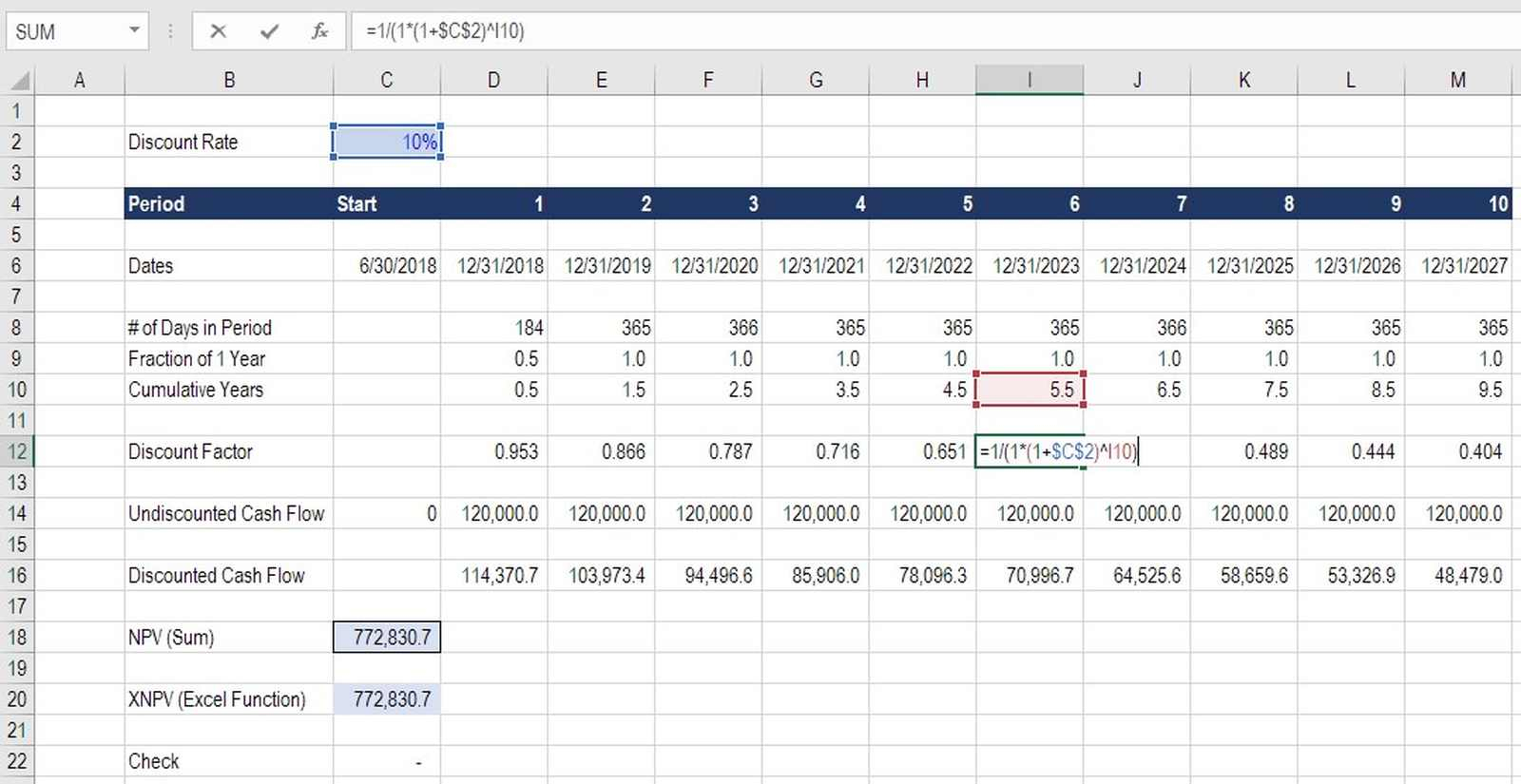

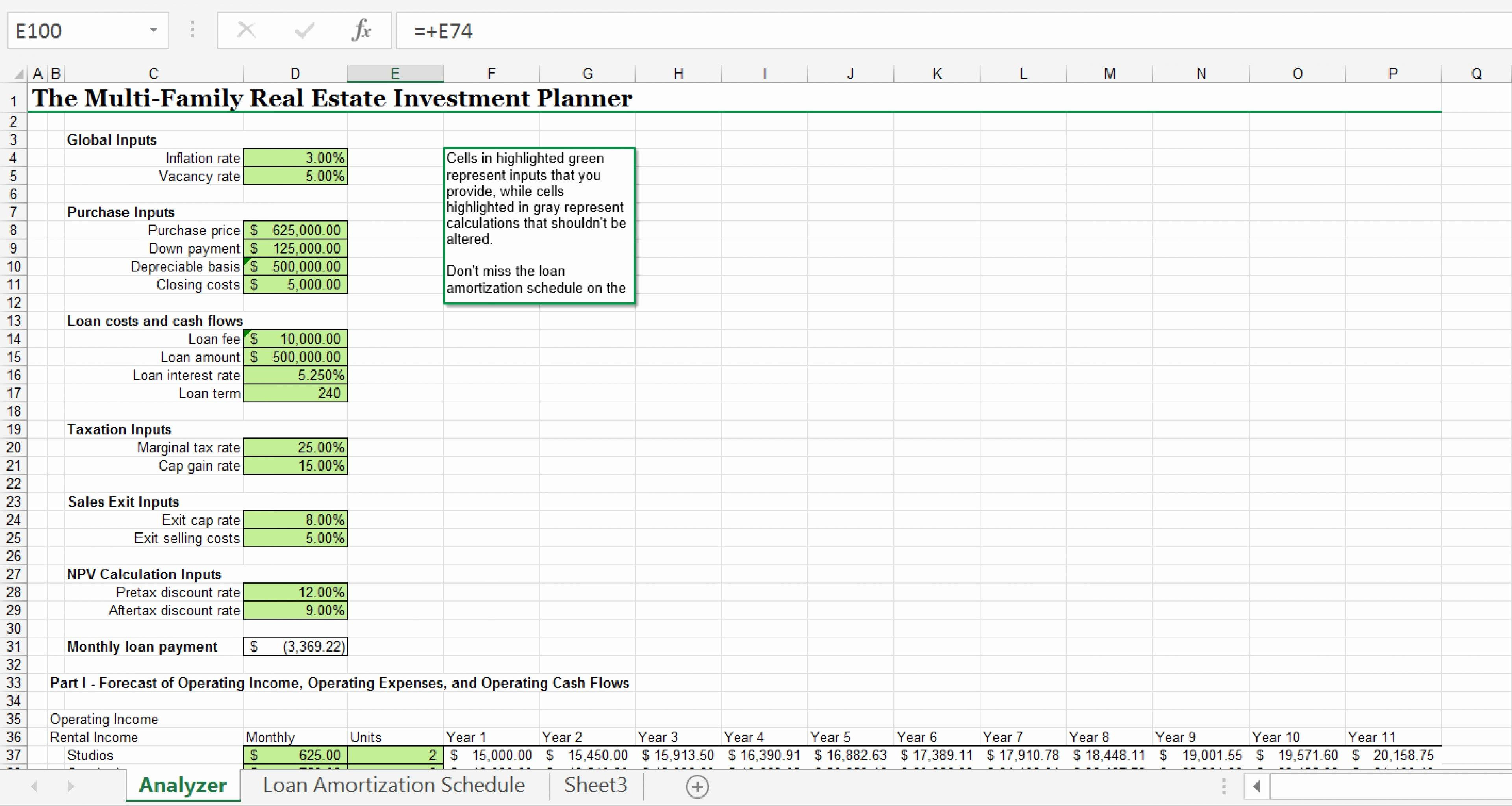

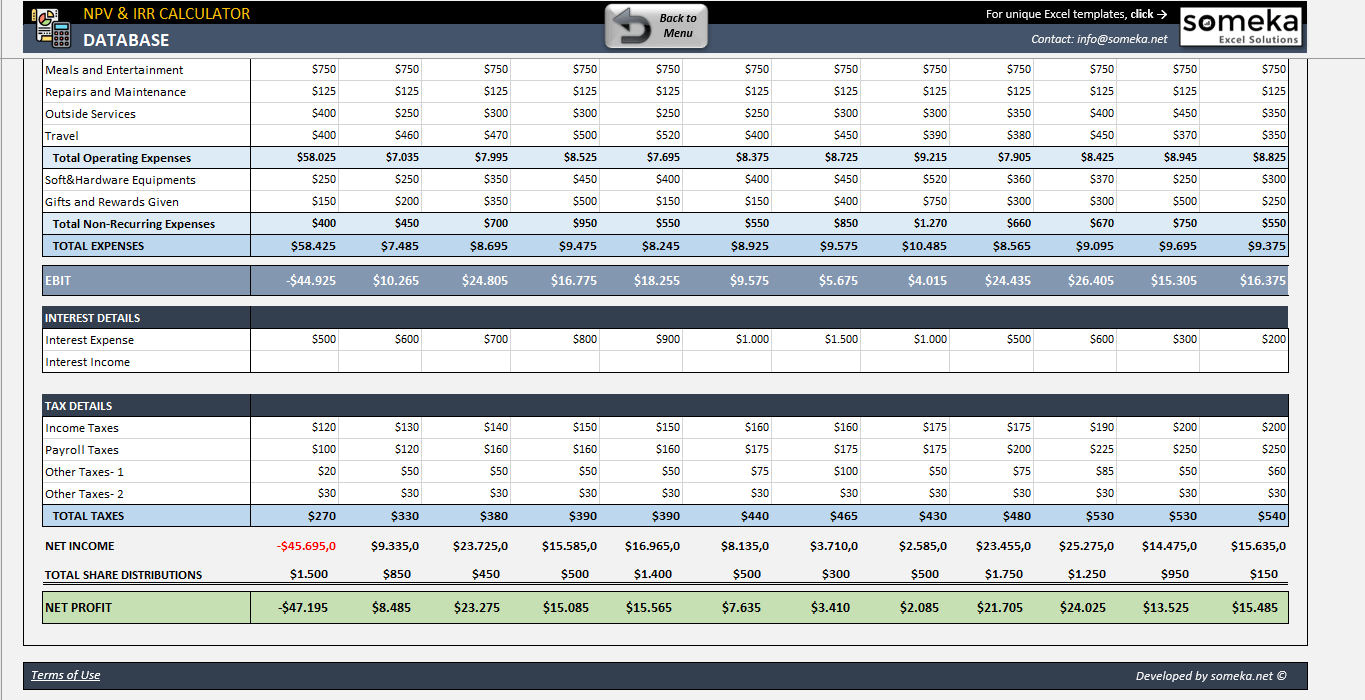

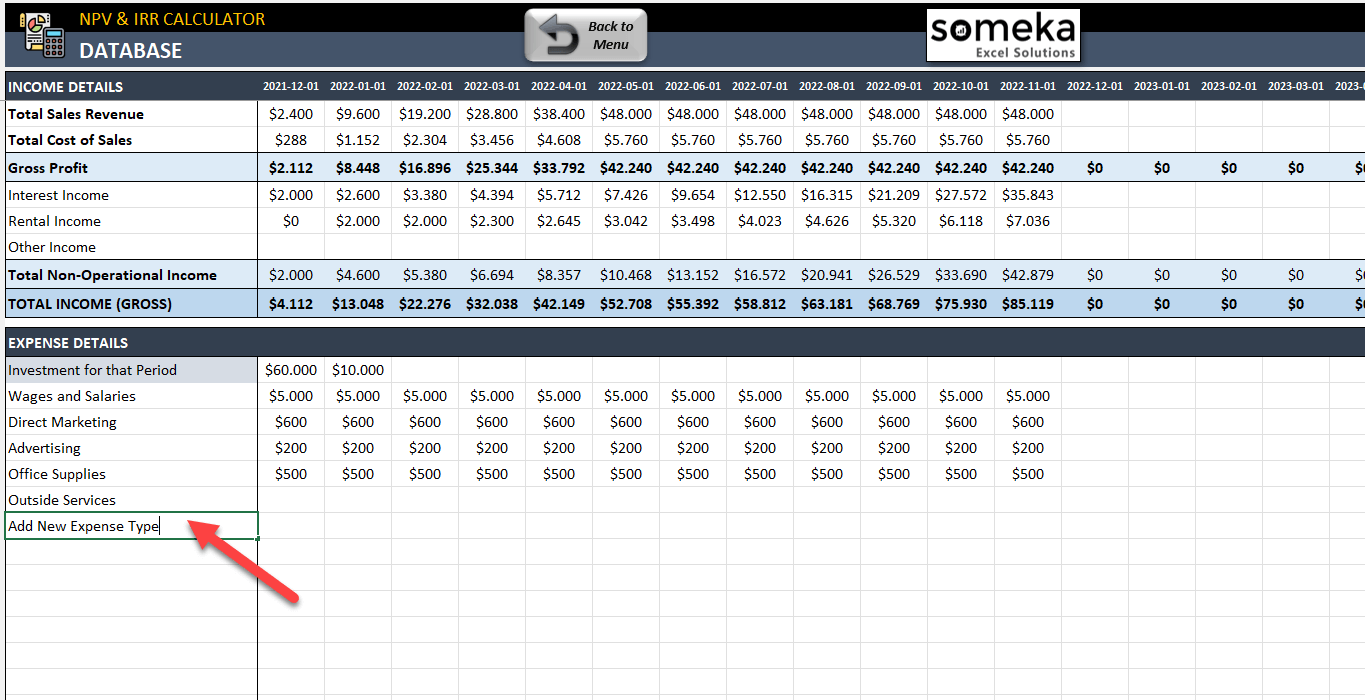

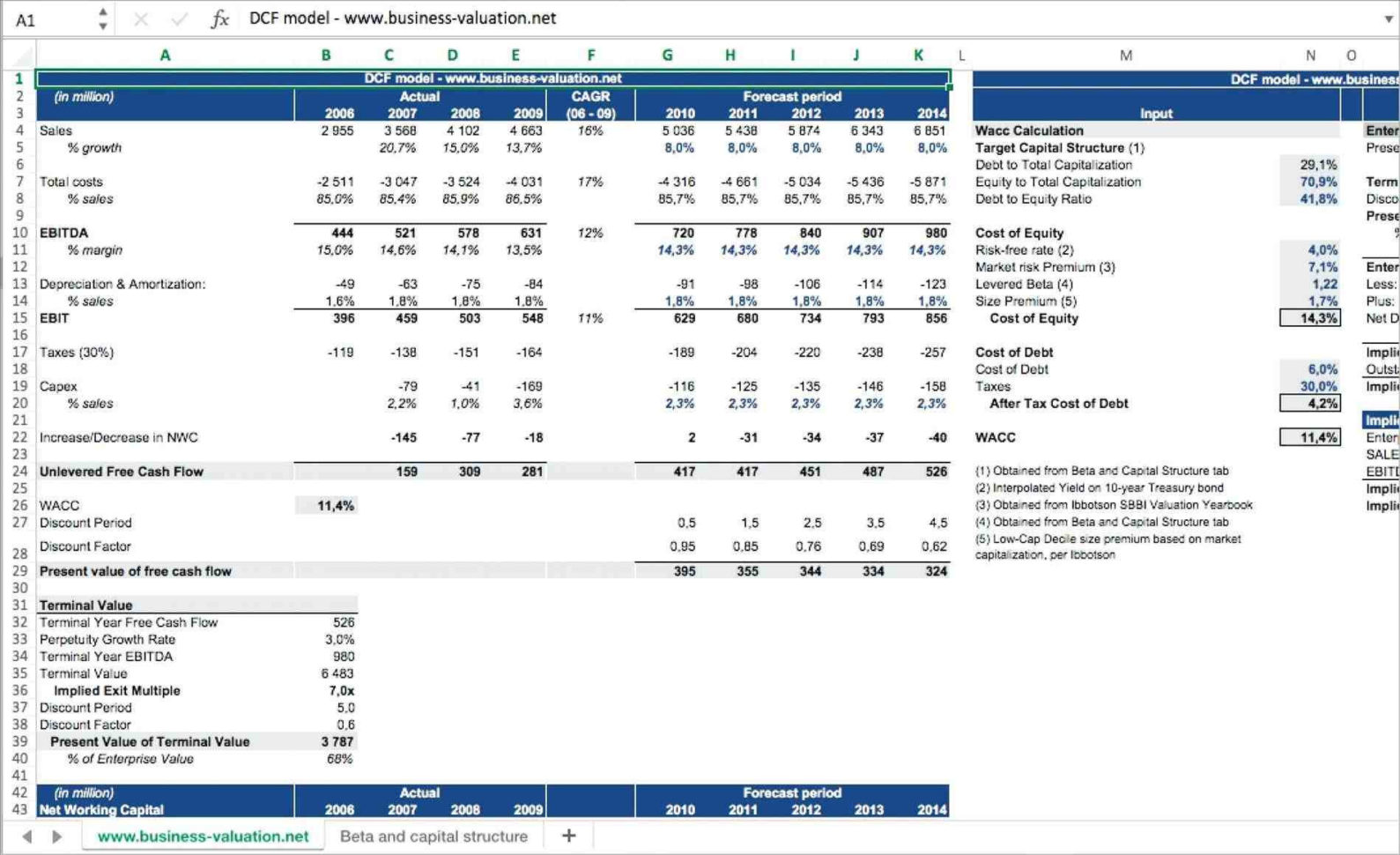

Npv Excel Template - Where n is the number of. =npv (rate,value1, [value2],…) for example, shamita has invested ₹100 in a fishing company. It is used to determine the. Web by svetlana cheusheva, updated on march 15, 2023 the tutorial shows how to calculate irr of a project in excel with formulas and the goal seek feature. Calculates the net present value of an investment by using a discount rate. It's important to understand exactly how the npv formula works in excel and the math. Web the net present value (npv) is the difference between the present value (pv) of a future stream of cash inflows and outflows. Web npv in excel formula to calculate the profitability of the investment is as follows: The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. Net present value is calculated using. Web series 1 series 2 series 3 series 4 npv: Web npv and irr calculator excel template rated 4.62 out of 5 based on 13 customer ratings 4.62 ( 13 reviews ) professional excel spreadsheet to calculate npv & irr. Web npv calculates that present value for each of the series of cash flows and adds them together to get. It's important to understand exactly how the npv formula works in excel and the math. Web excel offers two functions for calculating net present value: Type “=npv (“ select the discount rate “,” select the. Web you can use our free npv calculator to calculate the net present value of up to 10 cash flows. Web how to calculate net. Web a guide to the npv formula in excel when performing financial analysis. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Web by svetlana cheusheva, updated on march 15, 2023 the tutorial shows how to calculate irr of a project in excel with formulas. Type “=npv (“ select the discount rate “,” select the. Web you can use our free npv calculator to calculate the net present value of up to 10 cash flows. In practice, npv is widely used to determine the. Alternatively, you can use the excel formula. =npv (rate,value1, [value2],…) for example, shamita has invested ₹100 in a fishing company. Web series 1 series 2 series 3 series 4 npv: The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. In practice, npv is widely used to determine the. Net present value is calculated using. Alternatively, you can use the excel formula. Type “=npv (“ select the discount rate “,” select the. Web how to calculate net present value (npv) in excel [+ free template] you can easily undertake a net present value calculation in excel using the npv or the. Web the npv function in excel returns the net present value of an investment based on a discount or interest rate. Enter the cash flows in the series (in consecutive cells). It is used to determine the. Web series 1 series 2 series 3 series 4 npv: Calculates the net present value of an investment by using a discount rate. Net present value is calculated using. Web a guide to the npv formula in excel when performing financial analysis. In practice, npv is widely used to determine the. =npv (rate,value1, [value2],…) for example, shamita has invested ₹100 in a fishing company. Web the npv function in excel returns the net present value of an investment based on a discount or interest rate and a series of. Web by svetlana cheusheva, updated on march 15, 2023 the tutorial shows how to calculate irr of a project in excel with formulas and the goal seek feature. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Enter the cash flows in the series (in. Web the net present value (npv) is the difference between the present value (pv) of a future stream of cash inflows and outflows. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Where n is the number of. Web excel offers two functions for calculating. It's important to understand exactly how the npv formula works in excel and the math. Web npv = f / [ (1 + i)^n] in this formula, f is future cash flows, i is the interest rate and n is the number of financial periods until cash flow occurs. Enter the cash flows in the series (in consecutive cells). Similarly, we have to calculate it for other values. Web npv in excel formula to calculate the profitability of the investment is as follows: Calculates the net present value of an investment by using a discount rate. In practice, npv is widely used to determine the. Where n is the number of. First, we have to calculate the present value the output will be: The formula for npv is: Web this article describes the formula syntax and usage of the npv function in microsoft excel. Web by svetlana cheusheva, updated on march 15, 2023 the tutorial shows how to calculate irr of a project in excel with formulas and the goal seek feature. Web this dynamic template incorporates both the npv and xnpv functions of excel, providing a seamless way to analyze your potential investments by comparing. Enter the discount rate in a cell. Web series 1 series 2 series 3 series 4 npv: It is used to determine the. Web you can use our free npv calculator to calculate the net present value of up to 10 cash flows. Type “=npv (“ select the discount rate “,” select the. Alternatively, you can use the excel formula. Web a guide to the npv formula in excel when performing financial analysis. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. The formula for npv is: Similarly, we have to calculate it for other values. Web npv and irr calculator excel template rated 4.62 out of 5 based on 13 customer ratings 4.62 ( 13 reviews ) professional excel spreadsheet to calculate npv & irr. Web npv in excel formula to calculate the profitability of the investment is as follows: It is used to determine the. Web this dynamic template incorporates both the npv and xnpv functions of excel, providing a seamless way to analyze your potential investments by comparing. Enter the cash flows in the series (in consecutive cells). First, we have to calculate the present value the output will be: Web series 1 series 2 series 3 series 4 npv: The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. Web the npv function in excel returns the net present value of an investment based on a discount or interest rate and a series of future cash flows. Calculates the net present value of an investment by using a discount rate. In practice, npv is widely used to determine the. Enter the discount rate in a cell. Web the net present value (npv) is the difference between the present value (pv) of a future stream of cash inflows and outflows.Npv Excel Spreadsheet Template —

Download free Excel examples

10 Npv Template Excel Excel Templates Excel Templates

Npv Calculator Excel Template SampleTemplatess SampleTemplatess

Trending Discount Factor Formula Excel Pics Formulas

Npv Excel Spreadsheet Template —

10 Npv Irr Excel Template Excel Templates

NPV Calculator Template Free NPV & IRR Calculator Excel Template

Npv Excel ubicaciondepersonas.cdmx.gob.mx

Npv Excel Spreadsheet Template —

Web How To Calculate Net Present Value (Npv) In Excel [+ Free Template] You Can Easily Undertake A Net Present Value Calculation In Excel Using The Npv Or The.

It's Important To Understand Exactly How The Npv Formula Works In Excel And The Math.

=Npv (Rate,Value1, [Value2],…) For Example, Shamita Has Invested ₹100 In A Fishing Company.

Web Npv = F / [ (1 + I)^N] In This Formula, F Is Future Cash Flows, I Is The Interest Rate And N Is The Number Of Financial Periods Until Cash Flow Occurs.

Related Post: