Merger Model Template

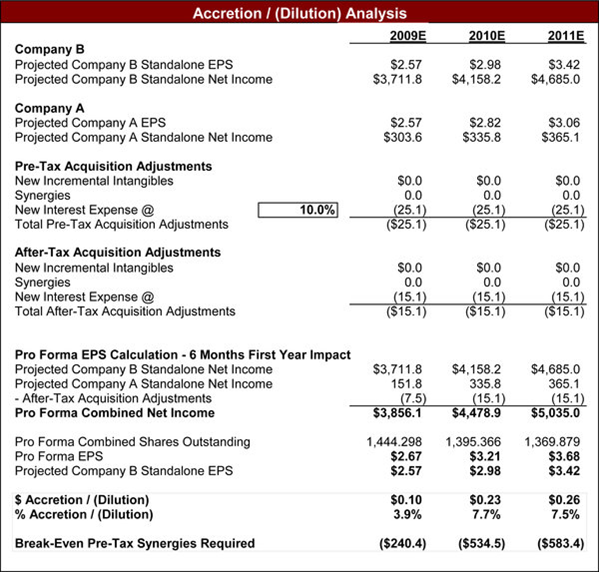

Merger Model Template - Web 33% debt, 33% stock, and 33% cash vs. And the list goes on. Web the key steps involved in building a merger model are: Web a merger agreement is a legal contract that dictates the joining of two companies into a single business entity. 50% cash and 50% debt vs…. M&a model inputs, followed by a range of m&a model assumptions, model analysis and model outputs. 8.5 hours of video content. Web up to 24% cash back a merger agreement will set the rules for the new organization until the convergence is finalized. The macabacus merger model implements advanced m&a, accounting, and tax concepts, and is intended for use in modeling live transactions (with some. Web merger & acquisition (m&a) simple financial model. This course is designed for professionals working in investment banking,. Obviously, merger agreements involve money, like the security deposit or earnest money. This is to ensure the commitment of both parties in. Web merger and acquisition model template consists of an excel model that assists the user to assess the financial viability of the resulting proforma merger of 2 companies. It includes an accounting of the assets and liabilities for each. Web the key steps involved in building a merger model are: All industries, financial model, general. Web in this section, we demonstrate how to model a merger of two public companies in excel. Web value combined entities using dcf models. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. And the list goes on. Mergers & acquisitions (m&a) modeling. The macabacus merger model implements advanced m&a, accounting, and tax concepts, and is intended for use in modeling live transactions (with some. Web. Web use the form below to get the accretion dilution excel model template that goes with this lesson: Web in this section, we demonstrate how to model a merger of two public companies in excel. Such as, two or more companies becoming one (merger) or one buys/takes over another (acquisition). It includes an accounting of the assets and liabilities for. All industries, financial model, general. This course is designed for professionals working in investment banking,. Web up to 24% cash back a merger agreement will set the rules for the new organization until the convergence is finalized. Web use the form below to get the accretion dilution excel model template that goes with this lesson: Web in this article, you’ll. 8.5 hours of video content. Web use the form below to get the accretion dilution excel model template that goes with this lesson: Accretion/dilution analysis financial modeling quick lesson: These kinds of agreements are mainly used to expand a. Web up to 24% cash back a merger agreement will set the rules for the new organization until the convergence is. This course is designed for professionals working in investment banking,. Web in this section, we demonstrate how to model a merger of two public companies in excel. Web this is the term use for consolidation of businesses or their assets. It includes an accounting of the assets and liabilities for each. All industries, financial model, general. And the list goes on. Obviously, merger agreements involve money, like the security deposit or earnest money. Accretion/dilution analysis financial modeling quick lesson: 50% cash and 50% debt vs…. M&a model inputs, followed by a range of m&a model assumptions, model analysis and model outputs. Web start by clicking on fill out the template. 8.5 hours of video content. Web value combined entities using dcf models. Mergers & acquisitions (m&a) modeling. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. This is to ensure the commitment of both parties in. Web merger & acquisition (m&a) simple financial model. Web a merger agreement is a legal contract that dictates the joining of two companies into a single business entity. Accretion/dilution analysis financial modeling quick lesson: It includes an accounting of the assets and liabilities for each. Web merger & acquisition (m&a) simple financial model. Answer a few questions and your document is created automatically. Accretion/dilution analysis financial modeling quick lesson: All industries, financial model, general. 8.5 hours of video content. These kinds of agreements are mainly used to expand a. This is to ensure the commitment of both parties in. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Web in this section, we demonstrate how to model a merger of two public companies in excel. M&a model inputs, followed by a range of m&a model assumptions, model analysis and model outputs. Web merger and acquisition model template consists of an excel model that assists the user to assess the financial viability of the resulting proforma merger of 2 companies and their. Web start by clicking on fill out the template. Web this is the term use for consolidation of businesses or their assets. Web download this free merger agreement template as a word document to help detail the financial terms of companies that decide to combine their businesses A merger is the “combination” of two companies, under a mutual agreement, to form a consolidated entity. Think about the “cost” of each method, start with the cheapest method, use the. Each topic contains a spreadsheet with which you can interact within your browser to. Web use the form below to get the accretion dilution excel model template that goes with this lesson: The model is great financial tool used to evaluate the financial impact of merger or acquisition, it typically includes projections. This course is designed for professionals working in investment banking,. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Think about the “cost” of each method, start with the cheapest method, use the. Mergers & acquisitions (m&a) modeling. Each topic contains a spreadsheet with which you can interact within your browser to. The macabacus merger model implements advanced m&a, accounting, and tax concepts, and is intended for use in modeling live transactions (with some. It includes an accounting of the assets and liabilities for each. Web start by clicking on fill out the template. Web up to 24% cash back a merger agreement will set the rules for the new organization until the convergence is finalized. Obviously, merger agreements involve money, like the security deposit or earnest money. 8.5 hours of video content. Web this is the term use for consolidation of businesses or their assets. Web 33% debt, 33% stock, and 33% cash vs. Web the key steps involved in building a merger model are: Answer a few questions and your document is created automatically. These kinds of agreements are mainly used to expand a. Such as, two or more companies becoming one (merger) or one buys/takes over another (acquisition).Merger Model StepByStep Walkthrough [Video Tutorial]

Merger Model M&A Excel Template from CFI Marketplace

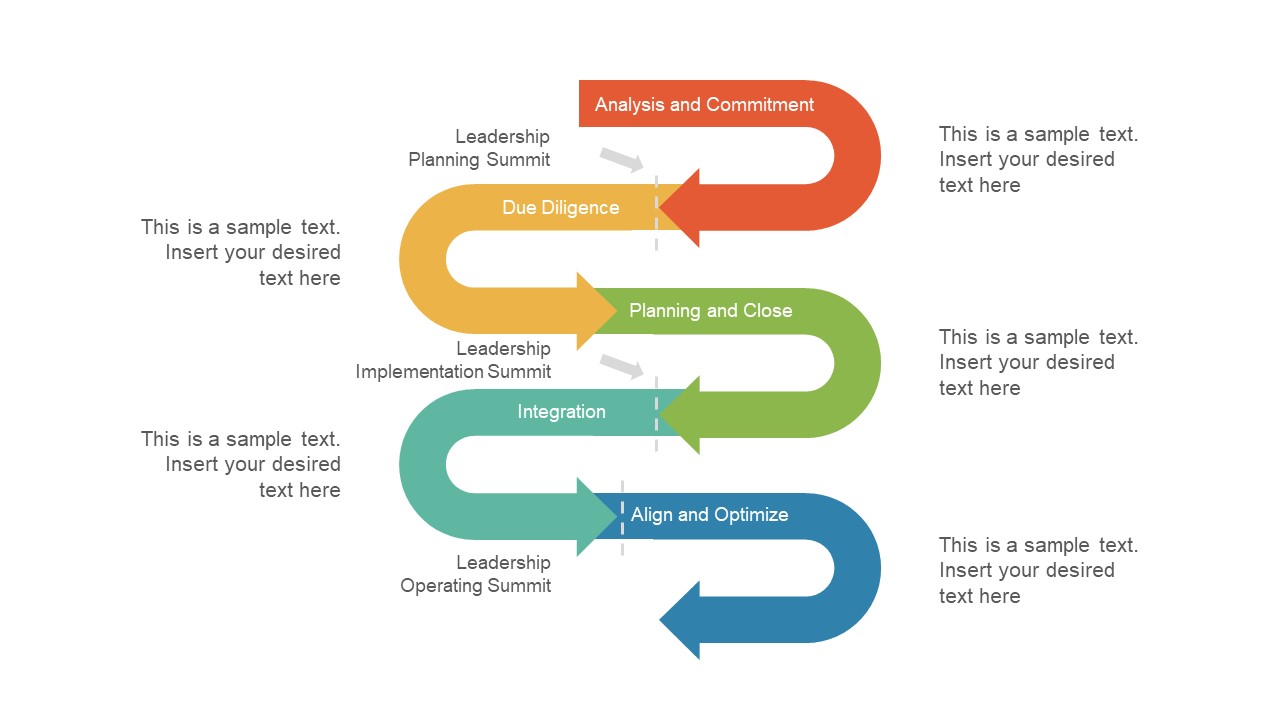

Acquisition Integration Plan Template New Merger Integration Work How

Merger Model, Factors affecting Merger Model, Steps in Merger Model

Timeline Template of Mergers Model SlideModel

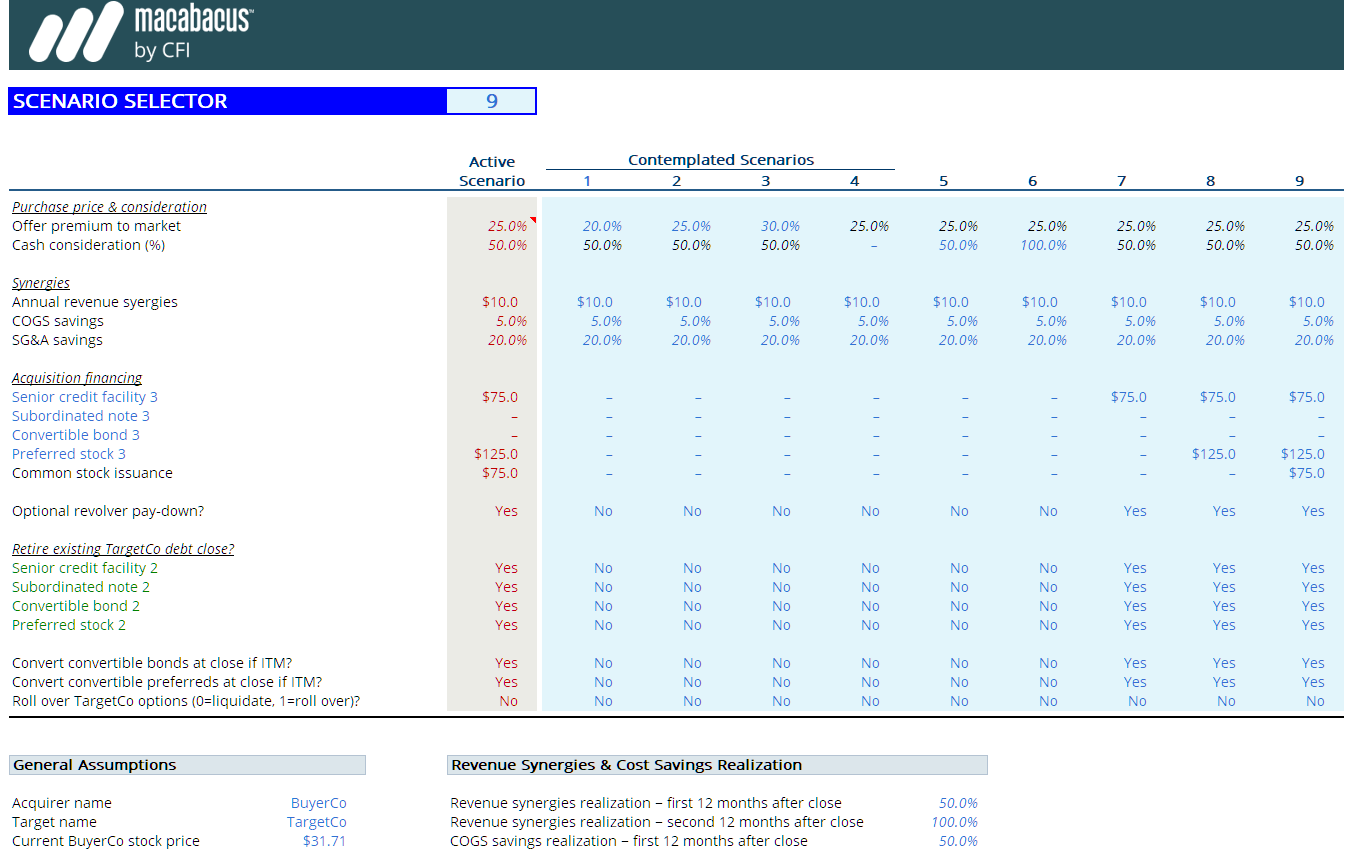

Merger Model Templates Macabacus

Post Merger Integration Framework By exMcKinsey Consultants Merger

Merger Model M&A Excel Template from CFI Marketplace

Merger Model M&A Excel Template from CFI Marketplace

Merger Model M&A Acquisition Street Of Walls

Web Use The Form Below To Get The Accretion Dilution Excel Model Template That Goes With This Lesson:

Web Merger And Acquisition Model Template Consists Of An Excel Model That Assists The User To Assess The Financial Viability Of The Resulting Proforma Merger Of 2 Companies And Their.

This Is To Ensure The Commitment Of Both Parties In.

M&A Model Inputs, Followed By A Range Of M&A Model Assumptions, Model Analysis And Model Outputs.

Related Post:

![Merger Model StepByStep Walkthrough [Video Tutorial]](https://biwsuploads-assest.s3.amazonaws.com/biws/wp-content/uploads/2019/04/22161546/Merger-Model-Assumptions-1024x537.jpg)