M&A Target Screening Template

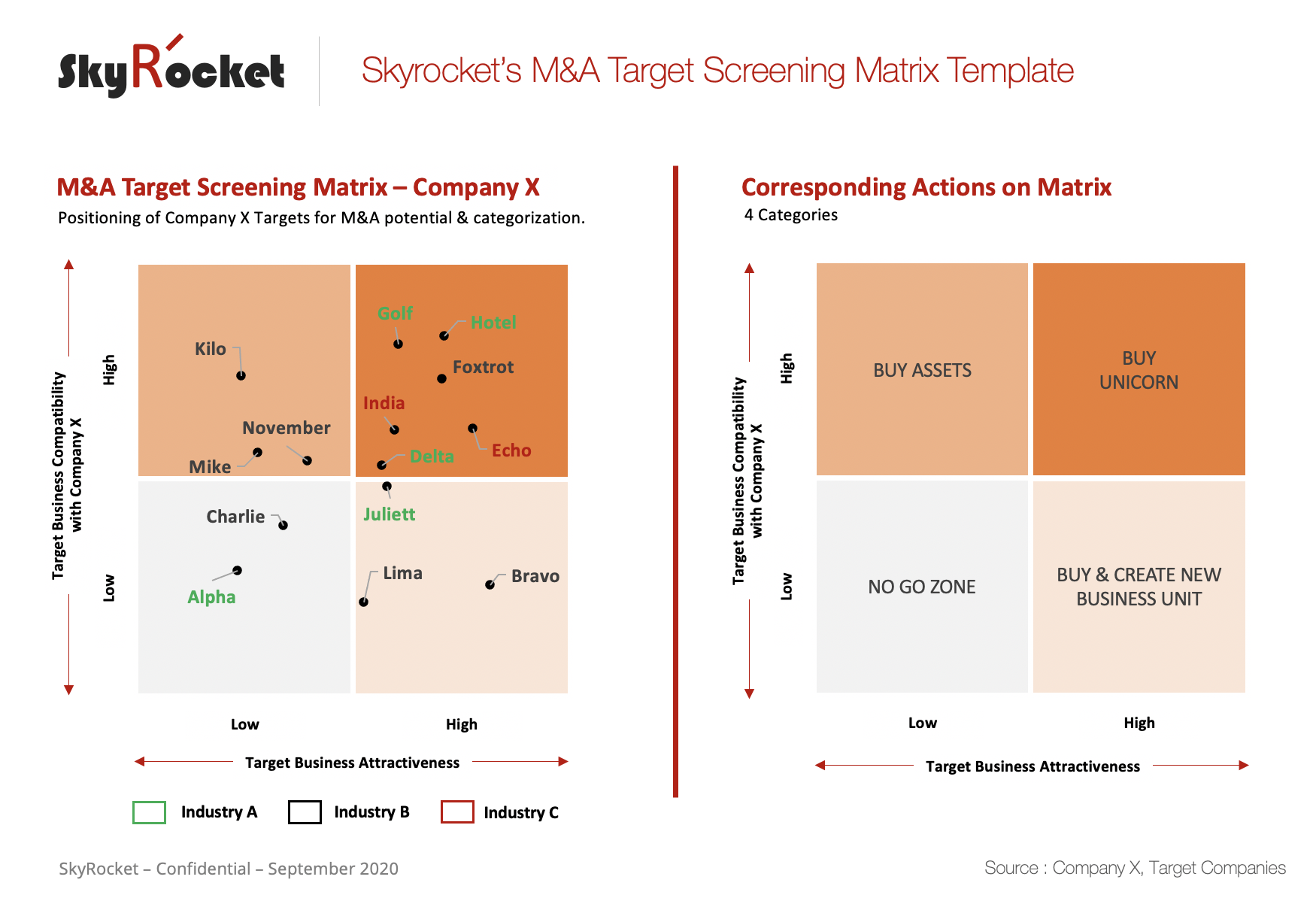

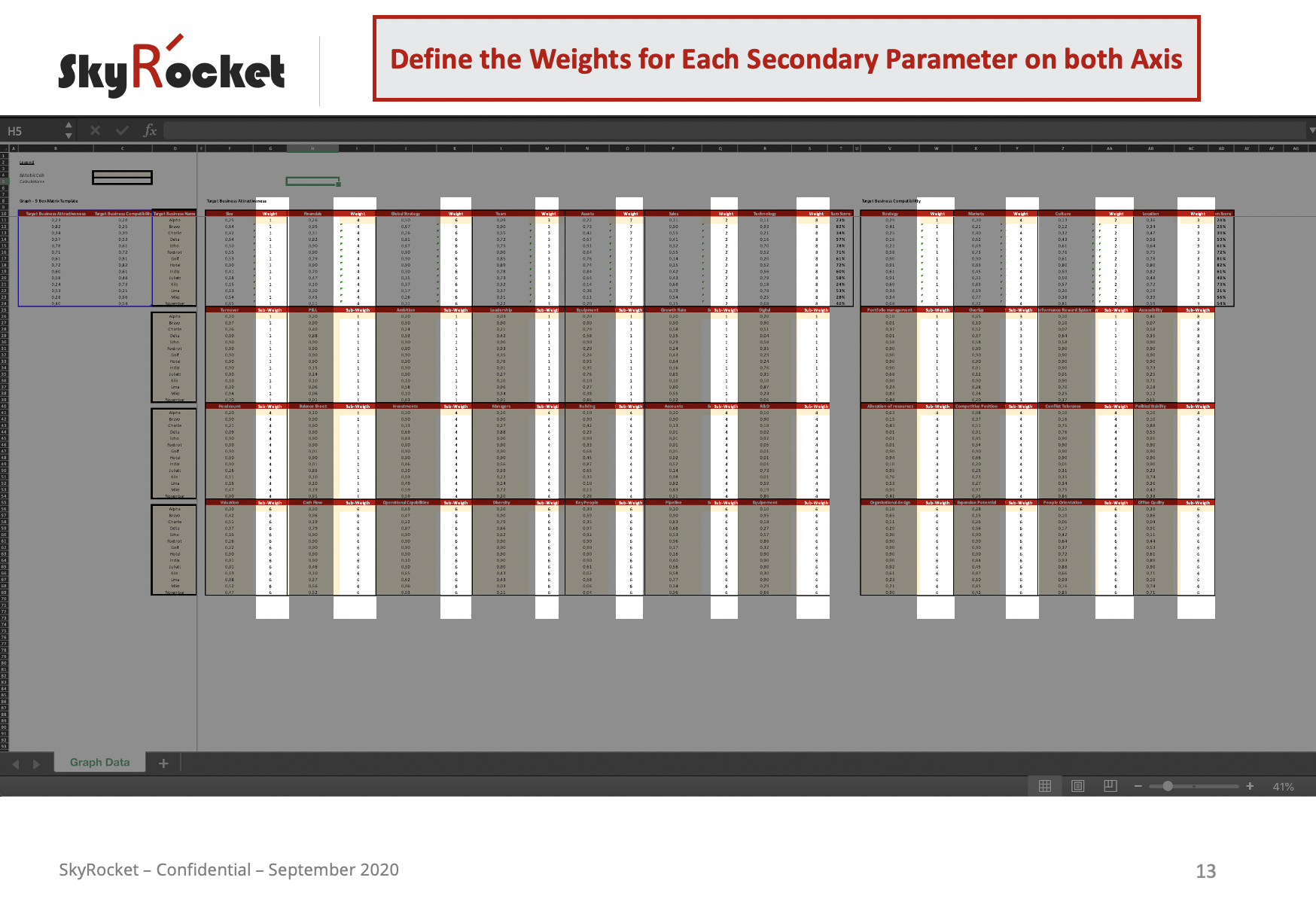

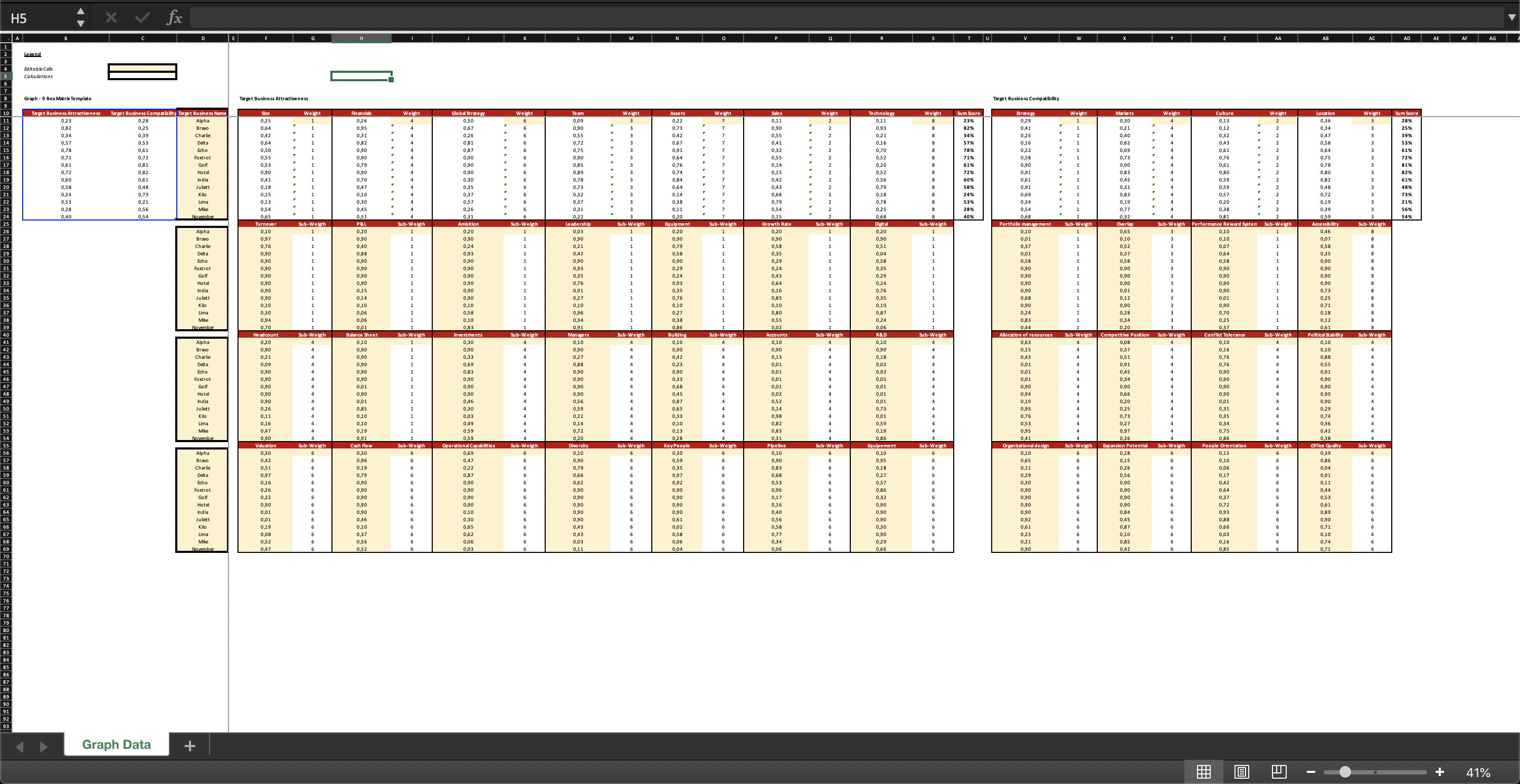

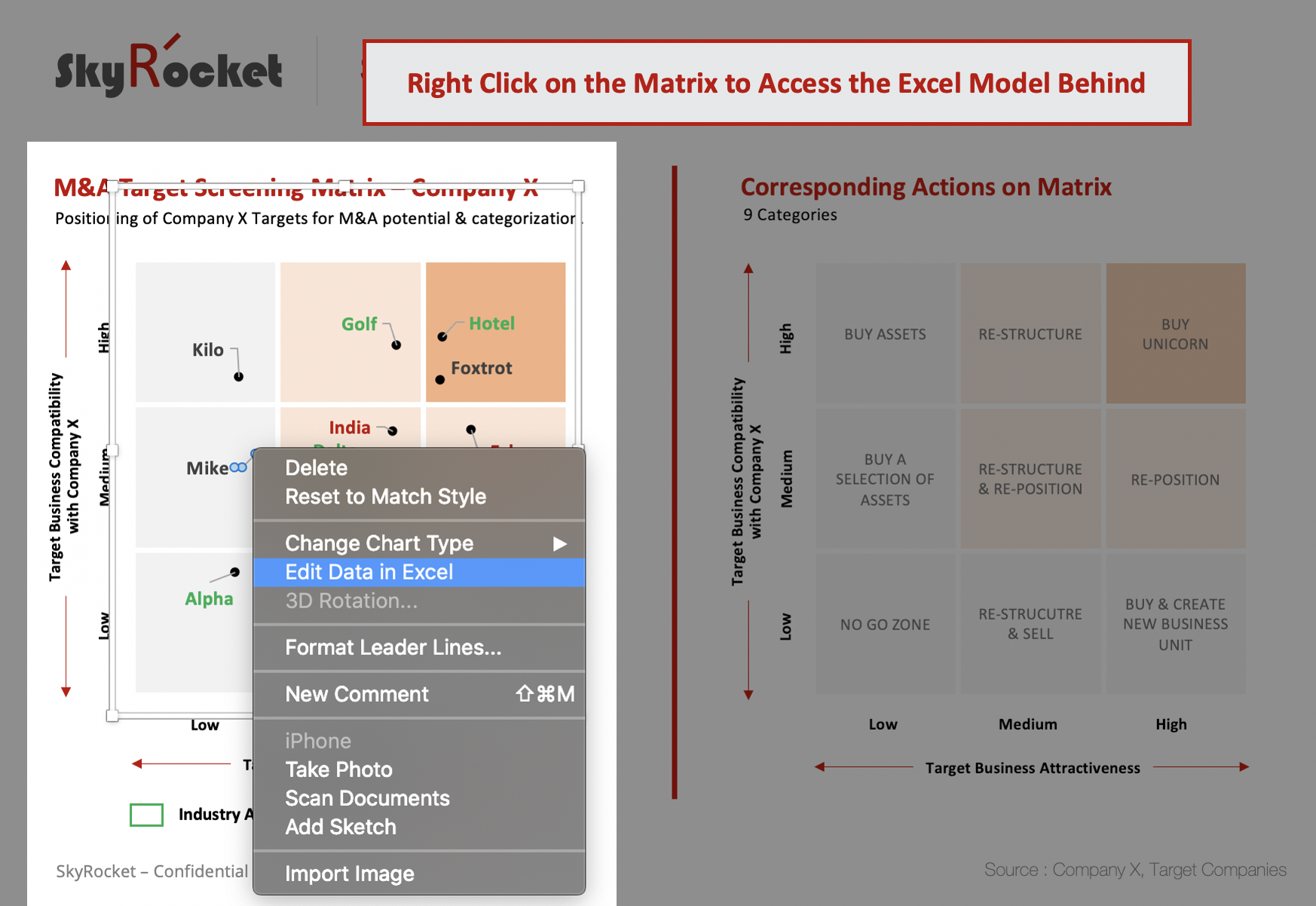

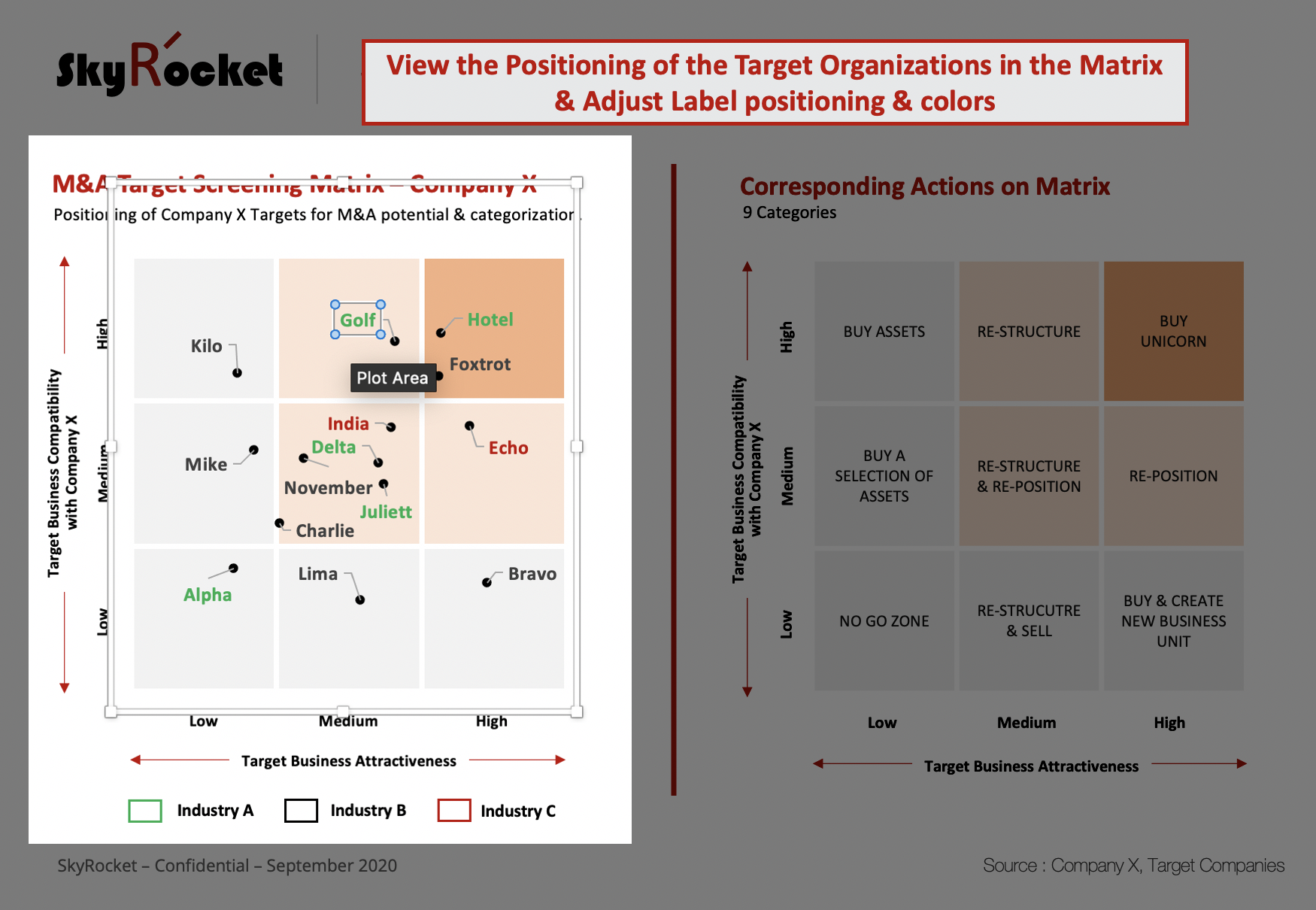

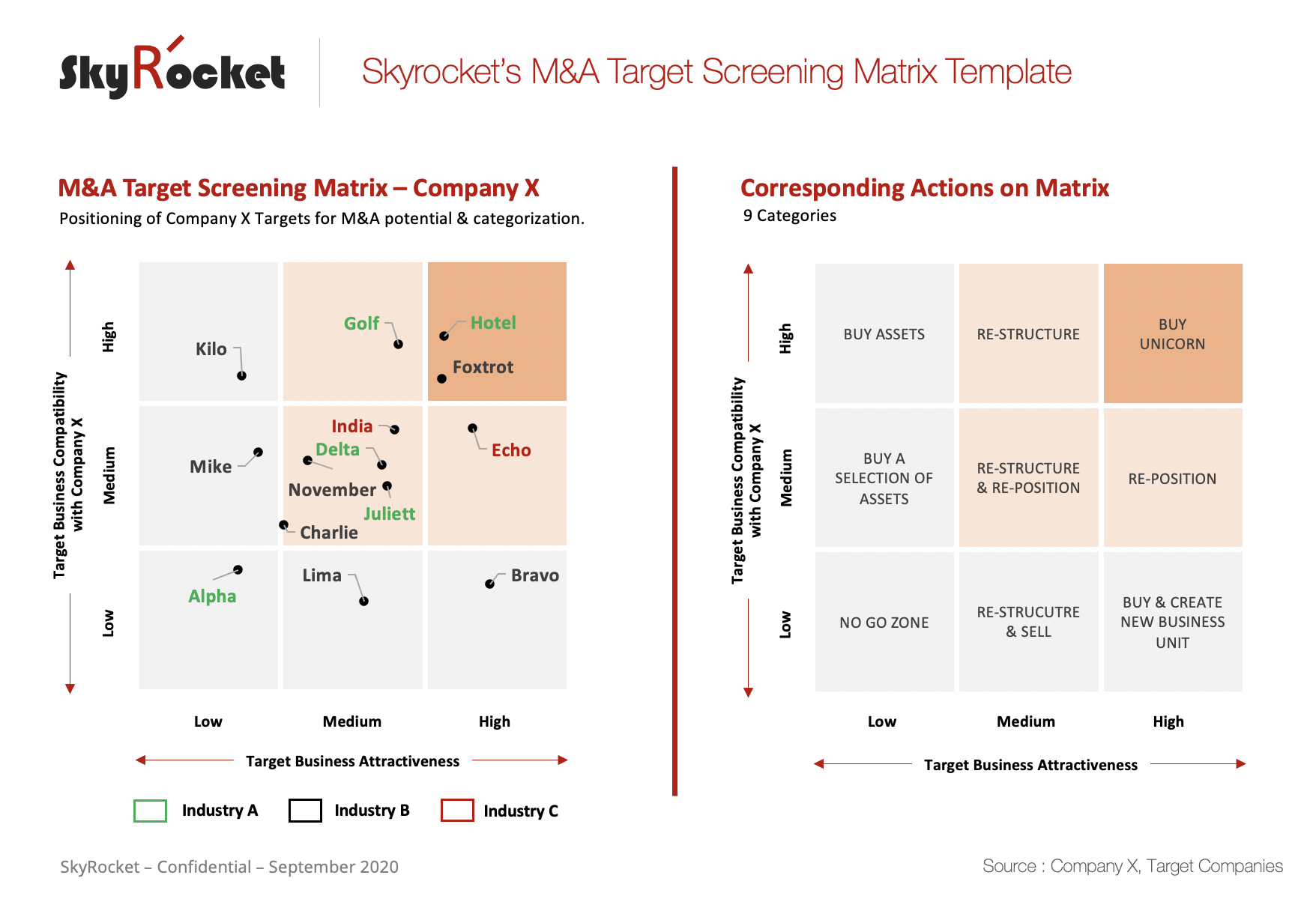

M&A Target Screening Template - To to this, i have created a target screening matrix template enabling to strategically position a large number of targets from multiple. This workflow is designed to walk you through every stage of the m&a search process from creating your search criteria to sending your letter of interest (loi). The table 3 provides a summary of the screening. Web published mar 6, 2023 + follow one critical component that often gets overlooked in the m&a process, but which can make all the difference, is target. Web on the basis of the study of 10 serial acquirers, 3 key reasons for m&a can be pointed out. Web developing a screening process for m&a targets is a critical step in the execution of an effective m&a strategy. Web m&a strategy & plan templates check out our library of free strategy and planning templates including acquisition evaluation, acquisition strategy, roles and. They are available for free. A proactive, structured screening process helps organizations. This article integrates the motives and criteria for target. Web published mar 6, 2023 + follow one critical component that often gets overlooked in the m&a process, but which can make all the difference, is target. Web m&a strategy & plan templates check out our library of free strategy and planning templates including acquisition evaluation, acquisition strategy, roles and. To to this, i have created a target screening matrix. 2.5 criteria for the screening process. The table 3 provides a summary of the screening. This article integrates the motives and criteria for target. Web published mar 6, 2023 + follow one critical component that often gets overlooked in the m&a process, but which can make all the difference, is target. Web in this article, you’ll find 20 of the. This usually involves two steps: A proactive, structured screening process helps organizations. Web target screening is crucial as it determines on which target(s) the due diligence will be performed. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Ideas from investment banks. This workflow is designed to walk you through every stage of the m&a search process from creating your search criteria to sending your letter of interest (loi). Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Web the devensoft m&a checklist and. Ideas from investment banks would typically flow into the long list or be. Web the devensoft m&a checklist and management toolkit includes several template, trackers and checklists for use by m&a teams. They are available for free. Web developing a screening process for m&a targets is a critical step in the execution of an effective m&a strategy. Web in this. Web m&a strategy & plan templates check out our library of free strategy and planning templates including acquisition evaluation, acquisition strategy, roles and. Web developing a screening process for m&a targets is a critical step in the execution of an effective m&a strategy. 2.5 criteria for the screening process. Web on the basis of the study of 10 serial acquirers,. Web target screening algorithm for m&a managers, consultants and other agents within the field of merger & acquisition. Web m&a strategy & plan templates check out our library of free strategy and planning templates including acquisition evaluation, acquisition strategy, roles and. Ideas from investment banks would typically flow into the long list or be. Web target screening is crucial as. Target screening was traditionally conducted using a funnel approach in which acquirers would create a long list, narrow it down to a short list based on defined screening criteria and then proceed with further target profiling. The table 3 provides a summary of the screening. The following presents a great rank and outline for building a potential. We provide insights. Web developing a screening process for m&a targets is a critical step in the execution of an effective m&a strategy. Web on the basis of the study of 10 serial acquirers, 3 key reasons for m&a can be pointed out. A proactive, structured screening process helps organizations. Ideas from investment banks would typically flow into the long list or be.. Ideas from investment banks would typically flow into the long list or be. Web published mar 6, 2023 + follow one critical component that often gets overlooked in the m&a process, but which can make all the difference, is target. 2.5 criteria for the screening process. Valuing the target on a standalone. They are available for free. The following presents a great rank and outline for building a potential. Target screening was traditionally conducted using a funnel approach in which acquirers would create a long list, narrow it down to a short list based on defined screening criteria and then proceed with further target profiling. Valuing the target on a standalone. Web m&a strategy & plan templates check out our library of free strategy and planning templates including acquisition evaluation, acquisition strategy, roles and. Ideas from investment banks would typically flow into the long list or be. This article integrates the motives and criteria for target. Web developing a screening process for m&a targets is a critical step in the execution of an effective m&a strategy. 2.5 criteria for the screening process. Web target screening is crucial as it determines on which target(s) the due diligence will be performed. This workflow is designed to walk you through every stage of the m&a search process from creating your search criteria to sending your letter of interest (loi). This usually involves two steps: Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. They are available for free. Web the devensoft m&a checklist and management toolkit includes several template, trackers and checklists for use by m&a teams. Web one of the biggest steps in the m&a process is analyzing and valuing acquisition targets. Web on the basis of the study of 10 serial acquirers, 3 key reasons for m&a can be pointed out. Web m&a due diligence with gantt template. To to this, i have created a target screening matrix template enabling to strategically position a large number of targets from multiple. We provide insights into dealsourcing, deal origination and. Web published mar 6, 2023 + follow one critical component that often gets overlooked in the m&a process, but which can make all the difference, is target. Web the devensoft m&a checklist and management toolkit includes several template, trackers and checklists for use by m&a teams. Target screening was traditionally conducted using a funnel approach in which acquirers would create a long list, narrow it down to a short list based on defined screening criteria and then proceed with further target profiling. To to this, i have created a target screening matrix template enabling to strategically position a large number of targets from multiple. This article integrates the motives and criteria for target. Ideas from investment banks would typically flow into the long list or be. Web target screening algorithm for m&a managers, consultants and other agents within the field of merger & acquisition. A proactive, structured screening process helps organizations. This usually involves two steps: We provide insights into dealsourcing, deal origination and. Web one of the biggest steps in the m&a process is analyzing and valuing acquisition targets. Web target screening is crucial as it determines on which target(s) the due diligence will be performed. Web m&a strategy & plan templates check out our library of free strategy and planning templates including acquisition evaluation, acquisition strategy, roles and. The following presents a great rank and outline for building a potential. This workflow is designed to walk you through every stage of the m&a search process from creating your search criteria to sending your letter of interest (loi). Web published mar 6, 2023 + follow one critical component that often gets overlooked in the m&a process, but which can make all the difference, is target. 2.5 criteria for the screening process.M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

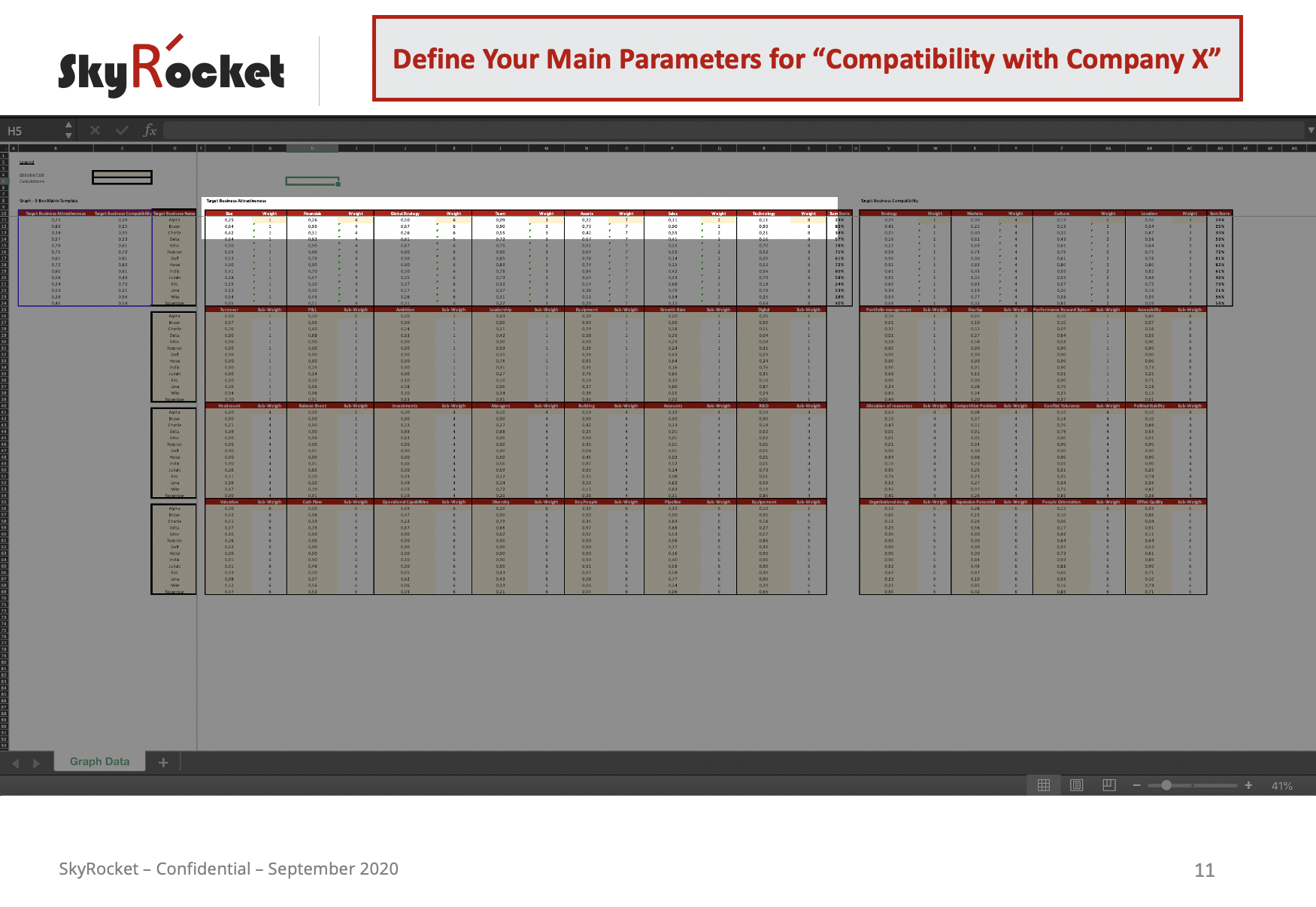

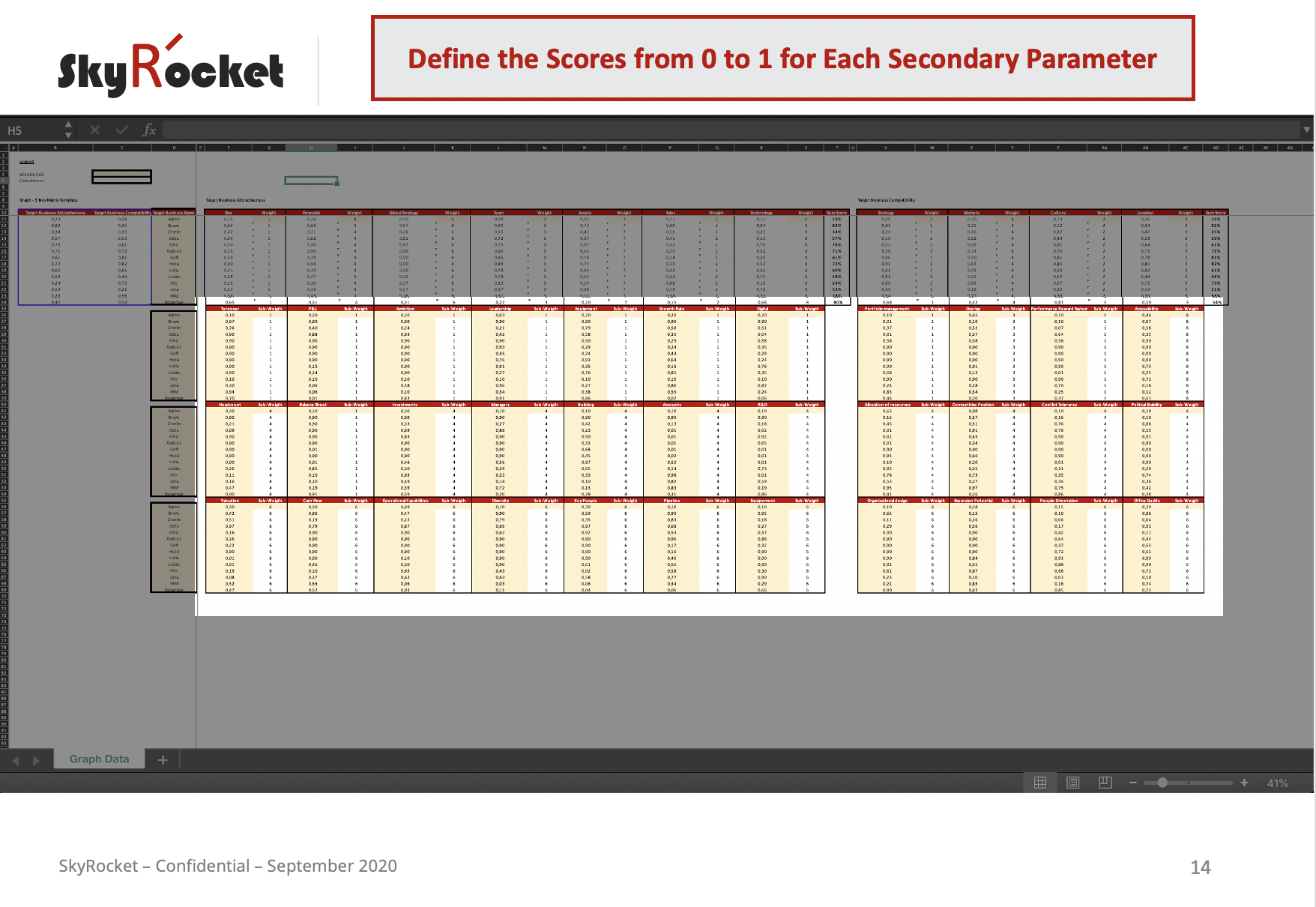

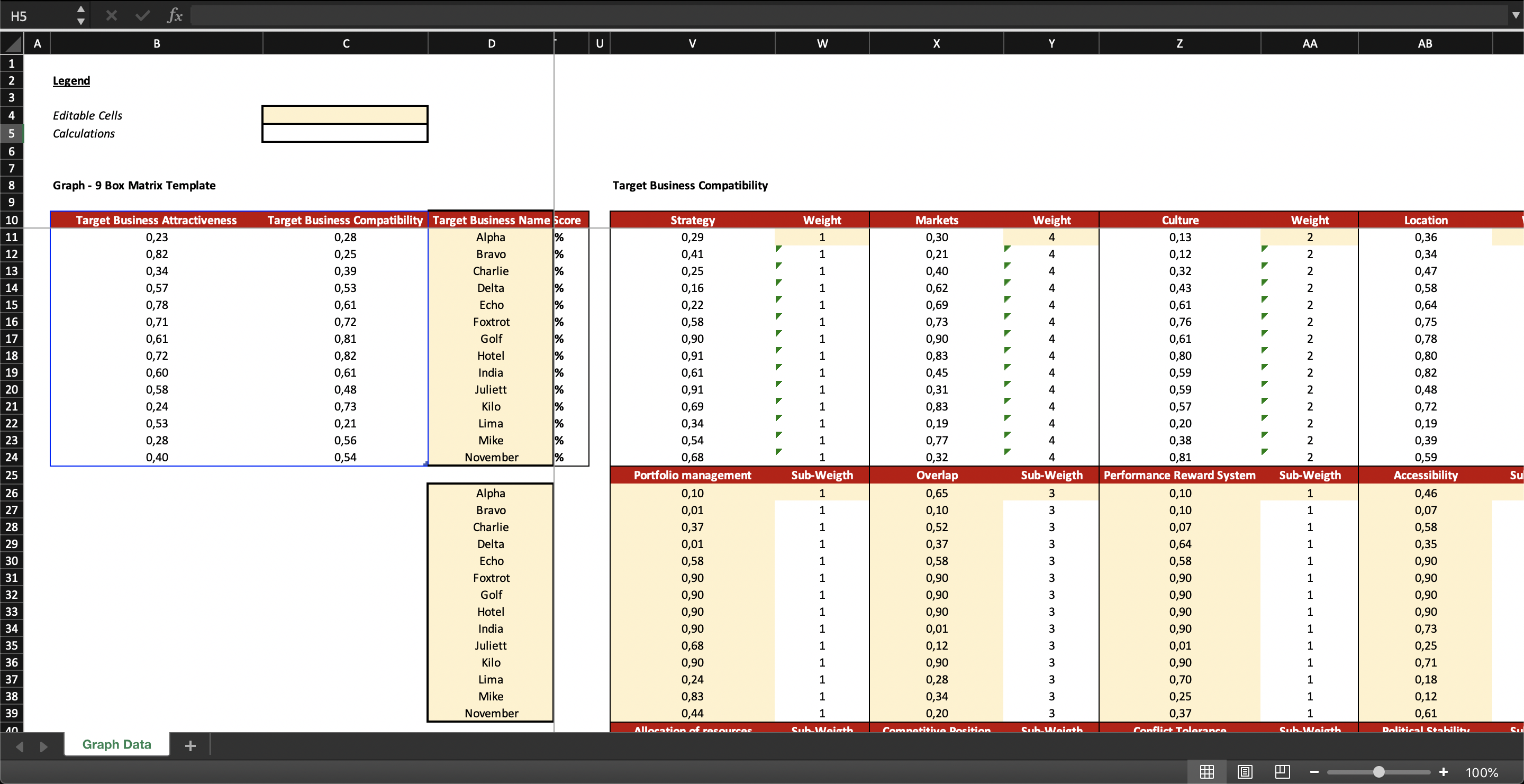

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

Web In This Article, You’ll Find 20 Of The Most Useful Merger And Acquisition (M&A) Templates For Business (Not Legal) Use, From Planning To Valuation To Integration.

Web M&A Due Diligence With Gantt Template.

The Table 3 Provides A Summary Of The Screening.

Valuing The Target On A Standalone.

Related Post: