M&A Deal Sheet Template

M&A Deal Sheet Template - Web a deal sheet (ds) records the number of deals or projects an employee has completed at the company during the fiscal year. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Web all templates get started fast with ready to use templates for specific use cases, job functions, and industries. Web updated may 15, 2023 what is a deal sheet? Manage all of your ongoing mergers and acquisitions with this m&a deal pipeline template. Web a merger and acquisition (m&a) agreement is used when a company purchases another company or when a struggling company seeks help from a much more successful. A purchase and sale agreement can take the form of a. In an interview, you’re only going to have 2 or 3 minutes to give an overview of the deal, so it. A deal sheet refers to a process record of the work experience of an entrepreneur or employee in past financial. Web two important documents are used in the m&a deal structuring process. Web two important documents are used in the m&a deal structuring process. Web the term sheet is a short bullet list of the key points of the transaction, such as the selling price, earnest money deposit, down payment, financing terms, length of time for due. It includes the key documents required for a financial due diligence (e.g., a financial fact.. Web track and resolve issues with ongoing mergers and acquisitions with this m&a issues report template. Web updated may 15, 2023 what is a deal sheet? In this guide, we’ll outline the. In an interview, you’re only going to have 2 or 3 minutes to give an overview of the deal, so it. Web a merger and acquisition (m&a) agreement. Web form:m&a term sheet (selling company favorable) description:this is a very detailed long form term sheet setting out proposed terms for the sale of a company. In an interview, you’re only going to have 2 or 3 minutes to give an overview of the deal, so it. Web the first step in creating a deal summary is to think about. Web the excel templates on this page will help you in preparing your business for a sale. Manage all of your ongoing mergers and acquisitions with this m&a deal pipeline template. Web a deal sheet (ds) records the number of deals or projects an employee has completed at the company during the fiscal year. In this guide, we’ll outline the.. We cover a wide variety of templates. Web all templates get started fast with ready to use templates for specific use cases, job functions, and industries. These templates are free for you to download and can be used within minutes. A deal sheet refers to a process record of the work experience of an entrepreneur or employee in past financial.. Web a deal sheet (ds) records the number of deals or projects an employee has completed at the company during the fiscal year. Web a merger and acquisition (m&a) agreement is used when a company purchases another company or when a struggling company seeks help from a much more successful. Web track and resolve issues with ongoing mergers and acquisitions. Use this spreadsheet to log tasks. Choose from over 200 starting points for project and task. Web the term sheet is a short bullet list of the key points of the transaction, such as the selling price, earnest money deposit, down payment, financing terms, length of time for due. Web the first step in creating a deal summary is to. A deal sheet refers to a process record of the work experience of an entrepreneur or employee in past financial. Web a deal sheet (ds) records the number of deals or projects an employee has completed at the company during the fiscal year. Web all templates get started fast with ready to use templates for specific use cases, job functions,. It includes the key documents required for a financial due diligence (e.g., a financial fact. A deal sheet refers to a process record of the work experience of an entrepreneur or employee in past financial. These documents are known as the term sheet and letter of intent ( loi ). Web a deal sheet (ds) records the number of deals. In an interview, you’re only going to have 2 or 3 minutes to give an overview of the deal, so it. Log every detail of every deal in your pipeline with the deals sheet, including. Web a merger and acquisition (m&a) agreement is used when a company purchases another company or when a struggling company seeks help from a much. In this guide, we’ll outline the. Web updated may 15, 2023 what is a deal sheet? These documents are known as the term sheet and letter of intent ( loi ). Web all templates get started fast with ready to use templates for specific use cases, job functions, and industries. A purchase and sale agreement can take the form of a. In an interview, you’re only going to have 2 or 3 minutes to give an overview of the deal, so it. Web two important documents are used in the m&a deal structuring process. Manage all of your ongoing mergers and acquisitions with this m&a deal pipeline template. Web a merger and acquisition (m&a) agreement is used when a company purchases another company or when a struggling company seeks help from a much more successful. Log issues, note their priority, assign them to users, and track. Web form:m&a term sheet (selling company favorable) description:this is a very detailed long form term sheet setting out proposed terms for the sale of a company. Use this spreadsheet to log tasks. Web the mergers and acquisitions (m&a) process has many steps and can often take anywhere from 6 months to several years to complete. It includes the key documents required for a financial due diligence (e.g., a financial fact. Web track and resolve issues with ongoing mergers and acquisitions with this m&a issues report template. We cover a wide variety of templates. Web the term sheet is a short bullet list of the key points of the transaction, such as the selling price, earnest money deposit, down payment, financing terms, length of time for due. These templates are free for you to download and can be used within minutes. Web a deal sheet (ds) records the number of deals or projects an employee has completed at the company during the fiscal year. Log every detail of every deal in your pipeline with the deals sheet, including. Web form:m&a term sheet (selling company favorable) description:this is a very detailed long form term sheet setting out proposed terms for the sale of a company. Web the excel templates on this page will help you in preparing your business for a sale. These are deals where the person. Web updated may 15, 2023 what is a deal sheet? Web the mergers and acquisitions (m&a) process has many steps and can often take anywhere from 6 months to several years to complete. In an interview, you’re only going to have 2 or 3 minutes to give an overview of the deal, so it. Choose from over 200 starting points for project and task. A deal sheet refers to a process record of the work experience of an entrepreneur or employee in past financial. Manage all of your ongoing mergers and acquisitions with this m&a deal pipeline template. Web track and resolve issues with ongoing mergers and acquisitions with this m&a issues report template. Web a merger and acquisition (m&a) agreement is used when a company purchases another company or when a struggling company seeks help from a much more successful. Use this spreadsheet to log tasks. A purchase and sale agreement can take the form of a. It includes the key documents required for a financial due diligence (e.g., a financial fact. Web the term sheet is a short bullet list of the key points of the transaction, such as the selling price, earnest money deposit, down payment, financing terms, length of time for due. Web all templates get started fast with ready to use templates for specific use cases, job functions, and industries.47 Simple Term Sheet Templates [Word] ᐅ TemplateLab

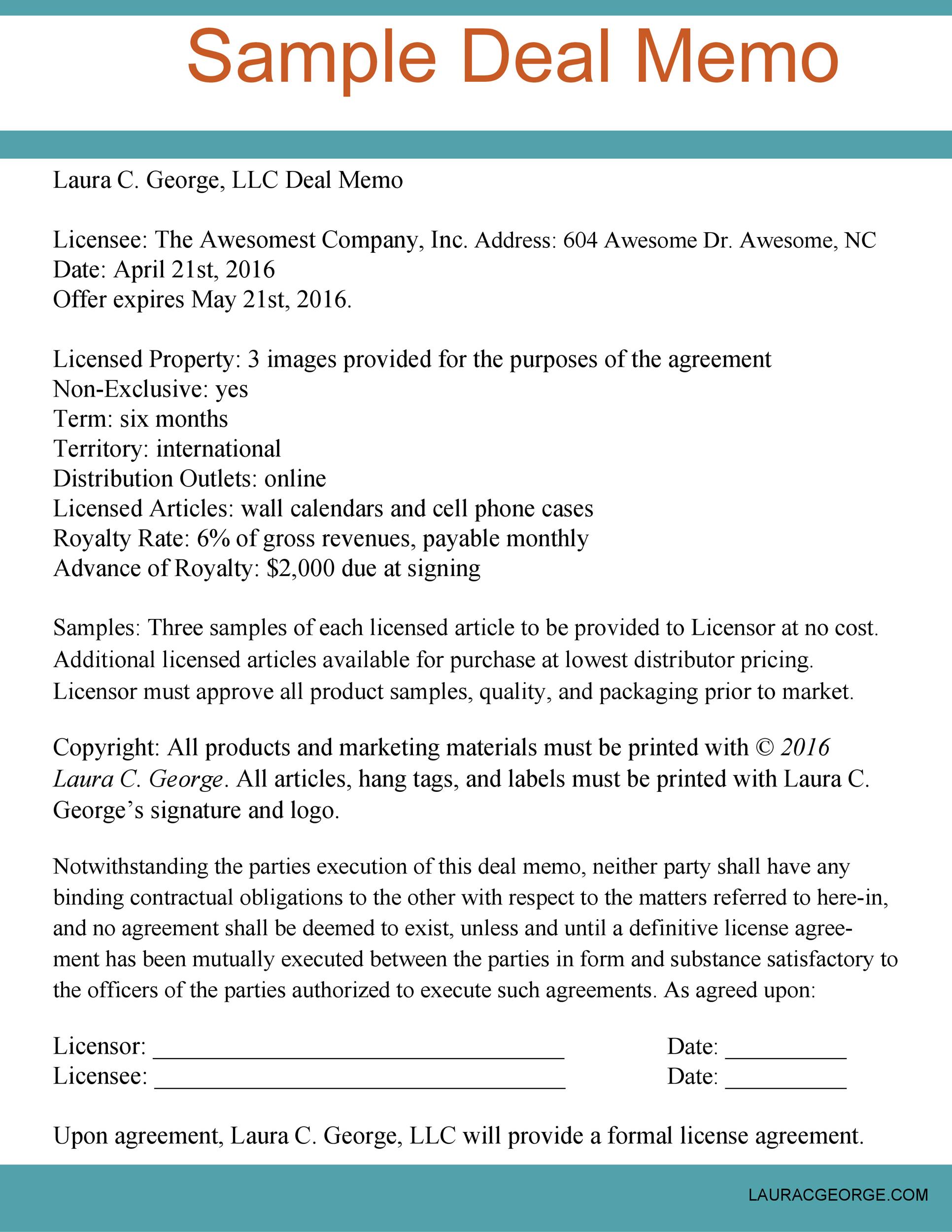

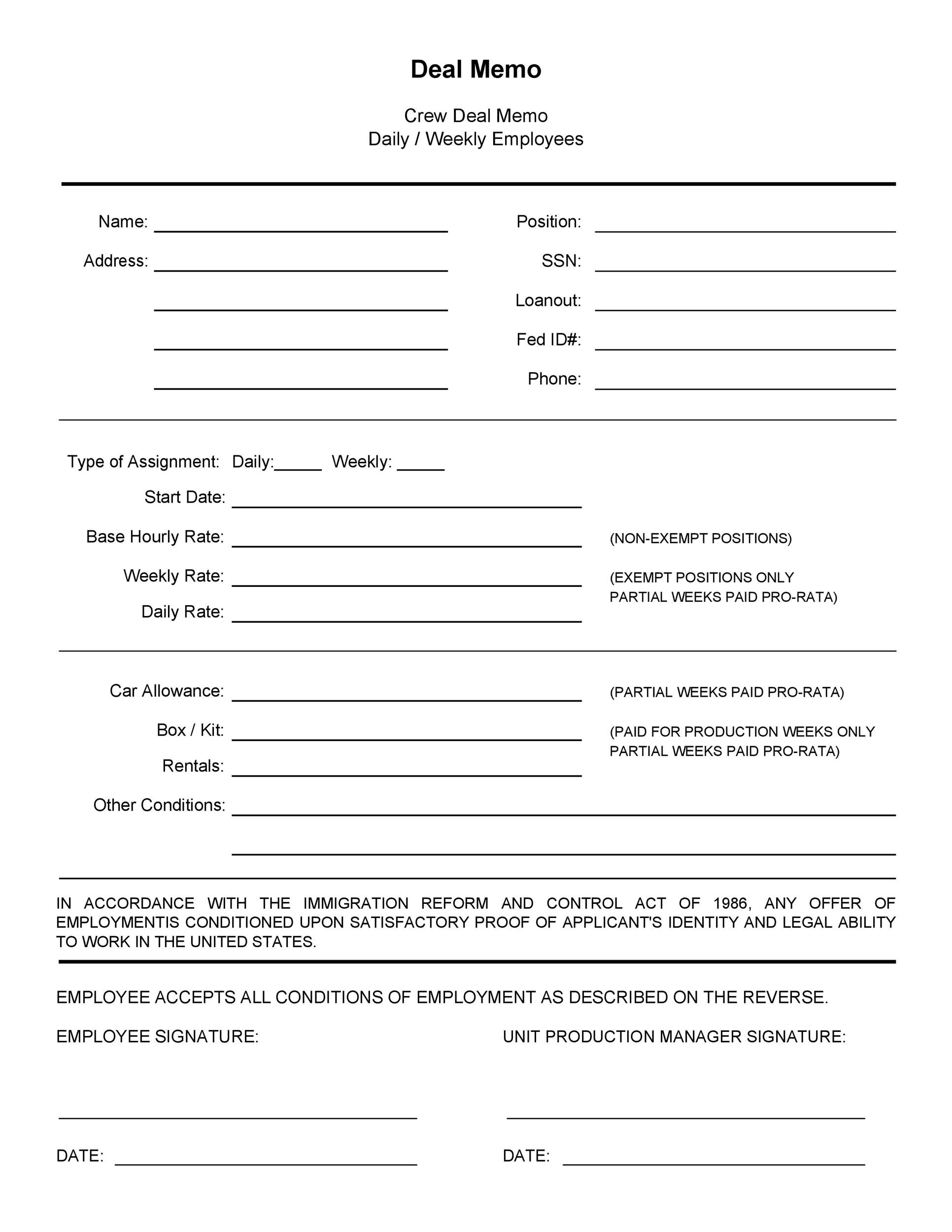

50 Simple Deal Memo Templates (& Layouts) ᐅ TemplateLab

Deal Sheet summary

Deal sheet summary

M&A deal evaluation

Arriba 74+ imagen modelo de memorandum simple Thcshoanghoathambadinh

47 Simple Term Sheet Templates [Word] ᐅ TemplateLab

Deal Sheet Example Business Development Balance Verkanarobtowner

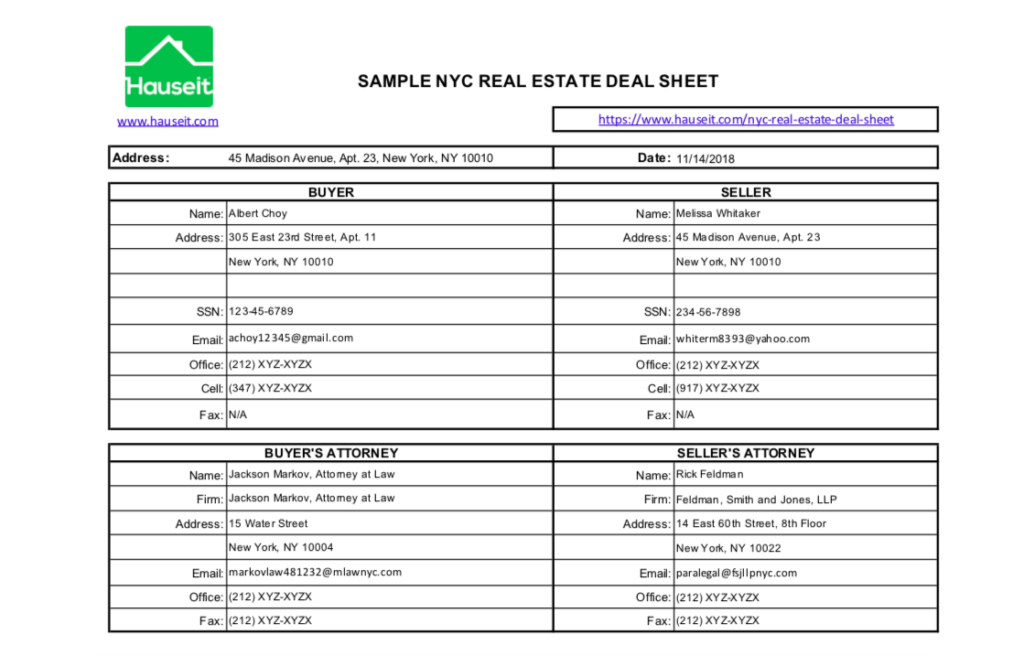

How to Prepare a Real Estate Deal Sheet in NYC Hauseit®

The Investment Banking Deal Sheet How to Win Job Offers

Web The First Step In Creating A Deal Summary Is To Think About The Purpose Of The Summary.

Log Issues, Note Their Priority, Assign Them To Users, And Track.

Log Every Detail Of Every Deal In Your Pipeline With The Deals Sheet, Including.

These Templates Are Free For You To Download And Can Be Used Within Minutes.

Related Post:

![47 Simple Term Sheet Templates [Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/04/term-sheet-template-29.jpg)

![47 Simple Term Sheet Templates [Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/04/term-sheet-template-01.jpg)