Kyc Checklist Template

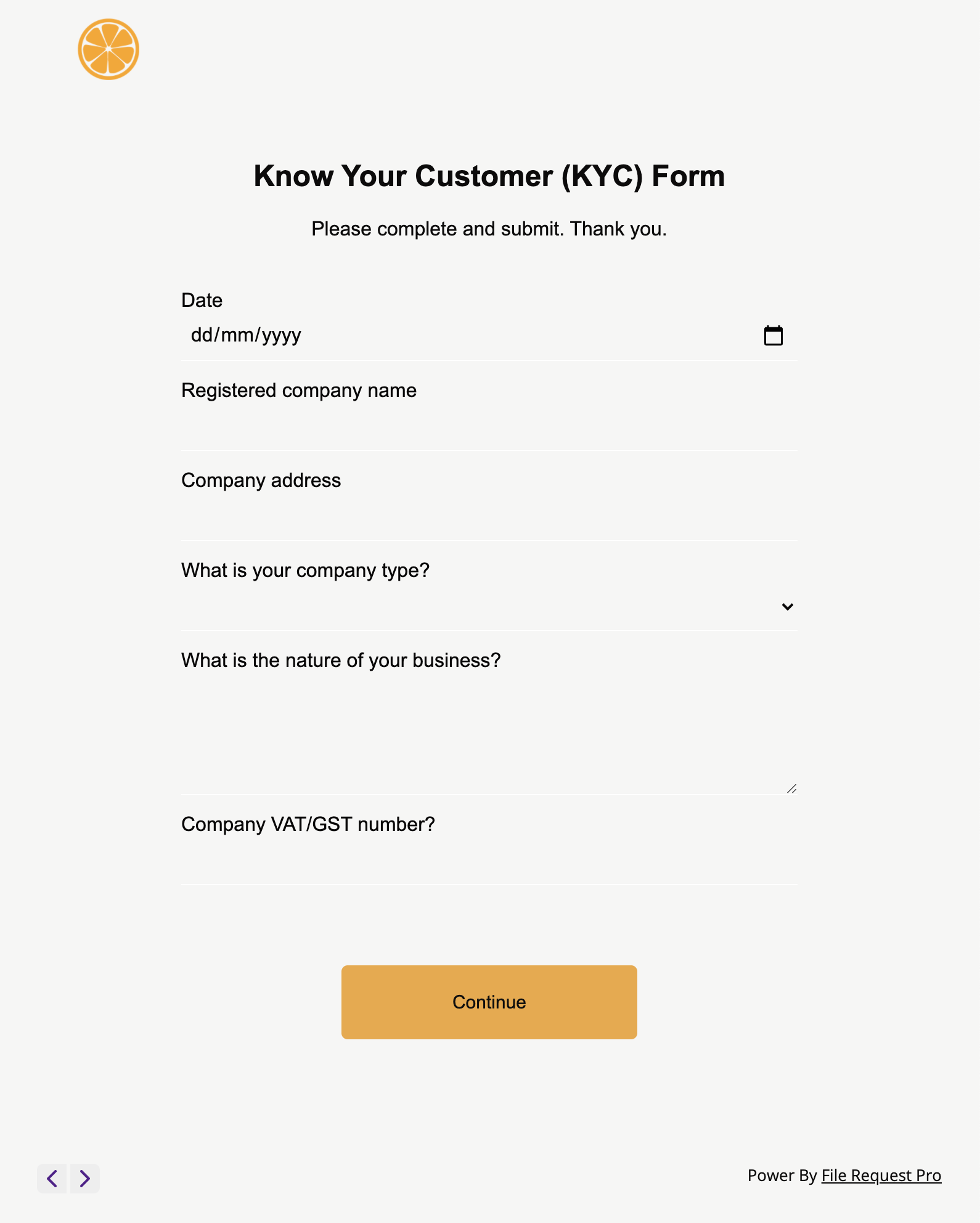

Kyc Checklist Template - Customer identification is the first step in a kyc program. Check global kyc differences ; Web kyc cdd checklist: Web have a look at our complete list of kyc compliance checklist that will help you in eliminating the possibility of financial fraud, identity theft, and money laundering. 🤖 learn how ai is revolutionizing contracts in our new ebook: Web a know your customer (kyc) checklist is a list of documents and information that a business or financial institution collects from its clients or customers to verify their identity and assess potential risks of money laundering, fraud, or other. A basic checklist might include: 🚀 learn more → product Think about cultural kyc differences ; It ensures we only do business with people and companies we have verified as being trustworthy. Web (‘kyc’) quick reference guide which provides quick and easy access to global aml and kyc information, to assist firms operating internationally in mitigating their risk. Web a know your customer (kyc) checklist is a list of documents and information that a business or financial institution collects from its clients or customers to verify their identity and assess potential risks. Web how to download our kyc and onboarding checklist templates? The questions posed are indicative only and not all will. A basic checklist might include: The new era of contracts. All you need for aml compliance. Think about cultural kyc differences ; To architect your approach, it is imperative to bring all stakeholders from compliance, risk, it, and customer growth. Web have a look at our complete list of kyc compliance checklist that will help you in eliminating the possibility of financial fraud, identity theft, and money laundering. Download our kyc checklist template ; Customer identification. This includes carrying out customer due diligence checks, updating. Customer identification is the first step in a kyc program. Web (‘kyc’) quick reference guide which provides quick and easy access to global aml and kyc information, to assist firms operating internationally in mitigating their risk. The new era of contracts. Improve visibility into potential risks associated with financial crimes through. The kyc onboarding checklists listed above are available for you to use at no cost for 7 days once you register to clustdoc. Think about cultural kyc differences ; Web have a look at our complete list of kyc compliance checklist that will help you in eliminating the possibility of financial fraud, identity theft, and money laundering. Check global kyc. Think about cultural kyc differences ; Web use kyc forms to establish the identity of your clients. It involves accurately identifying the customer and the risks associated with conducting business. Web this checklist provides the framework to guide you through a comprehensive examination of your kyc program. A basic checklist might include: Web template for entering kyc agreements with clients. Think about cultural kyc differences ; Chapter 2, risk assessment model, details different risk models of kyc. Web oracle financial services kyc risk assessment guide. How to create a kyc checklist ; It involves accurately identifying the customer and the risks associated with conducting business. The new era of contracts. How to create a kyc checklist ; Automate kyc with the right software ; Some common kyc documents include the following: Web (‘kyc’) quick reference guide which provides quick and easy access to global aml and kyc information, to assist firms operating internationally in mitigating their risk. All you need for aml compliance. Some common kyc documents include the following: Web template for entering kyc agreements with clients. 🚀 learn more → product Improve visibility into potential risks associated with financial crimes through kyc & cdd Chapter 2, risk assessment model, details different risk models of kyc. Web have a look at our complete list of kyc compliance checklist that will help you in eliminating the possibility of financial fraud, identity theft, and money laundering. Web (‘kyc’) quick reference guide which provides quick. Web know your customer (kyc) is the first step towards a safe and compliant bank. Check global kyc differences ; It will let you swiftly verify. Ad support a more comprehensive kyc workflow across the entire customer lifecycle. Chapter 1, kyc risk assessments, provides a brief overview of the kyc risk assessments. Improve visibility into potential risks associated with financial crimes through kyc & cdd To architect your approach, it is imperative to bring all stakeholders from compliance, risk, it, and customer growth. Web this checklist provides the framework to guide you through a comprehensive examination of your kyc program. 🤖 learn how ai is revolutionizing contracts in our new ebook: Web (‘kyc’) quick reference guide which provides quick and easy access to global aml and kyc information, to assist firms operating internationally in mitigating their risk. Chapter 2, risk assessment model, details different risk models of kyc. Proof of address — utility bills and other. Automate kyc with the right software ; The kyc onboarding checklists listed above are available for you to use at no cost for 7 days once you register to clustdoc. This year’s guide has been expanded to include additional new countries and incorporates the main. Think about cultural kyc differences ; For a start, do you. Web a know your customer (kyc) checklist is a list of documents and information that a business or financial institution collects from its clients or customers to verify their identity and assess potential risks of money laundering, fraud, or other. Web know your customer checklist: Web kyc cdd checklist: How seon does frictionless kyc see more It involves accurately identifying the customer and the risks associated with conducting business. Web kyc cdd checklist: Web know your customer checklist: Check global kyc differences ; It will let you swiftly verify. Web oracle financial services kyc risk assessment guide. Our kyc/kyb solution is comprehensive, robust, and engaging. Web know your customer (kyc) is the first step towards a safe and compliant bank. How to create a kyc checklist ; Customer identification is the first step in a kyc program. 🚀 learn more → product Web (‘kyc’) quick reference guide which provides quick and easy access to global aml and kyc information, to assist firms operating internationally in mitigating their risk. The questions posed are indicative only and not all will. Web 01 create document click create document button and the document will be prepared with your account details automatically filled in. Web use kyc forms to establish the identity of your clients.Kyc Template Excel Fill and Sign Printable Template Online US Legal

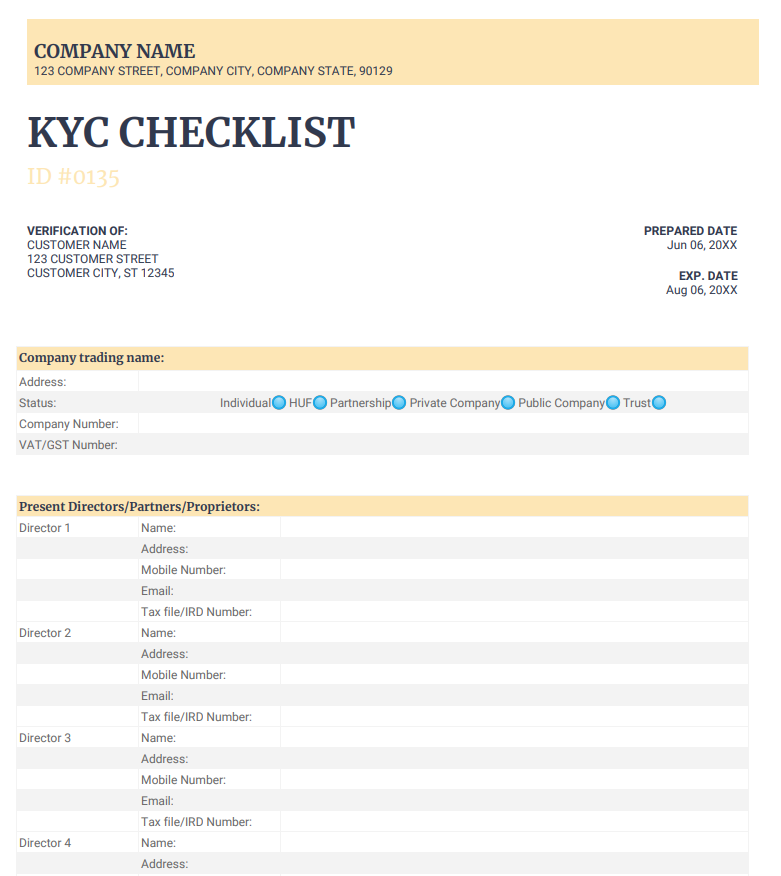

KYC Checklist What Are The Elements?

How to create a Know Your Customer (KYC) checklist

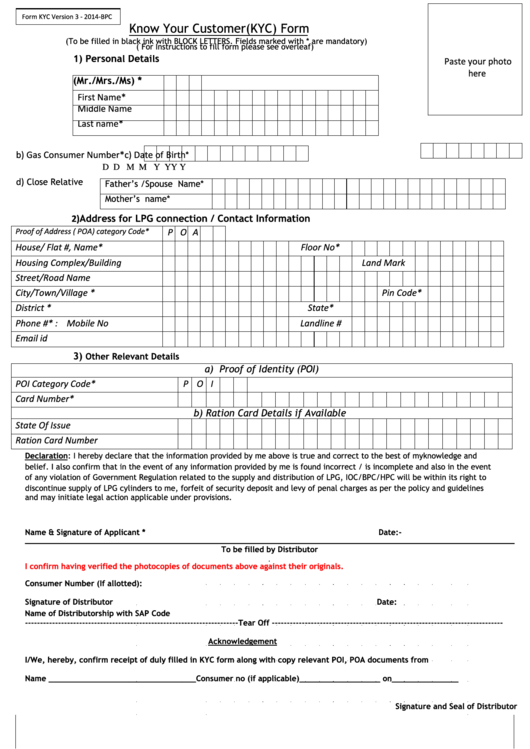

TO CA GROUPS Mandatory Client KYC forms for Practicing CA’s

KYC Checklist What Are The Elements?

Know Your CustomerKYC FormatSample ArtashGroup

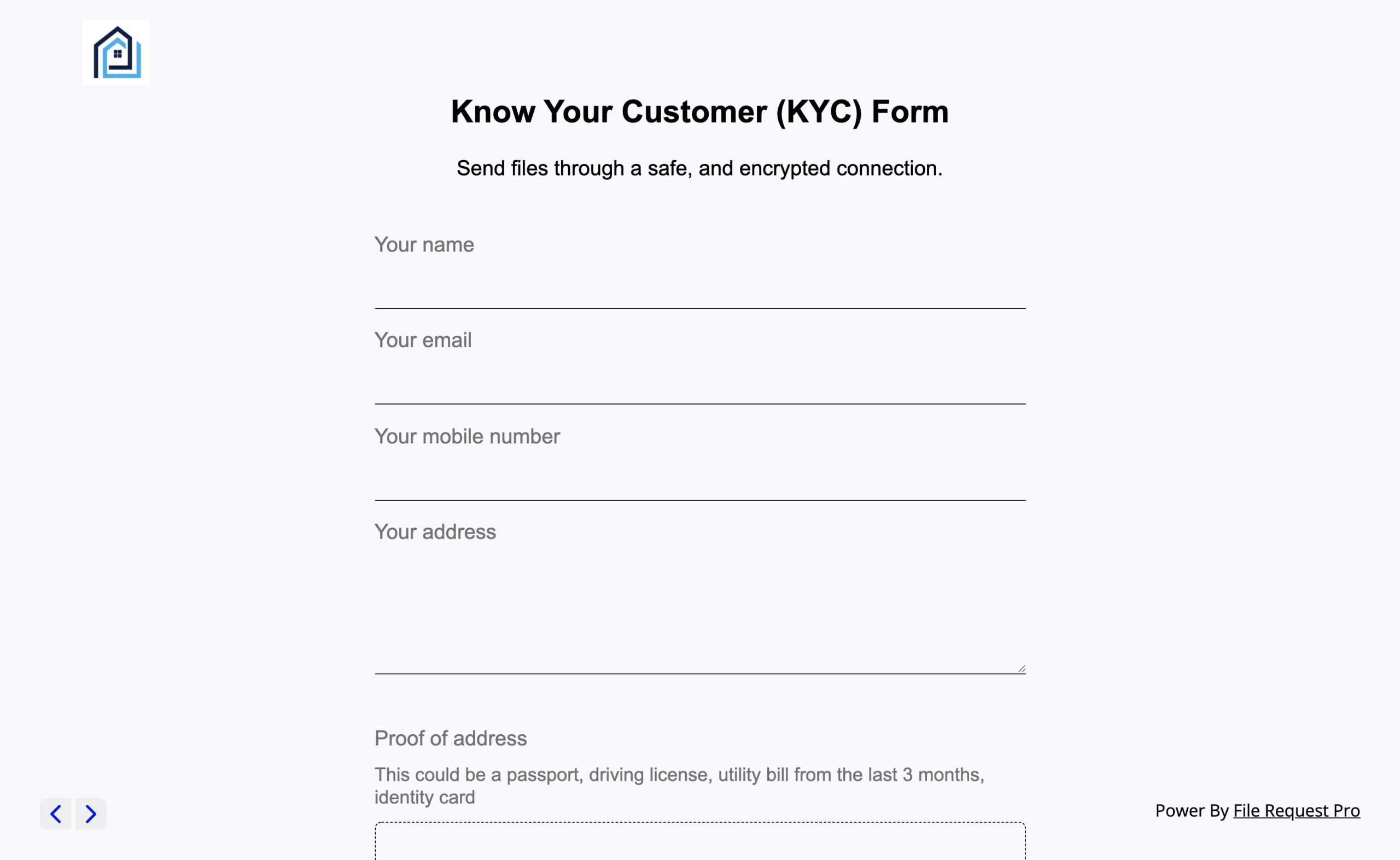

Know Your Customer(Kyc) Form printable pdf download

Download KYC Form for Free Page 2 FormTemplate

Icici Kyc Checklist Identity Document Official Documents Free 30

How to create a Know Your Customer (KYC) checklist

With Clustdoc, You Can Now Collect And Verify Your Client's Identity And Manage An Effective Response To Money.

Web How To Download Our Kyc And Onboarding Checklist Templates?

Improve Visibility Into Potential Risks Associated With Financial Crimes Through Kyc & Cdd

Web Know Your Customer Or Kyc Checklist Is Simply The Series Of Actions That A Business Is Mandated By Law To Take To Satisfy Anti Money Laundering Compliance.

Related Post: