Joint Revocable Trust Template

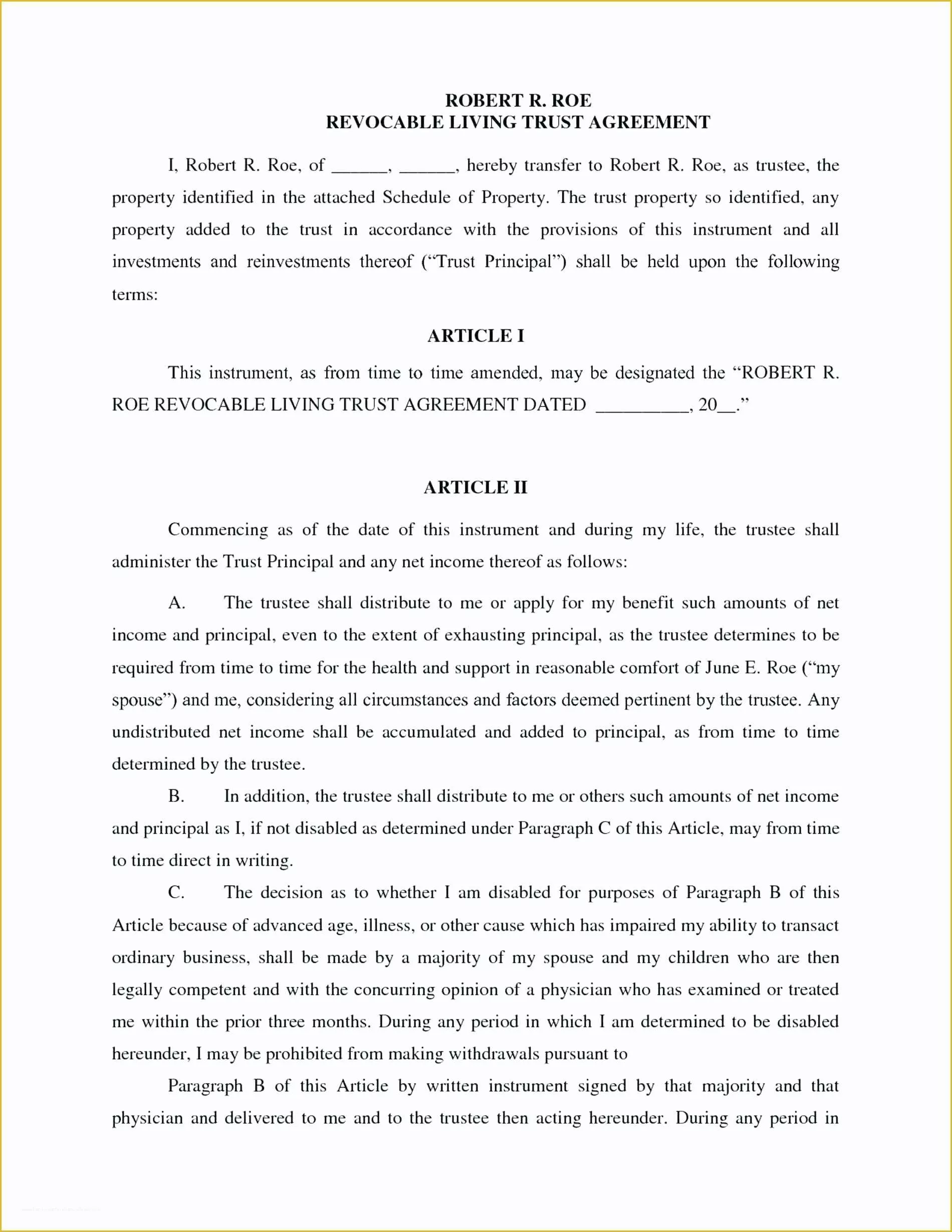

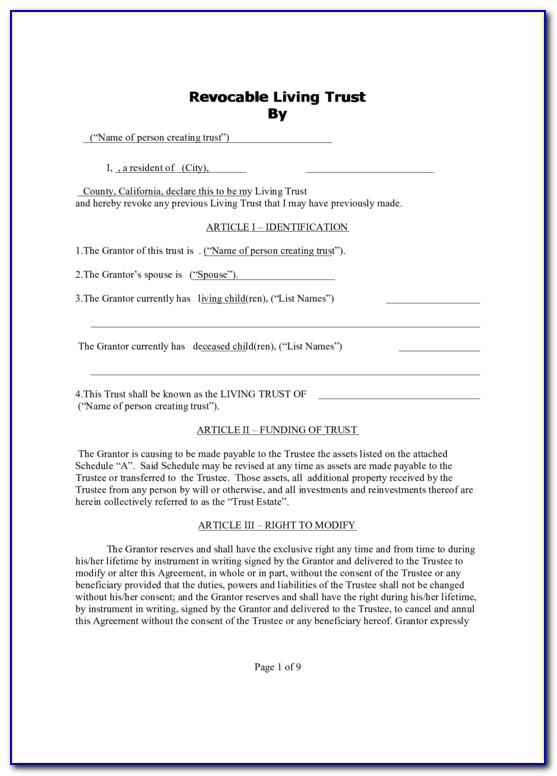

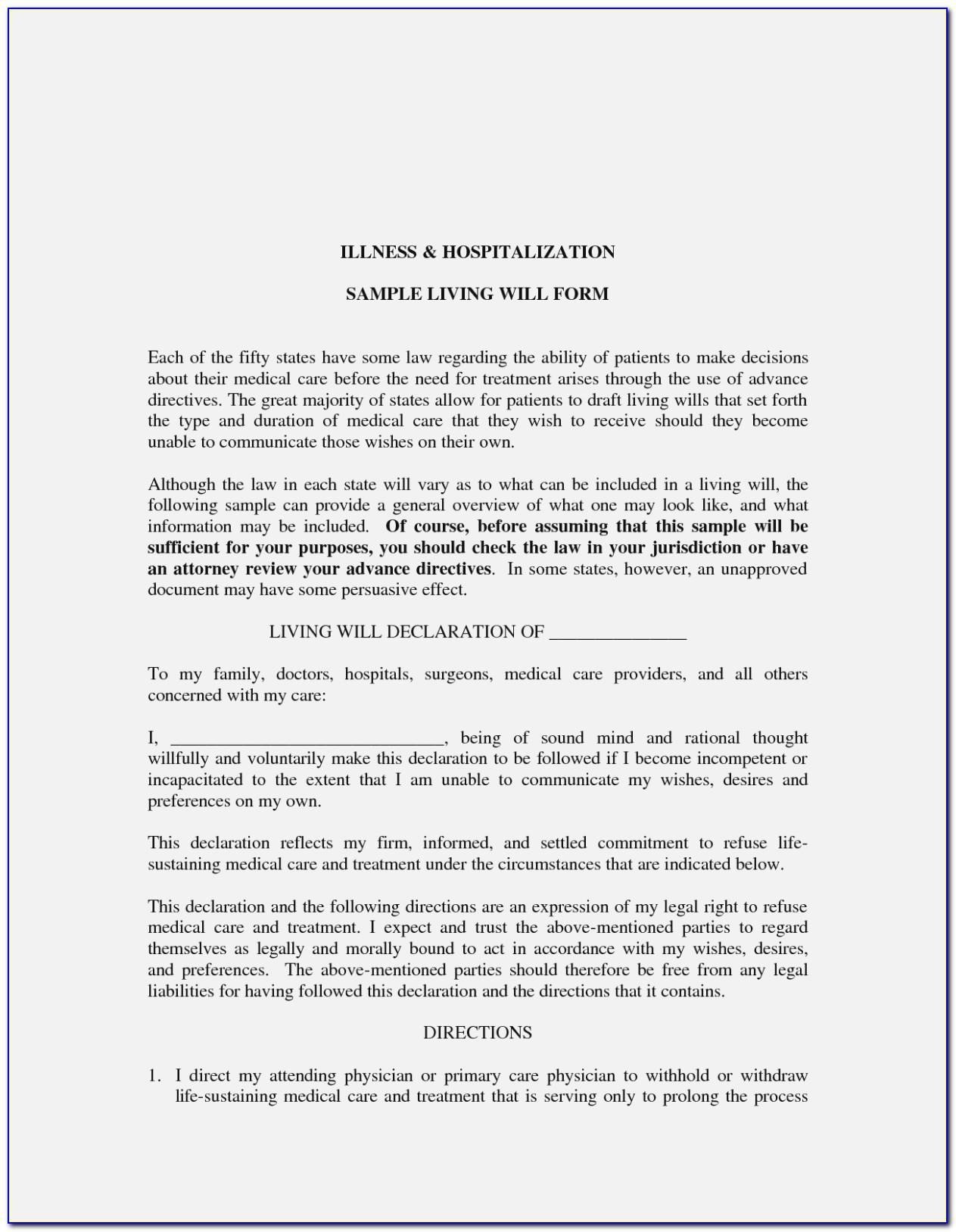

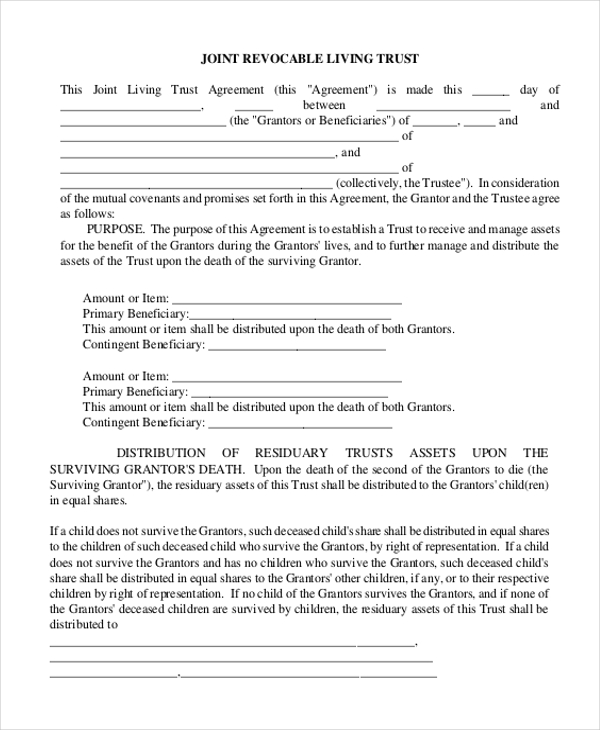

Joint Revocable Trust Template - Use us legal forms to get a printable revocable living trust for married couple. Web joint revocable trusts can be a solid option when a married couple has a generally simple estate and when total assets (combined) don’t meet the estate tax limit threshold, which. Upon the death or incapacity of the grantor, the trustee will be. Web both spouses manage a joint trust while they are still alive and competent. Rocketlawyer.com has been visited by 100k+ users in the past month Extreme care shall be taken to avoid numerous issues that can arise in a joint trust such as determining which spouse contributed which property, how separate. You will need a pdf. You will need a pdf. Both spouses will have full access and control over the trust and can change the. Web up to 25% cash back here is an example of a nolo living trust, made for a fictional couple. By establishing a revocable trust and a corresponding pour over will, a person can maintain all of his or. Ensure you know exactly who will receive your assets after you pass away. The initial trustee will be ________________________ [grantor] (the “trustee”). Extreme care shall be taken to avoid numerous issues that can arise in a joint trust such as determining. It can either be revocable. Web by joint agreement, we may remove any trustee at any time, with or without cause. Web up to 25% cash back here is an example of a nolo living trust, made for a fictional couple. Web our joint revocable living trust. If a trustee is removed, resigns, or cannot continue to serve for any. Web by joint agreement, we may remove any trustee at any time, with or without cause. Web how to fill out resaons to form a revocable trust? Web sample joint revocable living trust. Living trusts section of nolo.com. Extreme care shall be taken to avoid numerous issues that can arise in a joint trust such as determining which spouse contributed. The initial trustee will be ________________________ [grantor] (the “trustee”). You will need a pdf. Uslegalforms.com has been visited by 100k+ users in the past month Web separate trusts can be used to reduce or eliminate death tax. Web up to 24% cash back you can use a living trust revocation to revoke, dissolve and dismantle a living trust or joint. Unification of assets & avoidance of ancillary probate: Save time and money by creating and downloading any legally binding agreement in minutes. Rocketlawyer.com has been visited by 100k+ users in the past month Extreme care shall be taken to avoid numerous issues that can arise in a joint trust such as determining which spouse contributed which property, how separate. Web. Both spouses will have full access and control over the trust and can change the. Unification of assets & avoidance of ancillary probate: You will need a pdf. Web how to fill out resaons to form a revocable trust? Web both spouses manage a joint trust while they are still alive and competent. Web a joint revocable trust is a single trust document that two persons establish to hold title to assets which they typically own together as a married couple. Use us legal forms to get a printable revocable living trust for married couple. It's also used when revoking a living trust in preparation for. Click the link below to download a. Living trusts section of nolo.com. Web how to fill out resaons to form a revocable trust? Web download our living trust form free template to create your legal document. You will need a pdf. Ad create a living trust to seamlessly transfer your property or assets to a beneficiary. Use us legal forms to get a printable revocable living trust for married couple. Instead of creating two separate living trusts, couples can choose to make a joint living trust. Web up to 25% cash back here is an example of a nolo living trust, made for a fictional couple. Web sample joint revocable living trust. Living trusts section of. Unification of assets & avoidance of ancillary probate: Ad create a living trust to seamlessly transfer your property or assets to a beneficiary. Uslegalforms.com has been visited by 100k+ users in the past month Sample joint revocable living trust. Click the link below to download a pdf document of the sample document. Web joint revocable trusts can be a solid option when a married couple has a generally simple estate and when total assets (combined) don’t meet the estate tax limit threshold, which. Uslegalforms.com has been visited by 100k+ users in the past month If a trustee is removed, resigns, or cannot continue to serve for any reason,. It can either be revocable. Click the link below to download a pdf document of the sample document. Upon the death or incapacity of the grantor, the trustee will be. Web by joint agreement, we may remove any trustee at any time, with or without cause. Unification of assets & avoidance of ancillary probate: You will need a pdf. Click the link below to download a pdf document of the sample document. Web sample joint revocable living trust. Save time and money by creating and downloading any legally binding agreement in minutes. It's also used when revoking a living trust in preparation for. Web up to 25% cash back here is an example of a nolo living trust, made for a fictional couple. Web sample joint revocable living trust. Web separate trusts can be used to reduce or eliminate death tax. Sample joint revocable living trust. Instead of creating two separate living trusts, couples can choose to make a joint living trust. Helps avoid probate court and save money ensures your assets are distributed quickly ensures that you retain control over trust assets during. Sample joint revocable living trust. By establishing a revocable trust and a corresponding pour over will, a person can maintain all of his or. Web separate trusts can be used to reduce or eliminate death tax. It's also used when revoking a living trust in preparation for. Uslegalforms.com has been visited by 100k+ users in the past month Web up to 25% cash back here is an example of a nolo living trust, made for a fictional couple. Web both spouses manage a joint trust while they are still alive and competent. Instead of creating two separate living trusts, couples can choose to make a joint living trust. Web download our living trust form free template to create your legal document. Both spouses will have full access and control over the trust and can change the. Ad create a living trust to seamlessly transfer your property or assets to a beneficiary. Web by joint agreement, we may remove any trustee at any time, with or without cause. Web print & download forms instantly. Helps avoid probate court and save money ensures your assets are distributed quickly ensures that you retain control over trust assets during. Unification of assets & avoidance of ancillary probate: For most married couples federal death tax will not be a problem, because a married couple has a. Extreme care shall be taken to avoid numerous issues that can arise in a joint trust such as determining which spouse contributed which property, how separate.FREE 8+ Sample Living Trust Forms in PDF MS Word

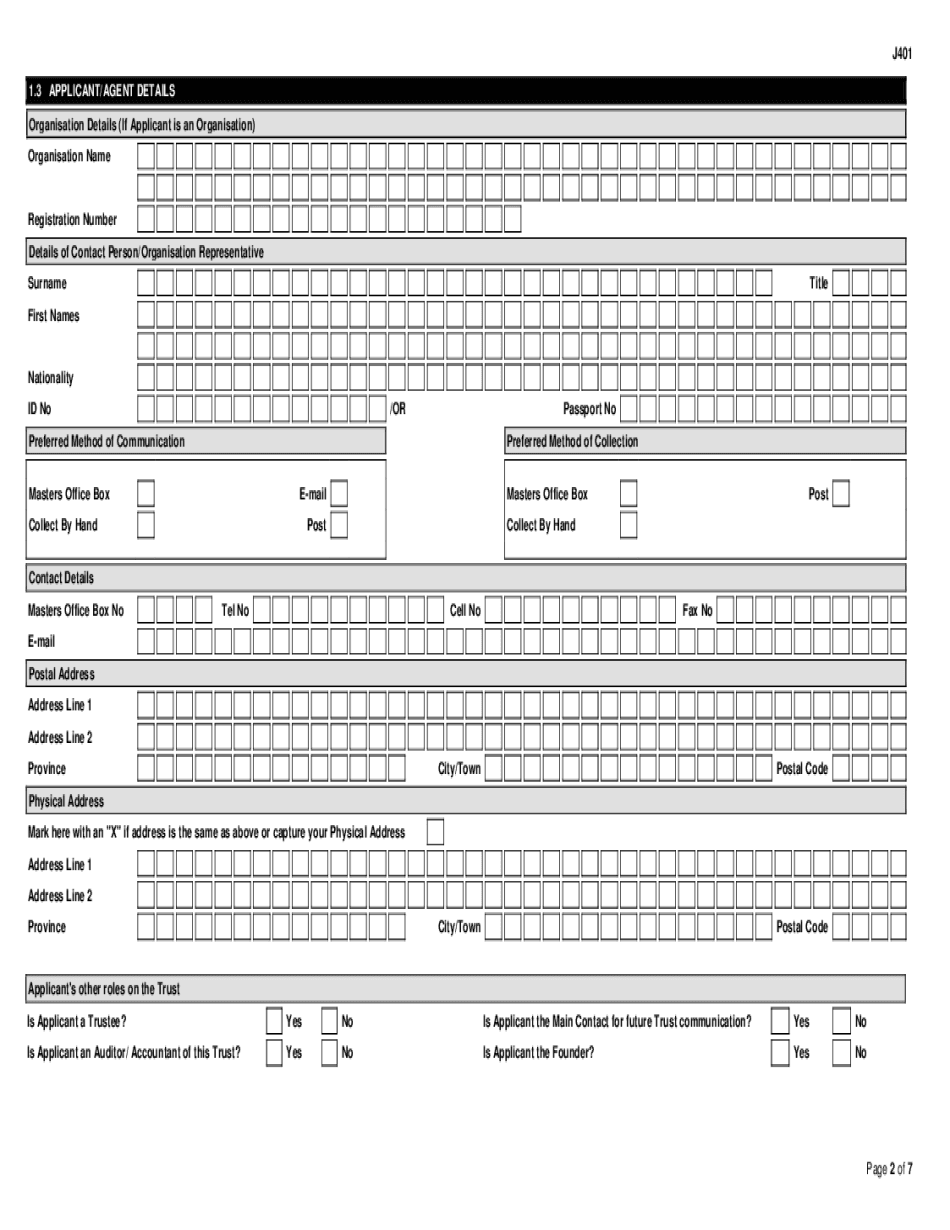

Trust Amendment Form Printable and Fillable, Blank PDF Sample

Virginia Revocable Living Trust for Husband and Wife for 3 joint

Joint Revocable Trust Template Templates MTA4MzAz Resume Examples

Revocable Trust Template Free Of Revocable Living Trust form Latest

Alabama Joint Living Trust Form Free Printable Legal Forms

Revocable Living Trust Form For Nevada

Revocable Living Trust Form Fillable PDF Free Printable Legal Forms

Revocable Trust Form Florida

FREE 8+ Sample Living Trust Forms in PDF MS Word

Sign & Make It Legal.

Click The Link Below To Download A Pdf Document Of The Sample Document.

Click The Link Below To Download A Pdf Document Of The Sample Document.

Sample Joint Revocable Living Trust.

Related Post: