Irs Mileage Template

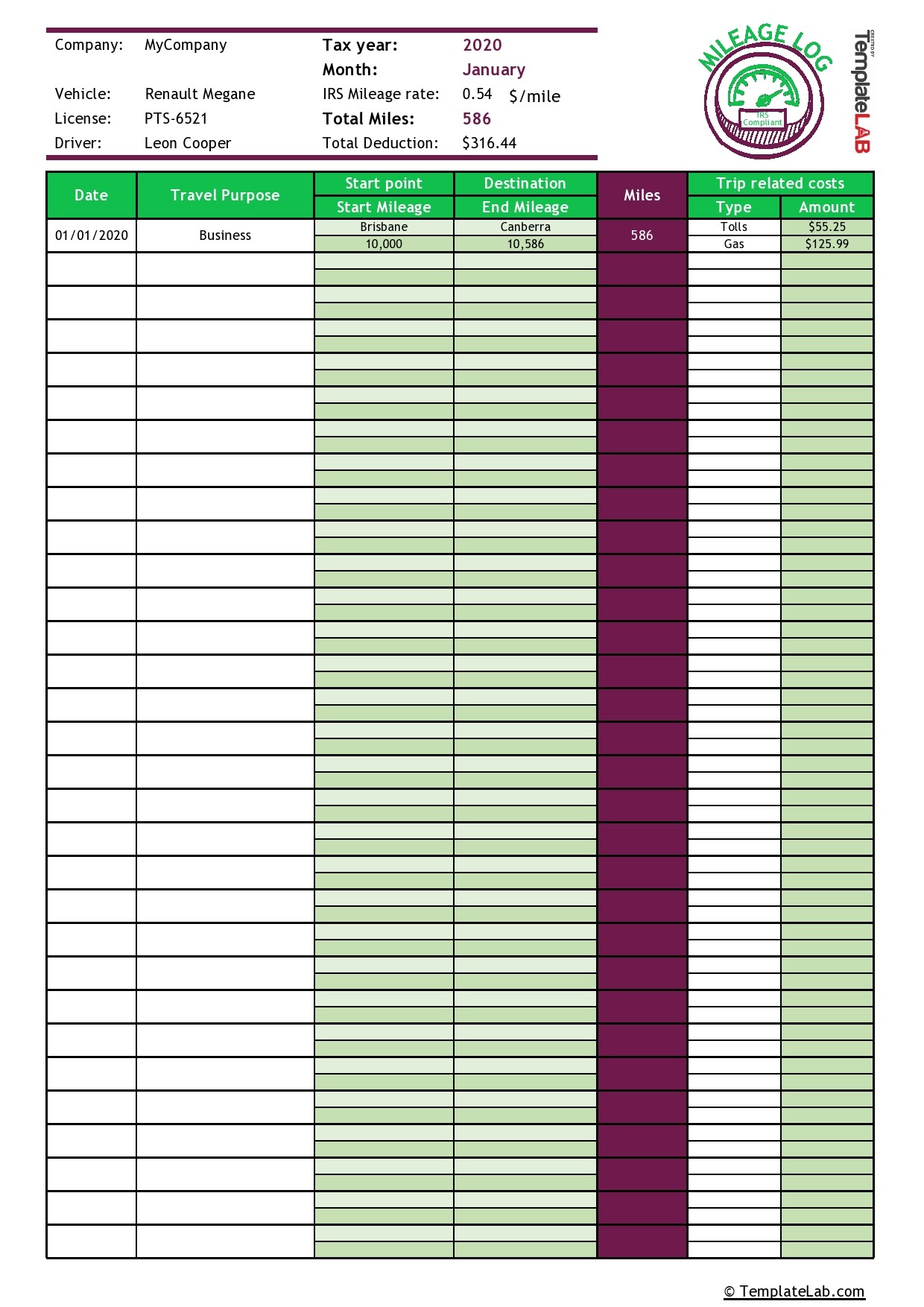

Irs Mileage Template - Web formula ( total miles) * (standard irs mileage rate) for example, if you drove 50 miles for your business in 2023, your mileage reimbursement calculation would. Try it for free now! See an overview of previous mileage rates. Web how long should you keep your tax records? Web download the free 2023 mileage log template as a pdf, sheets or excel version also keep track of your trassen. Web 17 rows the following table summarizes the optional standard mileage rates for. For example, a vehicle with $6,000 of expenses and 50 percent of total. Use one of gofar mileage tracking templates to make your life easier when it comes to logging your daily, weekly, monthly or yearly business miles. Web download irs compliant mileage log template 2022 (excel, openoffice calc & google sheets) we have created an irs compliant mileage log template with predefined. Go paperless, fill & sign documents electronically. Web washington — the internal revenue service today issued the 2021 optional standard mileage rates used to calculate the deductible costs of operating an. Remember to use the 2022 irs mileage rate if you log trips for last year. Web your mileage log and mileage logs can lead to significant savings through the mileage deduction or as a business expense.. Remember to use the 2022 irs mileage rate if you log trips for last year. Web how long should you keep your tax records? In 2022, the mileage rate was 58.5 cents per mile. Web download the free 2023 mileage log template as a pdf, sheets or excel version also keep track of your trassen. They are absolutely free of. Web how long should you keep your tax records? As a rule of thumb, it is usually worth it to keep tax records that date back a long time, though at a minimum you should keep a. Web washington — the internal revenue service today issued the 2021 optional standard mileage rates used to calculate the deductible costs of operating. They are absolutely free of cost! Upload, modify or create forms. Try it for free now! Web the percentage of mileage on the vehicle for business is then deducted from the costs on your taxes. Remember to use the 2022 irs mileage rate if you log trips for last year. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. Web 17 rows the following table summarizes the optional standard mileage rates for. For example, a vehicle with $6,000 of expenses and 50 percent of total. Web washington — the internal revenue service today. Web designed to help you accurately record your business or personal travel, these templates provide a convenient way to keep track of mileage for reimbursement or tax purposes. Try it for free now! Ad register and subscribe now to work on your icw med mileage expense & more fillable forms. See an overview of previous mileage rates. They are absolutely. As a rule of thumb, it is usually worth it to keep tax records that date back a long time, though at a minimum you should keep a. Upload, modify or create forms. Go paperless, fill & sign documents electronically. Web how long should you keep your tax records? Web designed to help you accurately record your business or personal. Web your mileage log and mileage logs can lead to significant savings through the mileage deduction or as a business expense. Remember to use the 2022 irs mileage rate if you log trips for last year. Go paperless, fill & sign documents electronically. Ad download or email mileage log & more fillable forms, register and subscribe now! Ad register and. Web designed to help you accurately record your business or personal travel, these templates provide a convenient way to keep track of mileage for reimbursement or tax purposes. See an overview of previous mileage rates. For example, a vehicle with $6,000 of expenses and 50 percent of total. Web your mileage log and mileage logs can lead to significant savings. Upload, modify or create forms. For example, a vehicle with $6,000 of expenses and 50 percent of total. Web your mileage log and mileage logs can lead to significant savings through the mileage deduction or as a business expense. Free irish printable driven log form to upload. Use one of gofar mileage tracking templates to make your life easier when. Free irish printable driven log form to upload. Web your mileage log and mileage logs can lead to significant savings through the mileage deduction or as a business expense. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. Web designed to help you accurately record your business or personal travel, these templates provide a convenient way to keep track of mileage for reimbursement or tax purposes. Use one of gofar mileage tracking templates to make your life easier when it comes to logging your daily, weekly, monthly or yearly business miles. Ad register and subscribe now to work on your icw med mileage expense & more fillable forms. For example, a vehicle with $6,000 of expenses and 50 percent of total. Web download irs compliant mileage log template 2022 (excel, openoffice calc & google sheets) we have created an irs compliant mileage log template with predefined. Web download the free 2023 mileage log template as a pdf, sheets or excel version also keep track of your trassen. Avail of the best irs mileage log templates. In 2022, the mileage rate was 58.5 cents per mile. Go paperless, fill & sign documents electronically. They are absolutely free of cost! Try it for free now! Web effective july 1 through dec. 31, 2022, the standard mileage rate for business travel will be 62.5 cents per mile, up 4 cents from the 58.5 cents per mile rate. Upload, modify or create forms. Web washington — the internal revenue service today issued the 2021 optional standard mileage rates used to calculate the deductible costs of operating an. Web how long should you keep your tax records? As a rule of thumb, it is usually worth it to keep tax records that date back a long time, though at a minimum you should keep a. They are absolutely free of cost! Web download the free 2023 mileage log template as a pdf, sheets or excel version also keep track of your trassen. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. Web your mileage log and mileage logs can lead to significant savings through the mileage deduction or as a business expense. Web effective july 1 through dec. Ad register and subscribe now to work on your icw med mileage expense & more fillable forms. See an overview of previous mileage rates. Web how long should you keep your tax records? Go paperless, fill & sign documents electronically. Use one of gofar mileage tracking templates to make your life easier when it comes to logging your daily, weekly, monthly or yearly business miles. Web download irs compliant mileage log template 2022 (excel, openoffice calc & google sheets) we have created an irs compliant mileage log template with predefined. 31, 2022, the standard mileage rate for business travel will be 62.5 cents per mile, up 4 cents from the 58.5 cents per mile rate. Web formula ( total miles) * (standard irs mileage rate) for example, if you drove 50 miles for your business in 2023, your mileage reimbursement calculation would. Avail of the best irs mileage log templates. Remember to use the 2022 irs mileage rate if you log trips for last year. Ad download or email mileage log & more fillable forms, register and subscribe now!Irs Mileage Log Template Excel For Your Needs

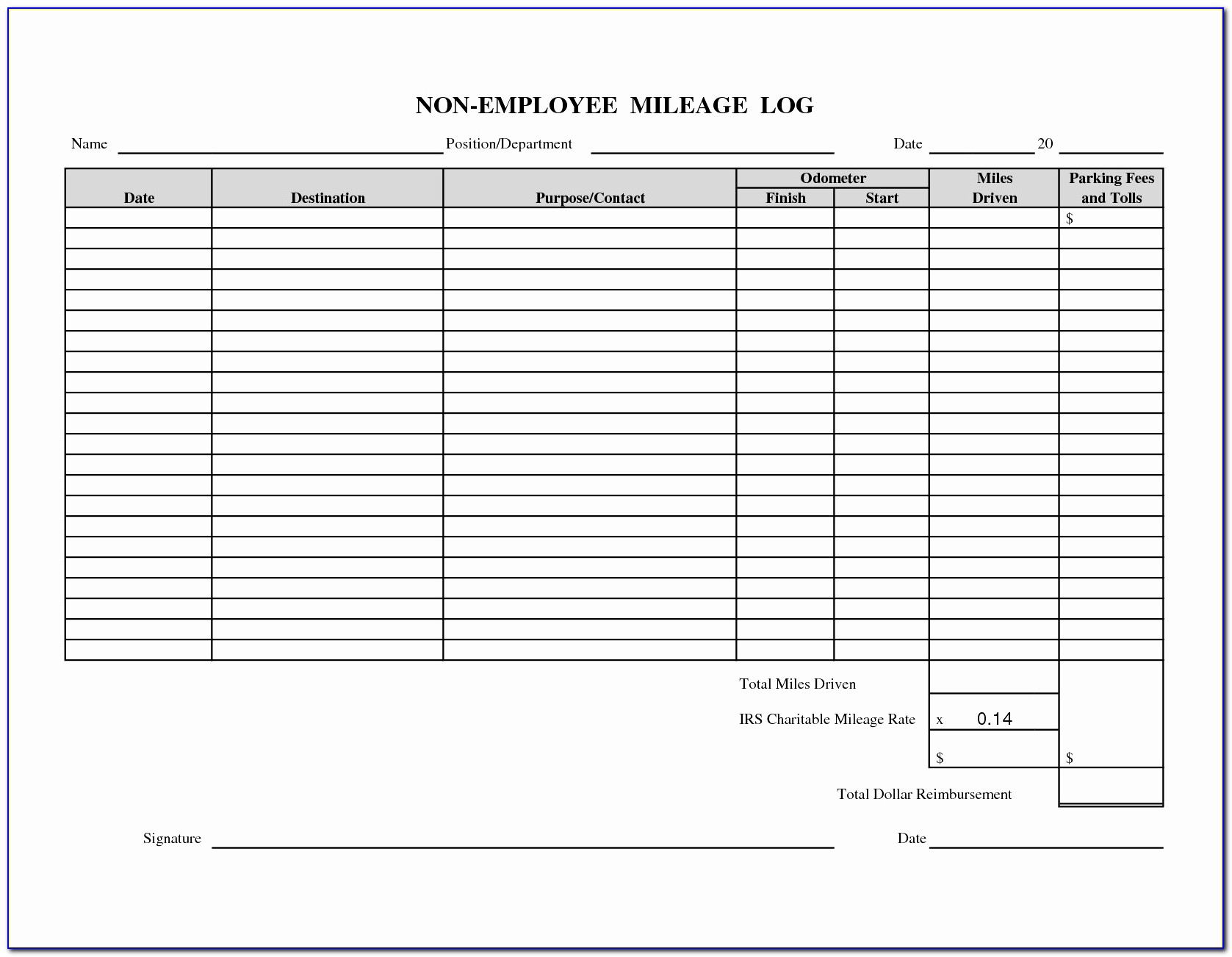

Irs Mileage Log Book Template Awesome Receipt Form Template Business

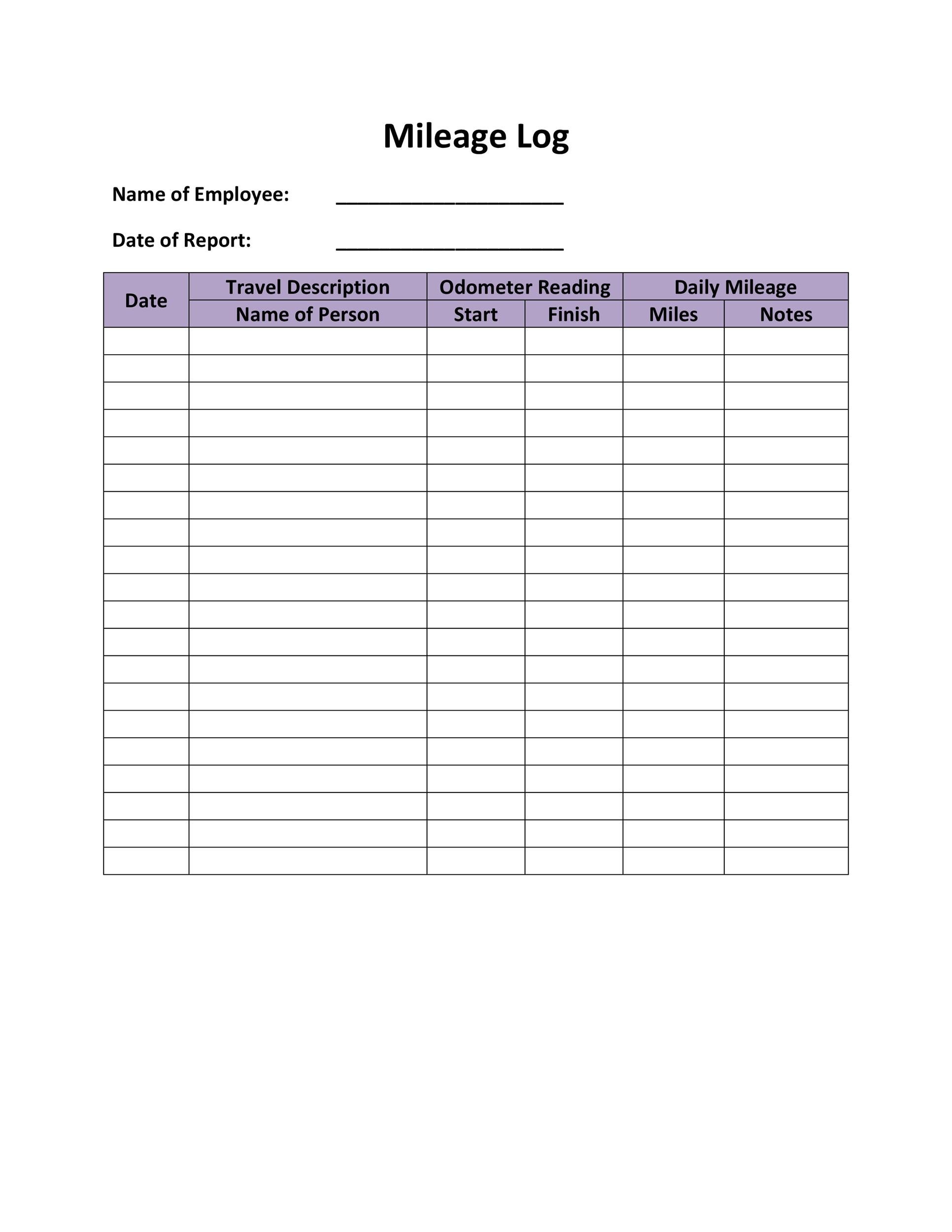

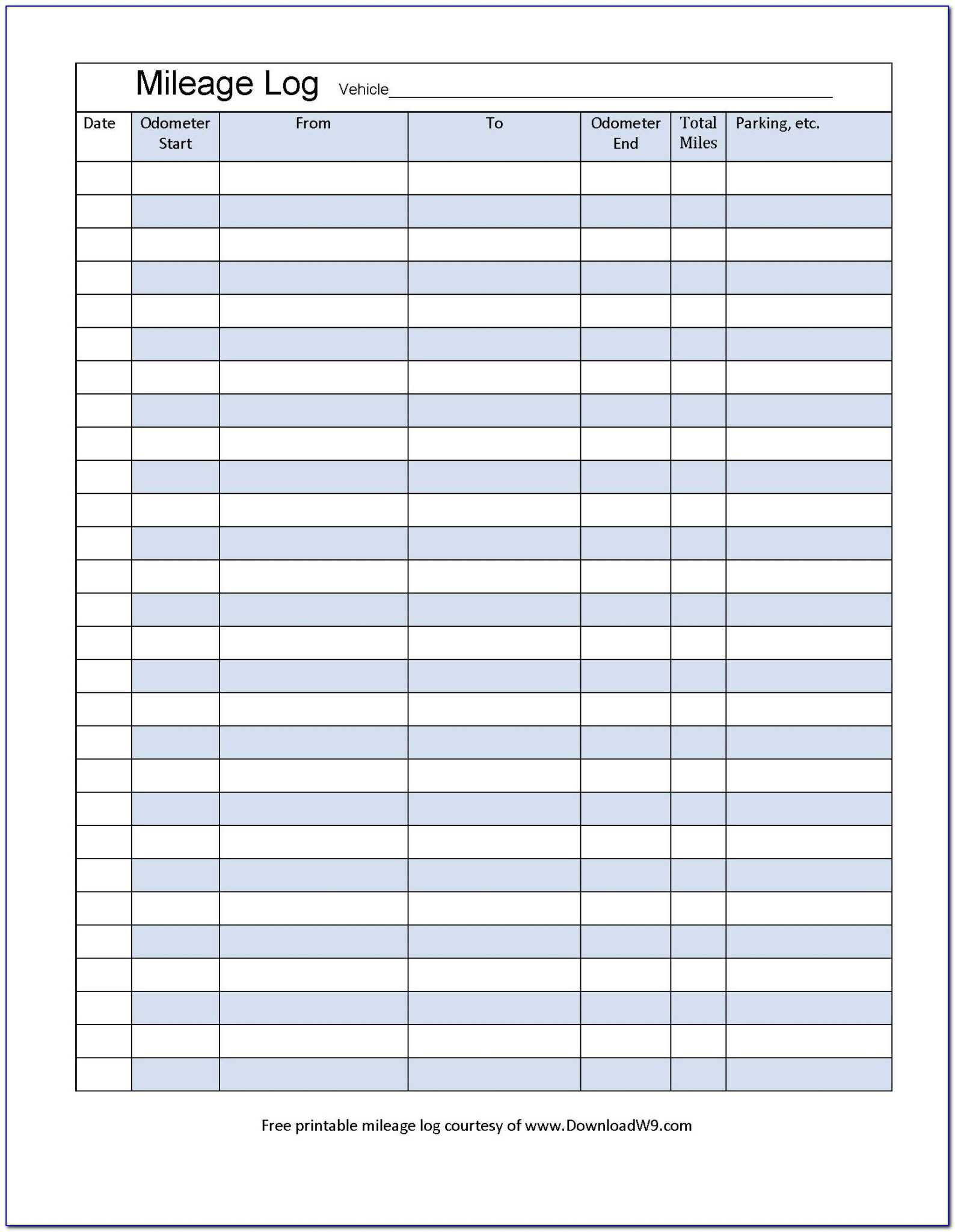

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

25 Printable Irs Mileage Tracking Templates Gofar In Mileage Report

Irs Mileage Log Form Form Resume Examples e4K4V6Y5Qn With Mileage

30 Printable Mileage Log Templates (Free) Template Lab

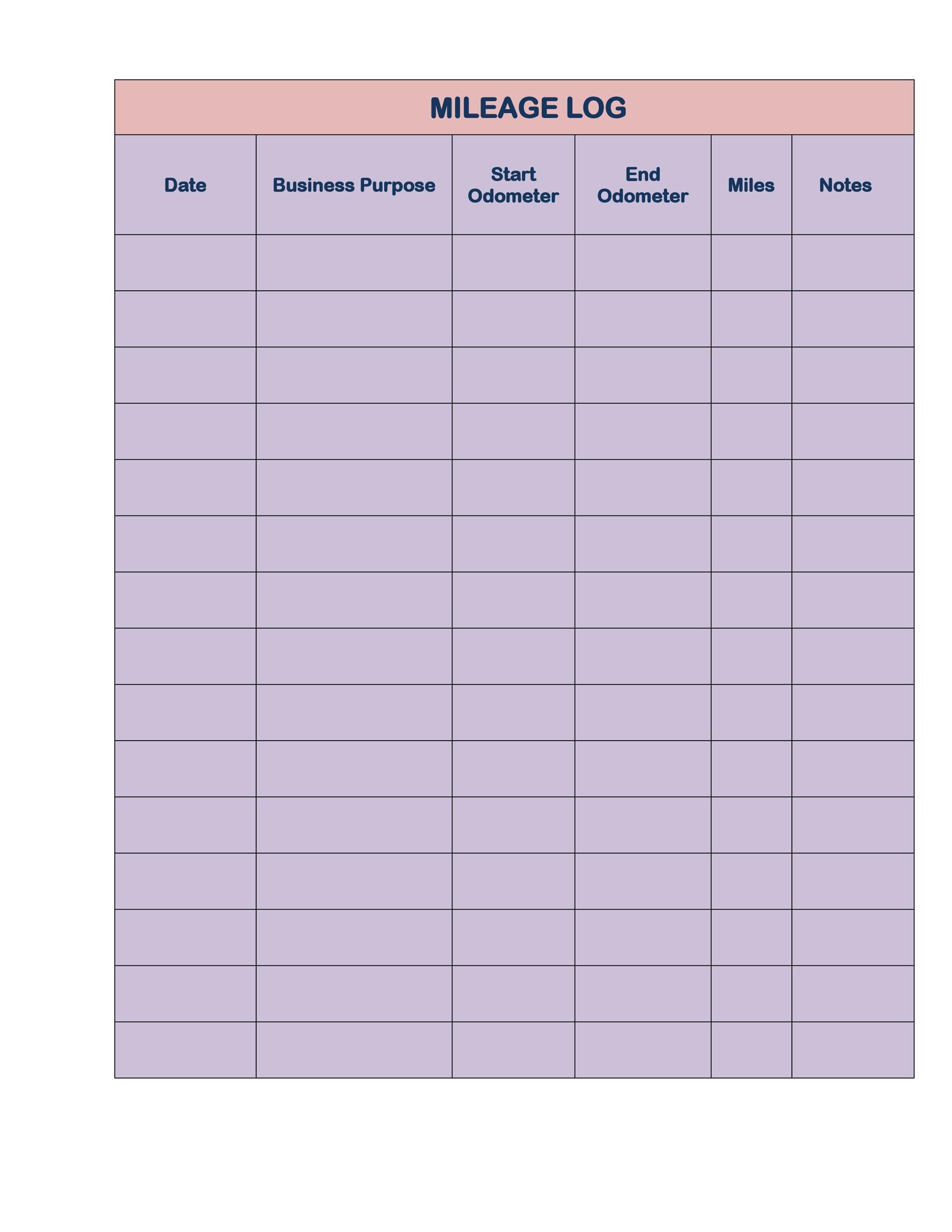

Irs Mileage Log Template shatterlion.info

25 Printable IRS Mileage Tracking Templates GOFAR

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Web 17 Rows The Following Table Summarizes The Optional Standard Mileage Rates For.

As A Rule Of Thumb, It Is Usually Worth It To Keep Tax Records That Date Back A Long Time, Though At A Minimum You Should Keep A.

Upload, Modify Or Create Forms.

In 2022, The Mileage Rate Was 58.5 Cents Per Mile.

Related Post: