Irs Gov 1099 Printable Form

Irs Gov 1099 Printable Form - Web loans treated as distributions. Download tax form in your account Copy a of this form is provided for informational purposes only. You exclude income from sources outside the united states or foreign housing, income earned by. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. The official printed version of copy a of. Box 5 shows the amount of net benefits. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a. Web loans treated as distributions. Read customer reviews & find best sellers. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). Ad browse & discover thousands of brands. Copy a of this form is provided for informational purposes only. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a. For your protection, this form may show only the last four digits of your. Box 5 shows the amount of net benefits. Savings bonds and treasury securities forms. Web loans treated as distributions. For internal revenue service center. For internal revenue service center. Ad browse & discover thousands of brands. Web loans treated as distributions. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). Web get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Once you've received your copy of. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). Once you've received your copy of. The official printed version of copy a of. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a. Ad browse & discover thousands of brands. Treasury international capital (tic) forms and instructions. Read customer reviews & find best sellers. Once you've received your copy of. Copy a appears in red, similar to the official irs form. Ad browse & discover thousands of brands. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Once you've received your copy of. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a. The official printed version of. Web 100 copies for each form (one copy of the corresponding instructions is automatically included) 5 copies for each instruction or publication some forms are printed 2 or 3 to a. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web get federal tax return forms and file by mail. Web www.irs.gov/form1099misc. Copy a of this form is provided for informational purposes only. For internal revenue service center. Treasury international capital (tic) forms and instructions. Web get federal tax return forms and file by mail. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). Download tax form in your account Ad browse & discover thousands of brands. Web loans treated as distributions. Once you've received your copy of. Do not miss the deadline. The official printed version of copy a of. For internal revenue service center. You exclude income from sources outside the united states or foreign housing, income earned by. Copy a appears in red, similar to the official irs form. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). Ad browse & discover thousands of brands. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web 100 copies for each form (one copy of the corresponding instructions is automatically included) 5 copies for each instruction or publication some forms are printed 2 or 3 to a. Web get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Treasury international capital (tic) forms and instructions. Download tax form in your account For your protection, this form may show only the last four digits of your. You exclude income from sources outside the united states or foreign housing, income earned by. Copy a of this form is provided for informational purposes only. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a. Web loans treated as distributions. Savings bonds and treasury securities forms. For internal revenue service center. Web get federal tax return forms and file by mail. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). The official printed version of copy a of. Find deals on 1099 tax forms on amazon Do not miss the deadline. Box 5 shows the amount of net benefits. You exclude income from sources outside the united states or foreign housing, income earned by. Web get federal tax return forms and file by mail. Read customer reviews & find best sellers. For your protection, this form may show only the last four digits of your. There are 20 total varieties of 1009 forms. Web loans treated as distributions. Some of the most popular are 1099. For your protection, this form may show only the last four digits of your. Treasury international capital (tic) forms and instructions. Once you've received your copy of. For internal revenue service center. The official printed version of copy a of. Proceeds from real estate transactions. Box 5 shows the amount of net benefits. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a.Irs Forms 1099 Are Critical, And Due Early In 2017 Free Printable

Free Printable 1099 Misc Forms Free Printable

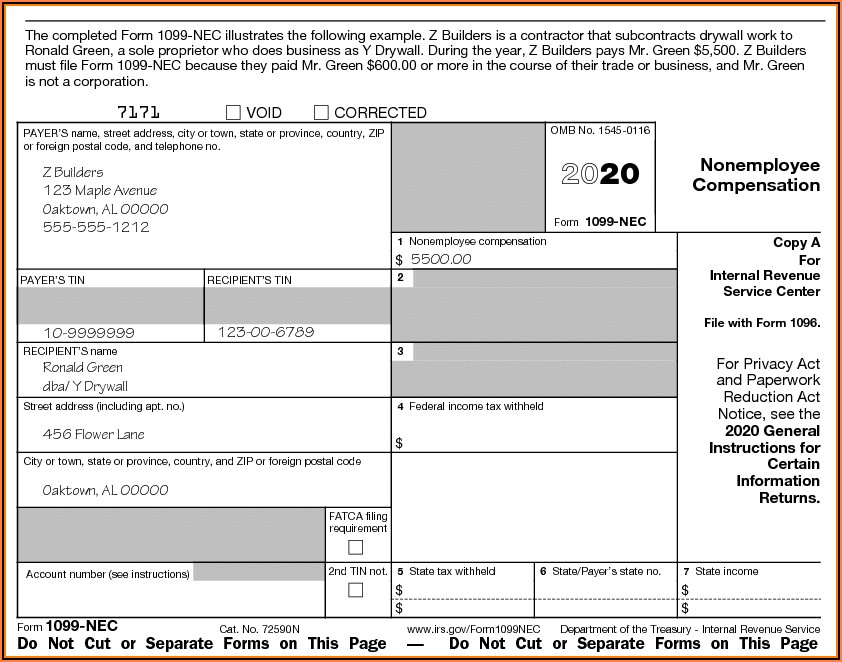

1099 Form 2020 📝 Get IRS Form 1099 Printable Blank PDF Online Tax Form

1099 Int Fill out in PDF Online

What is IRS Form 1099Q? TurboTax Tax Tips & Videos

1099 Form Ohio Printable Printable World Holiday

Form 1099R Definition

Irs 12 Form 12 Printable Free Papers And Forms Blank 1099 Misc

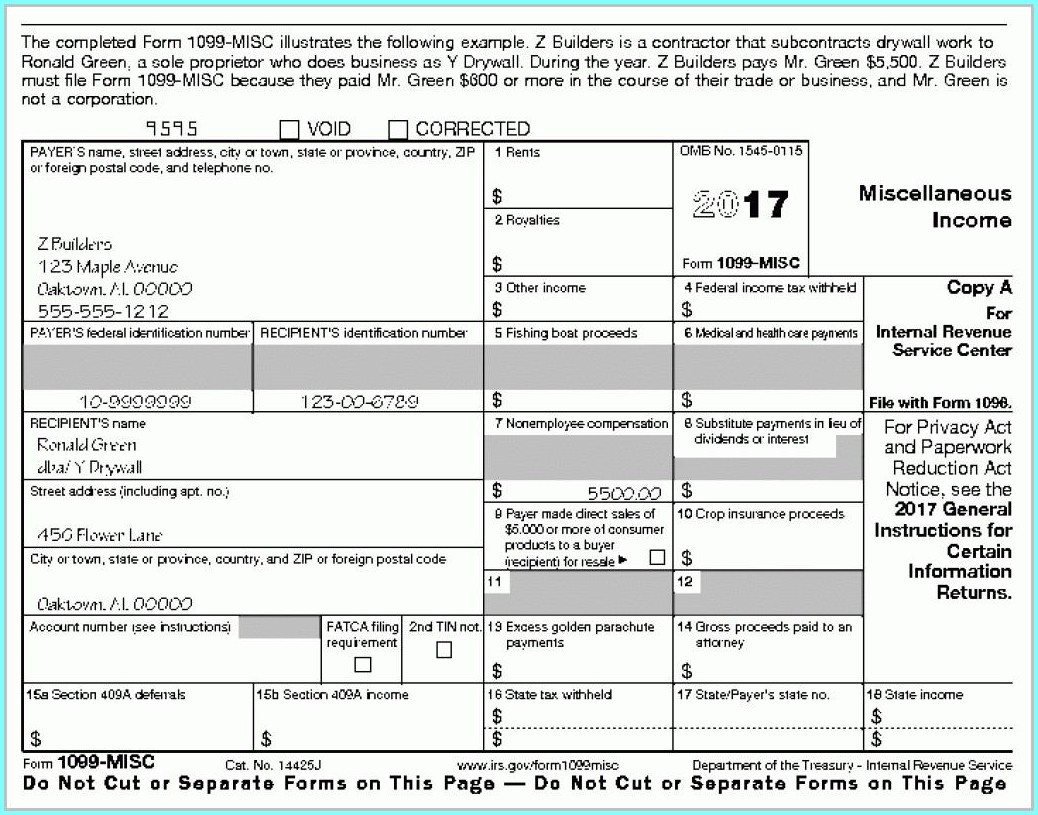

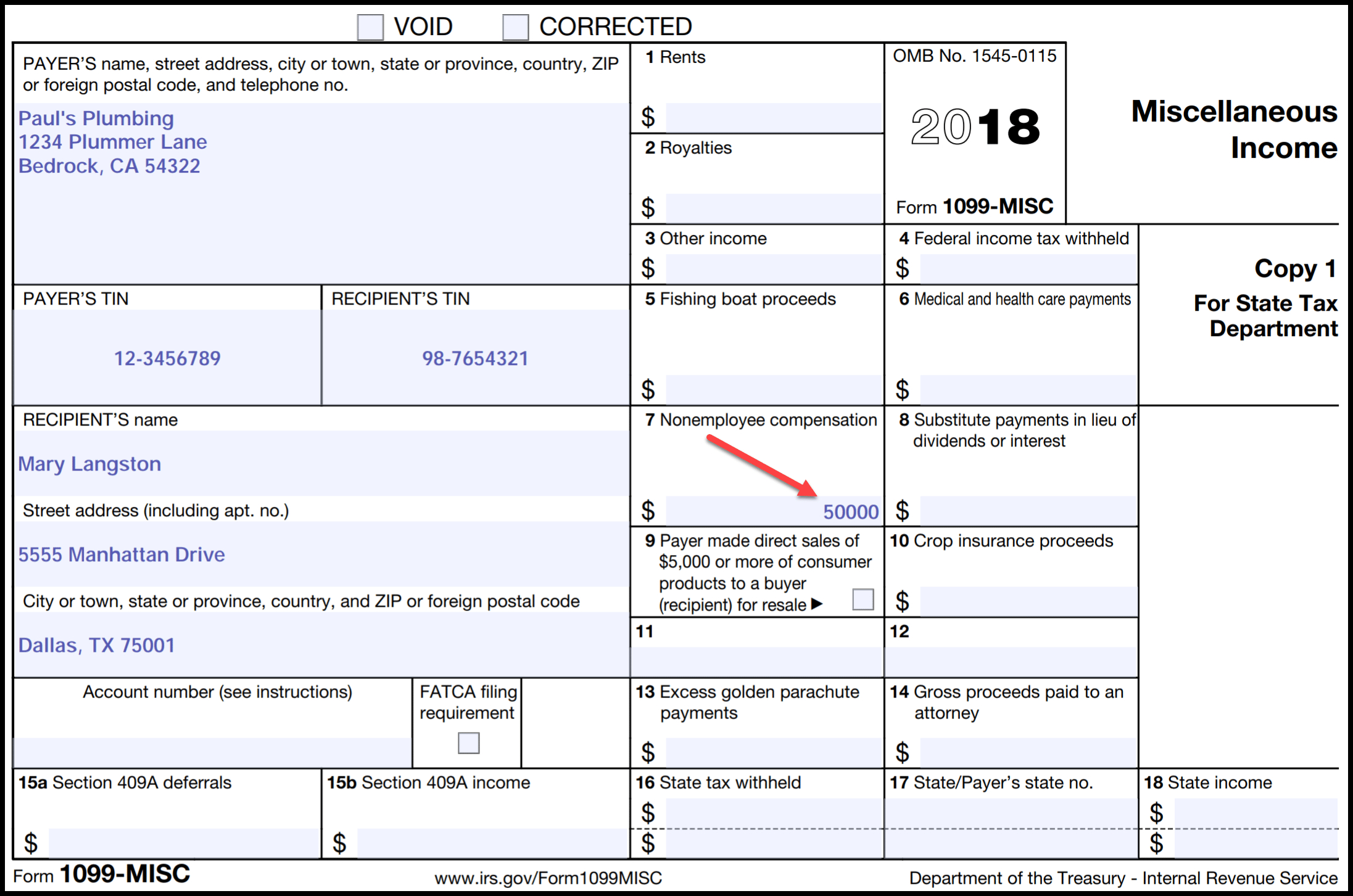

Form 1099MISC Miscellaneous Definition

Irs.gov 1099 Forms 2019 Form Resume Examples A19X0BA94k

Web Www.irs.gov/Form1099Misc Instructions For Recipient Recipient’s Taxpayer Identification Number (Tin).

If You Borrow Money From A Qualified Plan, Section 403(B) Plan, Or Governmental Section 457(B) Plan, You May Have To Treat The Loan As A.

Savings Bonds And Treasury Securities Forms.

Once You've Received Your Copy Of.

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)