Irs Form 147C Printable

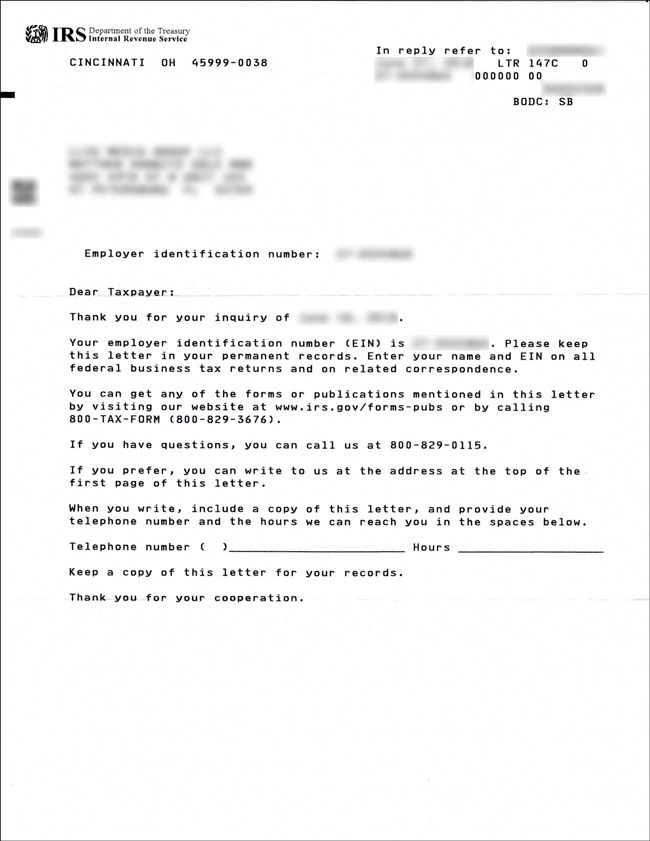

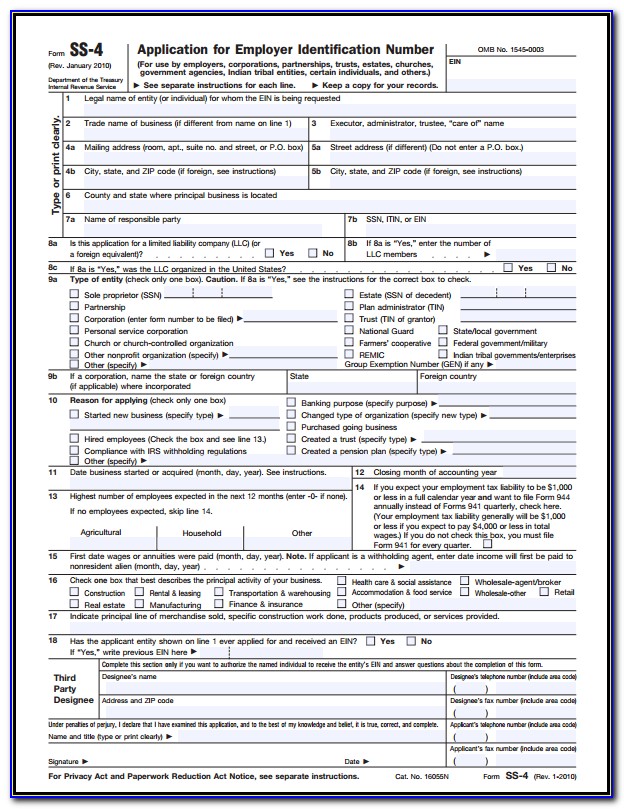

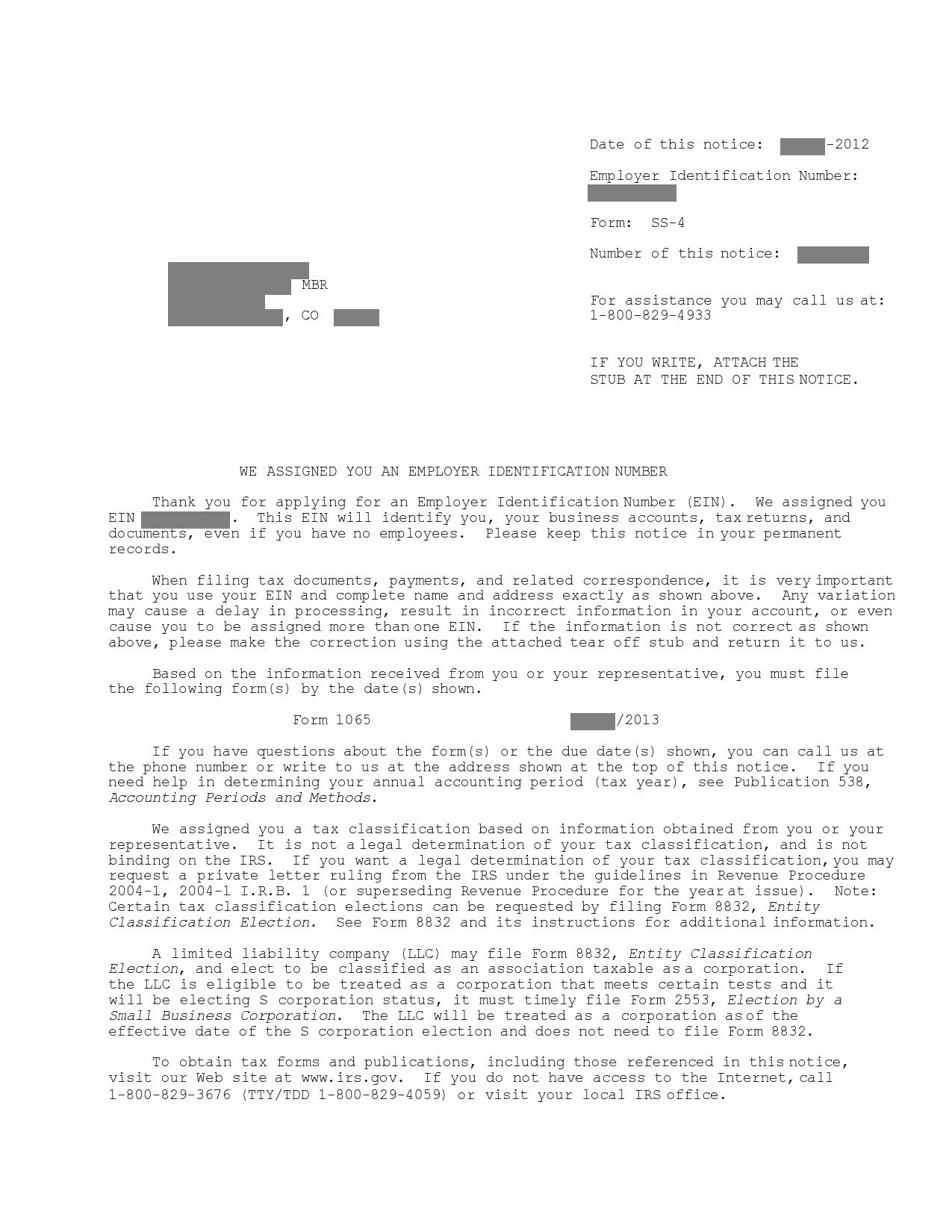

Irs Form 147C Printable - Instead, this is a form that will be sent to you if you have to ask the irs to tell you what your employer identification number (ein) is, in. Web there is a solution if you don’t have possession of the ein confirmation letter. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Your previously filed return should be notated with your ein. You will need to have the name and address of the church or entity that you have been using on your w‐2 forms, 1099 forms, or form 941. You can use three available alternatives;. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document. To get a letter verifying your employer identification number in 2023, you'll need to submit a written request to the irs and include proof of your identity as well as a copy of your ein. Ask the irs to search for your ein by calling the business & specialty tax line at. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web a wpd is required for all entities that have employees and are required to file an employment/unemployment tax return (form 940, form 941, form 943, form 944, or form 945). Your previously filed return should be. The form can be downloaded from the irs at: Web complete irs form 147c pdf online with us legal forms. Web did the irs make a typo on your ein letter and you need a new form? Ask the irs to search for your ein by calling the business & specialty tax line at. Select the sign button and make. Ask the irs to search for your ein by calling the business & specialty tax line at. After the submission of form 1099 information returns, the irs will send you a cp2100 or a cp2100a notice and a listing of. Use the information in the table below to validate the wpd provided by the. Web find a previously filed tax. Add the date to the document using the date option. You can use three available alternatives;. This document is often required for businesses to verify their ein for. The irs will mail your 147c letter to the mailing address they have on file for your llc. Easily fill out pdf blank, edit, and sign them. Here’s how you request an ein verification letter (147c) the easiest way to get a copy of an ein verification letter is to call the irs. Web complete irs form 147c pdf online with us legal forms. 2) make sure that the words ^147c. Web 1) you and your poa will need to complete the irs form 2848 and have. Edit your 147c form online type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Follow the below process to obtain a. Web as of 2021, the irs no longer provides form 147c to individuals. Web did the irs make a typo on your ein letter and you need a new form? Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document. Edit your form 147c online type text, add images, blackout confidential details, add comments, highlights and. Freetaxusa.com has been visited by 10k+. Web a wpd is required for all entities that have employees and are required to file an employment/unemployment tax return (form 940, form 941, form 943, form 944, or form 945). Your previously filed return should be notated with your ein. Edit your 147c form online type text, add images, blackout confidential details, add comments, highlights and more. Select the. To get a letter verifying your employer identification number in 2023, you'll need to submit a written request to the irs and include proof of your identity as well as a copy of your ein. Select the sign button and make an electronic signature. Web 1) you and your poa will need to complete the irs form 2848 and have. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document. Instead, this is a form that will be sent to you if you have to ask the irs to tell you what your employer identification number (ein) is, in. To get a letter verifying your employer identification number in. The irs will mail your 147c letter to the mailing address they have on file for your llc. Entity department ogden, ut 84201. Web fill in every fillable field. Follow the below process to obtain a. Freetaxusa.com has been visited by 10k+ users in the past month Web as of 2021, the irs no longer provides form 147c to individuals who request it online. You can use three available alternatives;. Edit your form 147c online type text, add images, blackout confidential details, add comments, highlights and. Web form 147c is not an internal revenue service (irs) form you have to file, nor is it one that you will find in your mailbox unexpectedly. The form can be downloaded from the irs at: Web home understanding your cp147 notice what this notice is about after previously notifying you that we couldn't apply the full amount you requested to the following year's taxes, we are now able to apply an additional part of that amount to your. Web 1) you and your poa will need to complete the irs form 2848 and have it ready to send to the irs via fax during the phone call with the irs. Web an ein verification letter ( commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms its validity. Ask the irs to search for your ein by calling the business & specialty tax line at. You will need to have the name and address of the church or entity that you have been using on your w‐2 forms, 1099 forms, or form 941. Web did the irs make a typo on your ein letter and you need a new form? Easily fill out pdf blank, edit, and sign them. This document is often required for businesses to verify their ein for. Call the irs at (800) 829‐4933 press “1” for service in english Ad create legal forms instantly. Web 1) you and your poa will need to complete the irs form 2848 and have it ready to send to the irs via fax during the phone call with the irs. The form can be downloaded from the irs at: After the submission of form 1099 information returns, the irs will send you a cp2100 or a cp2100a notice and a listing of. Save or instantly send your ready documents. Web an ein verification letter ( commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms its validity. Entity department ogden, ut 84201. You will need to request a “147c verification. Add the date to the document using the date option. Select the sign button and make an electronic signature. The business can contact the irs directly and request a replacement confirmation letter called a 147c letter. Web home understanding your cp147 notice what this notice is about after previously notifying you that we couldn't apply the full amount you requested to the following year's taxes, we are now able to apply an additional part of that amount to your. You’ll be able to confirm this address when you’re. You can also download it, export it or print it out. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Your previously filed return should be notated with your ein. Call the irs at (800) 829‐4933 press “1” for service in englishEin Verification Letter 147c certify letter

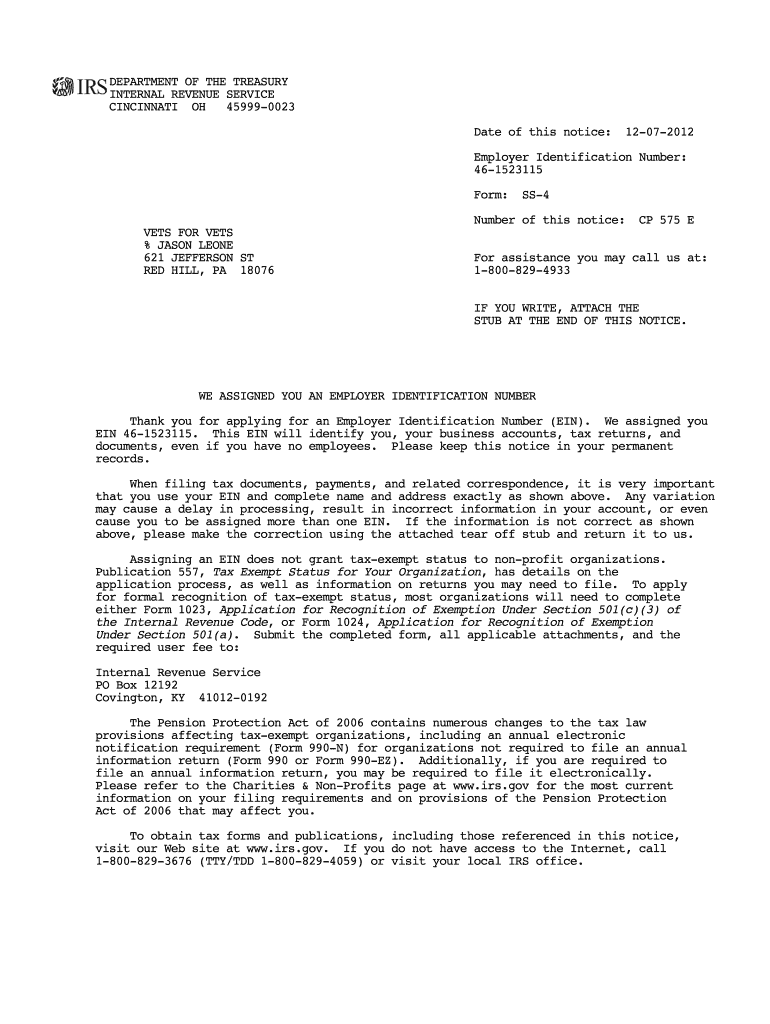

Printable Cp 575 Form Printable World Holiday

IRS FORM 147C PDF

Irs Form 147c Printable Printable World Holiday

20 EIN Verification Letters (147c Letters) ᐅ TemplateLab

Irs Form 147c Printable Printable Form, Templates and Letter

What Is Form CP575? Gusto

Irs Letter 147c Sample

Irs Form 147c Printable Printable Form, Templates and Letter

Ein Verification Letter 147c certify letter

Instead, This Is A Form That Will Be Sent To You If You Have To Ask The Irs To Tell You What Your Employer Identification Number (Ein) Is, In.

This Document Is Often Required For Businesses To Verify Their Ein For.

Ask The Irs To Search For Your Ein By Calling The Business & Specialty Tax Line At.

Web A Wpd Is Required For All Entities That Have Employees And Are Required To File An Employment/Unemployment Tax Return (Form 940, Form 941, Form 943, Form 944, Or Form 945).

Related Post: