Irs Accountable Plan Template

Irs Accountable Plan Template - All expenses must be substantiated within a reasonable period of time.1 see our. This document can be used as a guide to draft an accountable plan for expense reimbursements. Web sample accountable plan for business expense reimbursement purpose: Web 1 adequately account for means providing the council with a statement of expense, an account book, a diary, or a similar record in which you entered each expense at or near. An accountable plan is an expense reimbursement or allowance arrangement that requires employees to substantiate. Get free, competing quotes from the best. These terms are defined below. Web an accountable plan or nonaccountable plan. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. Web accountable plan policy template (word) accountable plan monthly reimbursement spreadsheet (excel) mileage log spreadsheet (excel) bonus: Web accountable plan policy template (word) accountable plan monthly reimbursement spreadsheet (excel) mileage log spreadsheet (excel) bonus: Ad resolve your past due tax issues permanently. Web 1 adequately account for means providing the council with a statement of expense, an account book, a diary, or a similar record in which you entered each expense at or near. Get free, competing. Web if you make the payment under an accountable plan, deduct it in the category of the expense paid. This document can be used as a guide to draft an accountable plan for expense reimbursements. Web 1 adequately account for means providing the council with a statement of expense, an account book, a diary, or a similar record in which. Web how to report.28 where to report.28 vehicle provided by your employer.28 reimbursements.29 accountable plans.29. These terms are defined below. Web what are the components of an accountable expense reimbursement plan? Web subscription services 1050 northgate dr., ste. Web following the rules for accountable plans. Calculate over 1,500 tax planning strategies automatically and save tens of thousands Web how to report.28 where to report.28 vehicle provided by your employer.28 reimbursements.29 accountable plans.29. These terms are defined below. An accountable plan is an expense reimbursement or allowance arrangement that requires employees to substantiate. This document can be used as a guide to draft an accountable plan. Web accountable plan policy template (word) accountable plan monthly reimbursement spreadsheet (excel) mileage log spreadsheet (excel) bonus: Ad resolve your past due tax issues permanently. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. Calculate over 1,500 tax planning strategies automatically and save tens of thousands Web an accountable plan or nonaccountable plan. Web an accountable plan or nonaccountable plan. Web subscription services 1050 northgate dr., ste. Web what are the components of an accountable expense reimbursement plan? Get free, competing quotes from the best. Web accountable plan policy template (word) accountable plan monthly reimbursement spreadsheet (excel) mileage log spreadsheet (excel) bonus: All expenses must be substantiated within a reasonable period of time.1 see our. This document can be used as a guide to draft an accountable plan for expense reimbursements. Web sample accountable plan for business expense reimbursement purpose: Web accountable plan policy template (word) accountable plan monthly reimbursement spreadsheet (excel) mileage log spreadsheet (excel) bonus: Don't let the irs intimidate. 351 san rafael, ca 94903 telephone: Web following the rules for accountable plans. These terms are defined below. Web 1 adequately account for means providing the council with a statement of expense, an account book, a diary, or a similar record in which you entered each expense at or near. Ad resolve your past due tax issues permanently. Web what are the components of an accountable expense reimbursement plan? Web 1 adequately account for means providing the council with a statement of expense, an account book, a diary, or a similar record in which you entered each expense at or near. Web an accountable plan or nonaccountable plan. Don't let the irs intimidate you. An accountable plan is. Web sample accountable plan for business expense reimbursement purpose: Web an accountable plan or nonaccountable plan. Calculate over 1,500 tax planning strategies automatically and save tens of thousands Get free, competing quotes for tax relief programs. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. Don't let the irs intimidate you. Get free, competing quotes for tax relief programs. Ad resolve your past due tax issues permanently. Web following the rules for accountable plans. Web if you make the payment under an accountable plan, deduct it in the category of the expense paid. All expenses must be substantiated within a reasonable period of time.1 see our. Calculate over 1,500 tax planning strategies automatically and save tens of thousands Web an accountable plan or nonaccountable plan. These terms are defined below. Web 1 adequately account for means providing the council with a statement of expense, an account book, a diary, or a similar record in which you entered each expense at or near. Web sample accountable plan for business expense reimbursement purpose: This document can be used as a guide to draft an accountable plan for expense reimbursements. Get free, competing quotes from the best. Web subscription services 1050 northgate dr., ste. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. Web what are the components of an accountable expense reimbursement plan? An accountable plan is an expense reimbursement or allowance arrangement that requires employees to substantiate. 351 san rafael, ca 94903 telephone: To be considered an accountable plan under federal tax provisions, a reimbursement or other employee expense allowance. Web how to report.28 where to report.28 vehicle provided by your employer.28 reimbursements.29 accountable plans.29. Web how to report.28 where to report.28 vehicle provided by your employer.28 reimbursements.29 accountable plans.29. Web if you make the payment under an accountable plan, deduct it in the category of the expense paid. For example, if you pay an employee for travel expenses incurred on your. Web sample accountable plan for business expense reimbursement purpose: Don't let the irs intimidate you. Get free, competing quotes from the best. Ad resolve your past due tax issues permanently. Web accountable plan policy template (word) accountable plan monthly reimbursement spreadsheet (excel) mileage log spreadsheet (excel) bonus: This document can be used as a guide to draft an accountable plan for expense reimbursements. 351 san rafael, ca 94903 telephone: All expenses must be substantiated within a reasonable period of time.1 see our. Get free, competing quotes for tax relief programs. Web following the rules for accountable plans. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. Web what are the components of an accountable expense reimbursement plan? These terms are defined below.Top Notch Accountable Expense Reimbursement Plan Template Inventory

Mileage Reimbursement form Template Lovely 13 Free Mileage

Employee Accountability Form Template Accounting Form Accounting

13 Printable Life Skills Worksheets for Students and Adults Life

Free Printable Reimbursement Forms IRS Mileage Rate 2021

How Do I Request An Installment Agreement With The Irs Paul Johnson's

Accountable Reimbursement Plan Template [Free PDF] Google Docs, Word

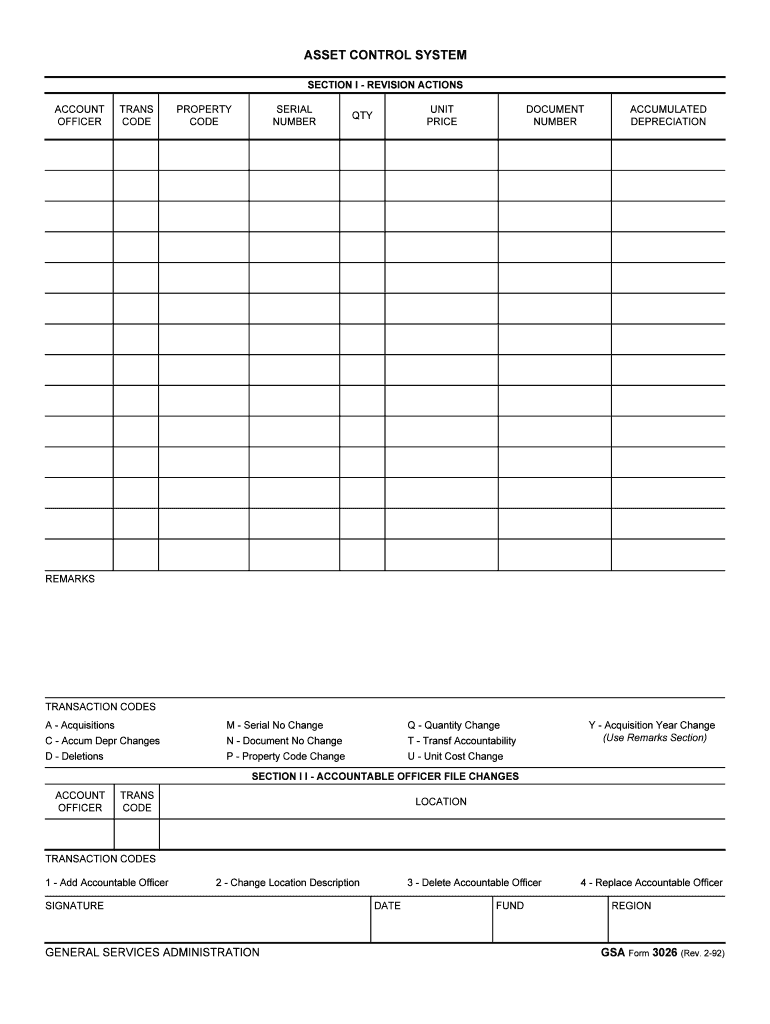

Listed Property Are You within the IRS Recordkeeping Fill Out and

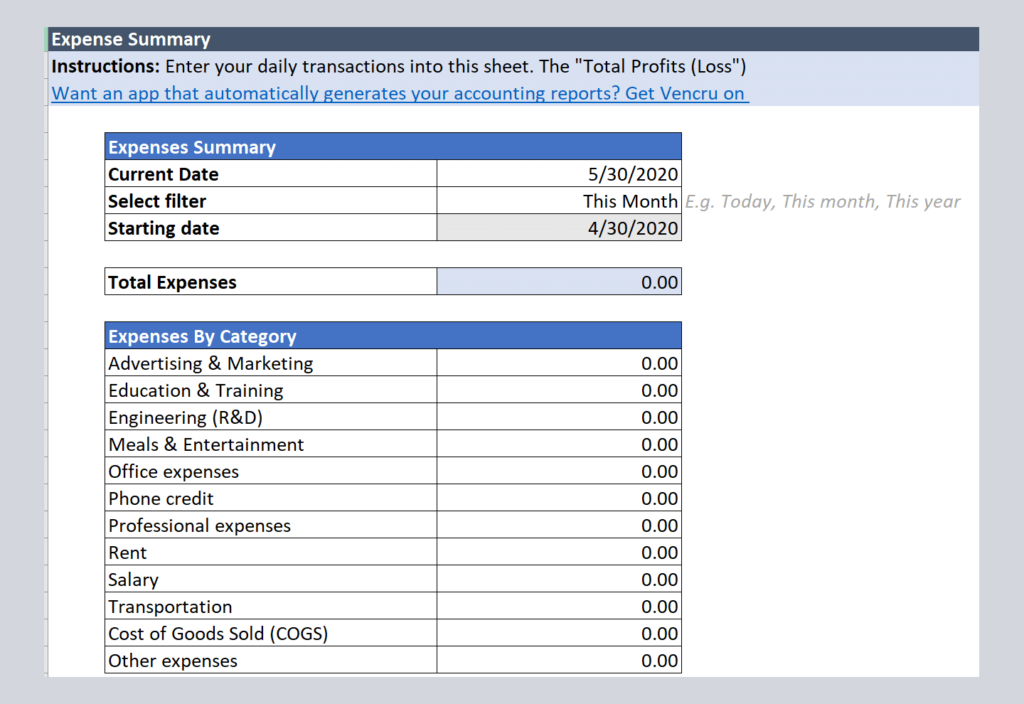

Expense Report Templates Vencru

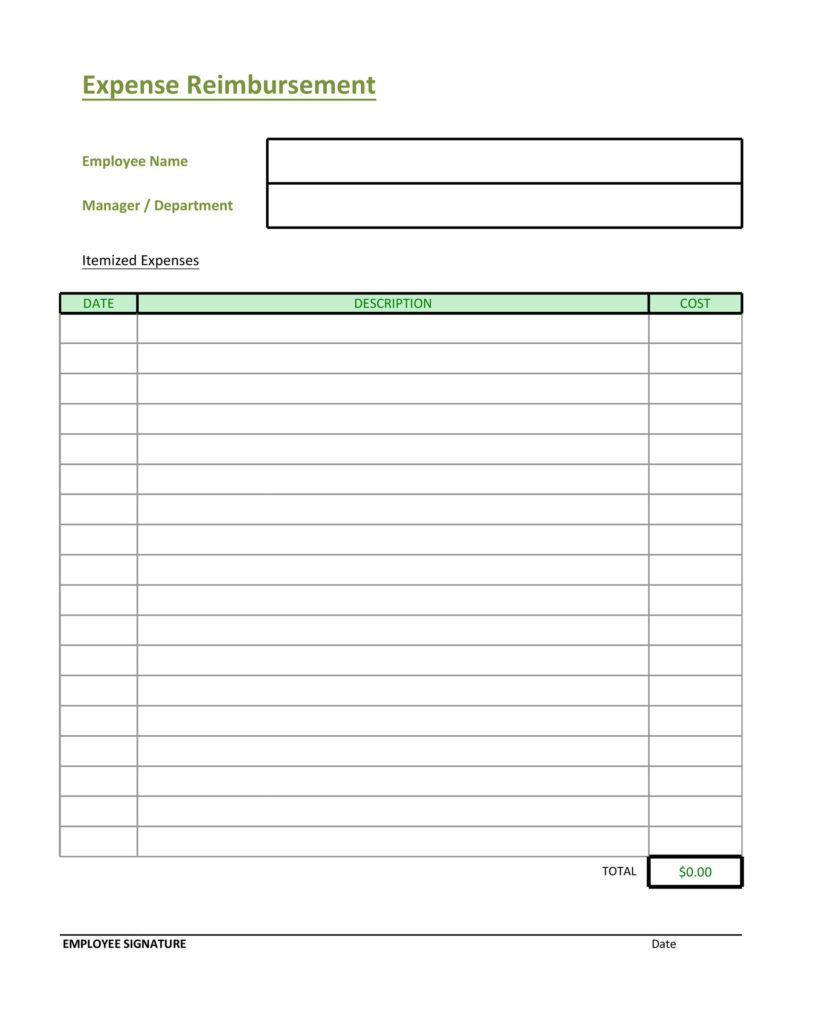

Free Reimbursement Form templatesWord, Excel, PDF Template Section

To Be Considered An Accountable Plan Under Federal Tax Provisions, A Reimbursement Or Other Employee Expense Allowance.

Web 1 Adequately Account For Means Providing The Council With A Statement Of Expense, An Account Book, A Diary, Or A Similar Record In Which You Entered Each Expense At Or Near.

Calculate Over 1,500 Tax Planning Strategies Automatically And Save Tens Of Thousands

Web Subscription Services 1050 Northgate Dr., Ste.

Related Post:

![Accountable Reimbursement Plan Template [Free PDF] Google Docs, Word](https://images.template.net/62891/Accountable-Reimbursement-Plan-Template-1.jpeg)