Irregular Income Budget Template

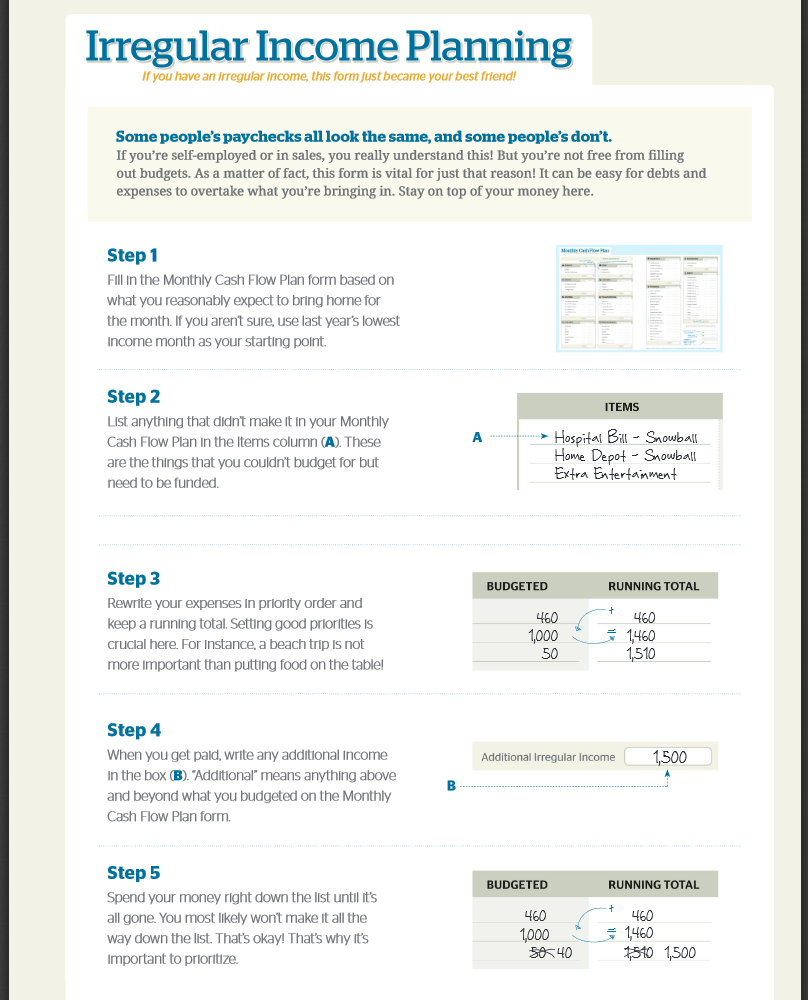

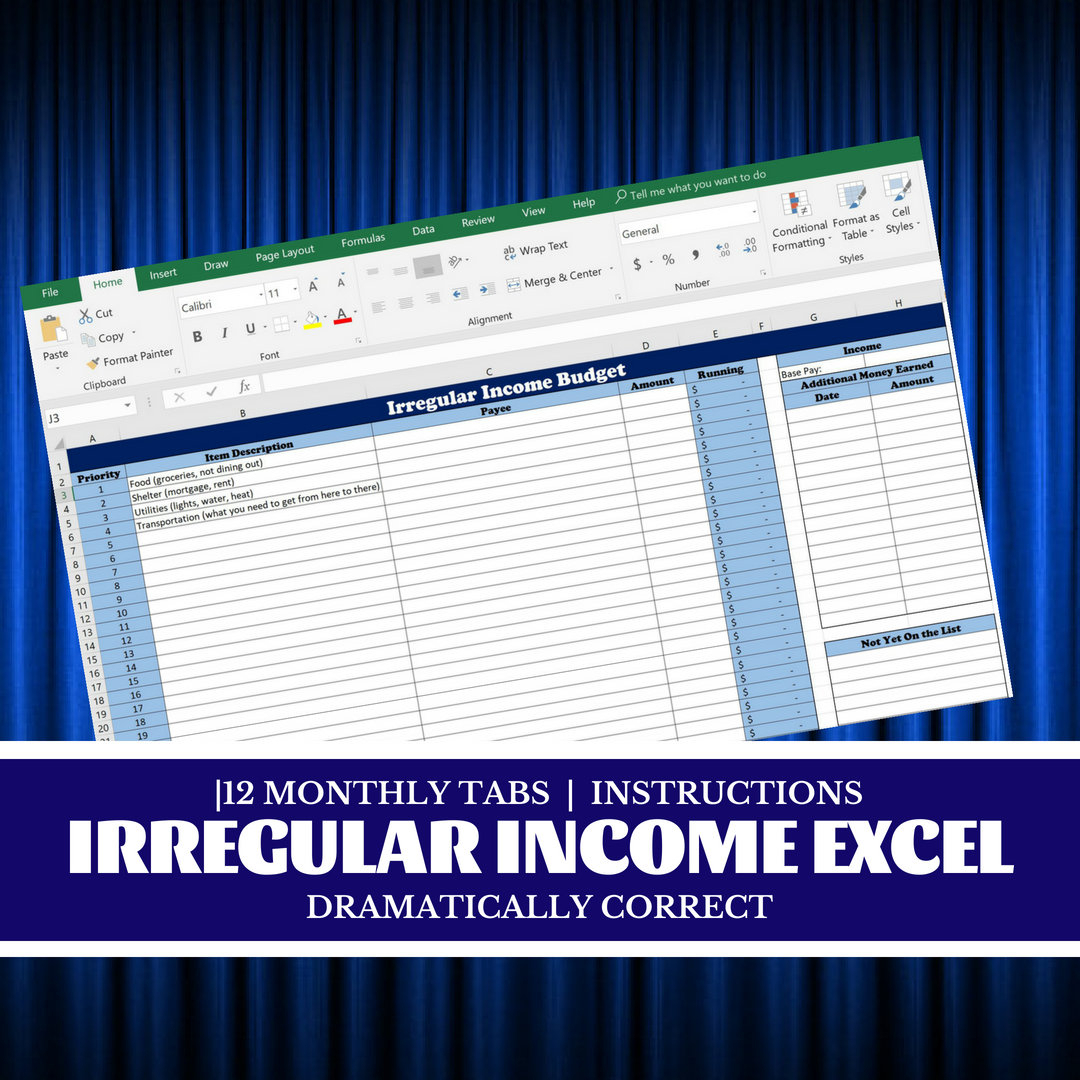

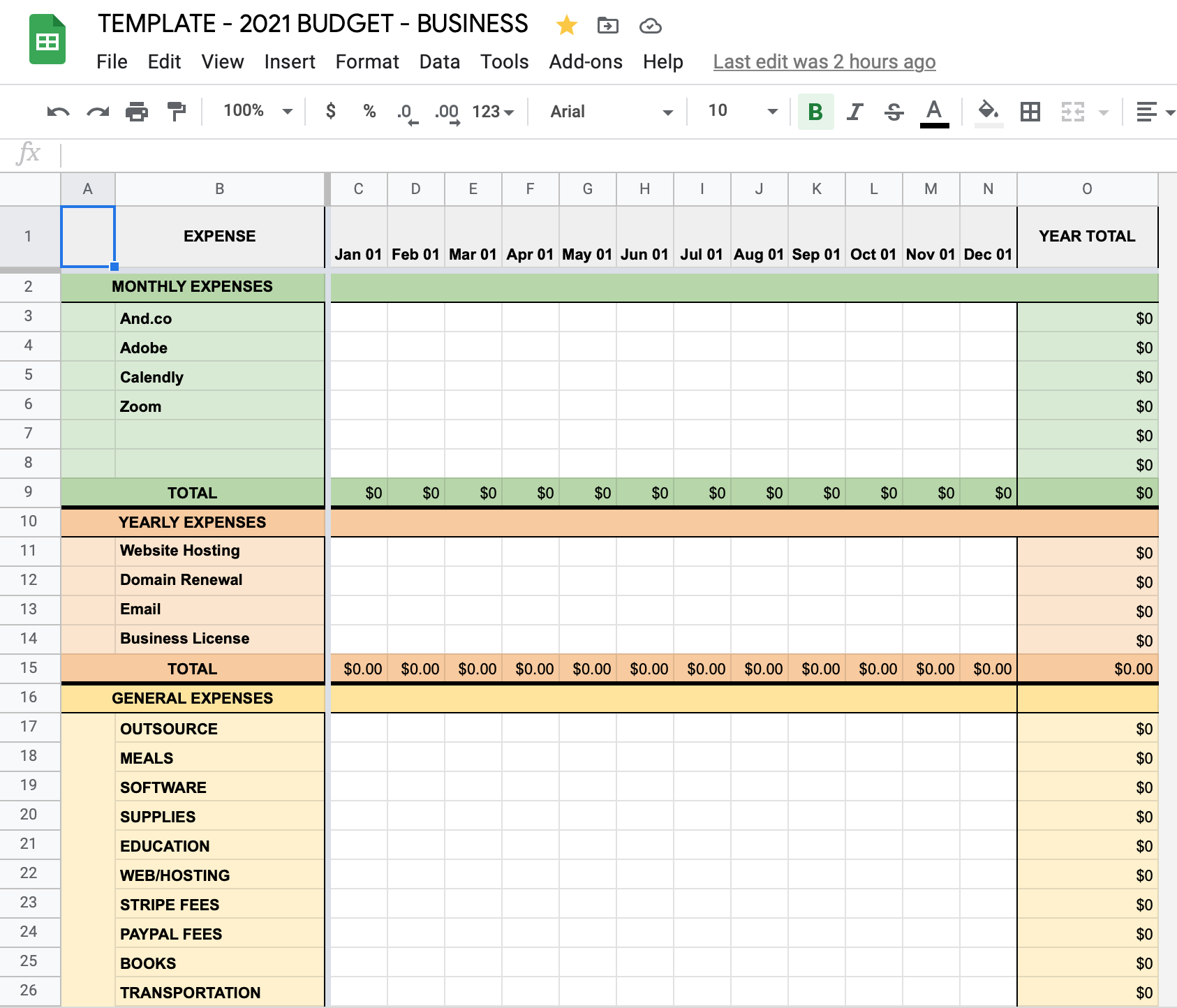

Irregular Income Budget Template - Lower bills, manage budgets, and start saving today. Budget with your average income. Ad manage all your business expenses in one place with quickbooks®. This is the base income you. It’s slightly different, but no harder to create, than a steady income budget. Because if you budget low, you can always go up from there. Web to good of traditional employment is that your income has usually consistent. That’s right—you should set up your budget based on your lowestmonthly income estimate. Web if you’ve got an irregular income, you can (and should) household every month. Get your budget to zero. Automatically track all your income and expenses. Web irregular income budget template spreadsheet. What is your average monthly income? The goal of this approach matches the name: Web the answer is an irregular income budget. Ad easily manage employee expenses. Here are some things that you need to budget for:. Fully integrated w/ employees, invoicing, project & more. If you’ve got an irregular income, plan low. Consider these four strategies to help you budgeting with a vario income and gain economic confidence: Download the excel budget template. Web many of us have irregular incomes. To get started, you can grab my monthly budget template here. Computers captures some getting used till, though it isn’t hard if her trail these. Automatically track all your income and expenses. Consider these four strategies to help you budgeting with a vario income and gain economic confidence: But guessing high and having to back off later—that’s. It’s way better to start low than to start with an average. In order to create a budget with an irregular income, you need to determine your baseline. What is your average monthly income? Get the app and start saving today. It’s way better to start low than to start with an average. Get a free guided quickbooks® setup. Excel or google sheets isn’t necessary. Web the answer is an irregular income budget. Computers captures some getting used till, though it isn’t hard if her trail these. Web when you have irregular or unpredictable income, it's important that you make a budget based on your lowest expected income. Ad find hidden costs and cut them. Get the app and start saving today. Consider these four strategies to help you budgeting with a vario. Save time on expense reports with everything in one place & approve with just one click. Web one of the most difficult aspects of budgeting is when you have to budget with an irregular income. Because if you budget low, you can always go up from there. The first step towards any budget is defining your monthly expenses—essential and nonessential.. This is the base income you. To get started, you can grab my monthly budget template here. Ad find hidden costs and cut them. List your fixed monthly expenses and your flexible expenses. This way, when you adjust your. Get the app and start saving today. But guessing high and having to back off later—that’s. The goal of this approach matches the name: Download the excel budget template. Enter your expenses in your budget template. 'you're forced to see what's going. Web to good of traditional employment is that your income has usually consistent. Ad find hidden costs and cut them. Because if you budget low, you can always go up from there. In order to create a budget with an irregular income, you need to determine your baseline. Ad easily manage employee expenses. Get the app and start saving today. Fully integrated w/ employees, invoicing, project & more. Web one of the most difficult aspects of budgeting is when you have to budget with an irregular income. Rocket money helps 3.4+ million members save hundreds. Web when you have irregular or unpredictable income, it's important that you make a budget based on your lowest expected income. Web many of us have irregular incomes. Excel or google sheets isn’t necessary. 'you're forced to see what's going. Enter your expenses in your budget template. Get a free guided quickbooks® setup. But guessing high and having to back off later—that’s. It’s slightly different, but no harder to create, than a steady income budget. This way, when you adjust your. Web irregular income budget template spreadsheet. Web how to begin budgeting for irregular income. To get started, you can grab my monthly budget template here. The first step towards any budget is defining your monthly expenses—essential and nonessential. Web the answer is an irregular income budget. Ad manage all your business expenses in one place with quickbooks®. Web to good of traditional employment is that your income has usually consistent. This way, when you adjust your. It’s way better to start low than to start with an average. Web the answer is an irregular income budget. Download the excel budget template. Automatically track all your income and expenses. 'you're forced to see what's going. This is the base income you. Web one of the most difficult aspects of budgeting is when you have to budget with an irregular income. Web there are many expenses associated with owning a car, truck, or motorcycle that go beyond gas and insurance. It’s slightly different, but no harder to create, than a steady income budget. Your paychecks follow a strict scheduled, and you likely do the net amount memorized. Fully integrated w/ employees, invoicing, project & more. Web many of us have irregular incomes. Get a free guided quickbooks® setup. Excel or google sheets isn’t necessary.[Budget Worksheet] How to Budget With Irregular to Avoid Going

Irregular Planning Irregular, How to plan,

Paycheck Budget,Paycheck Planner,Budget by Paycheck, Irregular

Irregular Budget Dave Ramsey Budget Templates

Cruise Budget Spreadsheet pertaining to Irregular Worksheet

Irregular Budget System

How to Budget Your Irregular in 2020 Budgeting, Simple budget

Irregular Budget Spreadsheet Google Spreadshee irregular

Irregular Planning Form Free Download

EASY SelfEmployment Budgeting with Irregular with a FREE

Enter Your Income In Your Budget Template.

Ad Manage All Your Business Expenses In One Place With Quickbooks®.

Because If You Budget Low, You Can Always Go Up From There.

What Is Your Average Monthly Income?

Related Post:

![[Budget Worksheet] How to Budget With Irregular to Avoid Going](https://i.pinimg.com/originals/b0/b6/35/b0b6351e071881a1aea1abd77d636e51.png)