Independent Contractor Printable 1099 Form

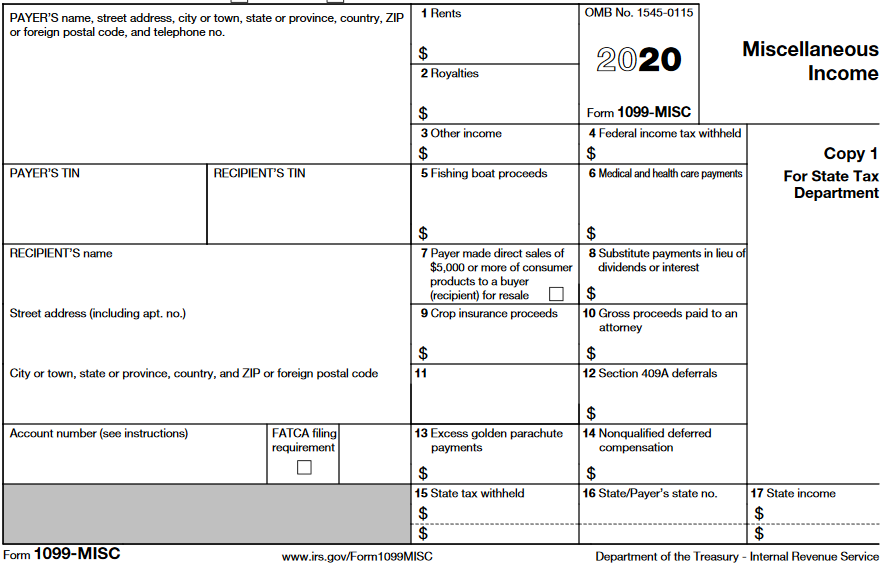

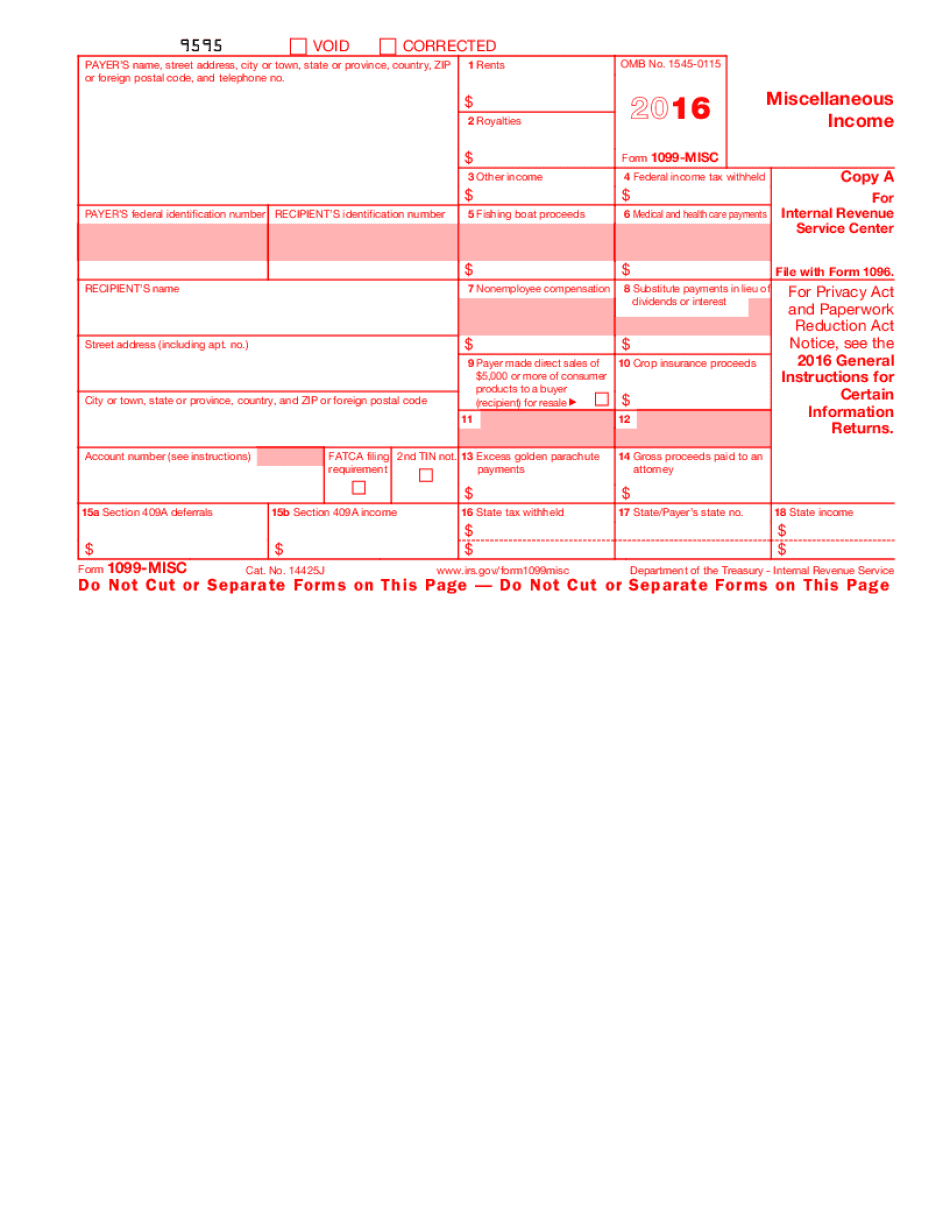

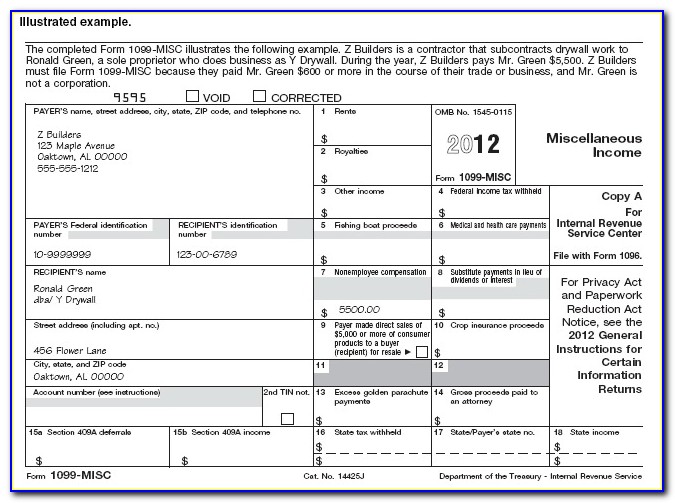

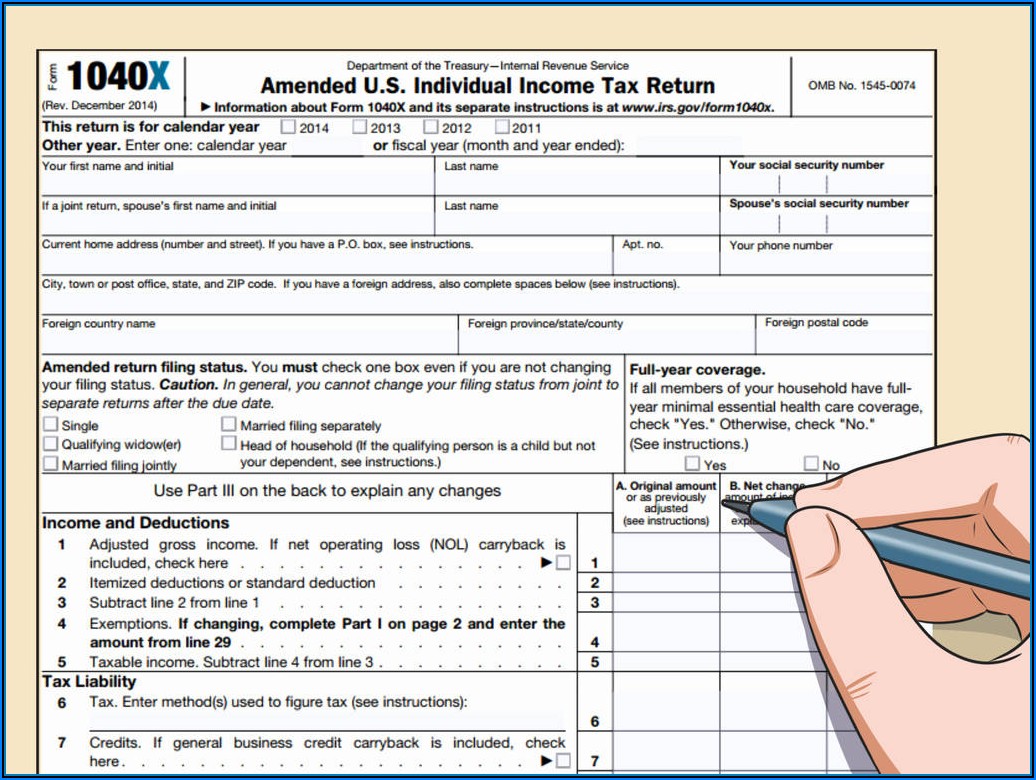

Independent Contractor Printable 1099 Form - An independent contractor agreement is a legal document between a. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. There is a separate form and there are separate directions. Also file schedule se (form 1040),. This form can be used to request the correct name and taxpayer identification number, or tin, of. Getting confused who is a 1099. 1099 form is an information return form used to report the payments made in a calendar year to the irs. Web you’ll issue a 1099 form. Web what is an independent contractor 1099 form? Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Also file schedule se (form 1040),. There is a separate form and there are separate directions. Web the 1099 nec will contain information previously reported in box 7 of the 1099 misc. Send copy b of 1099 to independent contractor. Getting confused who is a 1099. 1099 form is an information return form used to report the payments made in a calendar year to the irs. Web you’ll issue a 1099 form. An independent contractor agreement is a legal document between a. Web what is an independent contractor 1099 form? Web an independent contractor invoice is used by anyone independently working for themselves to request payment. Send copy b of 1099 to independent contractor. Web independent contractors report their income on schedule c (form 1040), profit or loss from business (sole proprietorship). Web create a high quality document now! 1099 form is an information return form used to report the payments made in a calendar year to the irs. Also file schedule se (form 1040),. As a result, those submitting a late. Now, send the 1099 copy b to independent contractors whether via postal mail or hand them personally. Web what is an independent contractor 1099 form? Web create a high quality document now! Also file schedule se (form 1040),. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Web what is an independent contractor 1099 form? Web you’ll issue a 1099 form. Web create a high quality document now! This form can be used to request the correct name and taxpayer identification number, or. There is a separate form and there are separate directions. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Send copy b of 1099 to independent contractor. Web create a high quality document now! An independent contractor agreement is a legal document between a. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. Web what is an independent contractor 1099 form? This form can be used to request the correct name and taxpayer identification number, or tin, of. Web independent. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. As a result, those submitting a late. Getting confused who is a 1099. You must also complete form 8919 and attach it to. There is a separate form and there are separate directions. Web what is an independent contractor 1099 form? Now, send the 1099 copy b to independent contractors whether via postal mail or hand them personally. An independent contractor agreement is a legal document between a. Send copy b of 1099 to independent contractor. Getting confused who is a 1099. Web create a high quality document now! Web independent contractors report their income on schedule c (form 1040), profit or loss from business (sole proprietorship). Now, send the 1099 copy b to independent contractors whether via postal mail or hand them personally. There is a separate form and there are separate directions. Web you’ll issue a 1099 form. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. Web create a high quality document now! As a result, those submitting a late. There is a separate form and there are separate directions. Web you’ll issue a 1099 form. Web what is an independent contractor 1099 form? 1099 form is an information return form used to report the payments made in a calendar year to the irs. You must also complete form 8919 and attach it to. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. This form can be used to request the correct name and taxpayer identification number, or tin, of. An independent contractor agreement is a legal document between a. Also file schedule se (form 1040),. Send copy b of 1099 to independent contractor. Web the 1099 nec will contain information previously reported in box 7 of the 1099 misc. Now, send the 1099 copy b to independent contractors whether via postal mail or hand them personally. Getting confused who is a 1099. Web independent contractors report their income on schedule c (form 1040), profit or loss from business (sole proprietorship). Getting confused who is a 1099. Web create a high quality document now! Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. This form can be used to request the correct name and taxpayer identification number, or tin, of. Send copy b of 1099 to independent contractor. Now, send the 1099 copy b to independent contractors whether via postal mail or hand them personally. 1099 form is an information return form used to report the payments made in a calendar year to the irs. Web what is an independent contractor 1099 form? Also file schedule se (form 1040),. Web the 1099 nec will contain information previously reported in box 7 of the 1099 misc. An independent contractor agreement is a legal document between a. You must also complete form 8919 and attach it to. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of.1099 Form Independent Contractor Pdf 1099 Tax Form Fill Online

Free 1099 Forms For Independent Contractors Universal Network

1099 Form For Independent Contractors 2018 Form Resume Examples

1099 Form Independent Contractor Pdf 29 Independent Contractor

1099 Form Independent Contractor 2018 Universal Network

Microsoft Word 1099 Tax Form Printable Template Printable Templates

1099 Form For Independent Contractors 2019 Form Resume Examples

1099 form independent contractor Fill Online, Printable, Fillable

Printable 1099 Form Independent Contractor Master of

1099 Form Independent Contractor Pdf Klauuuudia 1099 Misc Template

As A Result, Those Submitting A Late.

Web You’ll Issue A 1099 Form.

There Is A Separate Form And There Are Separate Directions.

Web Independent Contractors Report Their Income On Schedule C (Form 1040), Profit Or Loss From Business (Sole Proprietorship).

Related Post:

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)