Gas Expense Report Template

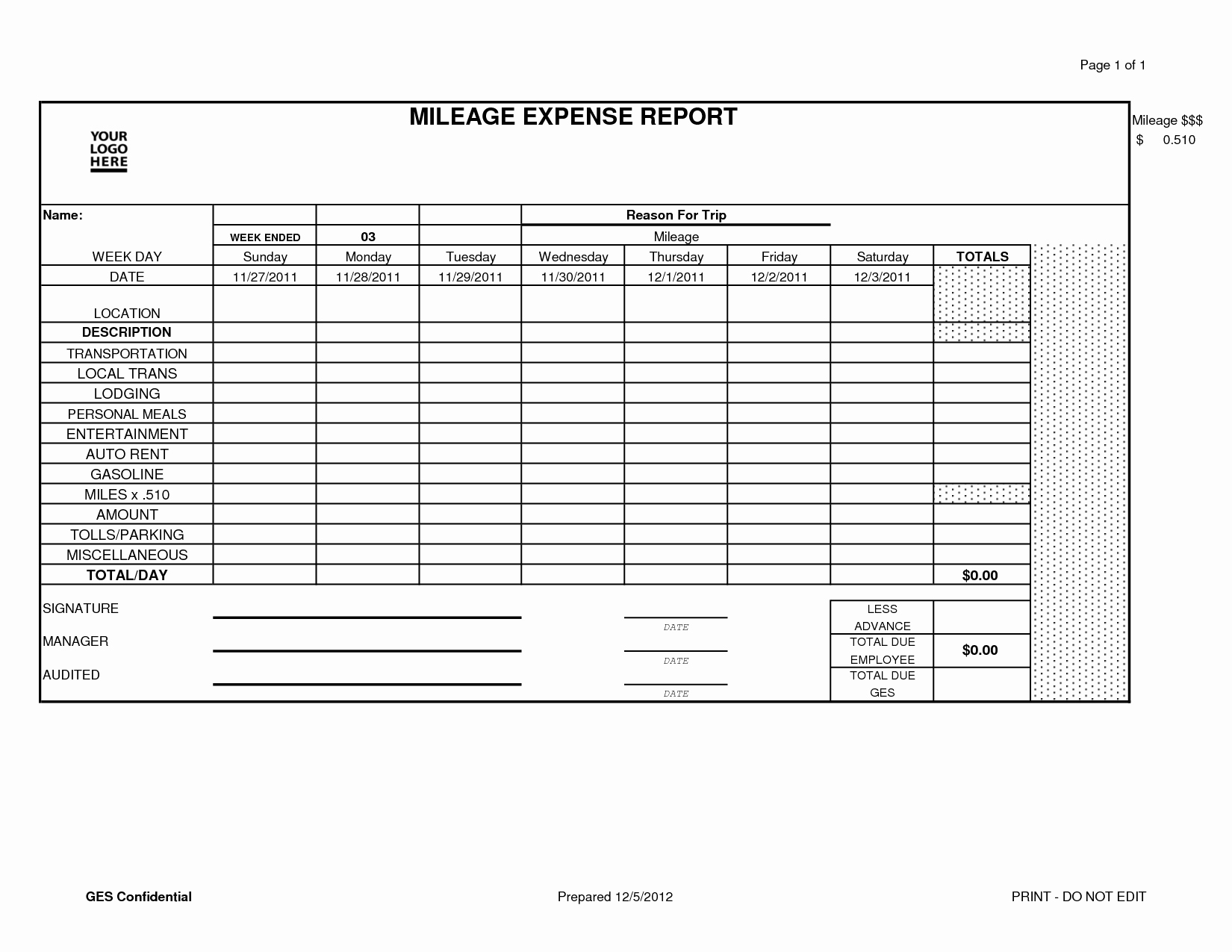

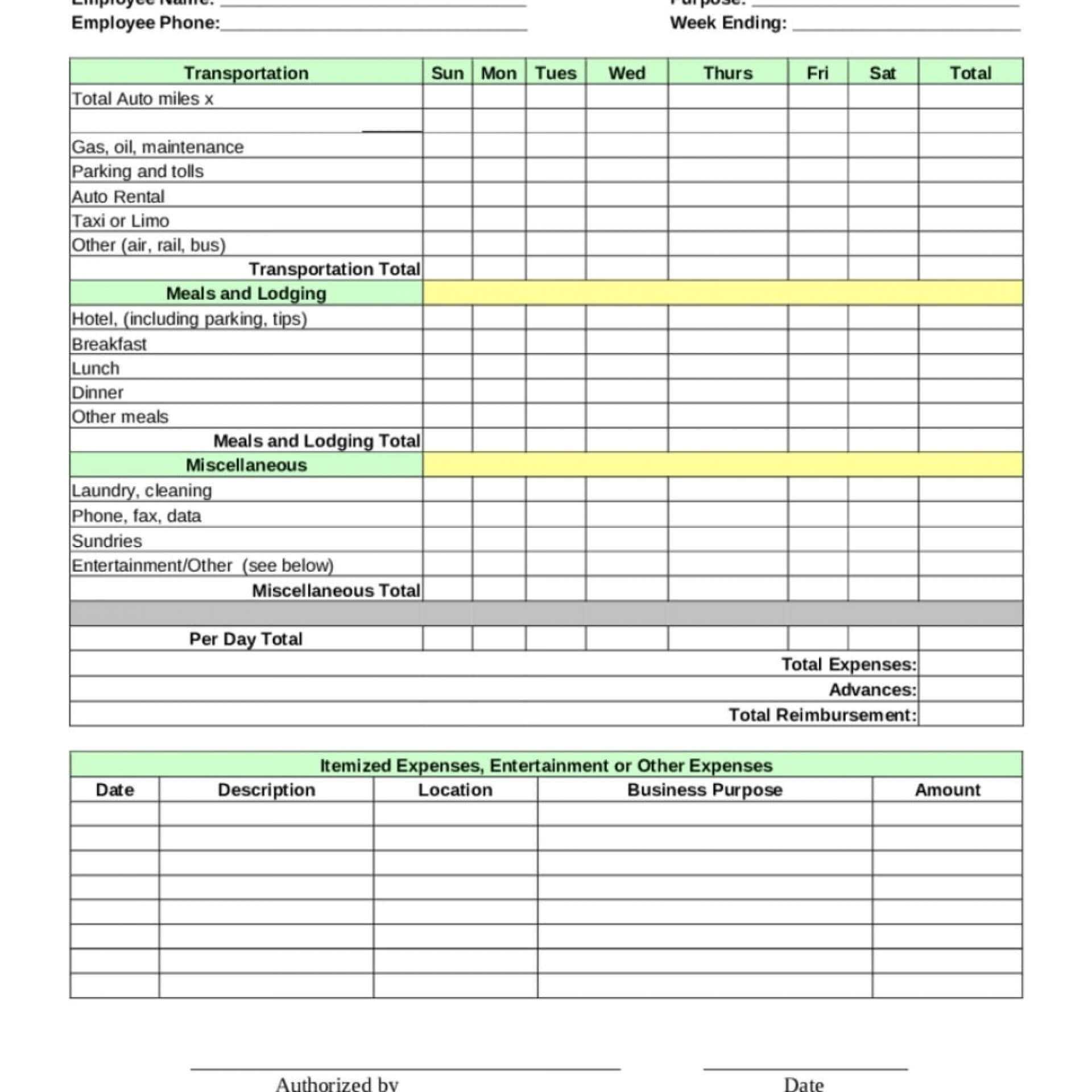

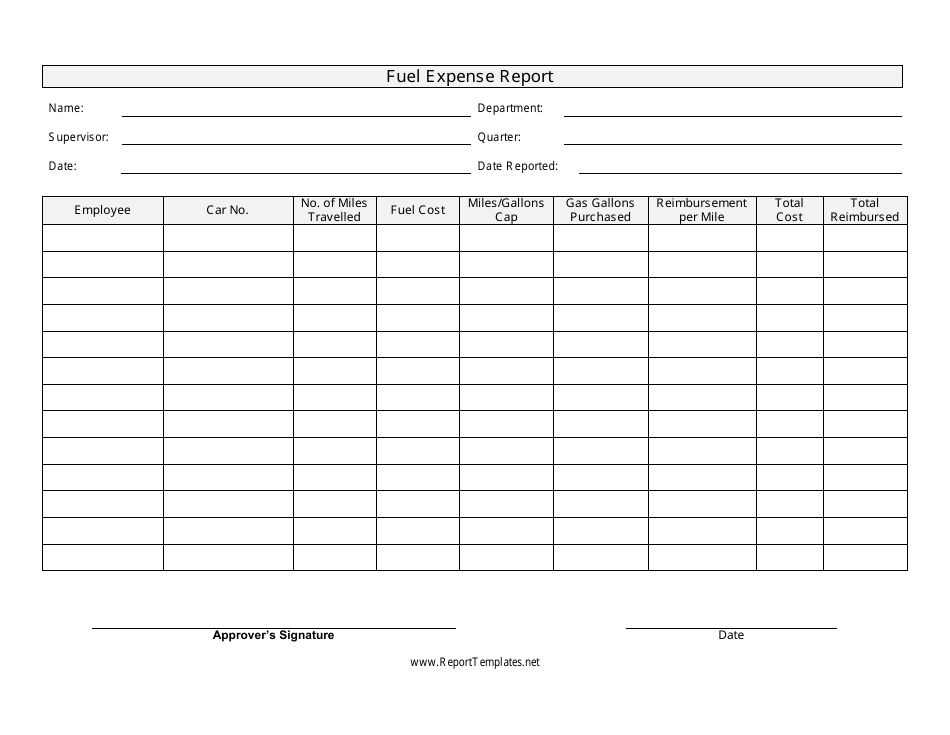

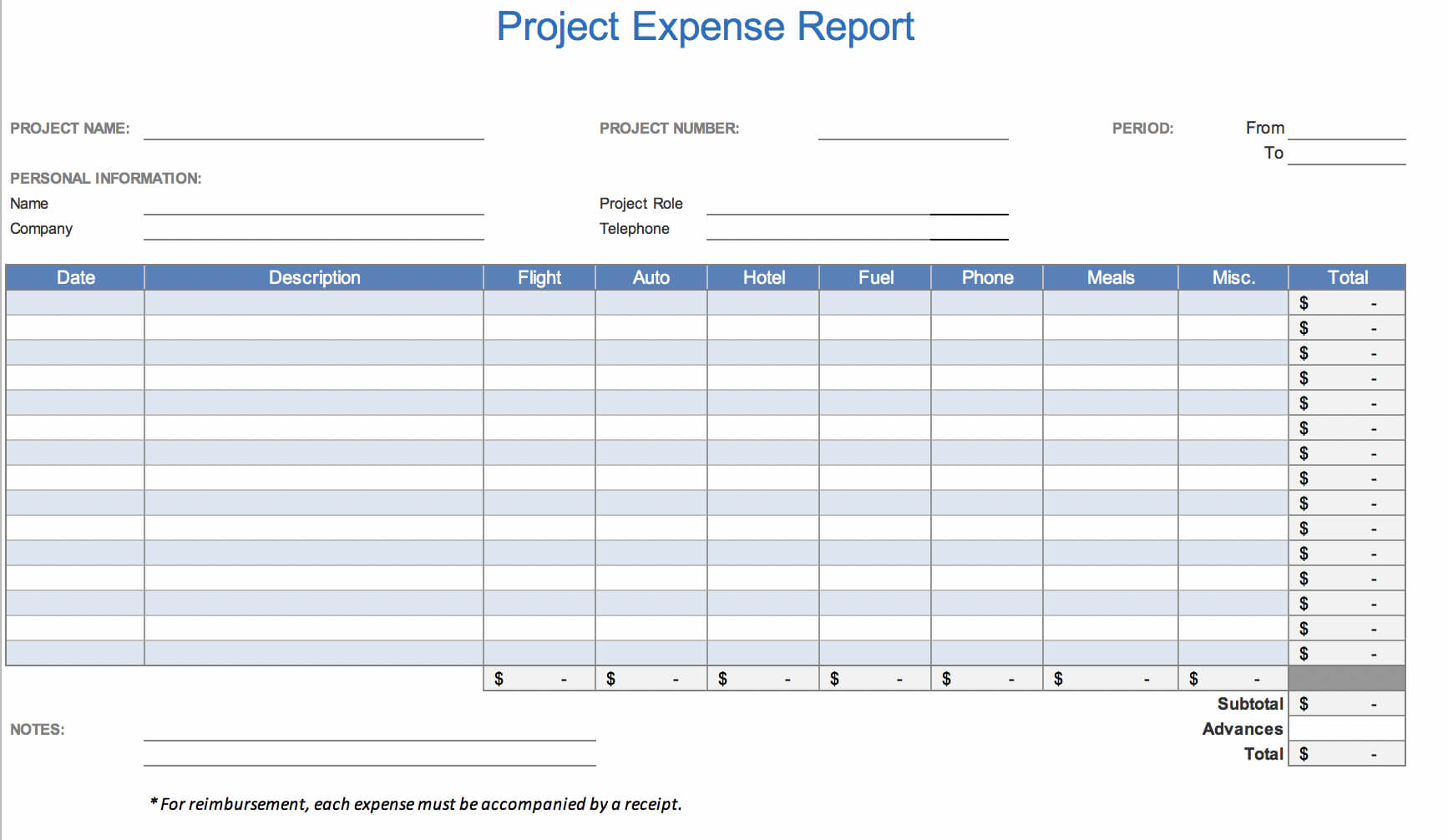

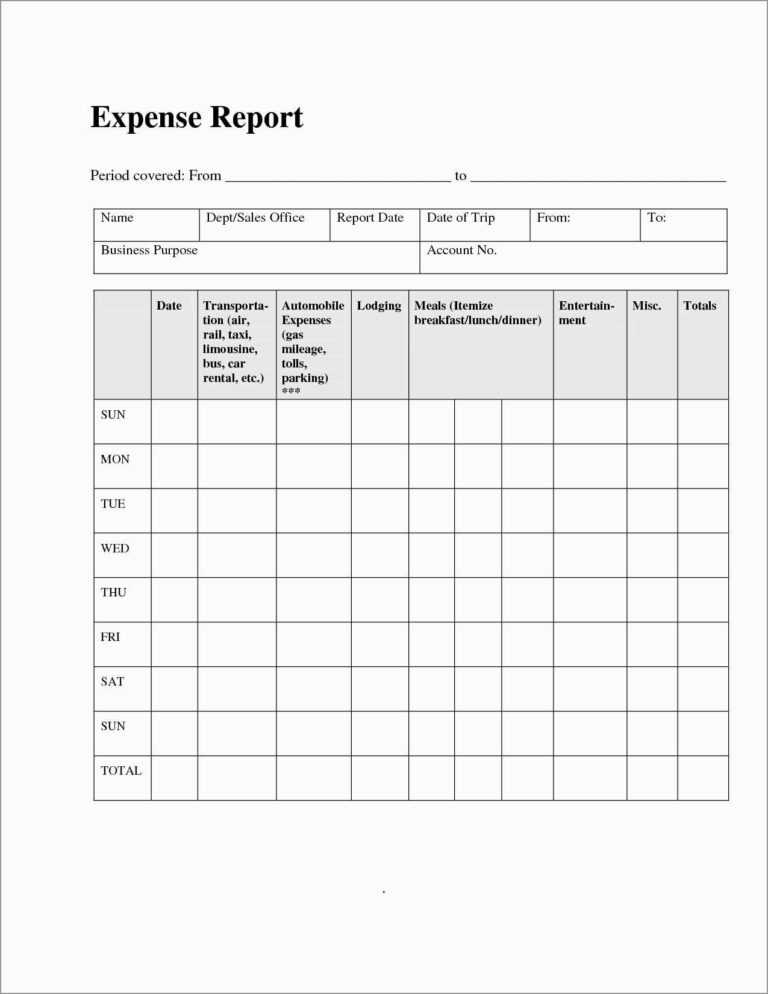

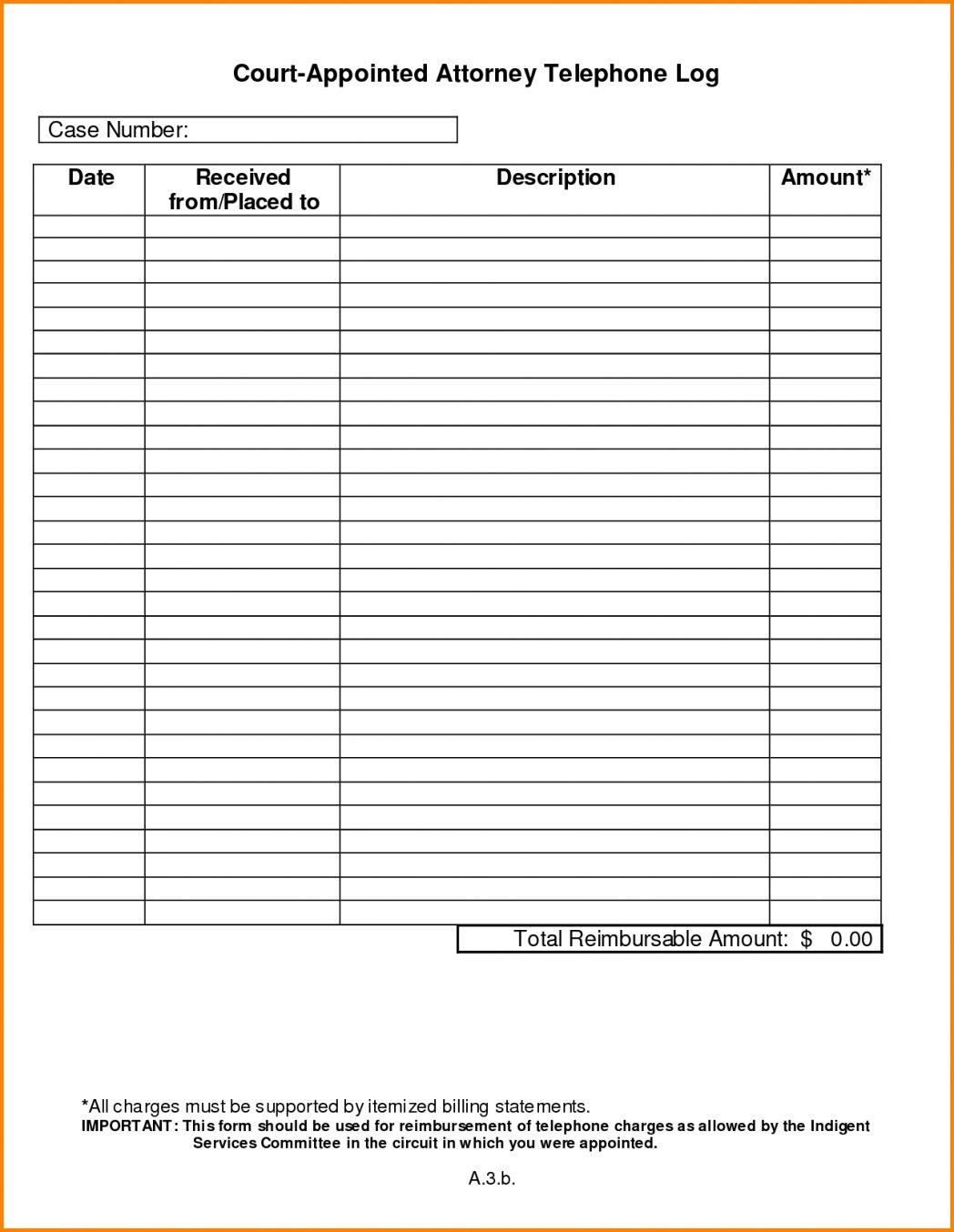

Gas Expense Report Template - Ad share the workload between employees, managers & accountants and save time. Notes on sample gas bill template example. Gas reimbursement form is used to deduct the business use of your car. An expense report is an organized way for businesses and their. This sample gas bill can be used to keep track of gas costs. Expense report with mileage tracking template; All the formats are editable and easy to work with; Web download gas reimbursement form for free. Fill in the information to customize for. Web gas mileage expense report template. Avail of the best irs mileage log templates. This sample gas bill can be used to keep track of gas costs. Web 20 printable mileage log templates (free) the irs has strict rules about the types of driving that can be deducted from your taxes. Ad share the workload between employees, managers & accountants and save time. 87% of customers. Web use a venngage expense report template. Get full visibility into all company spend, all in one place with center®. Web gas receipt templates by nutemplates are available in three formats: Web download printable expense report samples with either simple designs or spreadsheets. They are absolutely free of cost! Save time on expense reports with everything in one place & approve with just one click. Web download printable expense report samples with either simple designs or spreadsheets. Ad manage all your business expenses in one place with quickbooks®. Download report template (pdf format). If you want an expense report that showcases your branding and is visually appealing, choose a. Get full visibility into all company spend, all in one place with center®. An expense report is an organized way for businesses and their. Web free expense report template for microsoft® excel® and google sheets | updated 4/12/2022. Fill in the information to customize for. Web gas receipt templates by nutemplates are available in three formats: Web 20 printable mileage log templates (free) the irs has strict rules about the types of driving that can be deducted from your taxes. Web download gas reimbursement form for free. They are absolutely free of cost! Save time on expense reports with everything in one place & approve with just one click. Gas reimbursement form is used to deduct. Web here are 12 expense report templates you can try right now. Web the fuel expense report template is a practical solution for tracking and managing fuel expenses related to company vehicles. Avail of the best irs mileage log templates. They are absolutely free of cost! Stay financially organized with our expense report. Gas reimbursement form is used to deduct the business use of your car. If you want an expense report that showcases your branding and is visually appealing, choose a template from. Web download this expense report template design in excel, google sheets format. Many business owners are able to deduct. Web download printable expense report samples with either simple designs. Use these for small businesses, construction, travel expenses, or reimbursements. Gas reimbursement form is used to deduct the business use of your car. Web free expense report template for microsoft® excel® and google sheets | updated 4/12/2022. Personal expense template by month; This sample gas bill can be used to keep track of gas costs. Web 20 printable mileage log templates (free) the irs has strict rules about the types of driving that can be deducted from your taxes. Mileage reimbursement is intended to account for gas as. Download report template (pdf format). Web gas receipt templates by nutemplates are available in three formats: 87% of customers say quickbooks® simplifies their business finances. They are absolutely free of cost! Ad share the workload between employees, managers & accountants and save time. Web fuel expense report when going on a business trip, use this gas and mileage report for company reimbursement purposes. Web gas mileage expense report template. Web here are 12 expense report templates you can try right now. Web fuel expense report when going on a business trip, use this gas and mileage report for company reimbursement purposes. Ad manage all your business expenses in one place with quickbooks®. This sample gas bill can be used to keep track of gas costs. Getapp helps more than 1.8 million businesses find the best software for their needs. Web download printable expense report samples with either simple designs or spreadsheets. Ad share the workload between employees, managers & accountants and save time. Expense report with mileage tracking template; Use these for small businesses, construction, travel expenses, or reimbursements. Web free expense report template for microsoft® excel® and google sheets | updated 4/12/2022. By using this template, organizations can. Web use a venngage expense report template. An expense report is an organized way for businesses and their. Get full visibility into all company spend, all in one place with center®. Mileage reimbursement is intended to account for gas as. Save time on expense reports with everything in one place & approve with just one click. Web the fuel expense report template is a practical solution for tracking and managing fuel expenses related to company vehicles. Avail of the best irs mileage log templates. Web gas receipt templates by nutemplates are available in three formats: Web gas mileage expense report template. All the formats are editable and easy to work with; Web use a venngage expense report template. Use these for small businesses, construction, travel expenses, or reimbursements. Personal expense template by month; All the formats are editable and easy to work with; If you want an expense report that showcases your branding and is visually appealing, choose a template from. Web 20 printable mileage log templates (free) the irs has strict rules about the types of driving that can be deducted from your taxes. This sample gas bill can be used to keep track of gas costs. Web here are 12 expense report templates you can try right now. Download report template (pdf format). Many business owners are able to deduct. Web fuel expense report when going on a business trip, use this gas and mileage report for company reimbursement purposes. Web gas receipt templates by nutemplates are available in three formats: Stay financially organized with our expense report. Notes on sample gas bill template example. 87% of customers say quickbooks® simplifies their business finances. An expense report is a necessity for any employee who wants to be reimbursed for the business expenses they’ve incurred such as mileage, gas, or.40+ Expense Report Templates To Help You Save Money ᐅ intended for Gas

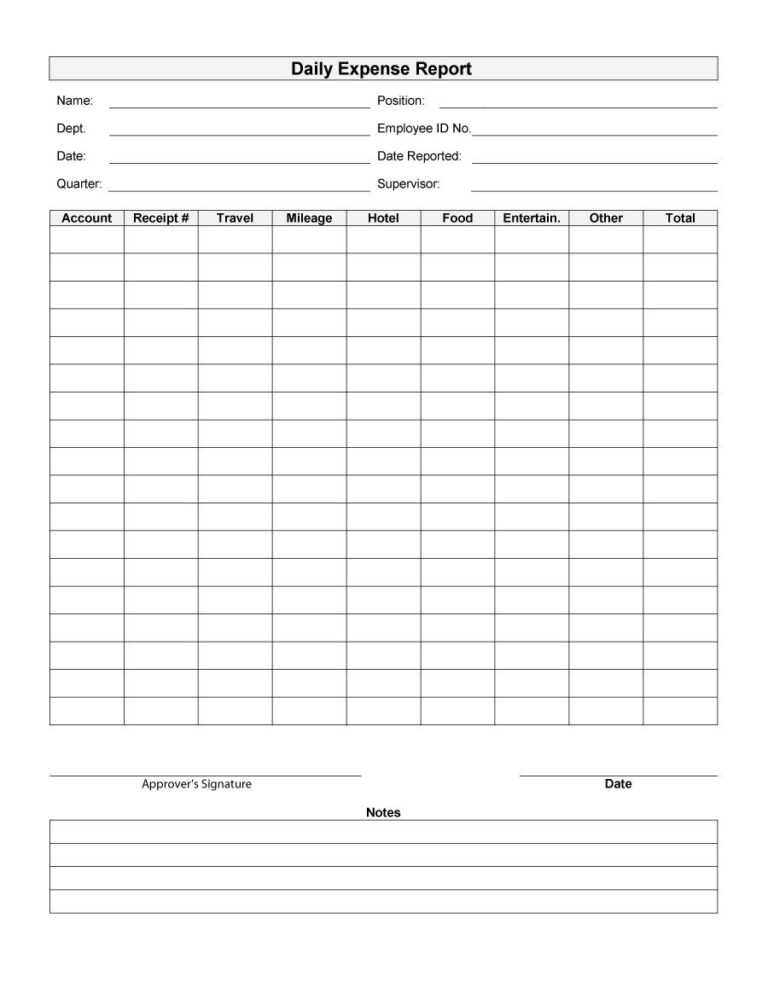

Simple Expense Report In Gas Mileage Expense Report Template

Gas Mileage Expense Report Template New Gas Mileage Spreadsheet Ebnefsi

Gas Mileage Expense Report Template

Fuel Expense Report Template Download Printable PDF Templateroller

Gas Mileage Expense Report Template

Expense Report Template For Mac Numbers Travel Excel 2007 Regarding Gas

Gas Mileage Expense Report Template (8) PROFESSIONAL TEMPLATES

Gas Mileage Expense Report Template (7) PROFESSIONAL TEMPLATES

Mileage Expense Report Spreadsheet intended for Gas Mileage Expense

Web The Fuel Expense Report Template Is A Practical Solution For Tracking And Managing Fuel Expenses Related To Company Vehicles.

By Using This Template, Organizations Can.

An Expense Report Is An Organized Way For Businesses And Their.

Web Download Printable Expense Report Samples With Either Simple Designs Or Spreadsheets.

Related Post: