Free Printable Debt Snowball Spreadsheet

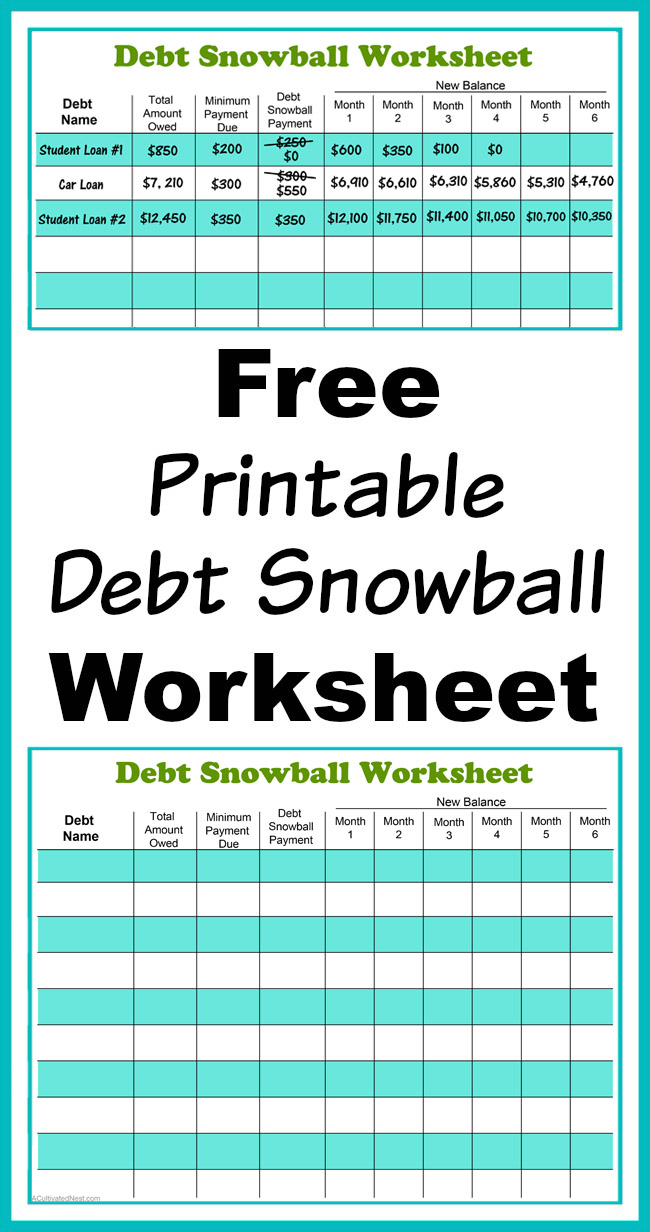

Free Printable Debt Snowball Spreadsheet - If you need help with actually. Tiller money is a budgeting tool that can help you manage your money and pay off your debt. Web here’s how the debt snowball works: You focus on your lowest balance debt first, while paying only the minimum payments on all other debts. Web by marc andre updated may 19, 2022 this page may contain links from our sponsors. Today we have some free worksheets. The current rate is $3.99 and $9.99,. Tiller money offers several types of spreadsheets. Make minimum payments on all your debts except the. List your debts from smallest to largest regardless of interest rate. Web download your free debt snowball spreadsheet here to get the template. Web debt snowball spreadsheet: Here’s how we make money. Web download your free debt snowball excel template. Web here’s how the debt snowball works: Debt payoff template from medium for google sheets 2. Tiller money offers several types of spreadsheets. Tiller money is a budgeting tool that can help you manage your money and pay off your debt. Web free debt snowball spreadsheets for excel & google sheets 1. List your debts from smallest to largest regardless of interest rate. Web download your free debt snowball excel template. Web get started with this free printable debt snowball worksheet! One option on this list. Web here’s how the debt snowball works: Debt payoff template from medium for google sheets 2. These worksheets make it easy to pay off debt quickly and. First, across the top of your debt snowball spreadsheet, enter the name of each loan. List your debts from smallest to largest regardless of interest rate. Here’s how we make money. Ad browse & discover thousands of business & investing book titles, for less. Debt payoff template from medium for google sheets 2. These worksheets make it easy to pay off debt quickly and. Web here’s how the debt snowball works: You focus on your lowest balance debt first, while paying only the minimum payments on all other debts. Web track your monthly payments and debt payoff progress with these free debt snowball printable. Today we have some free worksheets. 2 34 pay the minimumamount into do the samekeep using. Here’s how we make money. Tiller money is a budgeting tool that can help you manage your money and pay off your debt. The debt snowball method focuses on paying one debt off at a time. Today we have some free worksheets. Web here’s how the debt snowball works: First, across the top of your debt snowball spreadsheet, enter the name of each loan. Tiller money offers several types of spreadsheets. Web free debt snowball spreadsheets for excel & google sheets 1. Today we have some free worksheets. Web here’s how the debt snowball works: Web that’s why i’m giving you this free printable debt snowball worksheet to help you visualize your debt and execute a plan of attack. Web download your free debt snowball spreadsheet here to get the template. Web get started with this free printable debt snowball worksheet! If you need help with actually. Web the first free printable debt snowball worksheet is a tracking sheet. 2 34 pay the minimumamount into do the samekeep using. Web free debt snowball spreadsheets for excel & google sheets 1. Web here’s how the debt snowball works: Ad browse & discover thousands of business & investing book titles, for less. First, across the top of your debt snowball spreadsheet, enter the name of each loan. Web the first free printable debt snowball worksheet is a tracking sheet. Tiller money offers several types of spreadsheets. The current rate is $3.99 and $9.99,. Here’s how we make money. Web track your monthly payments and debt payoff progress with these free debt snowball printable worksheets. First, across the top of your debt snowball spreadsheet, enter the name of each loan. Web here’s how the debt snowball works: 2 34 pay the minimumamount into do the samekeep using. Tiller money is a budgeting tool that can help you manage your money and pay off your debt. Tiller money offers several types of spreadsheets. The current rate is $3.99 and $9.99,. Web download your free debt snowball excel template. Ad browse & discover thousands of business & investing book titles, for less. Today we have some free worksheets. Web below, we’ve got lots of free printable debt trackers (and debt payoff planners, debt snowball worksheets, debt thermometers, etc.) to help you work towards. Web the first free printable debt snowball worksheet is a tracking sheet. List your debts from smallest to largest regardless of interest rate. Web by marc andre updated may 19, 2022 this page may contain links from our sponsors. One option on this list. Write each one of your debts down on this form in order from smallest to largest. Make minimum payments on all your debts except the. Web get started with this free printable debt snowball worksheet! These worksheets make it easy to pay off debt quickly and. One option on this list. Ad browse & discover thousands of business & investing book titles, for less. Web that’s why i’m giving you this free printable debt snowball worksheet to help you visualize your debt and execute a plan of attack. Web download your free debt snowball excel template. First, across the top of your debt snowball spreadsheet, enter the name of each loan. Debt payoff template from medium for google sheets 2. Tiller money is a budgeting tool that can help you manage your money and pay off your debt. Today we have some free worksheets. The debt snowball method focuses on paying one debt off at a time. These worksheets make it easy to pay off debt quickly and. Make minimum payments on all your debts except the. Web track your monthly payments and debt payoff progress with these free debt snowball printable worksheets. If you need help with actually. The current rate is $3.99 and $9.99,. Web the first free printable debt snowball worksheet is a tracking sheet. Web below, we’ve got lots of free printable debt trackers (and debt payoff planners, debt snowball worksheets, debt thermometers, etc.) to help you work towards.38 Debt Snowball Spreadsheets, Forms & Calculators

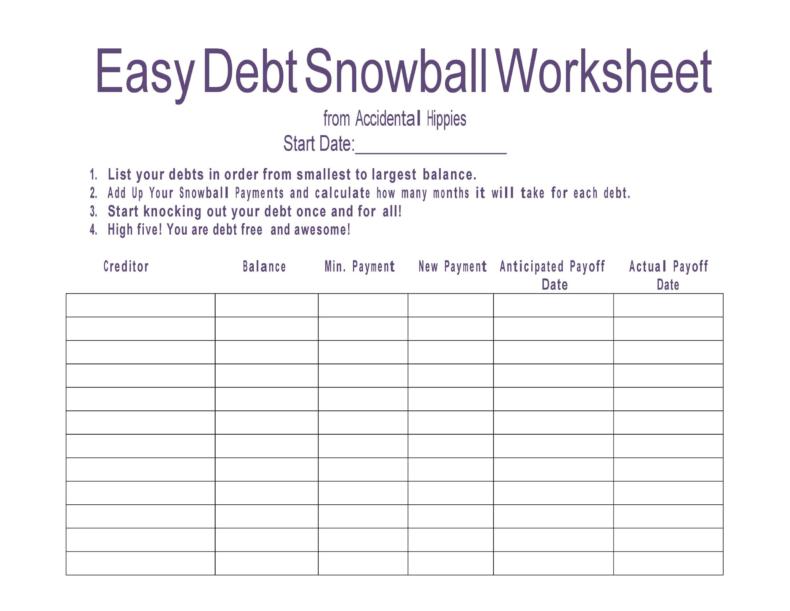

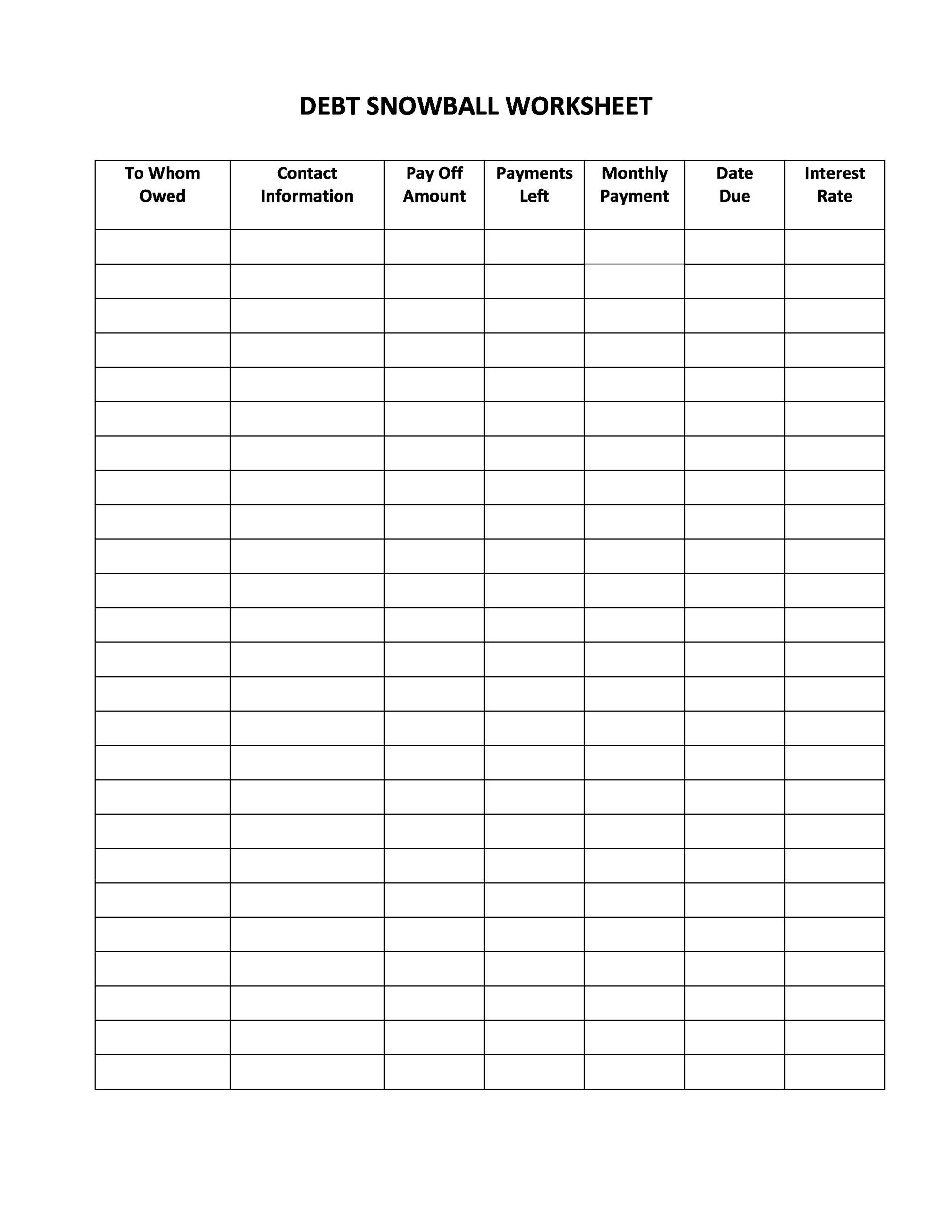

Free Debt Snowball Printable Worksheet Track Your Debt Payoff

130+ Free Printables to Help You Get Organized This year! Dishes and

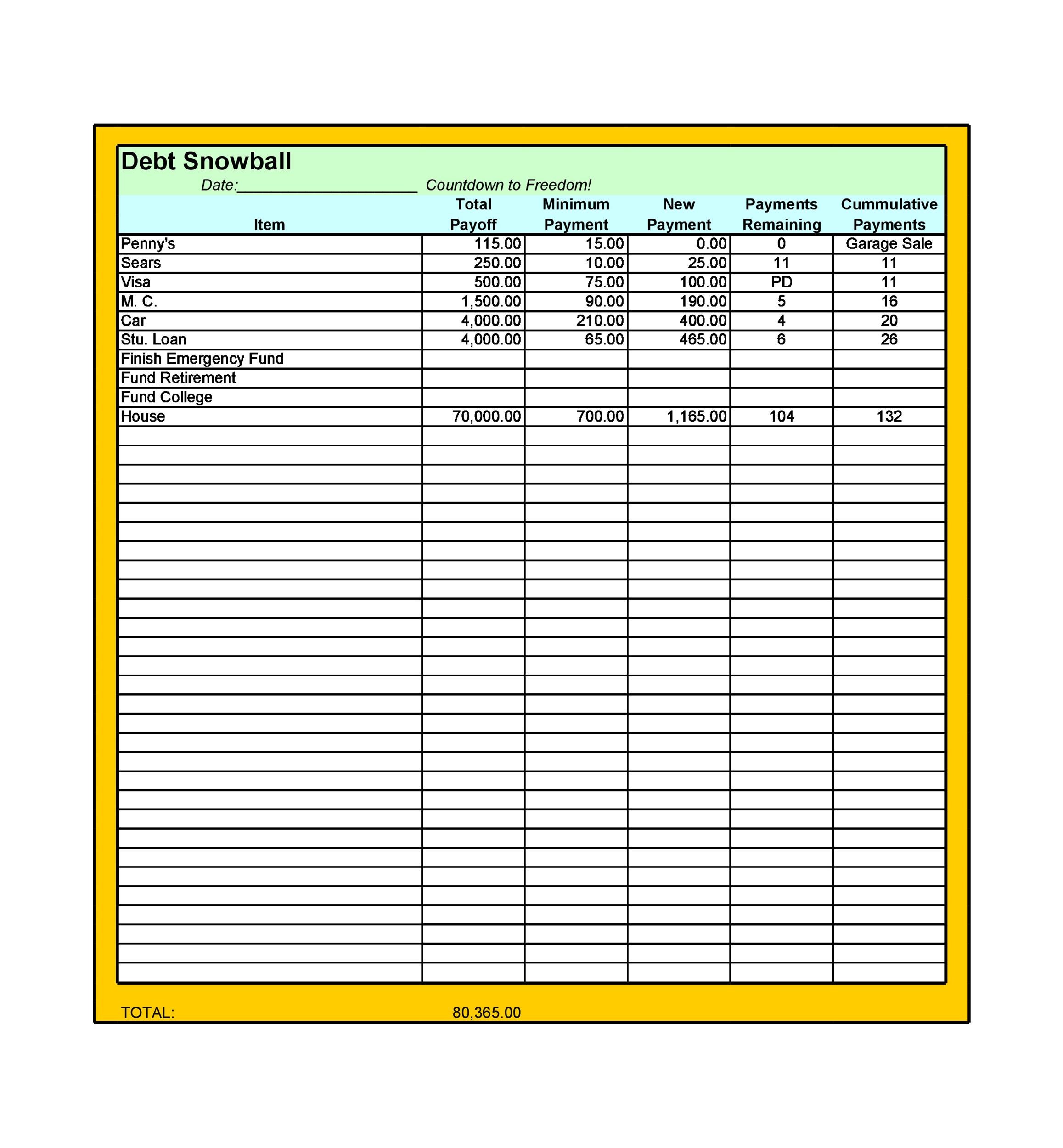

38 Debt Snowball Spreadsheets, Forms & Calculators

38 Debt Snowball Spreadsheets, Forms & Calculators

38 Debt Snowball Spreadsheets, Forms & Calculators

Free Printable Debt Snowball Worksheet Pay Down Your Debt!

Free Debt Snowball Printable Worksheet Track Your Debt Payoff

38 Debt Snowball Spreadsheets, Forms & Calculators

Free Debt Snowball Printable Worksheets Simplistically Living

Write Each One Of Your Debts Down On This Form In Order From Smallest To Largest.

You Focus On Your Lowest Balance Debt First, While Paying Only The Minimum Payments On All Other Debts.

Here’s How We Make Money.

Web 1 Snowball Worksheet List All Your Debts Below Starting From The Smallest To The Largest Balance.

Related Post: