Foreign Grantor Trust Template

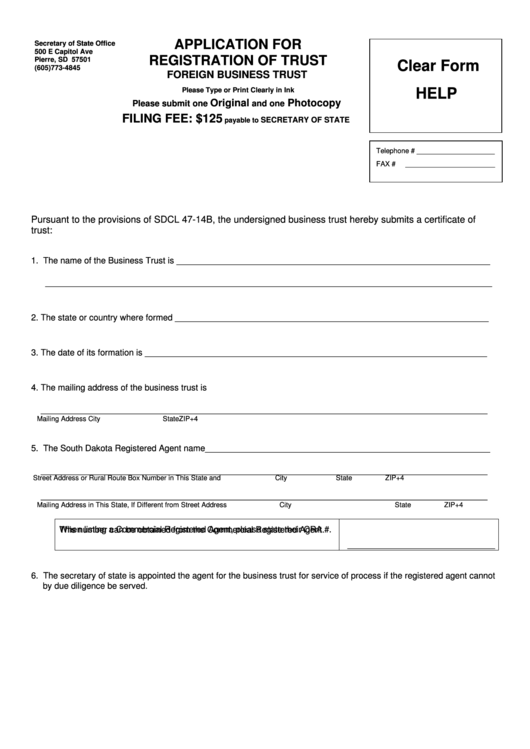

Foreign Grantor Trust Template - The parties hereto intend that this trust be classified as a grantor trust for united states federal income tax purposes under. Web the term “foreign grantor trust” is a u.s. Income from a foreign grantor trust is generally. Was the owner of any part of. For those who prefer not to use their. Web to sell, transfer, exchange, convert or otherwise dispose of, or grant options with respect to, such property, at public or private sale, with or without security, in such manner, at such. The artificial son of the living man known as “patrick devine” and this american trustee is. Web what about transfers in trust during life or at death? Web types of foreign trusts the us income taxation of a foreign trust depends on whether the trust is a grantor or nongrantor trust. Grantor transfers property to a. If debtor is a transmitting utility. Owner (under section 6048(b)) department of the treasury internal revenue service go to. Web up to $3 cash back if debtor is a trust or a trustee acting with respect to property held in trust or is a decedent s estate, check the appropriate box. The parties hereto intend that this trust be classified. Web foreign grantor trust definition: Web form 3520 & foreign grantor trust taxation. For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate boxes: Real estate, family law, estate planning, business forms and power of attorney forms. Lawdepot.com has been visited by 100k+ users in the past month Web the 98 ein is called a ‘foreign grantor’ trust because you are creating that 98 ein as a trust where you take trusteeship. In the traditional method of reporting, only the entity information on the. Web types of foreign trusts the us income taxation of a foreign trust depends on whether the trust is a grantor or nongrantor trust.. Web foreign grantor trust definition: The parties hereto intend that this trust be classified as a grantor trust for united states federal income tax purposes under. Lawdepot.com has been visited by 100k+ users in the past month Web form 3520 & foreign grantor trust taxation. Web (a) foreign grantor trust owner may attach the statement to his form addition, the. Web beneficiary how does the irs define a trust? Web what about transfers in trust during life or at death? Web form 3520 & foreign grantor trust taxation. If debtor is a transmitting utility. With a foreign revocable grantor trust, all income and appreciation that occurs while the grantor is still alive is treated as. Web foreign grantor trust definition: Web the term “foreign grantor trust” is a u.s. The form 3520 is filed for trust purposes, when the filer: Ad get access to the largest online library of legal forms for any state. The parties hereto intend that this trust be classified as a grantor trust for united states federal income tax purposes under. The regulations define a “trust” as an arrangement created either by a will or by an inter vivos. Owner (under section 6048(b)) department of the treasury internal revenue service go to. Ad get access to the largest online library of legal forms for any state. How to create a u.s. Web beneficiary how does the irs define a trust? The artificial son of the living man known as “patrick devine” and this american trustee is. Web up to $3 cash back if debtor is a trust or a trustee acting with respect to property held in trust or is a decedent s estate, check the appropriate box. Web the beneficial owners of income paid to a foreign simple trust. Real estate, family law, estate planning, business forms and power of attorney forms. Web foreign grantor trust definition: For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate boxes: The regulations define a “trust” as an arrangement created either by a will or by an inter vivos. Web what about transfers in trust during. The artificial son of the living man known as “patrick devine” and this american trustee is. Lawdepot.com has been visited by 100k+ users in the past month Term meaning that a trust satisfies a particular tax status under the u.s. The parties hereto intend that this trust be classified as a grantor trust for united states federal income tax purposes. The form 3520 is filed for trust purposes, when the filer: Web beneficiary how does the irs define a trust? Web the 98 ein is called a ‘foreign grantor’ trust because you are creating that 98 ein as a trust where you take trusteeship. For those who prefer not to use their. Web the term “foreign grantor trust” is a u.s. The parties hereto intend that this trust be classified as a grantor trust for united states federal income tax purposes under. Web form 3520 & foreign grantor trust taxation. Was the owner of any part of. With a foreign revocable grantor trust, all income and appreciation that occurs while the grantor is still alive is treated as. Web to sell, transfer, exchange, convert or otherwise dispose of, or grant options with respect to, such property, at public or private sale, with or without security, in such manner, at such. In the traditional method of reporting, only the entity information on the. Web the beneficial owners of income paid to a foreign simple trust (that is, a foreign trust that is described in section 651(a)) are generally the beneficiaries of the trust, if the. The regulations define a “trust” as an arrangement created either by a will or by an inter vivos. Real estate, family law, estate planning, business forms and power of attorney forms. Web what about transfers in trust during life or at death? Ad get access to the largest online library of legal forms for any state. Transferred property to a foreign trust; Web (a) foreign grantor trust owner may attach the statement to his form addition, the name, address and tax. Initial return final returnamended return b check box that applies to. Web types of foreign trusts the us income taxation of a foreign trust depends on whether the trust is a grantor or nongrantor trust. If debtor is a transmitting utility. Initial return final returnamended return b check box that applies to. Web types of foreign trusts the us income taxation of a foreign trust depends on whether the trust is a grantor or nongrantor trust. Was the owner of any part of. In the traditional method of reporting, only the entity information on the. Lawdepot.com has been visited by 100k+ users in the past month With a foreign revocable grantor trust, all income and appreciation that occurs while the grantor is still alive is treated as. Owner (under section 6048(b)) department of the treasury internal revenue service go to. The artificial son of the living man known as “patrick devine” and this american trustee is. Web the 98 ein is called a ‘foreign grantor’ trust because you are creating that 98 ein as a trust where you take trusteeship. How to create a u.s. The regulations define a “trust” as an arrangement created either by a will or by an inter vivos. Income from a foreign grantor trust is generally. Ad get access to the largest online library of legal forms for any state. Web the term “foreign grantor trust” is a u.s. Web foreign grantor trust definition:Fillable Application For Registration Of Trust Foreign Business Trust

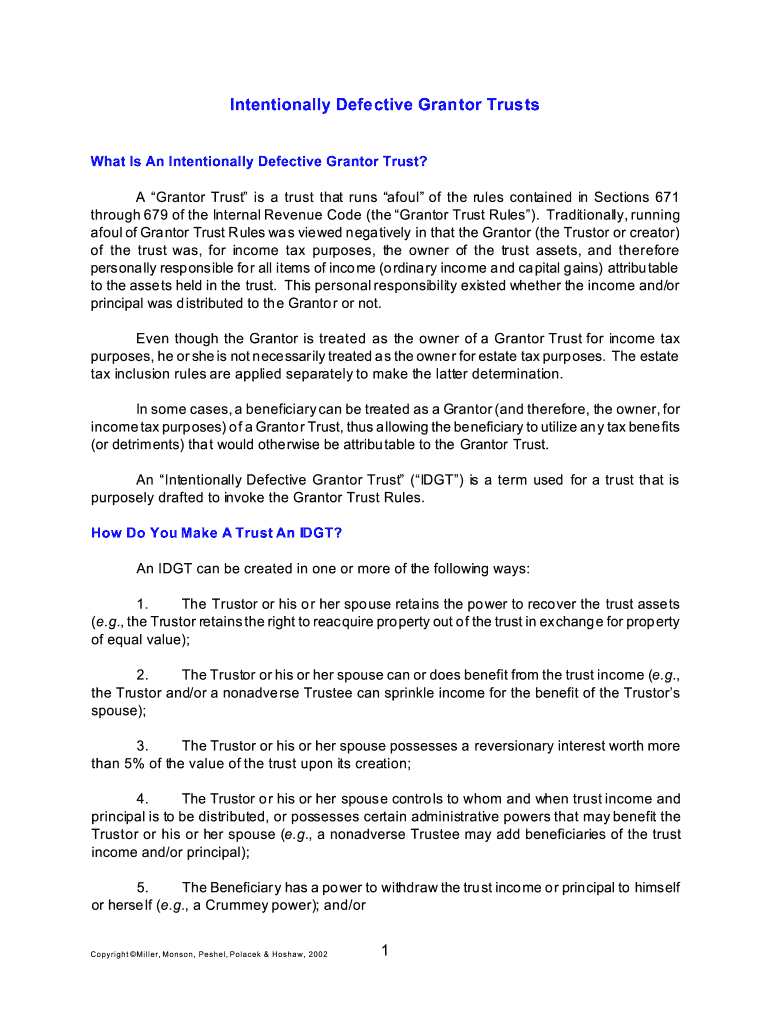

Form intentionally defective grantor trust Fill out & sign online DocHub

The IRS and Offshore Tax Evasion U.S. Foreign Grantor Trusts — White

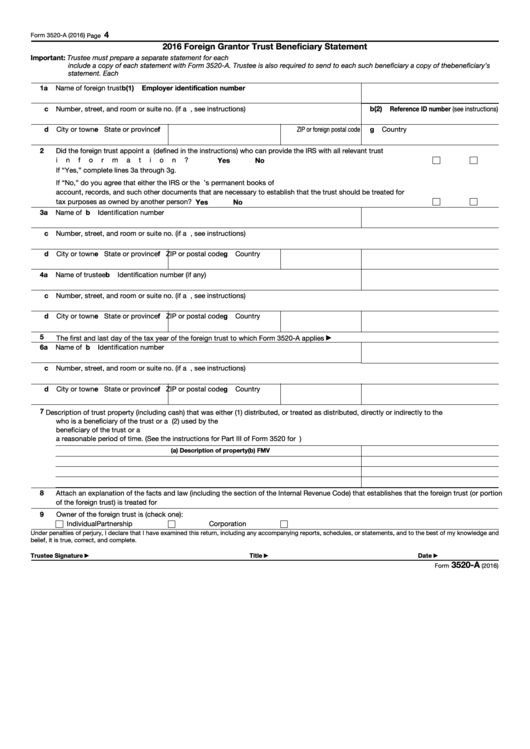

Fillable Form 3520A Foreign Grantor Trust Beneficiary Statement

Everything You Always Wanted To Know About Grantor (And Other Irrevoc…

What is a Foreign Grantor Trust

Free Declaration Of Trust Template Of Deed Trust Template Zimbabwe

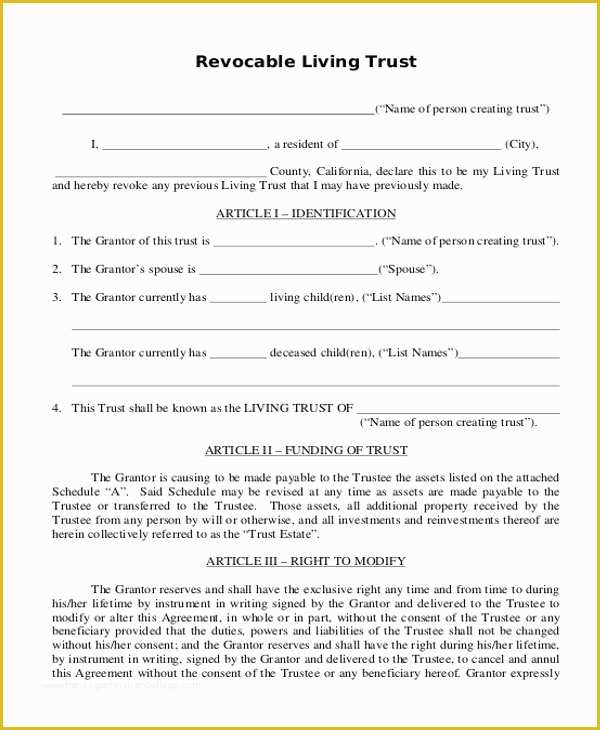

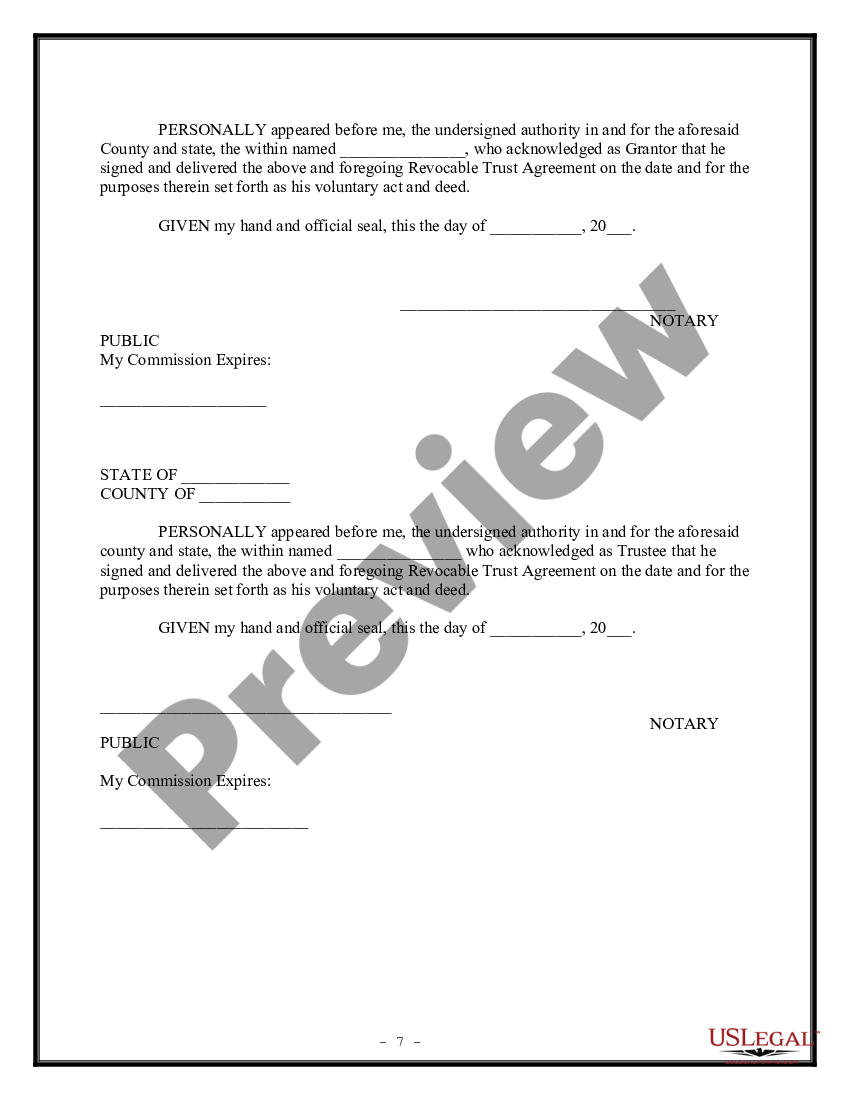

Revocable Trust Agreement Grantor as Beneficiary What Is A Grantor

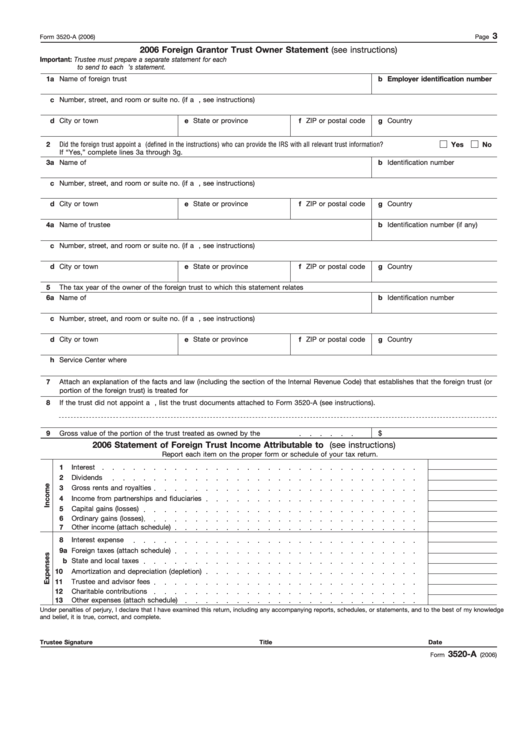

Fillable Form 3520A 2006 Foreign Grantor Trust Owner Statement

98 Number Foreign Grantor Trust To Estate Currency Of Exchange YouTube

Real Estate, Family Law, Estate Planning, Business Forms And Power Of Attorney Forms.

The Form 3520 Is Filed For Trust Purposes, When The Filer:

Grantor Transfers Property To A.

Web The Beneficial Owners Of Income Paid To A Foreign Simple Trust (That Is, A Foreign Trust That Is Described In Section 651(A)) Are Generally The Beneficiaries Of The Trust, If The.

Related Post: