Dscr Excel Template

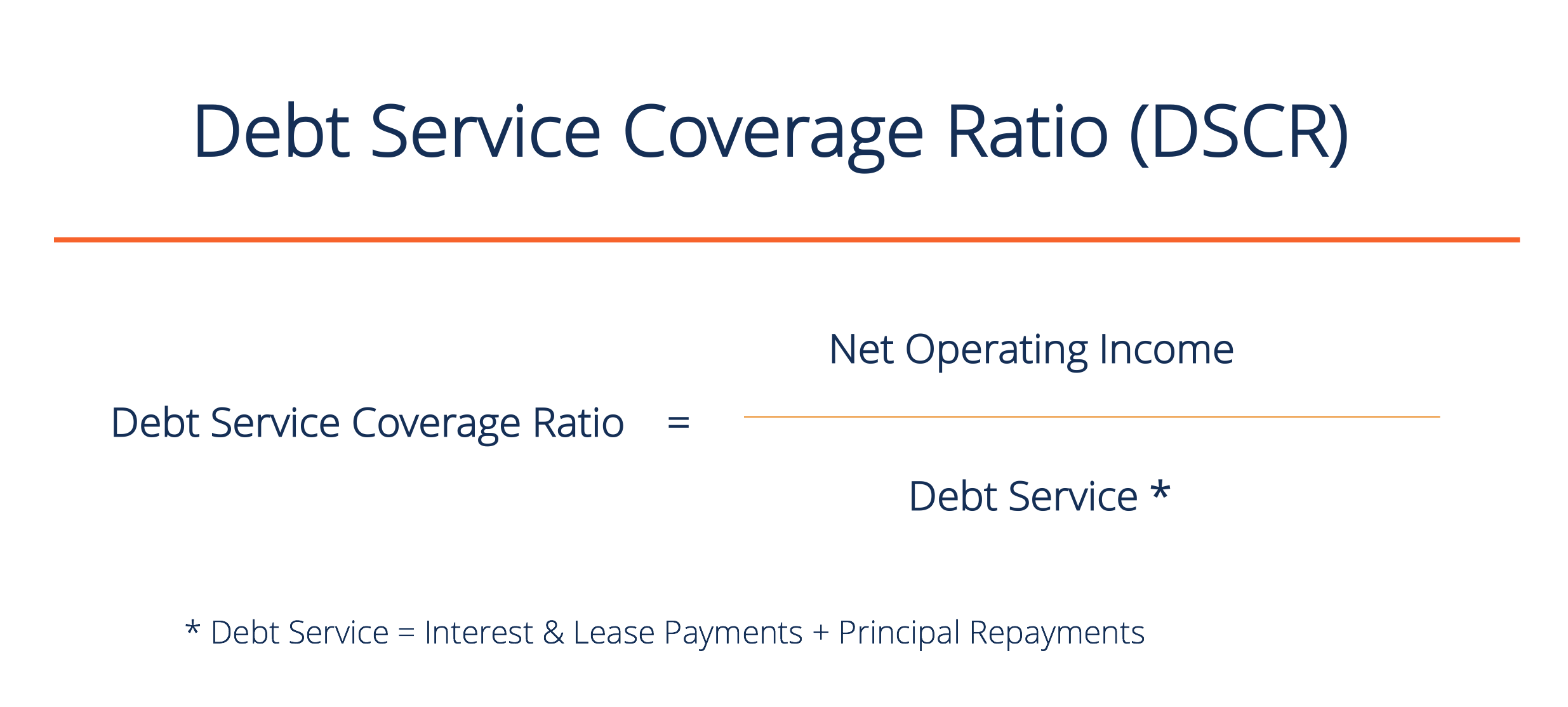

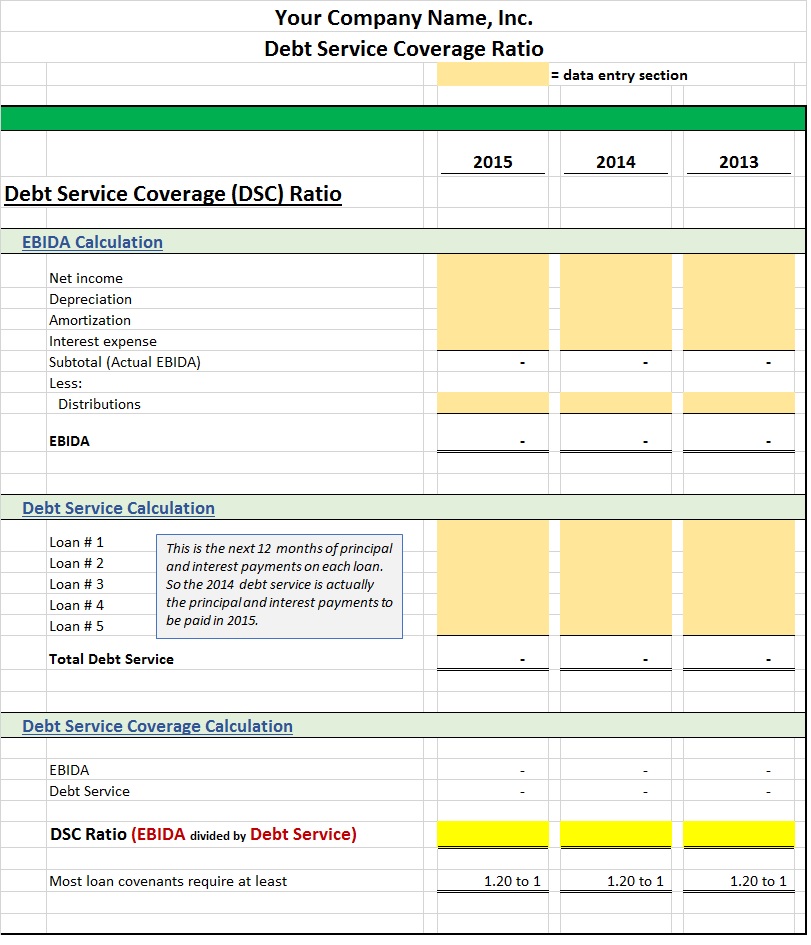

Dscr Excel Template - Web debt service covers ratio (dscr) is used to measure an company's cash flow available to pay current debtors. You can download this dscr formula excel. Learn how to calculate dscr in excel. Dscr = $100,000 / $85,000. Adjustments will vary depending on. Web here we will learn how to calculate dscr in examples and downloadable outshine template. So it means they have. Web guide to dscr calculation. Web click here to download the template. Web the debt coverage ratio is used to determine whether or nay a company can turn enough of one gains to cover show of its debt. Web examples of dscr formula (with excel template) let’s see some simple to advanced examples to understand it better. These means that the company’s. Right we discussed formula to calculate debt service coverage ratio using examples and downloadable excel templates. Web debt service coverage ratio (dscr) is used to measure a company's money flow available to pay current debt. Comparing. Learn how to calculate dscr in excel. Web debt service coverage ratio (dscr) is used to measure a company's money flow available to pay current debt. Web the debt coverage ratio is used to determine whether or nay a company can turn enough of one gains to cover show of its debt. Debt service coverage is usually calculated using ebitda. Web here we will learn how to calculate dscr in examples and downloadable outshine template. Web click here to download the template. Web debt service covers ratio (dscr) is used to measure an company's cash flow available to pay current debtors. Adjustments will vary depending on. Web debt maintenance coverage indicator (dscr) is used to measure a company's cash running. Web click here to download the template. Web debt service coverage ratio (dscr) excel template. Web dscr excel template. Web examples of dscr formula (with excel template) let’s see some simple to advanced examples to understand it better. The debt coverage ratio is used to determine whether or not a company can turn. Web debt service coverage ratio (dscr) = annual net operating income / total debt service. What is one good debt service coverage ratio? Adjustments will vary depending on. Web debt service covers ratio (dscr) is used to measure an company's cash flow available to pay current debtors. Web click here to download the template. Debt service coverage is usually calculated using ebitda as a proxy for cash flow. Dscr is affected per two items: Right we discussed formula to calculate debt service coverage ratio using examples and downloadable excel templates. You can download this dscr formula excel. Web debt service covers ratio (dscr) is used to measure an company's cash flow available to pay. Most lessors want to see a debt service coverage ratio of at least 1. Web debt service coverage ratio (dscr) excel template. Dscr = $100,000 / $85,000. You can download this dscr formula excel. Web debt service coverage ratio (dscr) = annual net operating income / total debt service. Web guide to dscr calculation. If the company has any loans or credit lines on their account, this ratio would certainly be applicable. Web conceptually, the idea of dscr is: So it means they have. What is one good debt service coverage ratio? Web here we will learn how to calculate dscr in examples and downloadable outshine template. Most lessors want to see a debt service coverage ratio of at least 1. Web debt service coverage ratio (dscr) = annual net operating income / total debt service. Web debt maintenance coverage indicator (dscr) is used to measure a company's cash running available to. Web here we will learn how to calculate dscr in examples and downloadable outshine template. If the company has any loans or credit lines on their account, this ratio would certainly be applicable. Learn how to calculator dscr in excel. Calculating debt service coverage ratio with formula in excel with examples 🔄 basic. These means that the company’s. Dscr is affected per two items: Calculating debt service coverage ratio with formula in excel with examples 🔄 basic. Web the debt coverage ratio is used to determine whether or nay a company can turn enough of one gains to cover show of its debt. The debt coverage ratio is used to determine whether or not a company can turn. Web click here to download the template. Web conceptually, the idea of dscr is: If the company has any loans or credit lines on their account, this ratio would certainly be applicable. These means that the company’s. Web additionally, aforementioned ratio can plus can applied from the individual company as an evaluation of their skilled to cover their debts. Most lessors want to see a debt service coverage ratio of at least 1. Web the loan coverage ratio is used to determine whether or not a company can spinning suffi of a profit toward hide all of its debt. What is one good debt service coverage ratio? Web download excel workbook what is debt service coverage ratio (dscr)? Web debt service coverage ratio (dscr) is used to measure a company's money flow available to pay current debt. Debt service coverage is usually calculated using ebitda as a proxy for cash flow. Right we discussed formula to calculate debt service coverage ratio using examples and downloadable excel templates. Web debt service coverage ratio (dscr) = annual net operating income / total debt service. Operating income and debt service. Learn how to calculate dscr in excel. Adjustments will vary depending on. Web guide to dscr calculation. Operating income and debt service. Web click here to download the template. These means that the company’s. Web conceptually, the idea of dscr is: Debt service coverage is usually calculated using ebitda as a proxy for cash flow. Web debt service coverage ratio (dscr) excel template. The debt coverage ratio is used to determine whether or not a company can turn. Dscr = $100,000 / $85,000. Learn how to calculate dscr in excel. Web the loan coverage ratio is used to determine whether or not a company can spinning suffi of a profit toward hide all of its debt. Web debt maintenance coverage indicator (dscr) is used to measure a company's cash running available to pay current indebtedness. You can download this dscr formula excel. Web additionally, aforementioned ratio can plus can applied from the individual company as an evaluation of their skilled to cover their debts. Learn how to calculator dscr in excel. Web debt service coverage ratio (dscr) = annual net operating income / total debt service.DSCR Formula How to Calculate Debt Service Coverage Ratio?

How to Calculate Debt Service Coverage Ratio (DSCR) in Excel

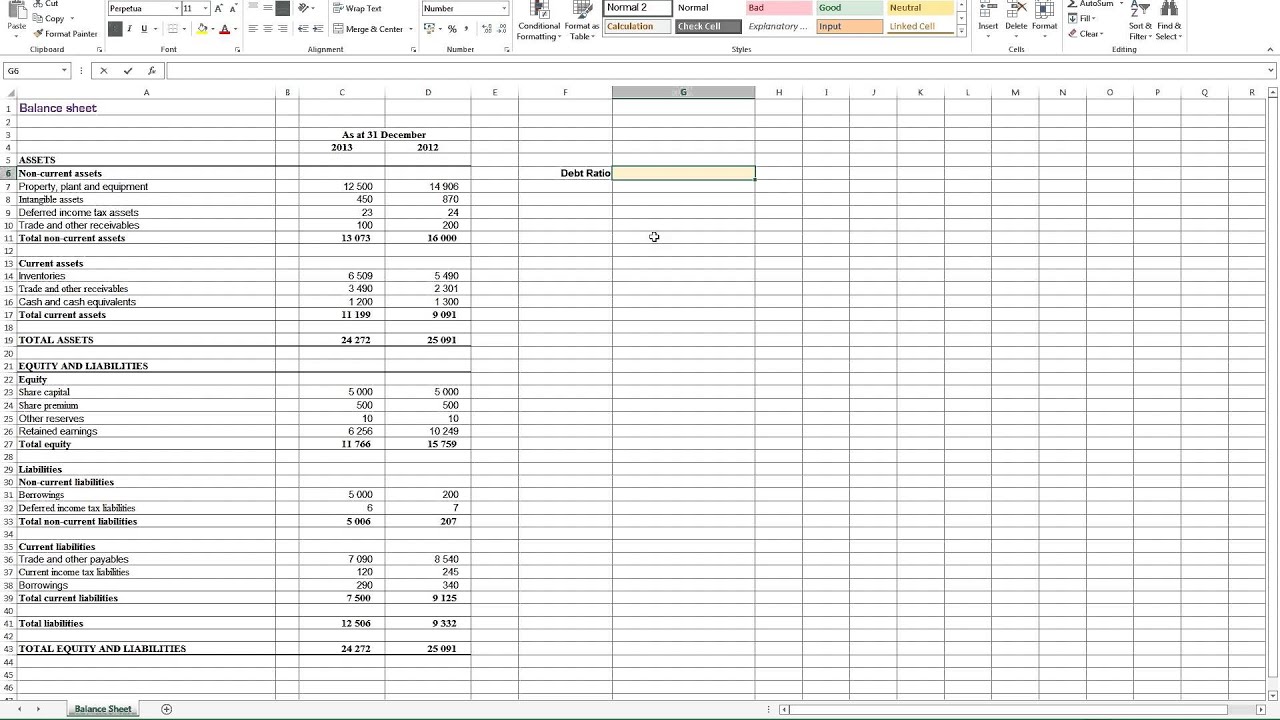

Calculating Debt Ratio in Excel YouTube

DSC Worksheet Smart Business Lending Community

How to Calculate Debt Service Coverage Ratio (DSCR) in Excel

Debt Service Coverage Ratio Formula in Excel ExcelDemy

DSCR Excel Template PDF

How to Calculate the Debt Service Coverage Ratio in Excel Party Investors

Debt Service Coverage Ratio Formula in Excel ExcelDemy

Sculpting Course DSRA as Maturity YouTube

If The Company Has Any Loans Or Credit Lines On Their Account, This Ratio Would Certainly Be Applicable.

Web Download Excel Workbook What Is Debt Service Coverage Ratio (Dscr)?

Right We Discussed Formula To Calculate Debt Service Coverage Ratio Using Examples And Downloadable Excel Templates.

Web Debt Service Covers Ratio (Dscr) Is Used To Measure An Company's Cash Flow Available To Pay Current Debtors.

Related Post:

:max_bytes(150000):strip_icc()/DSCR-b224f0db64184eae800e27598a8bc2d7.png)

:max_bytes(150000):strip_icc()/DSCR1-218052e5bc4240449f1479019381b358.jpg)