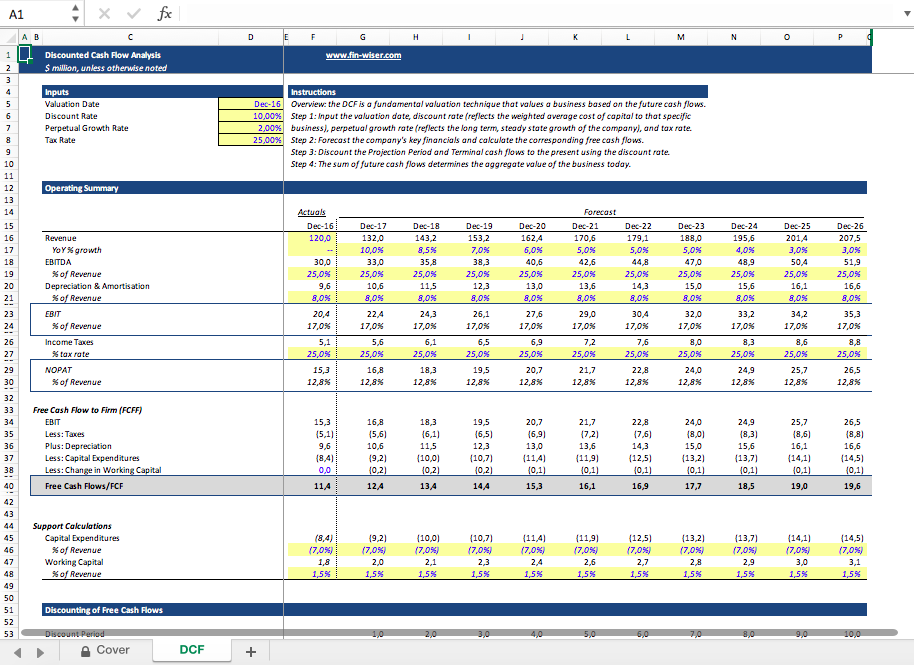

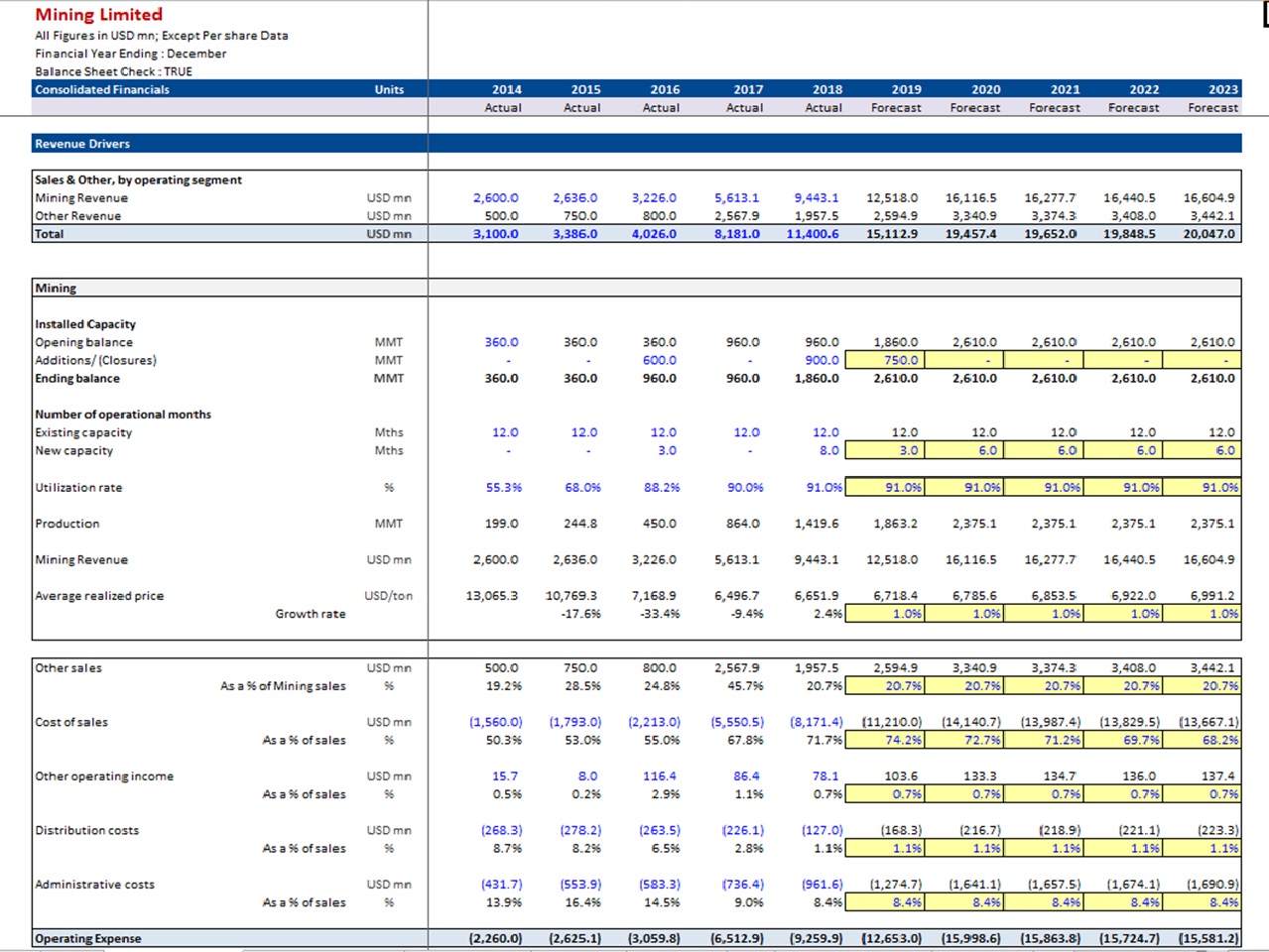

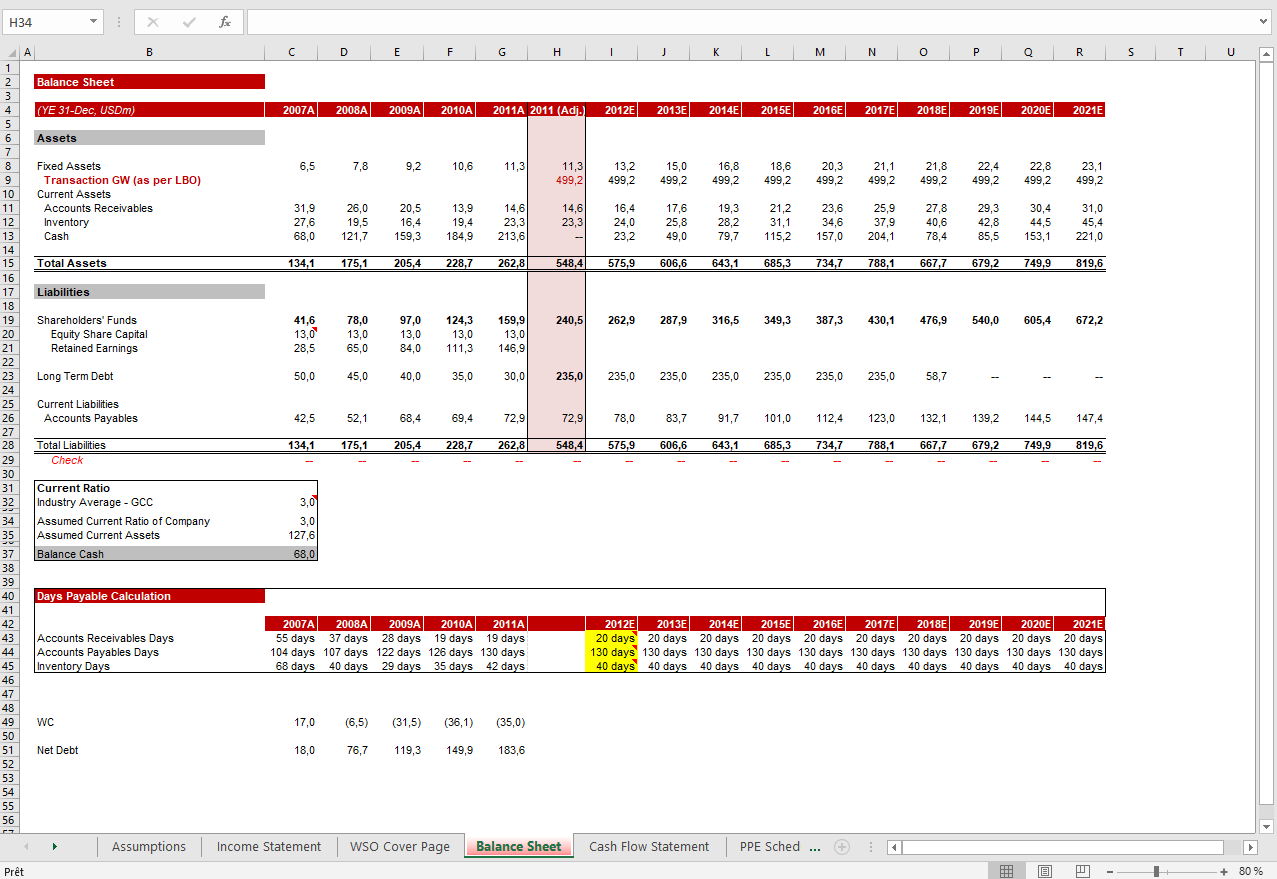

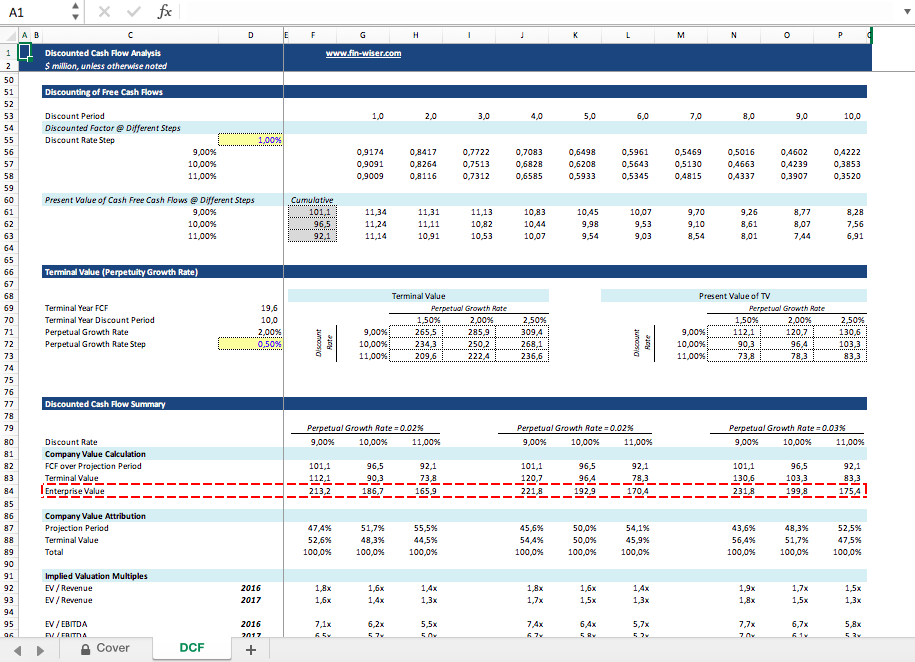

Discounted Cash Flow Template

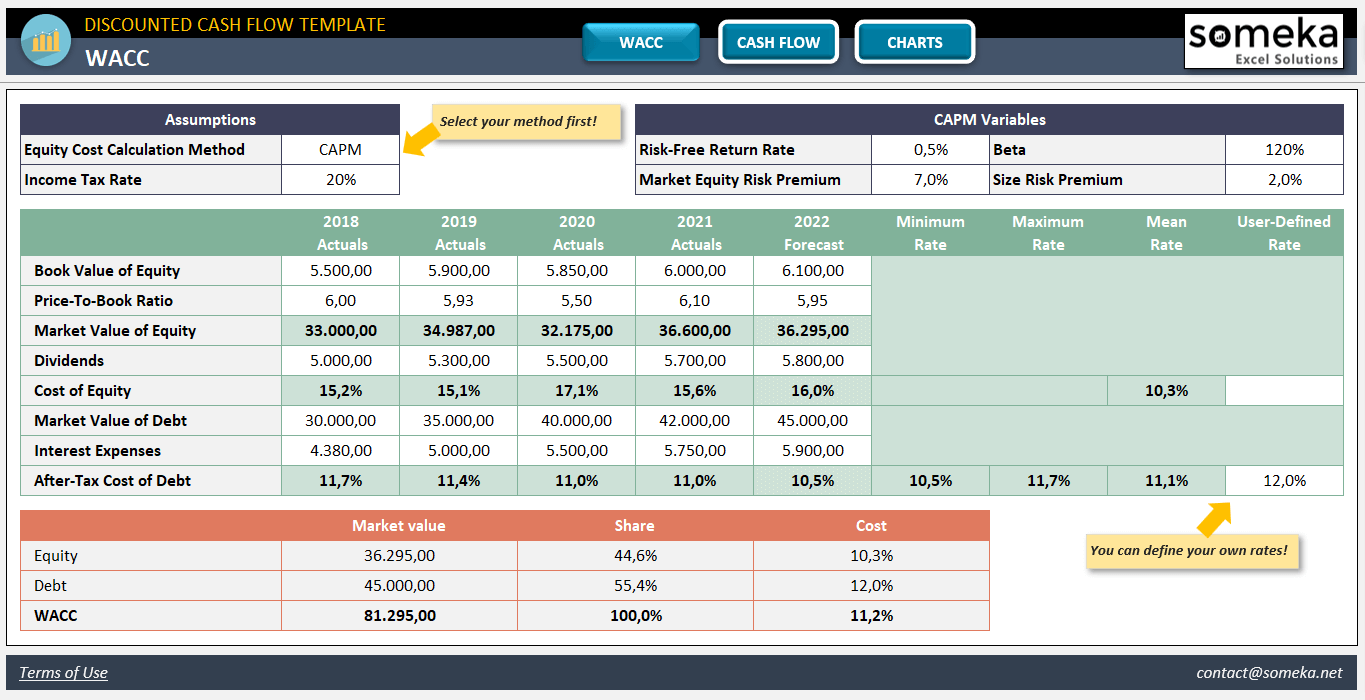

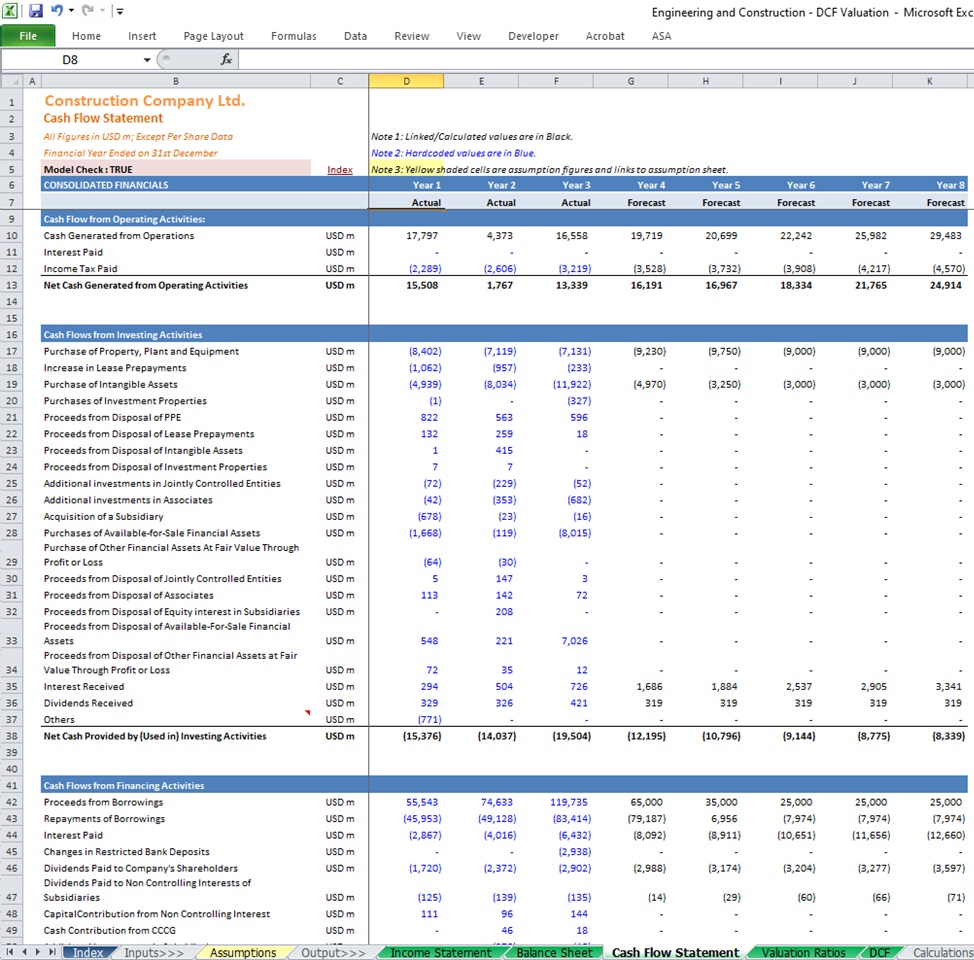

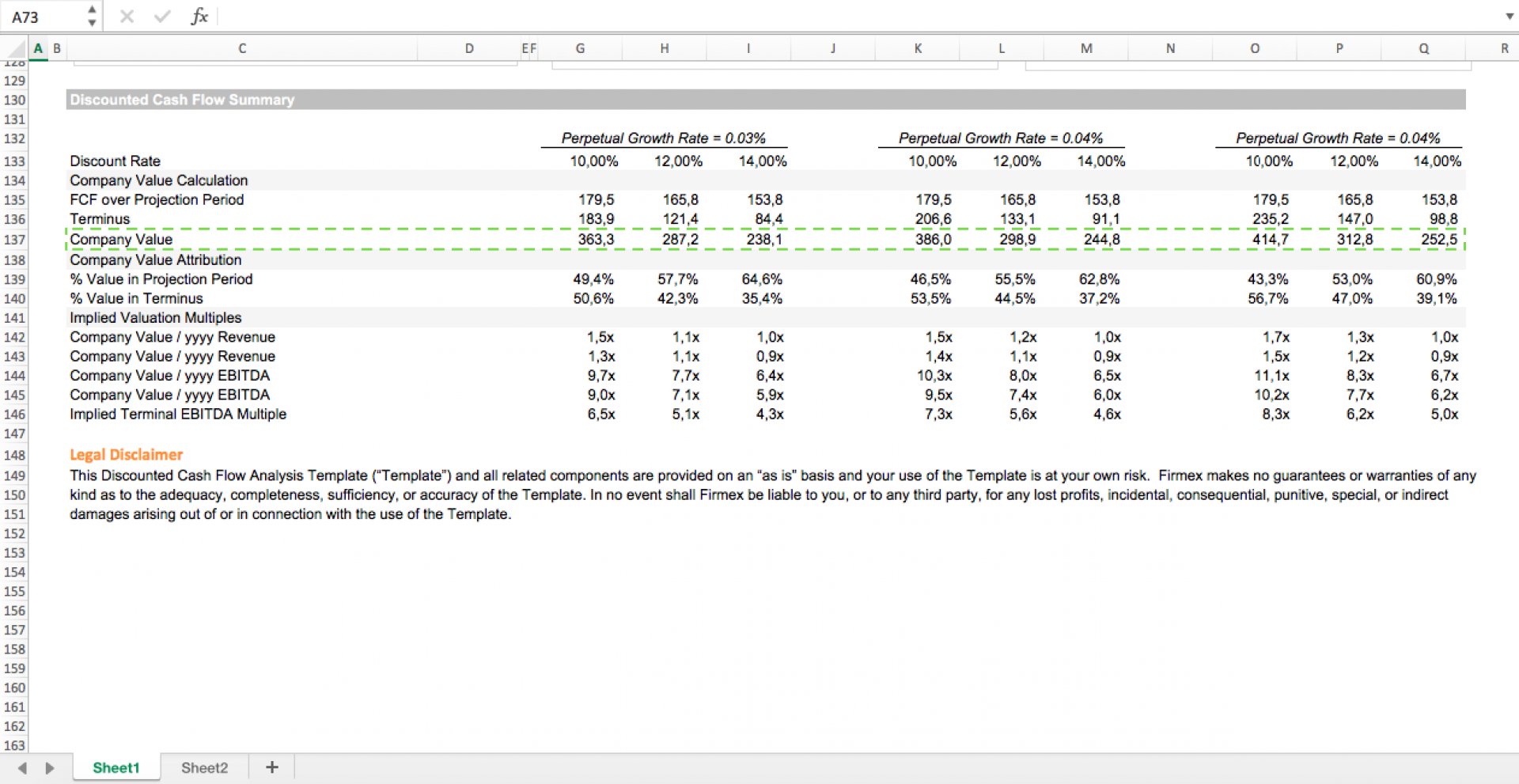

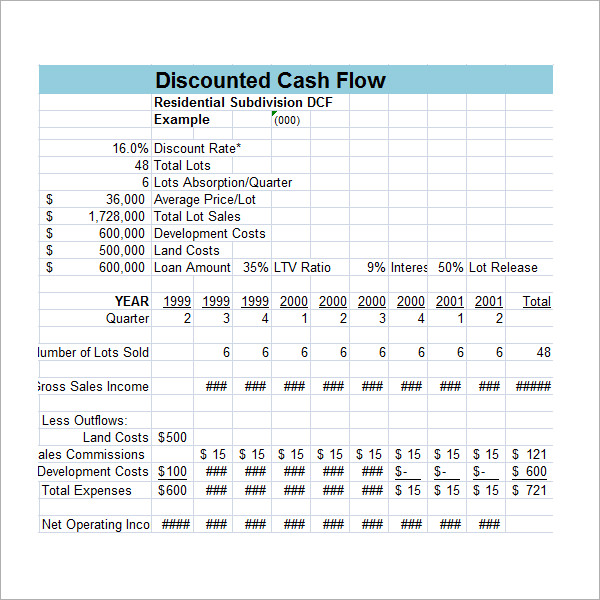

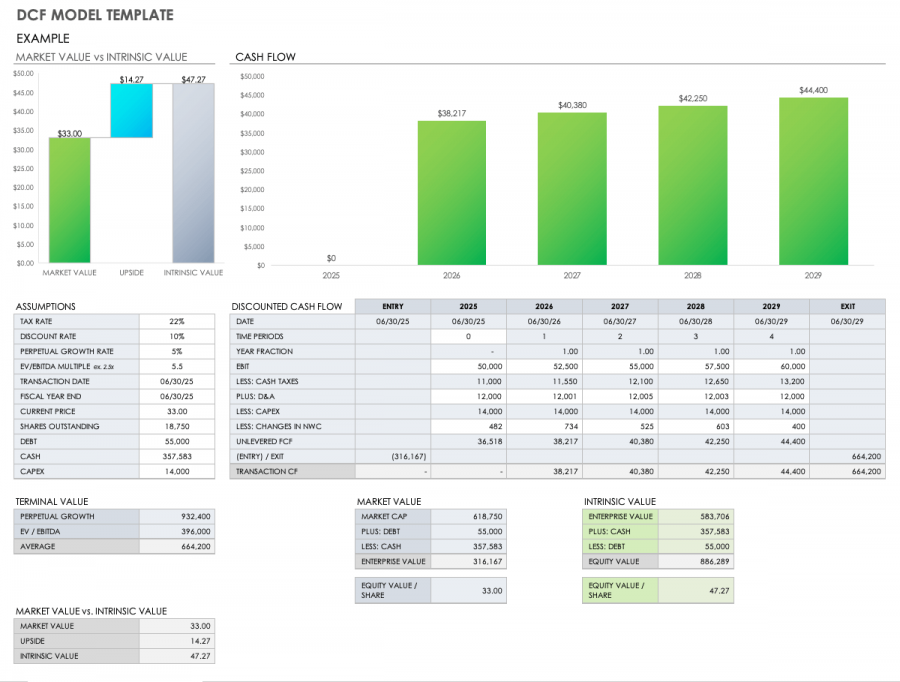

Discounted Cash Flow Template - Cfi = cash flow in the period i, so. Web the discounted cash flow (dcf) method is one of the three main methods for calculating a company’s value. Web a discounted cash flow model is one of the primary valuation methods used by finance professionals to derive a company's fair value. Web on this page, you’ll find the following: Web dcf stands for discounted cash flow, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is. Web ppl corporation (ppl) dcf excel template main parts of the financial model: Web the dcf formula is given as follows: Tips for doing a discounted cash flow analysis; Download wso's free discounted cash flow (dcf) model template below! Dcf = (cf1 / (1 + r)^1) + (cf2 / (1 + r)^2) +. The discounted cash flow formula; Download wso's free discounted cash flow (dcf) model template below! Dcf = (cf1 / (1 + r)^1) + (cf2 / (1 + r)^2) +. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn. Web this video opens with an explanation of the objective of a. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of. Web discounted cash flow (dcf) is an analysis method used to value investment by discounting the estimated future cash flows. The discounted cash flow (dcf) analysis represents. + cfn / (1 + r)^n) + tv / (1+r)^n where: Where, dcf = discounted cash flow. Web ppl corporation (ppl) dcf excel template main parts of the financial model: Dcf = cf1/ (1+r)1 + cf2/ (1+r)2 +. This template allows you to build your own discounted cash flow. Where, cf = cash flow in year. It’s also used for calculating a company’s share price, the value of. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of. Web dcf stands for discounted cash flow, so. Web a discounted cash flow model is one of the primary valuation methods used by finance professionals to derive a company's fair value. It’s also used for calculating a company’s share price, the value of. Web discounted cash flow (dcf) is an analysis method used to value investment by discounting the estimated future cash flows. Now that we know the. It’s also used for calculating a company’s share price, the value of. The discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all providers. This discount factor template helps you calculate the amount of discounted cash flows using explicit discount factors. Web january 31, 2022. Web dcf stands for discounted cash flow,. The discounted cash flow formula; This template allows you to build your own discounted cash flow. Dcf = cf1/ (1+r)1 + cf2/ (1+r)2 +. Web discounted cash flow formula example. Where, dcf = discounted cash flow. Cfi = cash flow in the period i, so. The model is completely flexible, so that when you put in the. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn. The dcf formula allows you to determine the. Web discounted cash flow formula example. Web on this page, you’ll find the following: It’s also used for calculating a company’s share price, the value of. Web a discounted cash flow model is one of the primary valuation methods used by finance professionals to derive a company's fair value. Web discounted cash flow formula example. Let’s say you look at your. Let’s say you look at your. Web discounted cash flow formula example. The model is completely flexible, so that when you put in the. Web dcf stands for discounted cash flow, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is. In dcf analysis, essentially what you are. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn. Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. The discounted cash flow formula; Where, cf = cash flow in year. This discount factor template helps you calculate the amount of discounted cash flows using explicit discount factors. Web the formula for dcf is: The company’s cash flow, cash flow growth rate, and potentially even the discount rate change over 5, 10, 15, or 20+ years, but the. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of. Dcf = (cf1 / (1 + r)^1) + (cf2 / (1 + r)^2) +. Let’s say you look at your. Web period #1 (explicit forecast period): Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Dcf analysis can be applied to value a. Download wso's free discounted cash flow (dcf) model template below! Now that we know the dcf formula, let’s put it into practice with a hypothetical example. Web the dcf formula is: R is the discount rate. Web january 31, 2022. Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash flows. Web the dcf formula is given as follows: The dcf formula allows you to determine the. Web a discounted cash flow model is one of the primary valuation methods used by finance professionals to derive a company's fair value. Cf1 to cfn are the forecasted cash flows. Dcf analysis can be applied to value a. It’s also used for calculating a company’s share price, the value of. Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash flows. Web discount factor template. The model is completely flexible, so that when you put in the. + cfn / (1 + r)^n) + tv / (1+r)^n where: Now that we know the dcf formula, let’s put it into practice with a hypothetical example. The discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all providers. Web discounted cash flow (dcf) is an analysis method used to value investment by discounting the estimated future cash flows. Web dcf stands for discounted cash flow, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is. Tips for doing a discounted cash flow analysis; Web the formula for dcf is: Web discounted cash flow formula example.Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

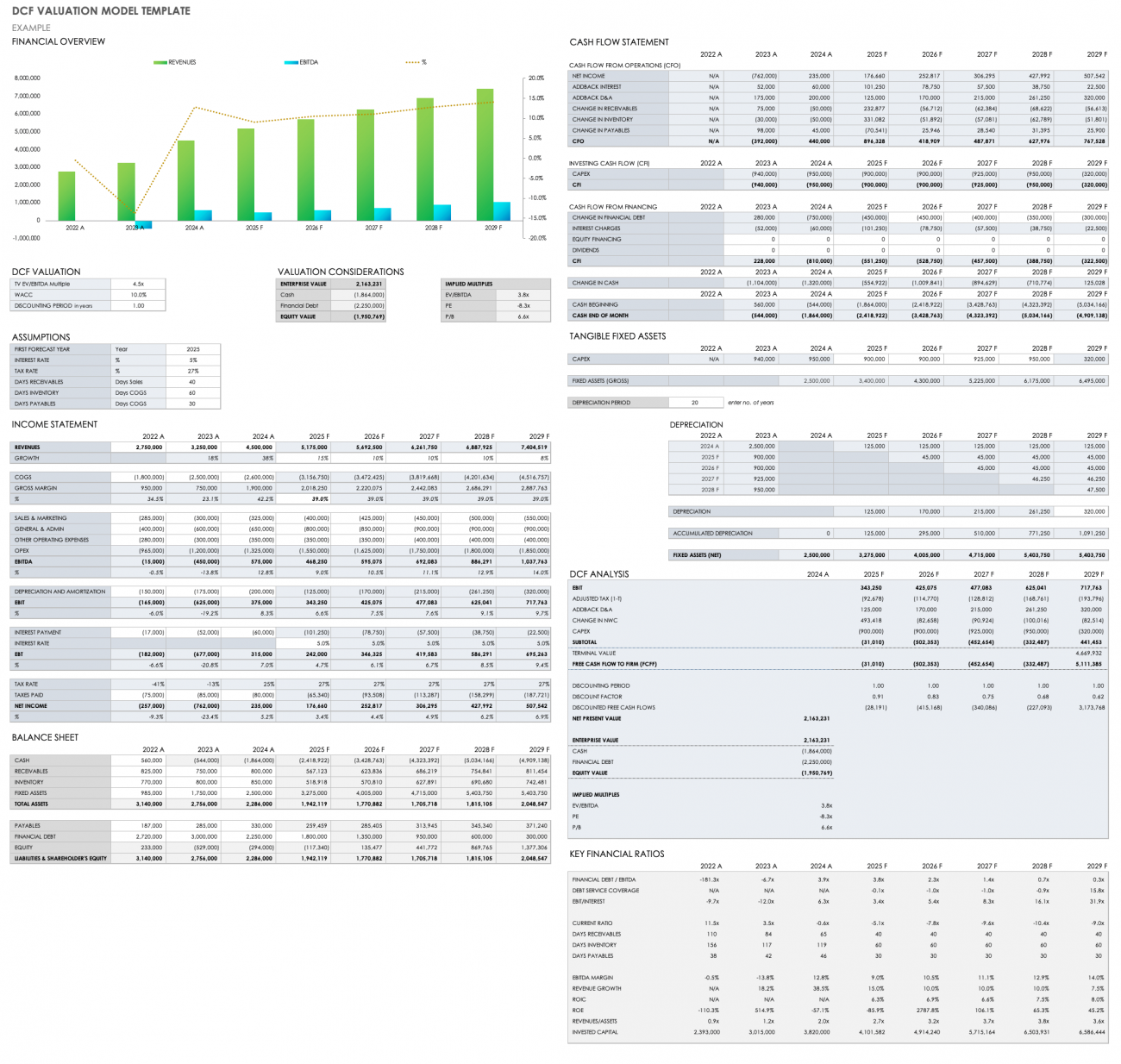

Discounted Cash Flow DCF Valuation Model Template (Mining Company

Discounted Cash Flow (DCF) Excel Model Template Eloquens

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

Discounted Cash Flow Excel Template DCF Valuation Template

xpressbasta Blog

DCF Discounted Cash Flow Model Excel Template Eloquens

Cash Flow Analysis Template 11+ Download Free Documents in PDF, Word

Free Discounted Cash Flow Templates Smartsheet

Free Discounted Cash Flow Templates Smartsheet

Web Ppl Corporation (Ppl) Dcf Excel Template Main Parts Of The Financial Model:

Web Discounted Cash Flow (Dcf) Is A Method Used To Estimate The Value Of An Investment Based On Future Cash Flow.

In Dcf Analysis, Essentially What You Are Doing Is Projecting The Cash Flows Of A.

Web The Dcf Formula Is Given As Follows:

Related Post: