Discounted Cash Flow Excel Template

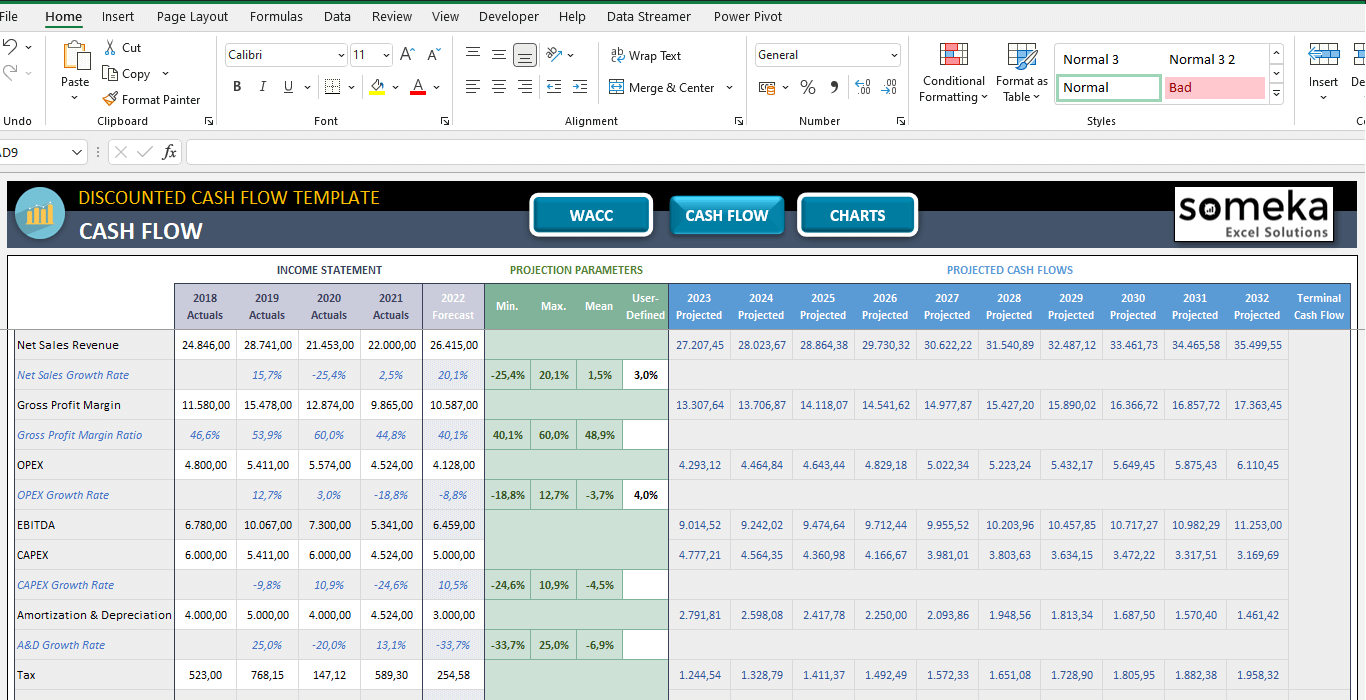

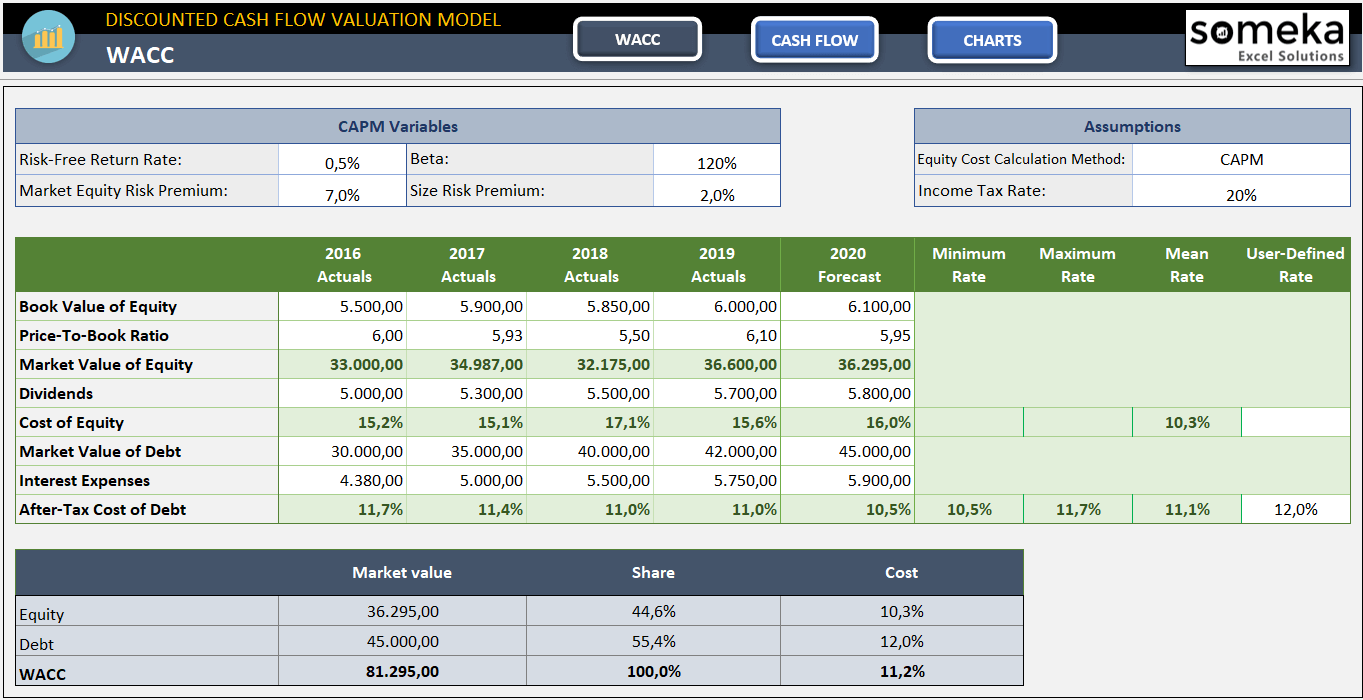

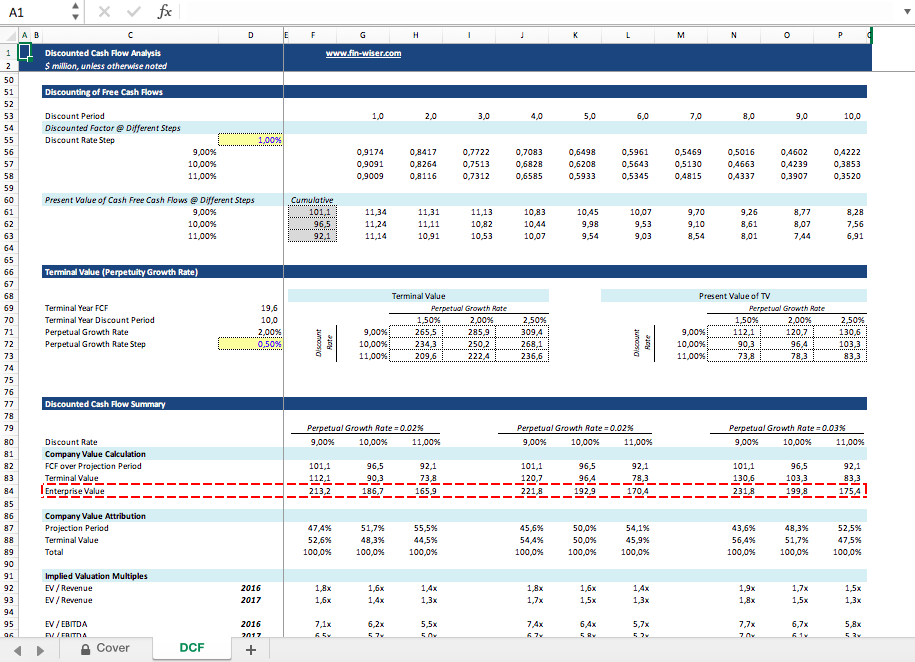

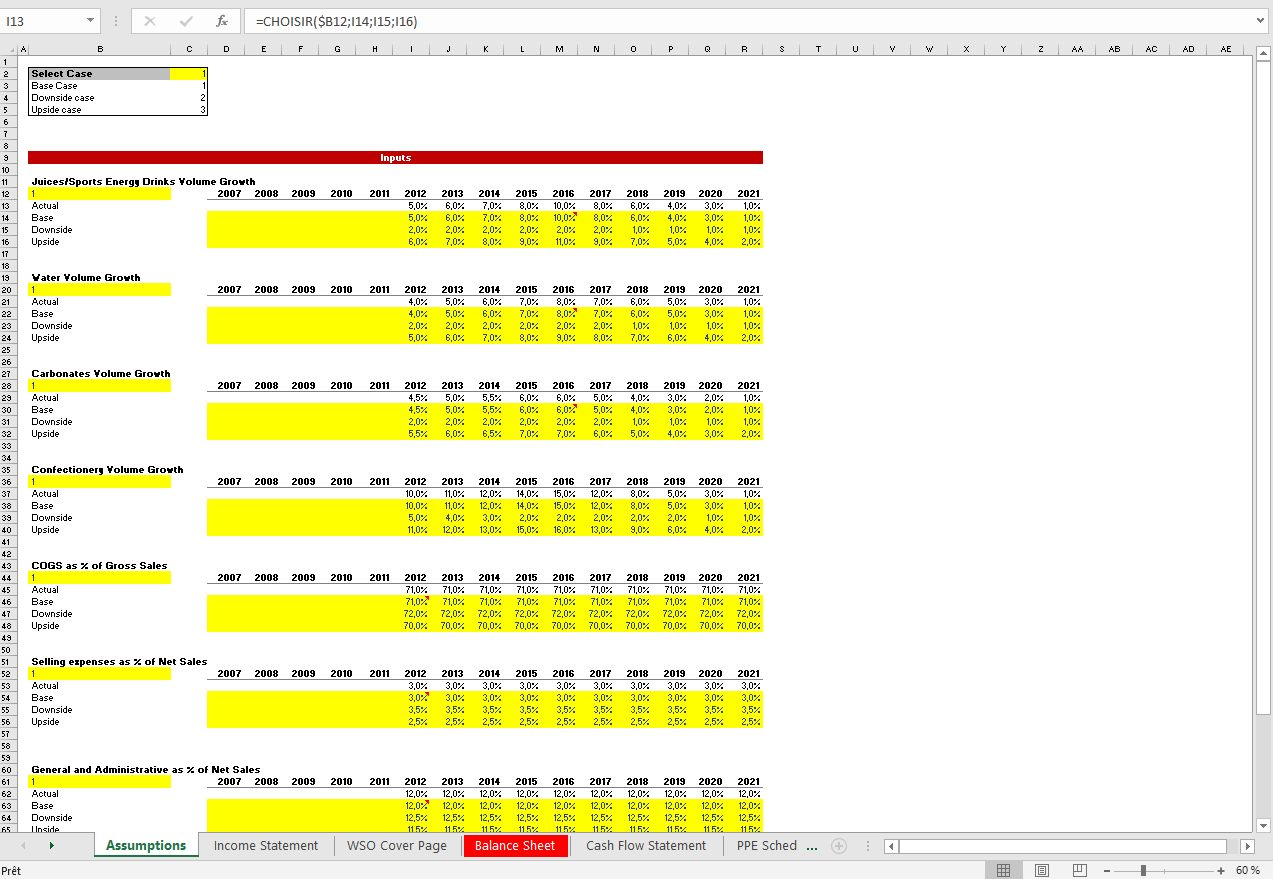

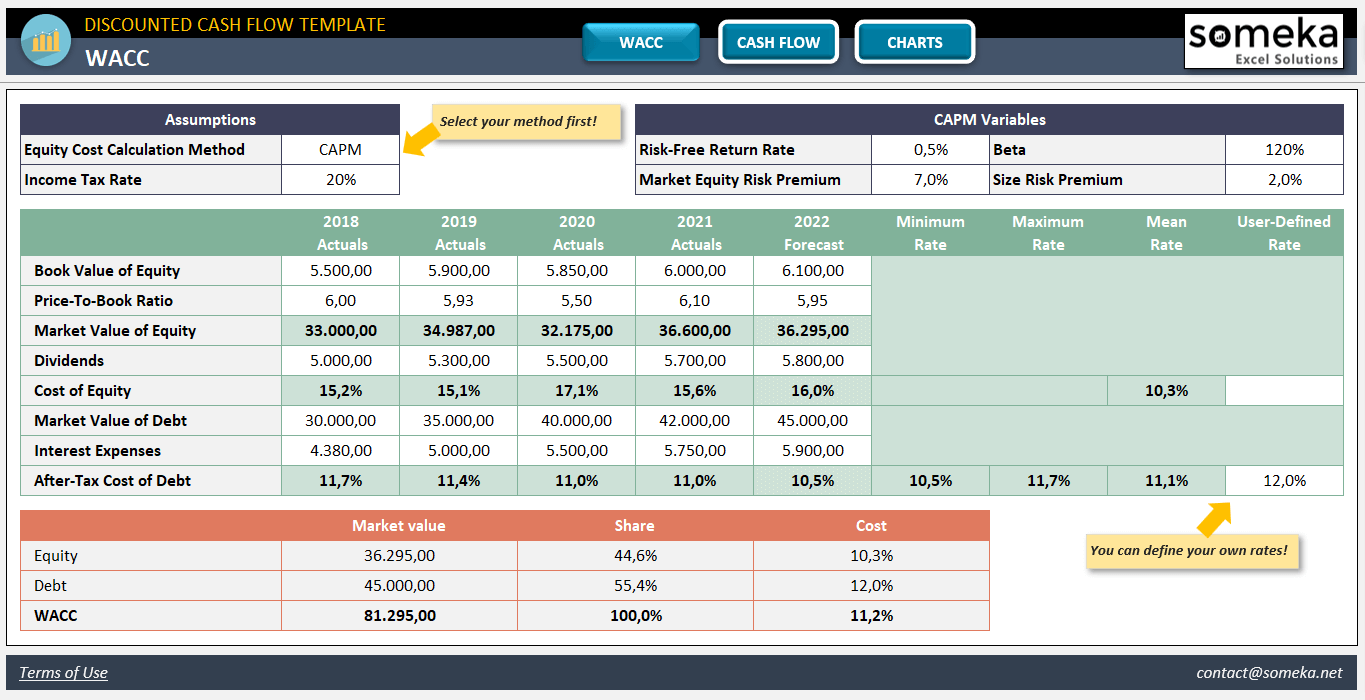

Discounted Cash Flow Excel Template - Net present value (npv) and internal rate of return (irr). The company’s cash flow, cash flow growth rate, and potentially even the discount rate change over 5, 10, 15, or 20+ years, but the. Web the discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive at a. Web download this cash flow calculator template design in excel, google sheets format. Where, cf = cash flow in year. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of. This template allows you to build your own discounted cash flow. Web discounted cash flow (dcf) excel model template. Web the formula for dcf is: 1) view sample cash flow statements & customize. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of. Net present value (npv) and internal rate of return (irr). The purpose of the discounted free cash flow financial model template is to provide the user with. Fast track your financial management efforts. (tcs) dcf excel template main parts of the financial model: 1) view sample cash flow statements & customize. Web period #1 (explicit forecast period): Net present value (npv) and internal rate of return (irr). Web download this cash flow calculator template design in excel, google sheets format. Web period #1 (explicit forecast period): Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. The purpose of the discounted free cash flow financial model template is to provide the user with a. Net present value. Web discounted cash flow model template; Web period #1 (explicit forecast period): Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of. Where, cf = cash flow in year. It computes the perpetuity growth rate. The company’s cash flow, cash flow growth rate, and potentially even the discount rate change over 5, 10, 15, or 20+ years, but the. Web the macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling. Where, cf = cash flow in year. Download wso's free discounted cash flow (dcf) model template below! Web the. Discounted cash flow analysis template; 1) view sample cash flow statements & customize. Both npv and irr are referred. Web the macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling. Download wso's free discounted cash flow (dcf) model template below! (tcs) dcf excel template main parts of the financial model: Web our discounted cash flow template in excel will help you to determine the value of the investment and calculate how much it will be in the future. Web discounted cash flow valuation model: Web download this cash flow calculator template design in excel, google sheets format. Web discounted cash. Assume that we have projected cash flows of $100, $200, $300, $400 and $500 for the next five years, and we want to use a discount rate of. (tcs) dcf excel template main parts of the financial model: Where, cf = cash flow in year. Web there are two financial methods that you can use to help you answer all. It computes the perpetuity growth rate. Web our discounted cash flow template in excel will help you to determine the value of the investment and calculate how much it will be in the future. Fast track your financial management efforts. Web the macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling. (tcs) dcf excel. * dashboard, * income statement, * cash flow, * balance sheet, * wacc. Net present value (npv) and internal rate of return (irr). Get powerful, streamlined insights into your company’s finances. Web the container store group, inc. The dcf formula allows you to determine the. Web discounted cash flow valuation model: 1) view sample cash flow statements & customize. Web here’s an example: Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn. In brief, the time value of. It computes the perpetuity growth rate. Fast track your financial management efforts. Web the container store group, inc. Web our discounted cash flow template in excel will help you to determine the value of the investment and calculate how much it will be in the future. Web january 31, 2022. Discounted cash flow valuation template ; Book a playbook demo to explore — schedule a call with us. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate ( wacc) raised to the power of. Assume that we have projected cash flows of $100, $200, $300, $400 and $500 for the next five years, and we want to use a discount rate of. Net present value (npv) and internal rate of return (irr). Web discounted cash flow model template; Download wso's free discounted cash flow (dcf) model template below! Both npv and irr are referred. Web period #1 (explicit forecast period): The company’s cash flow, cash flow growth rate, and potentially even the discount rate change over 5, 10, 15, or 20+ years, but the. Discounted cash flow analysis template; Web discounted cash flow (dcf) excel model template. This template allows you to build your own discounted cash flow. Web here’s an example: The purpose of the discounted free cash flow financial model template is to provide the user with a. Fast track your financial management efforts. Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. It computes the perpetuity growth rate. (tcs) dcf excel template main parts of the financial model: Download wso's free discounted cash flow (dcf) model template below! In brief, the time value of. Net present value (npv) and internal rate of return (irr). Web january 31, 2022. * dashboard, * income statement, * cash flow, * balance sheet, * wacc. Web there are two financial methods that you can use to help you answer all of these questions:Discounted Cash Flow (DCF) Excel Model Template Eloquens

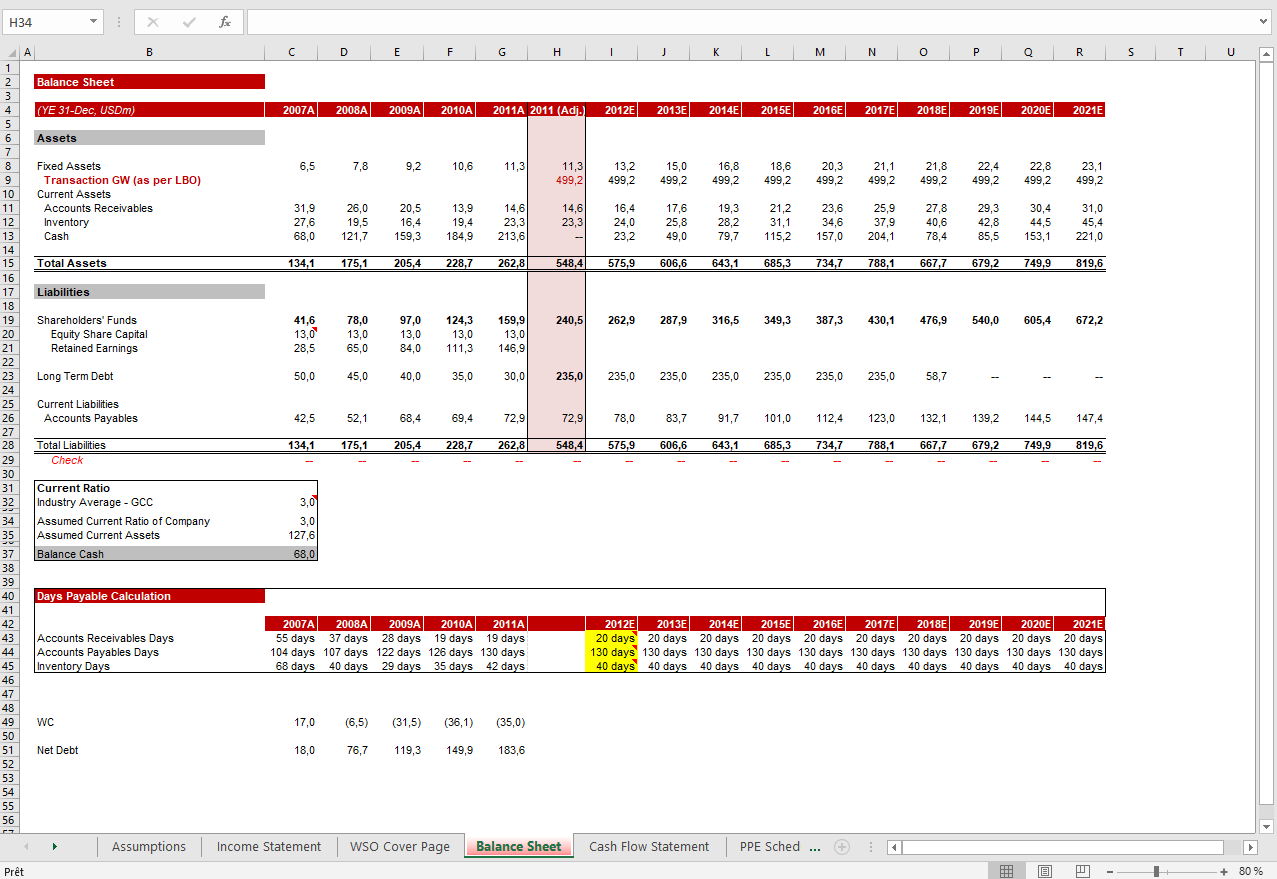

Discounted Cash Flow (DCF) Model Excel Template Eloquens

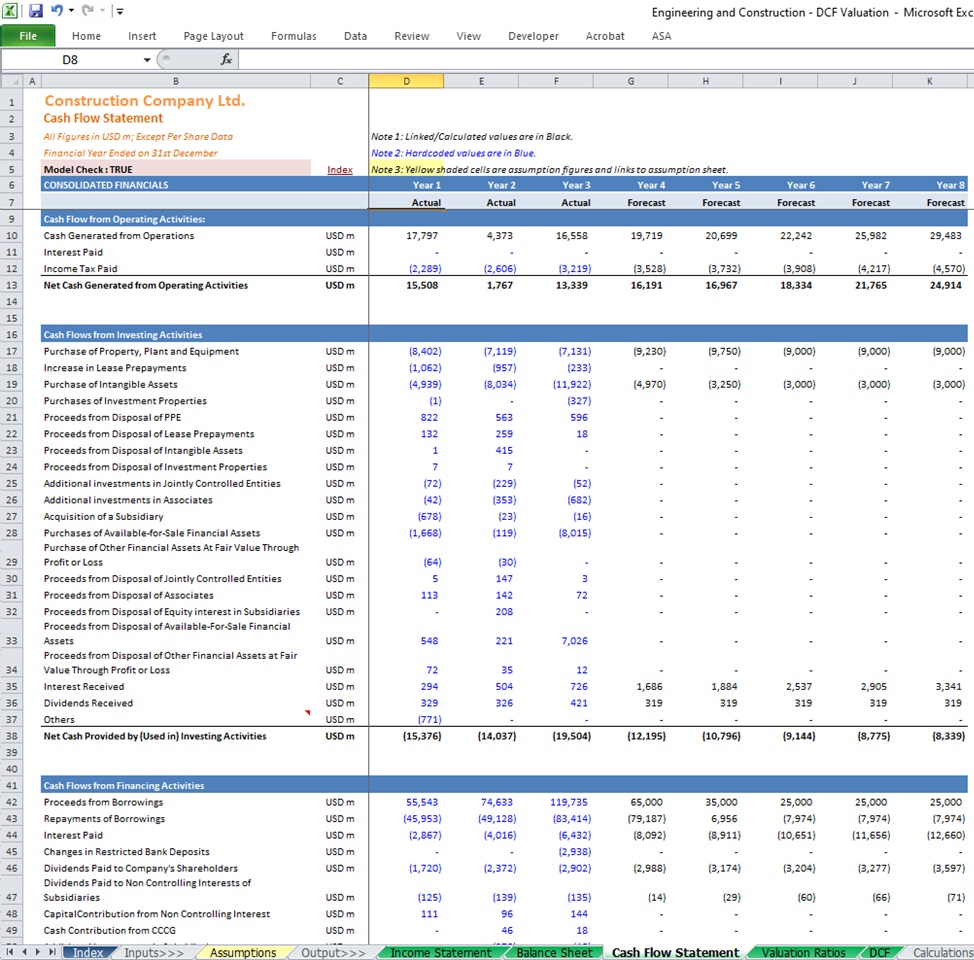

Discounted Cash Flow Excel Template DCF Valuation Template

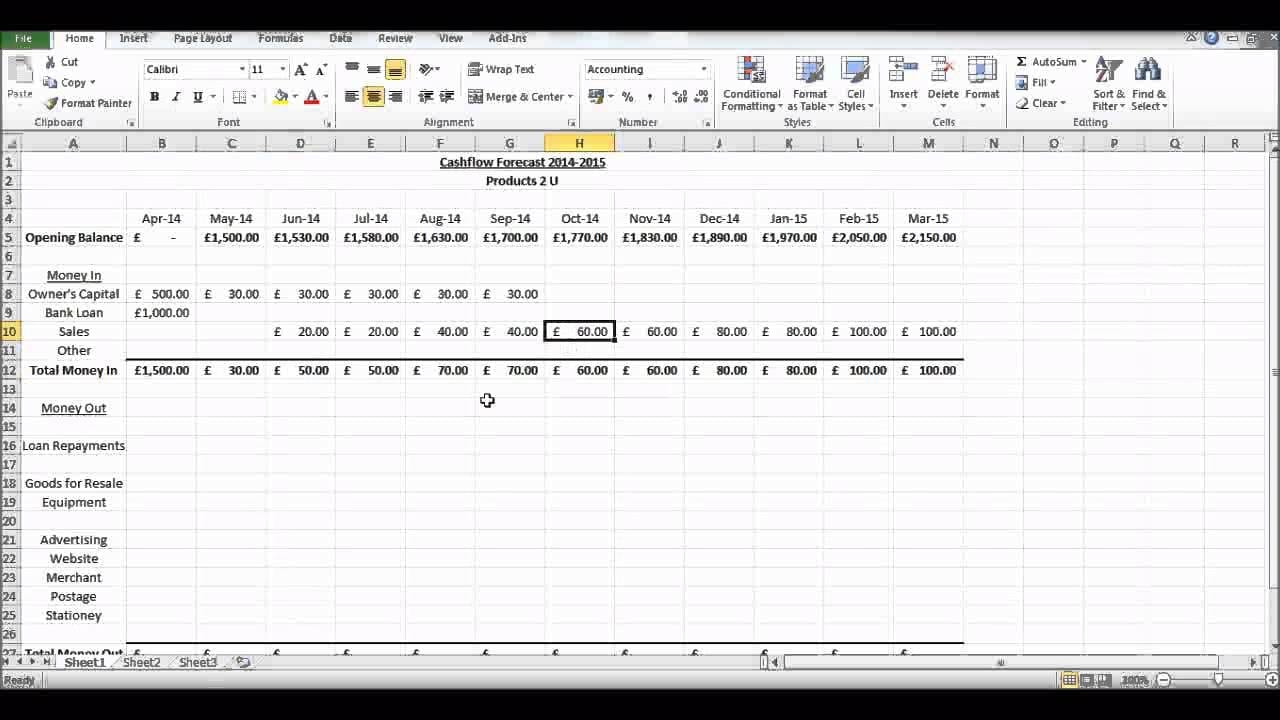

xpressbasta Blog

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

discounted cash flow excel template —

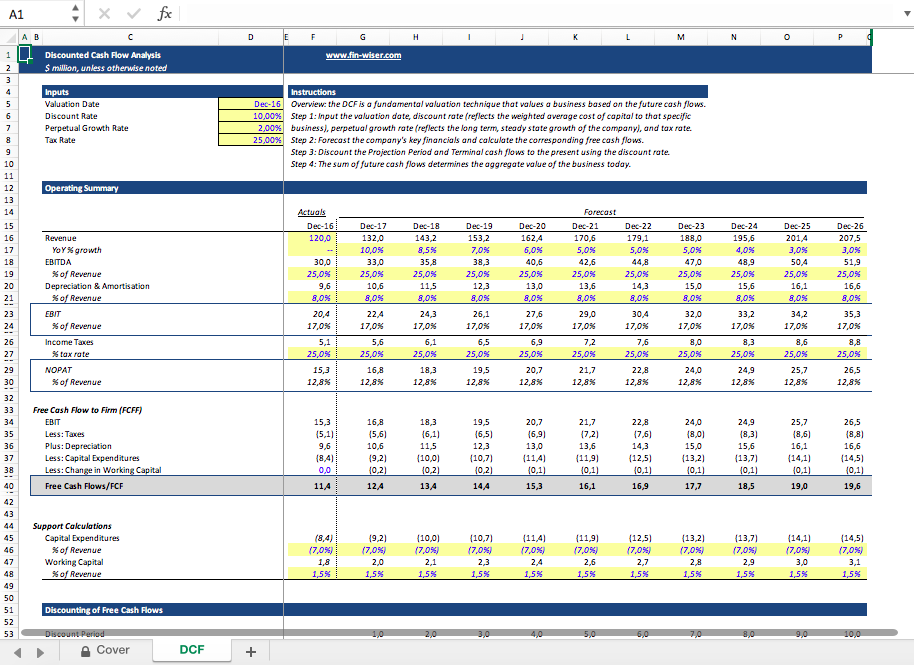

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

Discounted Cash Flow (DCF) Excel Model Template Eloquens

Discounted Cash Flow Excel Template DCF Valuation Template

The Dcf Formula Allows You To Determine The.

Web The Formula For Dcf Is:

Both Npv And Irr Are Referred.

Assume That We Have Projected Cash Flows Of $100, $200, $300, $400 And $500 For The Next Five Years, And We Want To Use A Discount Rate Of.

Related Post: