Depreciation Spreadsheet Template

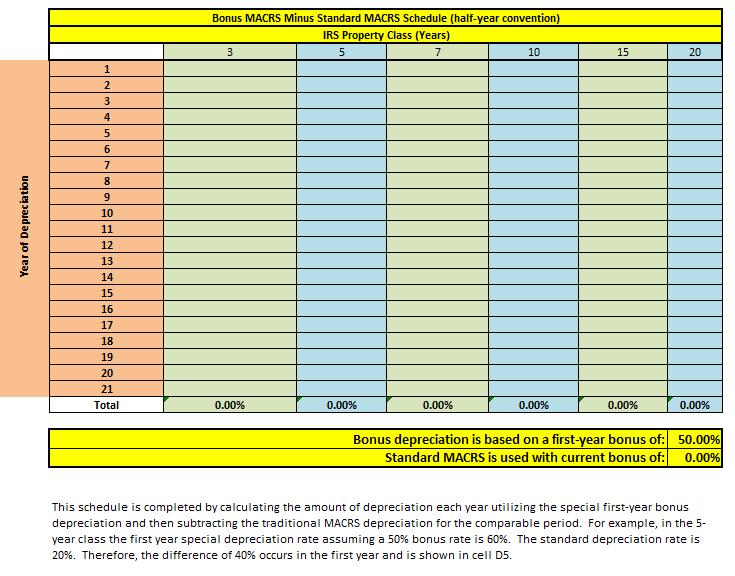

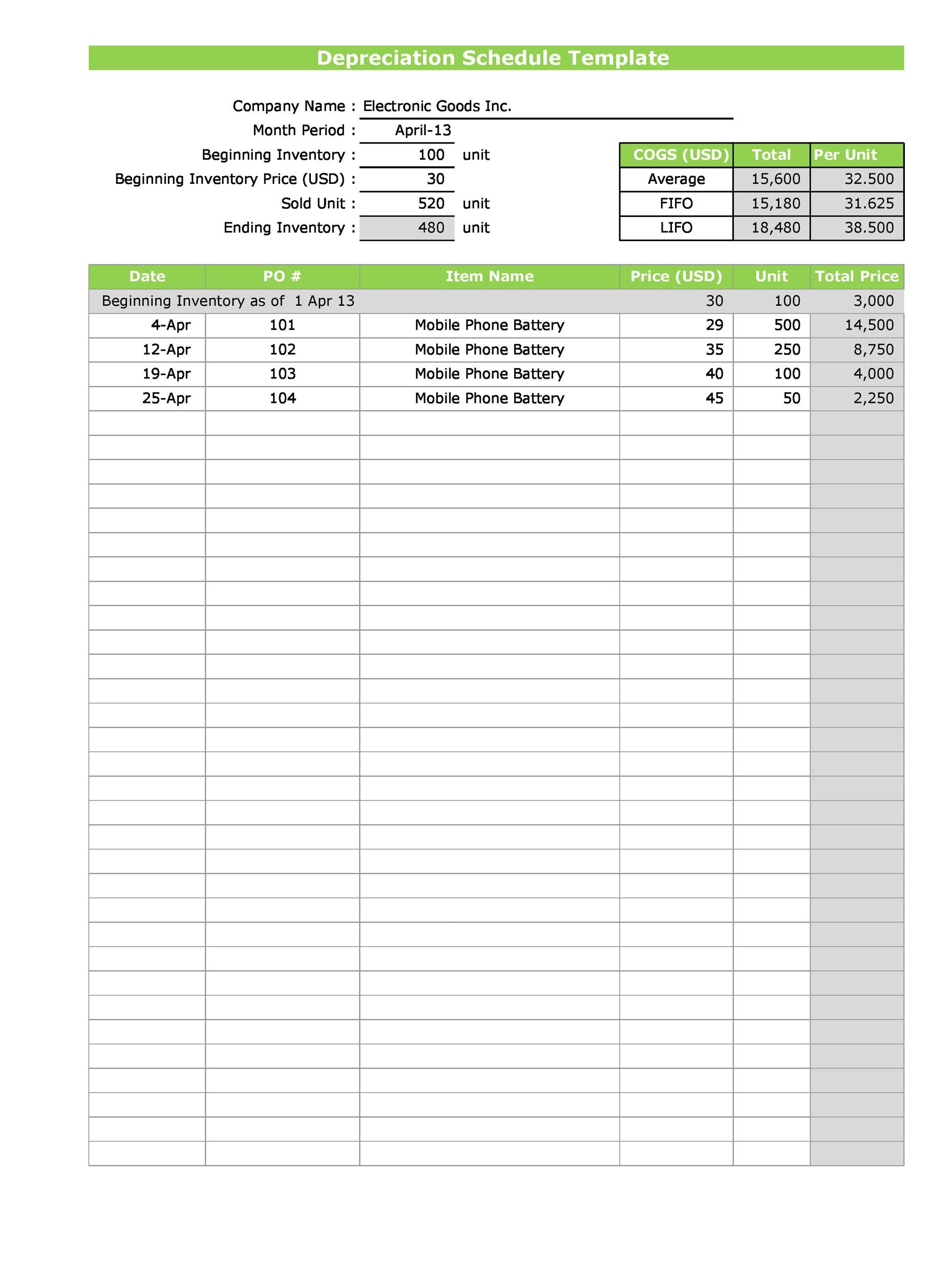

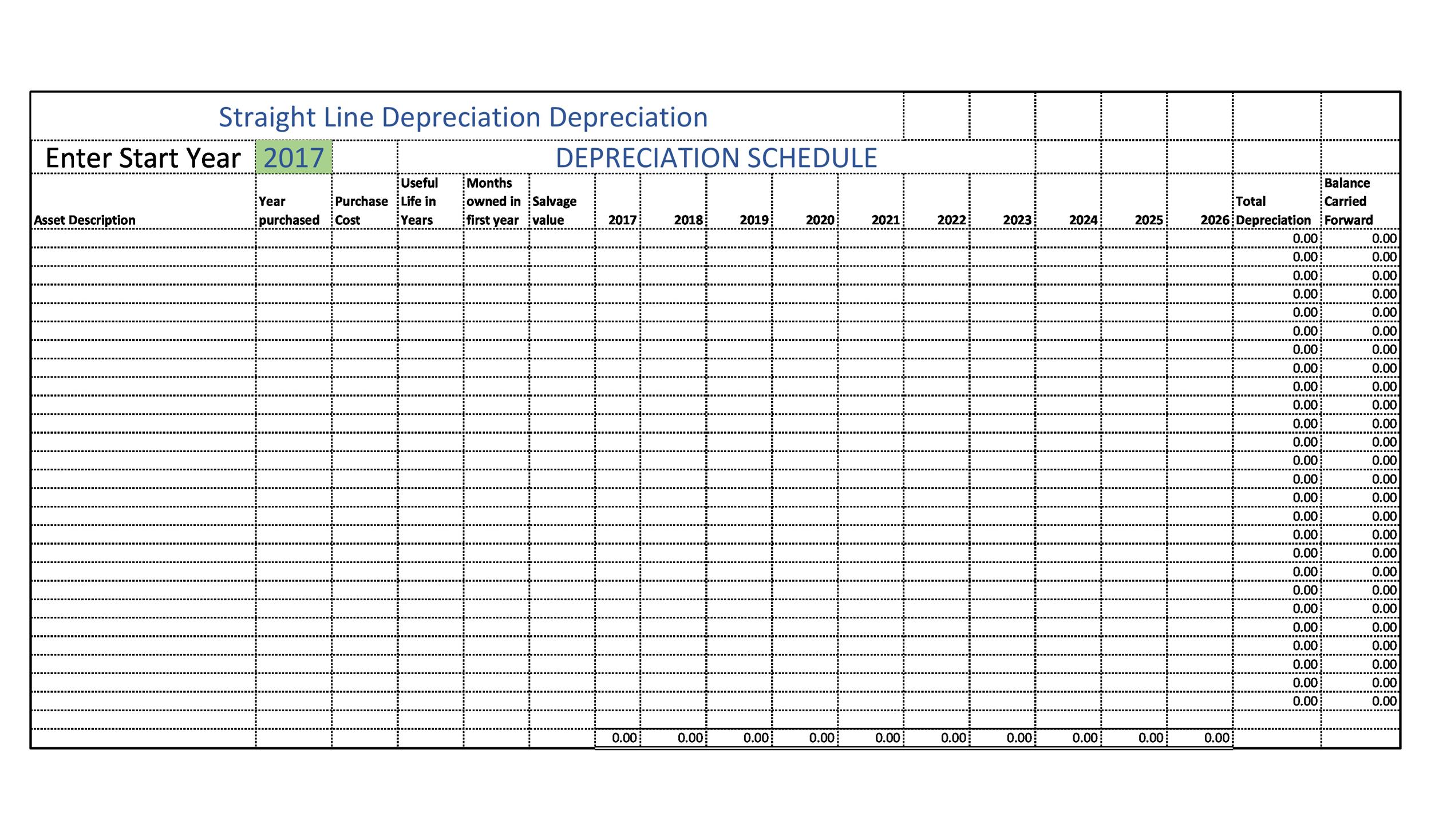

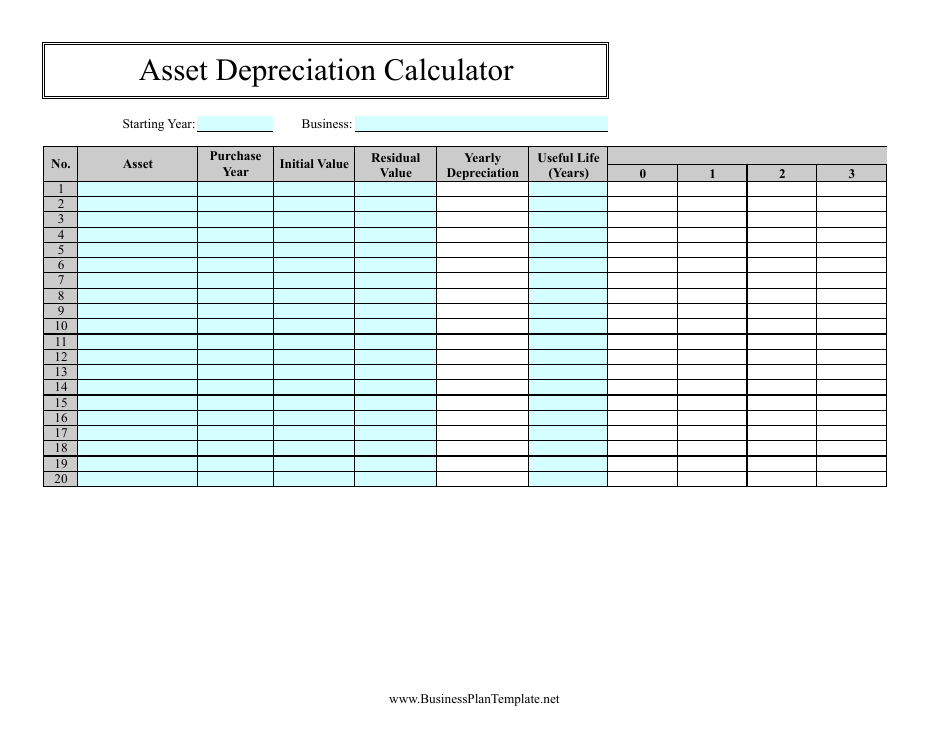

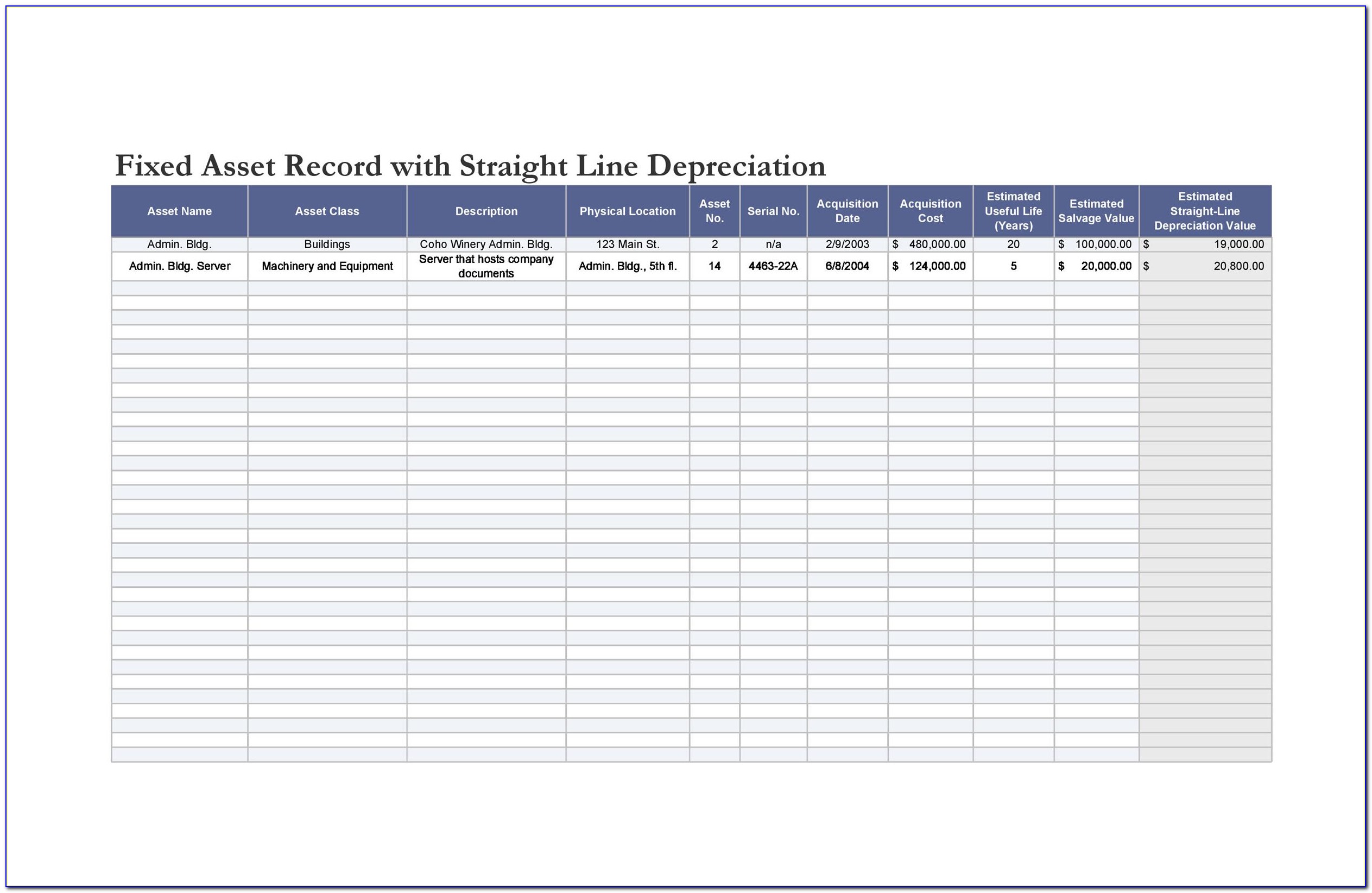

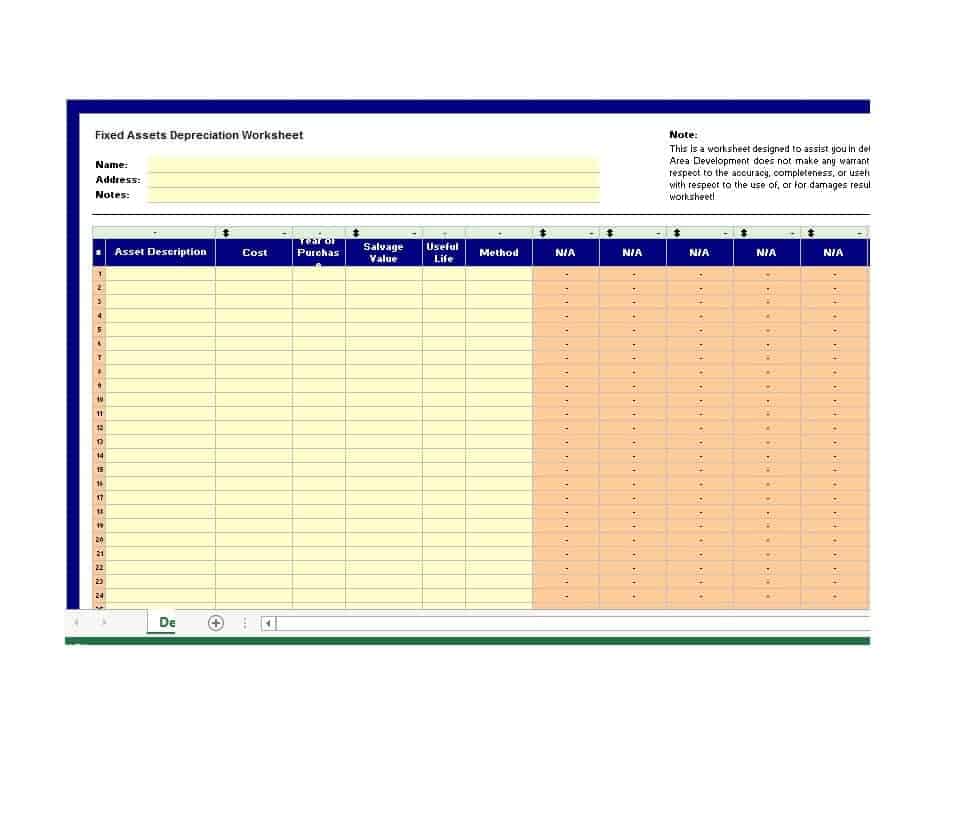

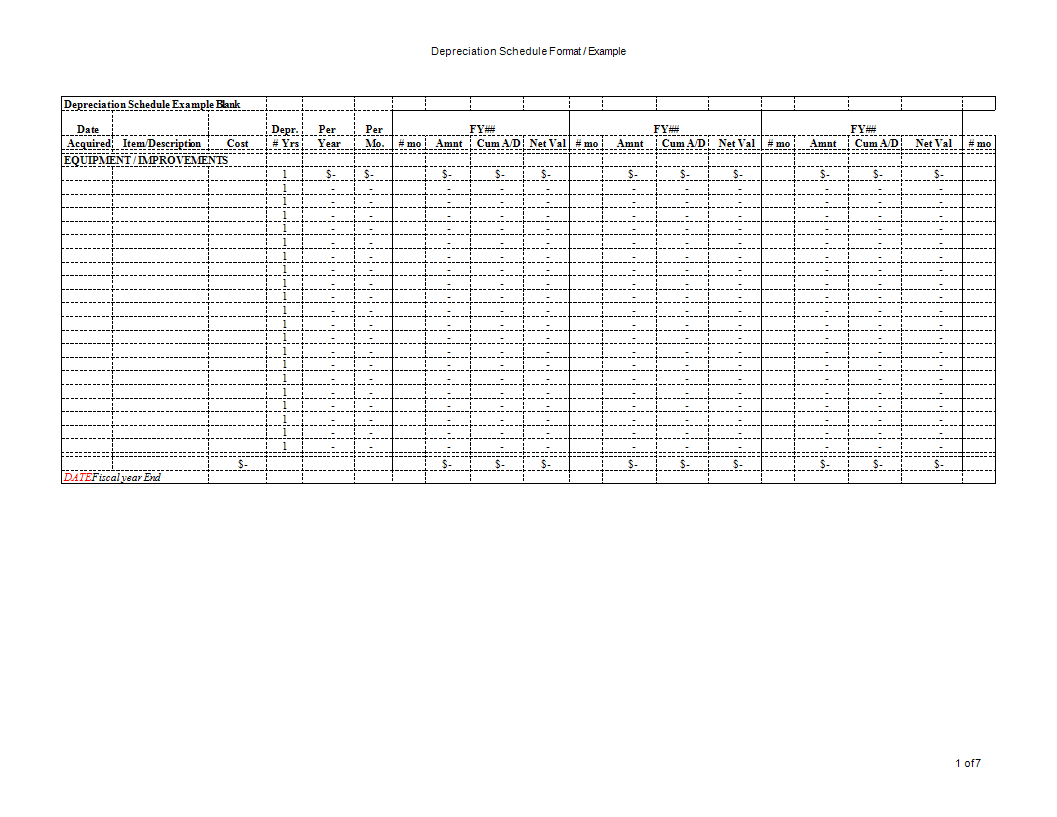

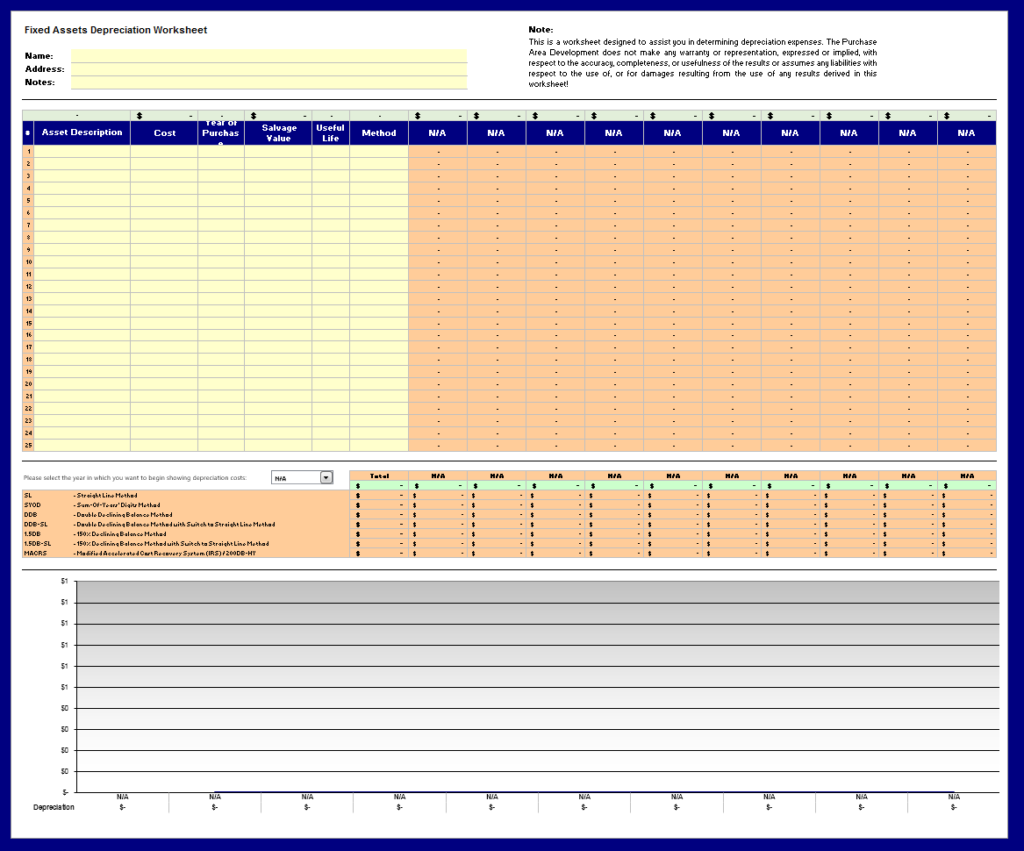

Depreciation Spreadsheet Template - Web excel offers five different depreciation functions. The straight line rate is 20% ($2,000 annual depreciation / $10,000 depreciable value),. Centralize key asset details, like vendor contracts, while reducing potential breakdowns with automated alerts. Ad easily manage employee expenses. Download this template for free. Sum of years’ digit 3. Straight line depreciation schedule 2. Using data validation tool to. Web depreciation methods template download the free template. Enter your name and email in the form below and download the free template now! Web asset manager with depreciation template. Stop losing receipts and have employees upload them directly into your expenses app. Web depreciation is used to match the cost of obtaining an asset to the income a company will earn due to acquiring it. Web download practice workbook 8 methods to prepare depreciation schedule in excel 1. Use these templates to add. Use these templates to add in pie. Web asset manager with depreciation template. Using data validation tool to. Centralize key asset details, like vendor contracts, while reducing potential breakdowns with automated alerts. Given that it is used for tangible assets, examples of the assets. Web asset manager with depreciation template. Ad easily manage employee expenses. Web depreciation is used to match the cost of obtaining an asset to the income a company will earn due to acquiring it. Get support for this template. Web download practice workbook 8 methods to prepare depreciation schedule in excel 1. Web excel offers five different depreciation functions. Straight line depreciation schedule 2. Web asset manager with depreciation template. Web depreciation is used to match the cost of obtaining an asset to the income a company will earn due to acquiring it. Depreciation is the reduction in the value of an asset due to usage, passage of time,. Enter your name and email in the form below and download the free template now! Web download practice workbook 8 methods to prepare depreciation schedule in excel 1. Web manage your finances using excel templates. We consider an asset with an initial cost of $10,000, a salvage value (residual value) of $1000 and a useful life of 10 periods (years).. Depreciation is the reduction in the value of an asset due to usage, passage of time,. Web manage your finances using excel templates. The straight line rate is 20% ($2,000 annual depreciation / $10,000 depreciable value),. This double declining balance depreciation template will help you find depreciation expense using one of the. Web this depreciation schedule template provides a simple. Web depreciation is used to match the cost of obtaining an asset to the income a company will earn due to acquiring it. Web double declining balance depreciation template. Stay on track for your personal and business goals by evaluating your income and expenses. Depreciation is the reduction in the value of an asset due to usage, passage of time,.. Web depreciation is used to match the cost of obtaining an asset to the income a company will earn due to acquiring it. Centralize key asset details, like vendor contracts, while reducing potential breakdowns with automated alerts. Given that it is used for tangible assets, examples of the assets. Use these templates to add in pie. Web 1.00 factors macrsyears. Depreciation is the reduction in the value of an asset due to usage, passage of time,. Web asset manager with depreciation template. Sum of years’ digit 3. Web this depreciation schedule template provides a simple method for calculating total yearly depreciation for multiple assets. Web depreciation methods template download the free template. Web the annual straight line depreciation would be $2,000 ($10,000 / 5 years). Web manage your finances using excel templates. Web depreciation is used to match the cost of obtaining an asset to the income a company will earn due to acquiring it. Given that it is used for tangible assets, examples of the assets. Web double declining balance depreciation. Use these templates to add in pie. Straight line depreciation schedule 2. Sum of years’ digit 3. Using data validation tool to. This double declining balance depreciation template will help you find depreciation expense using one of the. Get support for this template. Web depreciation methods template download the free template. Web manage your finances using excel templates. This is an easy to use depreciation calculator template that can give you the annual depreciation rates and book values using straight. Web 1.00 factors macrsyears methods methods noswitch fixed assets depreciation worksheet check max min selection asset description cost year of purchase salvage. Web excel supports various methods and formulas to calculate depreciation. Download this template for free. Enter your name and email in the form below and download the free template now! Web asset manager with depreciation template. Depreciation is the reduction in the value of an asset due to usage, passage of time,. Web download practice workbook 8 methods to prepare depreciation schedule in excel 1. Use the template to list all of your. Web excel offers five different depreciation functions. The straight line rate is 20% ($2,000 annual depreciation / $10,000 depreciable value),. Fully integrated w/ employees, invoicing, project & more. Using data validation tool to. Web manage your finances using excel templates. Given that it is used for tangible assets, examples of the assets. Web 1.00 factors macrsyears methods methods noswitch fixed assets depreciation worksheet check max min selection asset description cost year of purchase salvage. Get support for this template. Web double declining balance depreciation template. Web this depreciation schedule template provides a simple method for calculating total yearly depreciation for multiple assets. Sum of years’ digit 3. Web depreciation is used to match the cost of obtaining an asset to the income a company will earn due to acquiring it. Web excel supports various methods and formulas to calculate depreciation. Fully integrated w/ employees, invoicing, project & more. Web download practice workbook 8 methods to prepare depreciation schedule in excel 1. Stop losing receipts and have employees upload them directly into your expenses app. This is an easy to use depreciation calculator template that can give you the annual depreciation rates and book values using straight. Use these templates to add in pie. Enter your name and email in the form below and download the free template now!20+ Free Depreciation Schedule Templates MS Excel & MS Word

Depreciation Excel Template Database

Schedule Of Real Estate Owned Excel Sample Excel Templates

Depreciation Schedule Template Excel Free Printable Templates

Asset Depreciation Calculator Spreadsheet Template Download Printable

Depreciation Schedule Template Excel Free Printable Templates

Depreciation Schedule Template Excel Free Printable Templates

Depreciation schedule Excel format Templates at

20+ Free Depreciation Schedule Templates MS Excel & MS Word

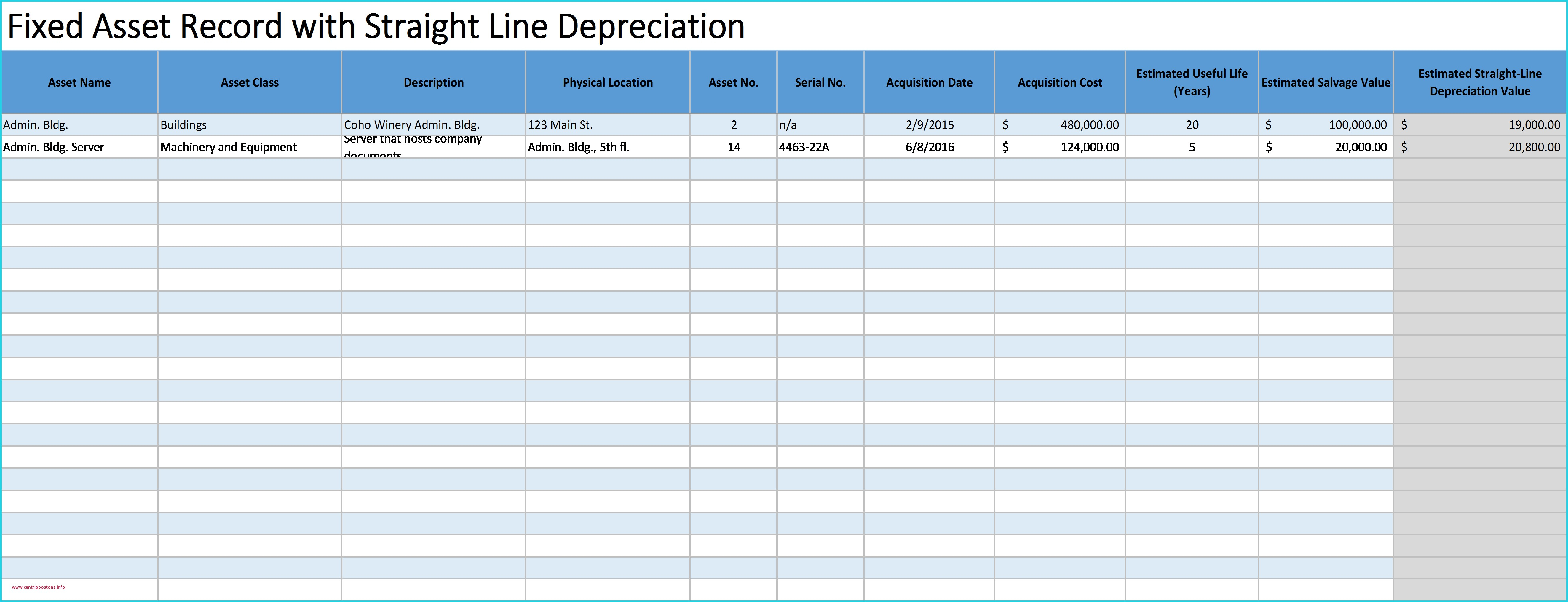

Fixed Asset Depreciation Excel Spreadsheet —

Web Depreciation Methods Template Download The Free Template.

Ad Easily Manage Employee Expenses.

Stay On Track For Your Personal And Business Goals By Evaluating Your Income And Expenses.

Web Excel Offers Five Different Depreciation Functions.

Related Post: