Debt Repayment Budget Template

Debt Repayment Budget Template - This list should also include all of your debt, from. See where your money is going. Try our free budget template (excel file or pdf ). Web a budget can help you: Web all you need to do is download the template and plug in a few numbers—the spreadsheet will do all the math. Web our calculator can help you estimate when you’ll pay off your credit card debt or other debt — such as auto loans, student loans or personal loans — and how much you’ll need to pay each month, based on how much you owe and your interest rate. Divide your income among needs, wants, savings and debt repayment, using the 50/30/20 budget. Web a properly created debt budget will help you save money that then goes towards repayment of your debts. Your list should include the minimum payment amount, the interest rate, and how much you owe total. Some of the options listed also present schemes for dealing with your loans, a multiple credit card payoff calculator, and recommendations for paying down other debt. If you have previously saved a budget, click the load button to see it. Budgets should use monthly figures because most important bills are monthly. Web our calculator can help you estimate when you’ll pay off your credit card debt or other debt — such as auto loans, student loans or personal loans — and how much you’ll need to. Graphs will help you compare the two strategies side by side. Easily track your income, expenses, and debt payments, while gaining insights to optimize your financial strategy. Web this free, printable template provides a detailed income and expense tracking chart where you enter items such as fixed and variable expenses, debt and savings. Web all you need to do is. Graphs will help you compare the two strategies side by side. Web debt payoff template for google sheets the tiller community debt snowball spreadsheet allows you to calculate estimated payoff dates and track your progress toward debt freedom. Web if you have a $10,000 line of credit from your mortgage and take $2,000 of it for a vacation, include $2,000. Divide your income among needs, wants, savings and debt repayment, using the 50/30/20 budget. Start your budget by filling in the your household section below. We are not a loan company, we do not lend money. This 2021 version is highly advanced. This list should also include all of your debt, from. Web this free, printable template provides a detailed income and expense tracking chart where you enter items such as fixed and variable expenses, debt and savings. Make a list of all your debts. Web for a good starting point, you can see how your current spending aligns with the 50/30/20 budget, which recommends spending 50% of your income on needs,. When it comes to figuring out the best tactic, two popular debt repayment methods are the: Vertex 42 debt reduction snowball calculator and credit. Web all you need to do is download the template and plug in a few numbers—the spreadsheet will do all the math. Web ian group has paid down $190,000 in student loans. To start, no matter. He shared screenshots of the budget template he created and explained how it. Ad licensed debt management service provider. It’s available on instant download so you can access it anywhere, at anytime. Web follow these six easy steps to set up a debt repayment plan. Some of the options listed also present schemes for dealing with your loans, a multiple. To start, no matter which strategy you choose, you’ll want to make the minimum payments on all your debts. Divide your income among needs, wants, savings and debt repayment, using the 50/30/20 budget. This template acts as a perfect guide for creating your own debt payment plan. It’s available on instant download so you can access it anywhere, at anytime.. Web if you have a $10,000 line of credit from your mortgage and take $2,000 of it for a vacation, include $2,000 as money in, but include the debt repayment as money out as you are repaying it. Try our free budget template (excel file or pdf ). Easily track your income, expenses, and debt payments, while gaining insights to. Try our free budget template (excel file or pdf ). Web for a good starting point, you can see how your current spending aligns with the 50/30/20 budget, which recommends spending 50% of your income on needs, 30% on wants and 20% on debt payments and. Save time on expense reports with everything in one place & approve with just. Some of the options listed also present schemes for dealing with your loans, a multiple credit card payoff calculator, and recommendations for paying down other debt. It’s available on instant download so you can access it anywhere, at anytime. Budgets should use monthly figures because most important bills are monthly. When it comes to figuring out the best tactic, two popular debt repayment methods are the: We are not a loan company, we do not lend money. Web all you need to do is download the template and plug in a few numbers—the spreadsheet will do all the math. Start your budget by filling in the your household section below. Otherwise, your credit will suffer. Web our calculator can help you estimate when you’ll pay off your credit card debt or other debt — such as auto loans, student loans or personal loans — and how much you’ll need to pay each month, based on how much you owe and your interest rate. Save time on expense reports with everything in one place & approve with just one click. Web follow these six easy steps to set up a debt repayment plan. Fully integrated w/ employees, invoicing, project & more. He shared screenshots of the budget template he created and explained how it. Web ian group has paid down $190,000 in student loans. Web the debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Web debt reduction spreadsheet 2021. Ad easily manage employee expenses. Easily track your income, expenses, and debt payments, while gaining insights to optimize your financial strategy. To start, no matter which strategy you choose, you’ll want to make the minimum payments on all your debts. If you have previously saved a budget, click the load button to see it. This debt reduction spreadsheet 2021 is very helpful in planning repayment strategies. Ad easily manage employee expenses. Web a budget can help you: Web debt payoff template for google sheets the tiller community debt snowball spreadsheet allows you to calculate estimated payoff dates and track your progress toward debt freedom. Web follow these six easy steps to set up a debt repayment plan. This list should also include all of your debt, from. We are not a loan company, we do not lend money. Otherwise, your credit will suffer. Web create a plan of attack. Web if you have a $10,000 line of credit from your mortgage and take $2,000 of it for a vacation, include $2,000 as money in, but include the debt repayment as money out as you are repaying it. Include interest earned from your checking or money market bank account or any other interest that is yours to spend. Budgets should use monthly figures because most important bills are monthly. Save time on expense reports with everything in one place & approve with just one click. Try our free budget template (excel file or pdf ). Graphs will help you compare the two strategies side by side. Make a list of all your debts.The Ultimate Debt Payoff Planner That Will Help You Crush Your Debt

Get A FREE Debt Payment Log Credit card payment tracker, Free budget

Debt Payment Plan Printable by aRodgersDesigns on Etsy Debt Free

Free Excel Budget Template Collection for Business and Personal Use

2021 Budget Binder Printables Budget binder printables, Debt

Editable Paying Off Debt Worksheets Debt Repayment Budget Template

Pin by Connie Peterson on For the Home Simple budget, Budgeting, Debt

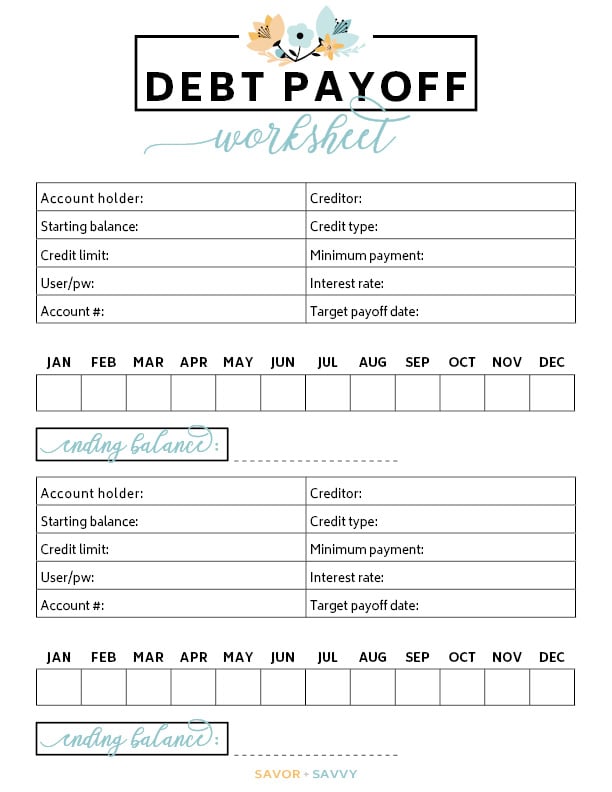

Free Debt Payoff Log Worksheet Printable Finances Savor + Savvy

How to Create A Budget Binder One Sweet Life

Debt Repayment Plan Template Master of Documents

Some Of The Options Listed Also Present Schemes For Dealing With Your Loans, A Multiple Credit Card Payoff Calculator, And Recommendations For Paying Down Other Debt.

If You Have Previously Saved A Budget, Click The Load Button To See It.

See Where Your Money Is Going.

Web All You Need To Do Is Download The Template And Plug In A Few Numbers—The Spreadsheet Will Do All The Math.

Related Post: