Chargeback Agreement Template

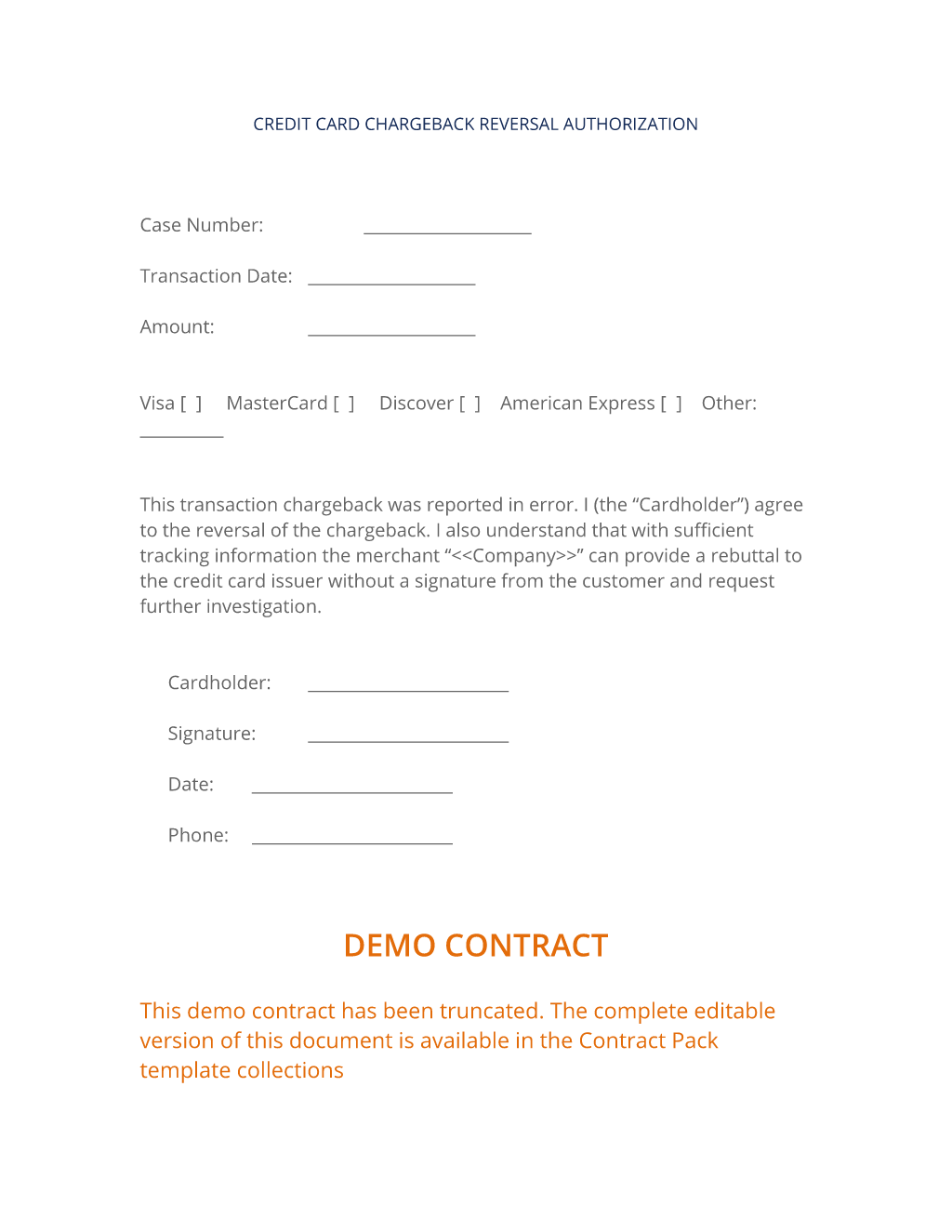

Chargeback Agreement Template - Web templates created by legal professionals customize your documents quickly & easily 24/7 free phone & email customer support trusted by 1,895 users. Web merchant may not initiate a sale transaction in an attempt to collect a chargeback. Web a credit card authorization form is a document, signed by a cardholder, that grants a merchant permission to charge their credit card for recurring payments during a period of time as written in that document. Customizable sections allowing you to specify your business' information. Merchants may be charged $15 or more per chargeback. No amendments to or modifications of this agreement. While back charges are typically made when costs are incurred on the same project, some states allow a type of chargeback known as a setoff. Step 3 | use the right fraud detection tools; Web do “no chargeback agreements” exist? Building a better chargeback response as a merchant, you have the option to submit a response and try to recover your funds any time you receive a chargeback. If client does not fully settle a customer dispute promptly and in good faith, purchaser may, in addition to any other remedies under this agreement, charge or sell back the account to client. Web chargeback response template for digital goods not received chargeback. Web a back charge is also known as a chargeback. No amendments to or modifications of this. Web a chargeback, also called a payment dispute, is a funds reversal when a customer disputes a card transaction. This document describes the policies and procedures for establishing chargeback rates at. Will this be an ach or credit card payment authorization? Web chargeback form templates: Web a back charge is also known as a chargeback. Credit card ach both get your contract what is the difference between ach and credit card authorization? The ‘no chargeback agreement’ that works best: Will this be an ach or credit card payment authorization? Web a back charge is also known as a chargeback. There is no reason for a chargeback to ever be filed. This process is called representment, and it involves submitting several items, including a chargeback form template commonly referred to as a rebuttal. Will this be an ach or credit card payment authorization? Web do “no chargeback agreements” exist? This agreement shall be governed by and construed in all respects according to the laws of the state at colorado. 4 tips. 4 tips to prevent chargebacks without a no chargeback agreement. Web do “no chargeback agreements” exist? Customizable sections allowing you to specify your business' information. Web follow these steps to get started. Instant digital download of the chargeback prevention policy. Merchant will pay the current published fees for each chargeback as listed on the merchant application and any other fines, fees, or assessments imposed by. Web a chargeback, also called a payment dispute, is a funds reversal when a customer disputes a card transaction. This process is called representment, and it involves submitting several items, including a chargeback form template. While back charges are typically made when costs are incurred on the same project, some states allow a type of chargeback known as a setoff. This document describes the policies and procedures for establishing chargeback rates at. Phase i draft retrieval phase ii prenotification phase iii chargeback phase iv chargeback reversal (if possible) Instant digital download of the chargeback prevention. The ‘no chargeback agreement’ that works best: You may need written permission from them to get the chargeback reversed. Step 2 | optimize customer service; Step 3 | use the right fraud detection tools; Buy now instant digital download of your chargeback policy:. Instant digital download of the chargeback prevention policy. There is no reason for a chargeback to ever be filed. A setoff occurs when a gc charges a subcontractor on one project for costs incurred under a separate contract. Buy now instant digital download of your chargeback policy:. Customizable sections allowing you to specify your business' information. Merchants may be charged $15 or more per chargeback. Web follow these steps to get started. There is no reason for a chargeback to ever be filed. Web merchant may not initiate a sale transaction in an attempt to collect a chargeback. Company shall have the absolute right to set forth cash discounts, to make such allowances and adjustments to. Buy now instant digital download of your chargeback policy:. The ‘no chargeback agreement’ that works best: Instant digital download of the chargeback prevention policy. There is no reason for a chargeback to ever be filed. Web a chargeback, also called a payment dispute, is a funds reversal when a customer disputes a card transaction. Web templates created by legal professionals customize your documents quickly & easily 24/7 free phone & email customer support trusted by 1,895 users. While back charges are typically made when costs are incurred on the same project, some states allow a type of chargeback known as a setoff. Web a credit card authorization form is a document, signed by a cardholder, that grants a merchant permission to charge their credit card for recurring payments during a period of time as written in that document. 4 tips to prevent chargebacks without a no chargeback agreement. Step 1 | refine your tos; This document describes the policies and procedures for establishing chargeback rates at. Step 3 | use the right fraud detection tools; Use the chargeback reversal agreement if you have a customer who charged back a product or service inappropriately. Web merchant may not initiate a sale transaction in an attempt to collect a chargeback. Headings of the sections of this agreement are inserted for convenience only and shall not be deemed to constitute a part hereof. Web your chargeback policy template comes with instructions on how to customize your agreement for your specific situation. Web a back charge is also known as a chargeback. Web do “no chargeback agreements” exist? Step 2 | optimize customer service; No amendments to or modifications of this agreement. Customizable sections allowing you to specify your business' information. Web chargeback form templates: There is no reason for a chargeback to ever be filed. Web chargeback response template for digital goods not received chargeback. Web do “no chargeback agreements” exist? Web templates created by legal professionals customize your documents quickly & easily 24/7 free phone & email customer support trusted by 1,895 users. Web follow these steps to get started. Web a chargeback, also called a payment dispute, is a funds reversal when a customer disputes a card transaction. Web a back charge is also known as a chargeback. All references to a “chargeback” refer to a reversal of a credit / debit card charge placed on the site. Merchant will pay the current published fees for each chargeback as listed on the merchant application and any other fines, fees, or assessments imposed by. Merchants may be charged $15 or more per chargeback. Buy now instant digital download of your chargeback policy:. The ‘no chargeback agreement’ that works best: A setoff occurs when a gc charges a subcontractor on one project for costs incurred under a separate contract. Building a better chargeback response as a merchant, you have the option to submit a response and try to recover your funds any time you receive a chargeback.Chargeback Reversal Agreement (Standard) 3 Easy Steps

Chargeback Form Fill Out and Sign Printable PDF Template signNow

Vendor Chargeback Form Template Form Resume Examples Vj1yxWv8yl

Charge Back Letter No. 1 SAMPLE

Chargeback Management

Sample Vendor Risk Management Policy To identify, reduce and prevent

Chargeback Rebuttal Letter Template Database

Chargeback Form Sbi Fill Out and Sign Printable PDF Template signNow

Chargeback Rebuttal Letter Template Best Of Rebuttal Letter Template

ICCI Bank Transaction Charge Back Form For Disputed Transactions Fill

Instant Digital Download Of The Chargeback Prevention Policy.

Step 1 | Refine Your Tos;

Web Your Chargeback Policy Template Comes With Instructions On How To Customize Your Agreement For Your Specific Situation.

Step 2 | Optimize Customer Service;

Related Post: