Business Tax Write Off Spreadsheet Template

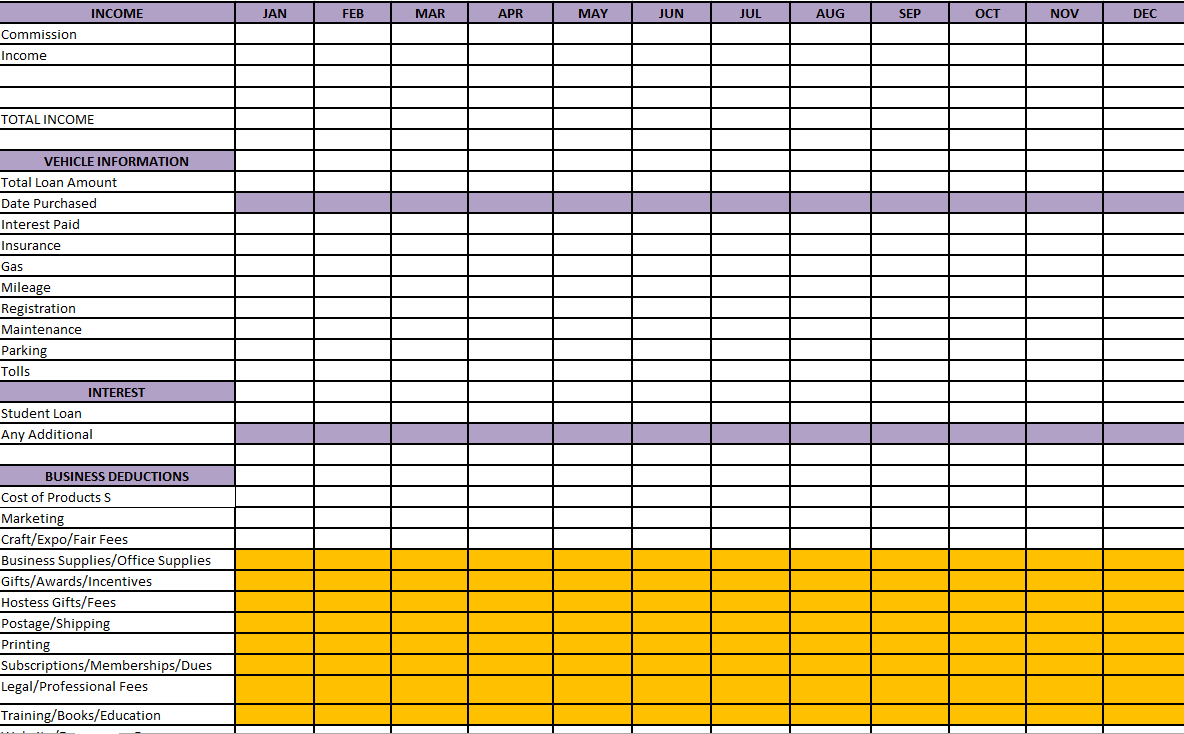

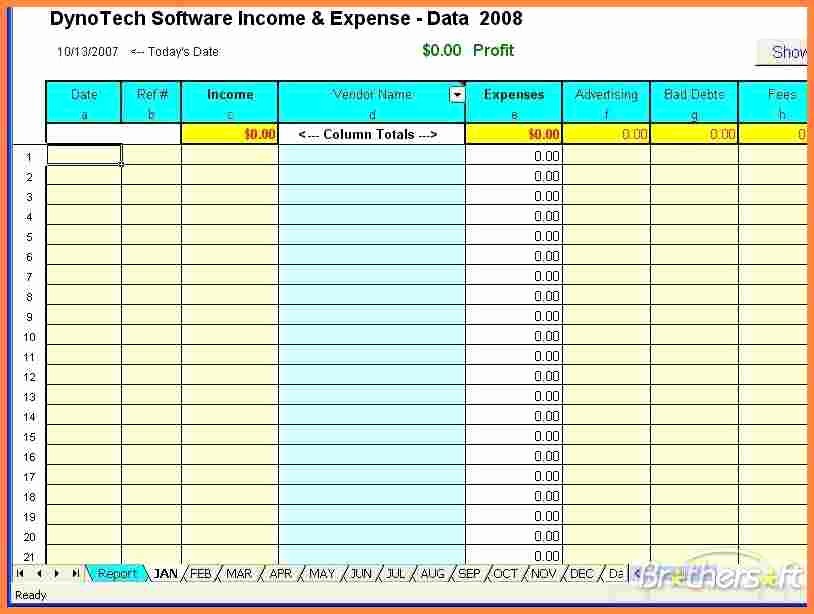

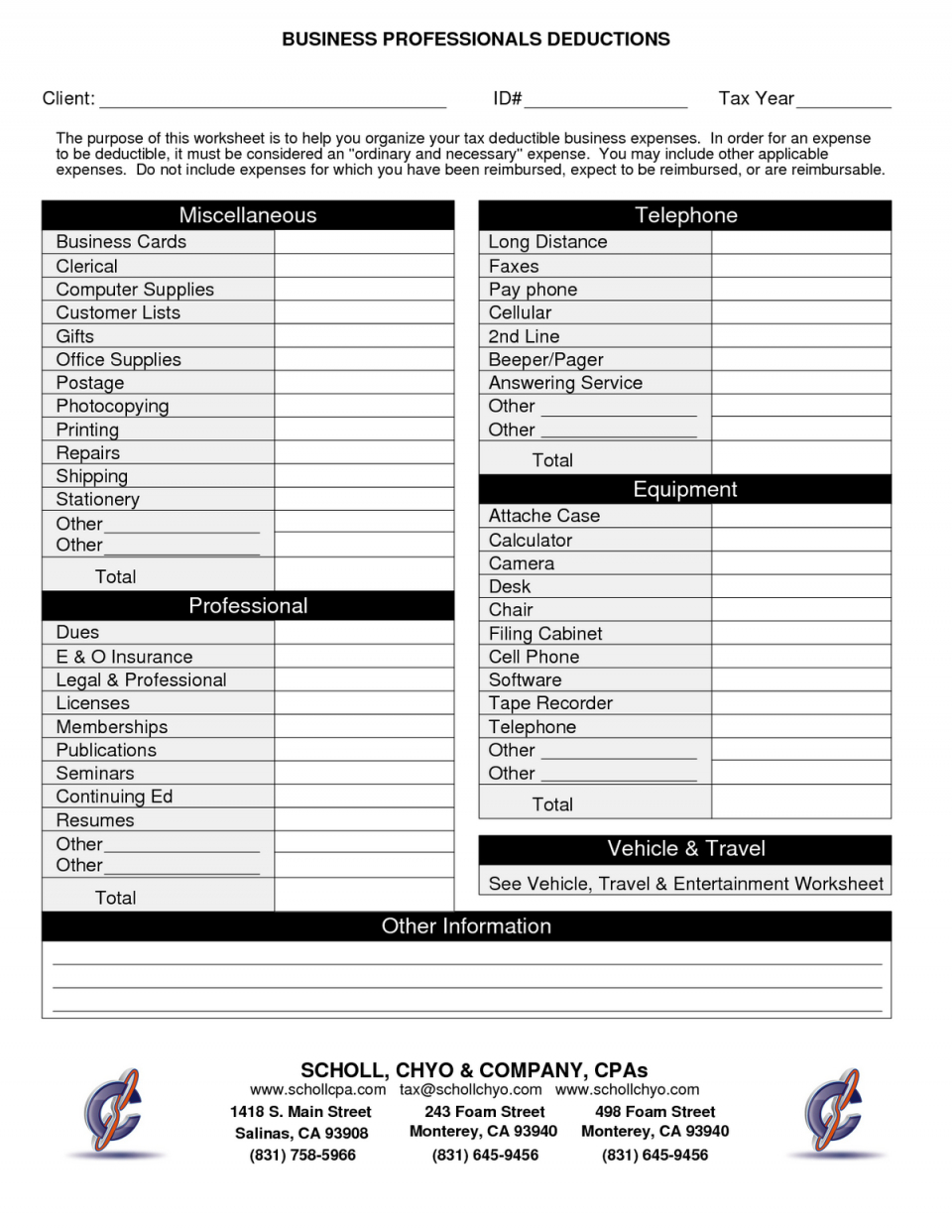

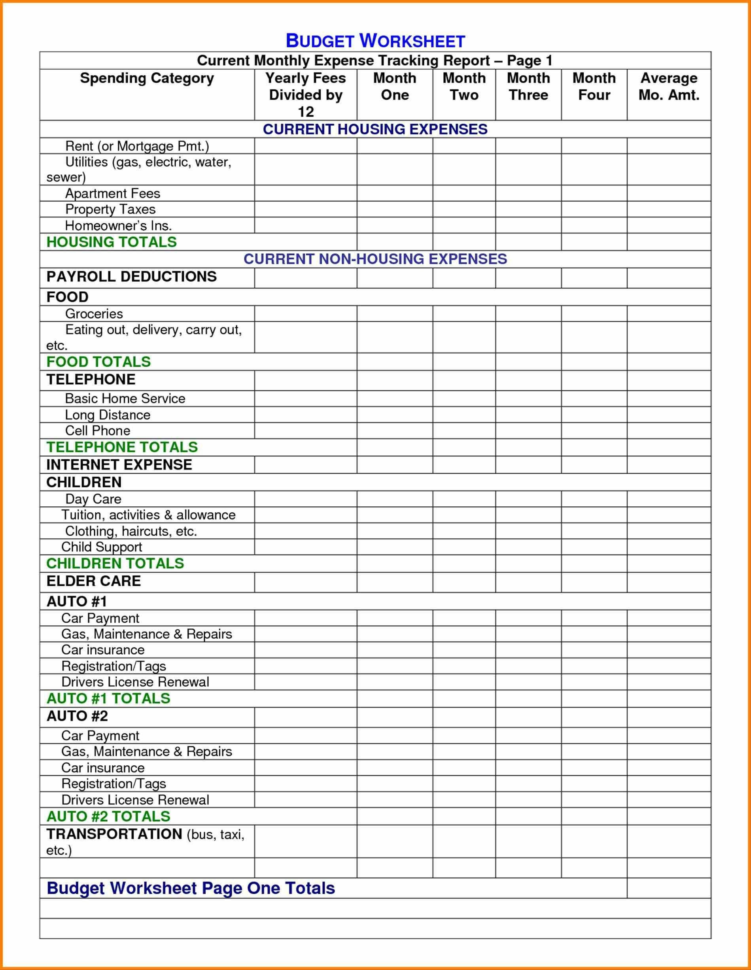

Business Tax Write Off Spreadsheet Template - Automatically track all your income and expenses. While the irs does provide. You can find all of the above in our free excel spreadsheet for 1099 contractors! Web organize your finances for your small business with this free small business tax spreadsheet in excel. By taking advantage of business. Ad read reviews on the premier expense report software in the industry! You can easily now calculate the tax expenses with. Calculate over 1,500 tax planning strategies automatically and save tens of thousands Id # tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible. Web income & deduction overview your name current year income amount billed,taxes billed,total income freelance income,ca$ 0.00,ca$ 0.00,ca$ 0.00 tax deductions. While the irs does provide. Web in general, if an expense is ordinary and necessary for you to conduct business, it can be written off as a business expense. Ad read reviews on the premier expense report software in the industry! A tax deduction is an expense you can subtract from your taxable income. December 12, 2022 the home office. Ad manage all your business expenses in one place with quickbooks®. You can find all of the above in our free excel spreadsheet for 1099 contractors! Calculate over 1,500 tax planning strategies automatically and save tens of thousands Web organize your finances for your small business with this free small business tax spreadsheet in excel. A tax deduction is an. Web independent contractor expenses spreadsheet: Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. Web make your tax preparation a breeze with this free template to speed this process up a bit, you can start by downloading an excel copy of your bank or credit card transactions. Ad manage all your business expenses. Get a free guided quickbooks® setup. Web make your tax preparation a breeze with this free template to speed this process up a bit, you can start by downloading an excel copy of your bank or credit card transactions. Web using this free business expense tracking spreadsheet is the ideal option. The only software you need for your business. Free. Web income & deduction overview your name current year income amount billed,taxes billed,total income freelance income,ca$ 0.00,ca$ 0.00,ca$ 0.00 tax deductions. Expense tracking spreadsheets use standardized templates to help you track various. Id # tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible. Web every business must file and pay taxes,. Web using this free business expense tracking spreadsheet is the ideal option. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. Automatically track all your income and expenses. Get a free guided quickbooks® setup. Web #taxes tom smery updated on: Web make your tax preparation a breeze with this free template to speed this process up a bit, you can start by downloading an excel copy of your bank or credit card transactions. You can easily now calculate the tax expenses with. Learn how to do your taxes for your small business. Automatically track all your income and expenses. Free. You can find all of the above in our free excel spreadsheet for 1099 contractors! While the irs does provide. Ad read reviews on the premier expense report software in the industry! Web 30 best business expense spreadsheets (100% free) november 3, 2020 6 mins read as a business owner, it’s important for you to have a system to monitor. A tax deduction is an expense you can subtract from your taxable income. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. Web if you're a freelancer, independent contractor, or small business owner who uses your home for business purposes, the home office tax deduction can be huge. Web organize your finances for. Web organize your finances for your small business with this free small business tax spreadsheet in excel. Ad read reviews on the premier expense report software in the industry! Web every business must file and pay taxes, but understanding how to properly report financial information can help lessen the burden. Automatically track all your income and expenses. Web make your. Calculate over 1,500 tax planning strategies automatically and save tens of thousands Web income & deduction overview your name current year income amount billed,taxes billed,total income freelance income,ca$ 0.00,ca$ 0.00,ca$ 0.00 tax deductions. Ad integrated, simple, & loved by million users. You can find all of the above in our free excel spreadsheet for 1099 contractors! December 12, 2022 the home office deduction is one of the most significant tax benefits of running a small business out of your home. Learn how to do your taxes for your small business. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. Id # tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible. The types of deductions vary from standard to itemized, and again you can make this. Ad manage all your business expenses in one place with quickbooks®. It even comes with a few. Get a free guided quickbooks® setup. Everything you need to know (plus: Web make your tax preparation a breeze with this free template to speed this process up a bit, you can start by downloading an excel copy of your bank or credit card transactions. By taking advantage of business. Ad read reviews on the premier expense report software in the industry! Ad manage all your business expenses in one place with quickbooks®. Web using this free business expense tracking spreadsheet is the ideal option. Expense tracking spreadsheets use standardized templates to help you track various. Web if you're a freelancer, independent contractor, or small business owner who uses your home for business purposes, the home office tax deduction can be huge. Id # tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible. Everything you need to know (plus: Web using this free business expense tracking spreadsheet is the ideal option. Ad manage all your business expenses in one place with quickbooks®. Free template) march 9th, 2022 | accounting & bookkeeping, contractor. You can easily now calculate the tax expenses with. Try any app for free and see what odoo can accomplish for you and your business. It even comes with a few. Excel tax expense statistics template this excel tax template is used to analyze the tax expense statistics. A tax deduction is an expense you can subtract from your taxable income. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. Calculate over 1,500 tax planning strategies automatically and save tens of thousands Web income & deduction overview your name current year income amount billed,taxes billed,total income freelance income,ca$ 0.00,ca$ 0.00,ca$ 0.00 tax deductions. Web if you're a freelancer, independent contractor, or small business owner who uses your home for business purposes, the home office tax deduction can be huge. Expense tracking spreadsheets use standardized templates to help you track various. While the irs does provide.Tax Write Off Spreadsheet Template For Your Needs

Pin by Jonathancdrake on Templates printable free Business tax

free business tax expense spreadsheet —

Tax Spreadsheet For Small Business Spreadsheet Downloa tax worksheet

50 Small Business Tax Excel Spreadsheet Template

Small Business Tax Spreadsheet And Expenses Nz —

New Business Expense Sheet exceltemplate xls xlstemplate xlsformat

Tax Deduction Worksheet Small business tax deductions, Small business

Small Business Tax Deductions Worksheet

Tax Spreadsheet For Small Business for Small Business Tax Spreadsheet

Web Make Your Tax Preparation A Breeze With This Free Template To Speed This Process Up A Bit, You Can Start By Downloading An Excel Copy Of Your Bank Or Credit Card Transactions.

However, Not Every Business Expense And Business Activity Is Deductible.

Web In General, If An Expense Is Ordinary And Necessary For You To Conduct Business, It Can Be Written Off As A Business Expense.

Automatically Track All Your Income And Expenses.

Related Post: