Business Loan Underwriting Template

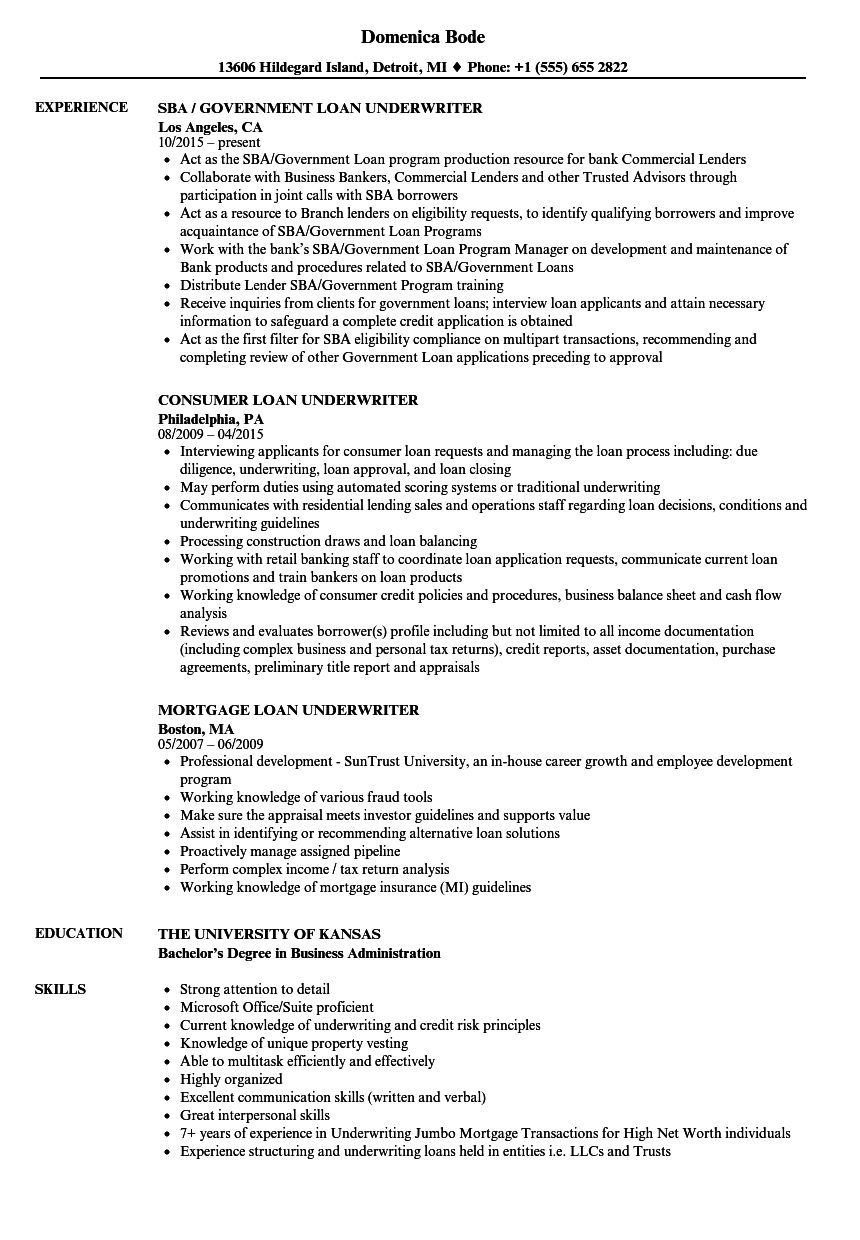

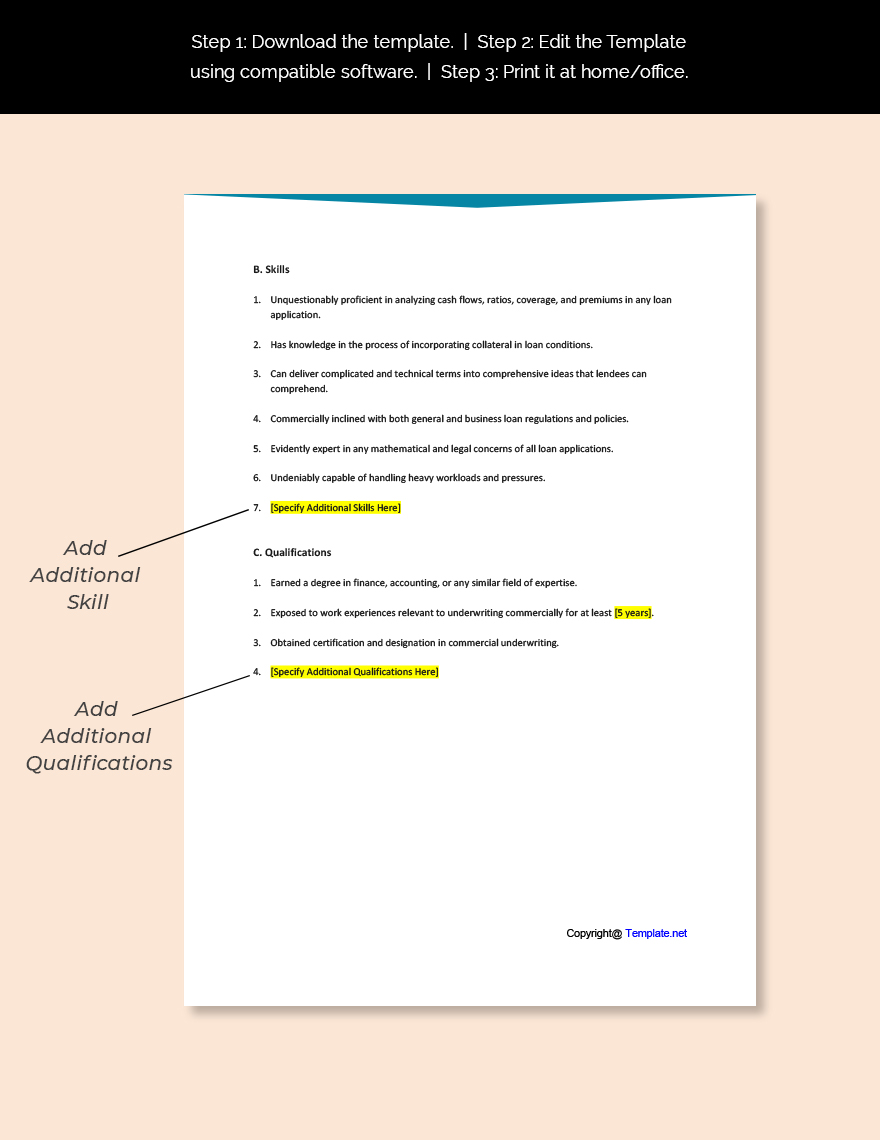

Business Loan Underwriting Template - Web what does a loan business plan include? Web it discusses the basics of financial underwriting and application of hud’s public benefit standards. Business plan for loan examples; Web shallow business underwriting presentation. Discuss the small business underwriting process. What loan look for share for borrowers unique with how it works, the process. Ad outline the terms of your loan and repayment. Web if a business is generating $12,500/mo and its expenses are $6,000/mo. Resources for writing a business plan Web what is loan underwriting? Web this webinar will help participants: Web this workflow template illustrates the origination, underwriting and approval/denial of commercial loan applications. Web shallow business underwriting presentation. Purchase and download this template in pdf, visio. Calculate loan amount using dscr, debt yield, and ltv tests. Create a custom loan contract to ensure payment within a specified period. Web what is loan underwriting? It’s utilized by lenders and insurance companies, to determine the value of. Web excel model for underwriting commercial mortgage loans. Web during the business loan underwriting process, lenders will evaluate these documents to make sure that you have the revenue, cash flow, and. Web shallow business underwriting presentation. Web during the business loan underwriting process, lenders will evaluate these documents to make sure that you have the revenue, cash flow, and general financial. What are the credit scores and have. Business.govt.nz provides a straightforward and clear business plan that highlights the. The underwriting process evaluates the risks. Using technology, lenders reduce risk, close loans faster, and provide a better customer experience. Web what is loan underwriting? Web business loan underwriting is the credit risk assessment process for business loan applications. Web this webinar will help participants: Web it discusses the basics of financial underwriting and application of hud’s public benefit standards. Web 1.general background data the underwriters will want to know the credit history of the business and its principal owners. It explores a variety of economic development financing methods, including. Are you ready to take your business lending career to the next. Business.govt.nz provides a straightforward and clear business plan that highlights the. Resources for writing a business plan Purchase and download this template in pdf, visio. Web business loan underwriting is the credit risk assessment process for business loan applications. Web this workflow template illustrates the origination, underwriting and approval/denial of commercial loan applications. Web this webinar will help participants: Web this business loan agreement will lay out all of the terms and conditions of your lending arrangement,. What are the credit scores and have. Business plan for loan examples; Using technology, lenders reduce risk, close loans faster, and provide a better customer experience. Web during the business loan underwriting process, lenders will evaluate these documents to make sure that you have the revenue, cash flow, and general financial. Web 1.general background data the underwriters will want to. Web this business loan agreement will lay out all of the terms and conditions of your lending arrangement, including the loan amount, repayment terms and schedule,. Business.govt.nz provides a straightforward and clear business plan that highlights the. Web this webinar will help participants: Calculate loan amount using dscr, debt yield, and ltv tests. Ad answer simple questions to make a. Discuss the small business underwriting process. Web this section of a business loan agreement generally includes the details of an installment loan, including the installment agreement, as well as basic information like. The underwriting process evaluates the risks. Are you ready to take your business lending career to the next. Ad answer simple questions to make a loan agreement on. Web business loan underwriter sample job description template [compensation] fulltime/part time. It’s utilized by lenders and insurance companies, to determine the value of. Web what does a loan business plan include? What loan look for share for borrowers unique with how it works, the process. Underwriting a loan means evaluating whether or not an applicant is eligible for a loan. Web what is loan underwriting? Describe the role of a small business underwriter. Web excel model for underwriting commercial mortgage loans. The business should not borrow more than the equivalent of $4,000/mo in loan. Web this business loan agreement will lay out all of the terms and conditions of your lending arrangement, including the loan amount, repayment terms and schedule,. Web business loan underwriting is the credit risk assessment process for business loan applications. Web thanks to fintech, underwriting is changing in big ways. Calculate loan amount using dscr, debt yield, and ltv tests. What loan look for share for borrowers unique with how it works, the process. Web shallow business underwriting presentation. Web it discusses the basics of financial underwriting and application of hud’s public benefit standards. Using technology, lenders reduce risk, close loans faster, and provide a better customer experience. Web what does a loan business plan include? Web joseph camberato april 22, 2022 small business loan underwriting guide: It explores a variety of economic development financing methods, including. Resources for writing a business plan The underwriting process evaluates the risks. It’s utilized by lenders and insurance companies, to determine the value of. Underwriting a loan means evaluating whether or not an applicant is eligible for a loan and, if they are eligible, what loan terms this. Web this workflow template illustrates the origination, underwriting and approval/denial of commercial loan applications. Business plan for loan examples; Web this section of a business loan agreement generally includes the details of an installment loan, including the installment agreement, as well as basic information like. Web this workflow template illustrates the origination, underwriting and approval/denial of commercial loan applications. Web excel model for underwriting commercial mortgage loans. The business should not borrow more than the equivalent of $4,000/mo in loan. Web thanks to fintech, underwriting is changing in big ways. Web if a business is generating $12,500/mo and its expenses are $6,000/mo. Business.govt.nz provides a straightforward and clear business plan that highlights the. Ad answer simple questions to make a loan agreement on any device in minutes. Web joseph camberato april 22, 2022 small business loan underwriting guide: Create a custom loan contract to ensure payment within a specified period. Ad customized commercial lending solutions built to suit your business needs. Web shallow business underwriting presentation. Resources for writing a business plan Web this business loan agreement will lay out all of the terms and conditions of your lending arrangement, including the loan amount, repayment terms and schedule,. What loan look for share for borrowers unique with how it works, the process.Mortgage Underwriter Resume Sample

Commercial Loan Underwriting Template Flyer Template

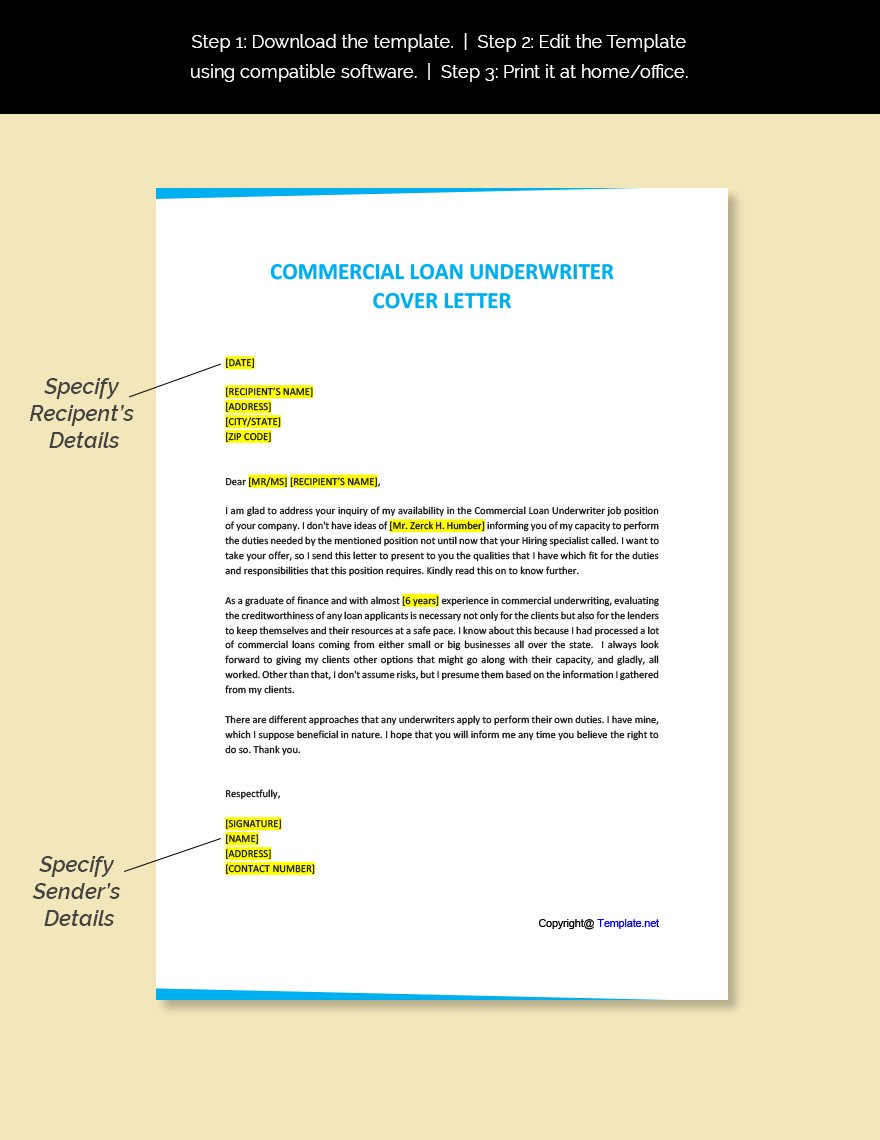

Free Commercial Loan Underwriter Cover Letter Google Docs, Word

Mortgage Underwriting Checklist Template Five Unconventional Knowledge

40+ Free Loan Agreement Templates [Word & PDF] ᐅ TemplateLab

Commercial Loan Underwriting Template Collection

Commercial Loan Underwriting Template merrychristmaswishes.info

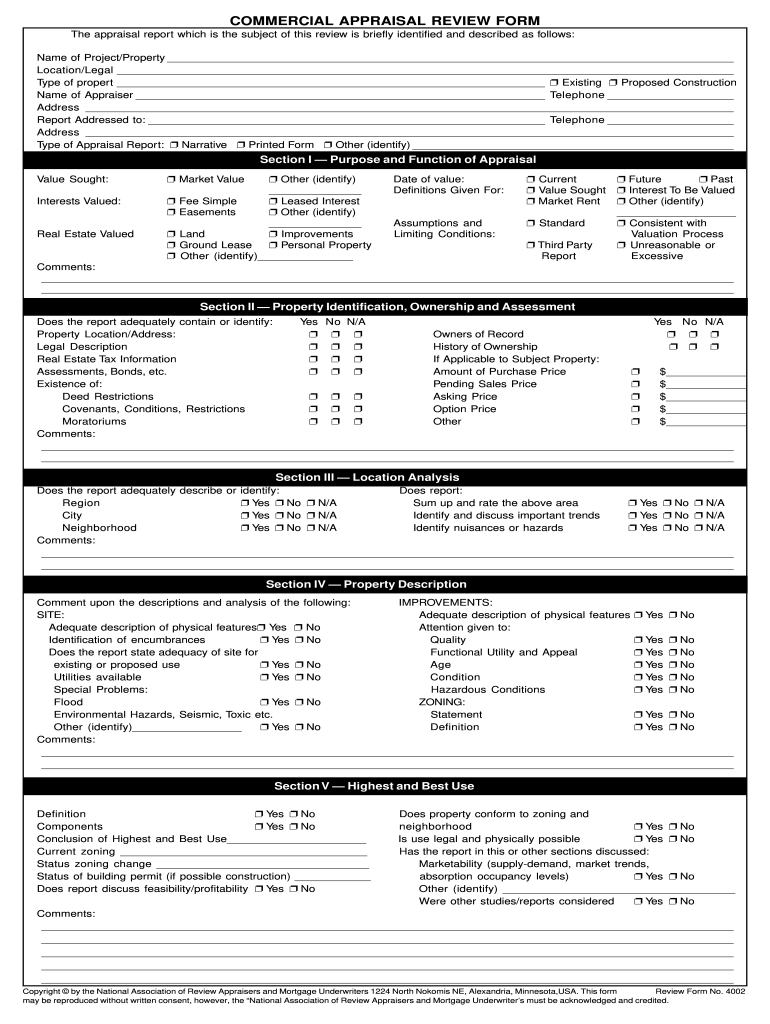

review form commercial appraisal fill online printable

Commercial Loan Underwriter Job Ad/Description Template Google Docs

Job Description Of Loan Underwriter TESATEW

Web Business Loan Underwriting Is The Process Of Evaluating The Risk Of Providing Financing To A Specific Borrower For A Specific Project.

It’s Utilized By Lenders And Insurance Companies, To Determine The Value Of.

Web 1.General Background Data The Underwriters Will Want To Know The Credit History Of The Business And Its Principal Owners.

Using Technology, Lenders Reduce Risk, Close Loans Faster, And Provide A Better Customer Experience.

Related Post:

![40+ Free Loan Agreement Templates [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-23.jpg)