941 Reconciliation Template Excel

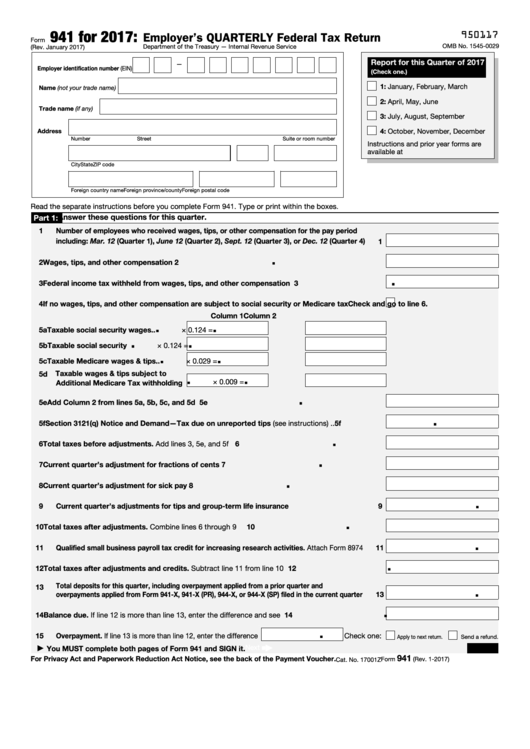

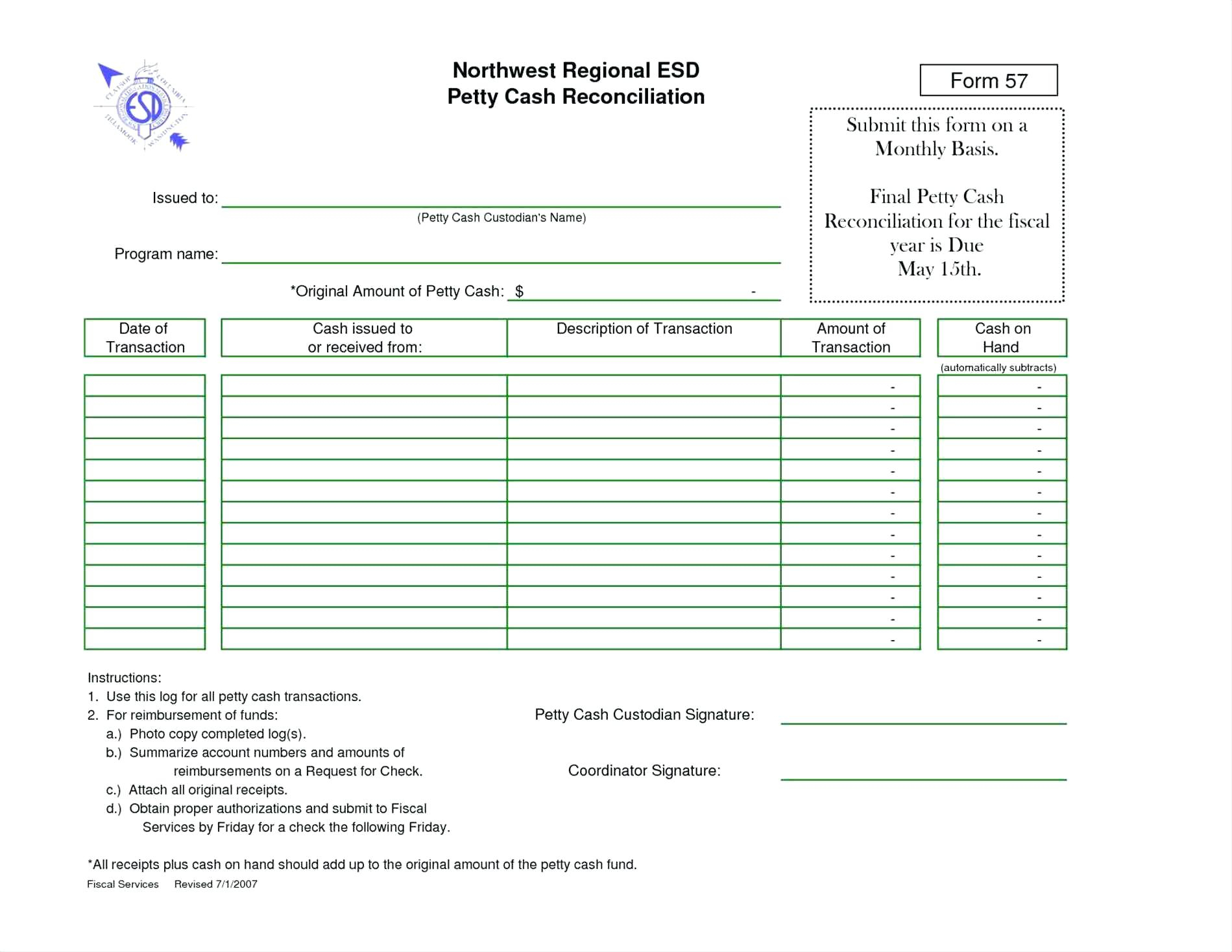

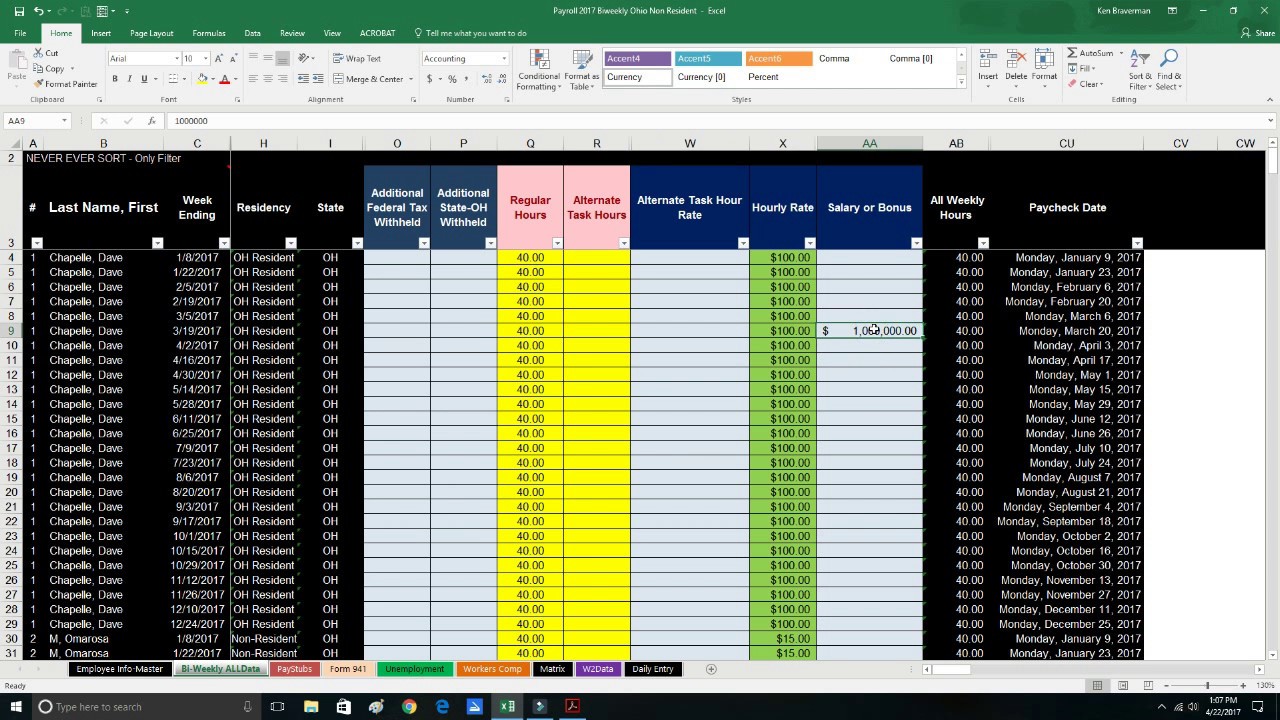

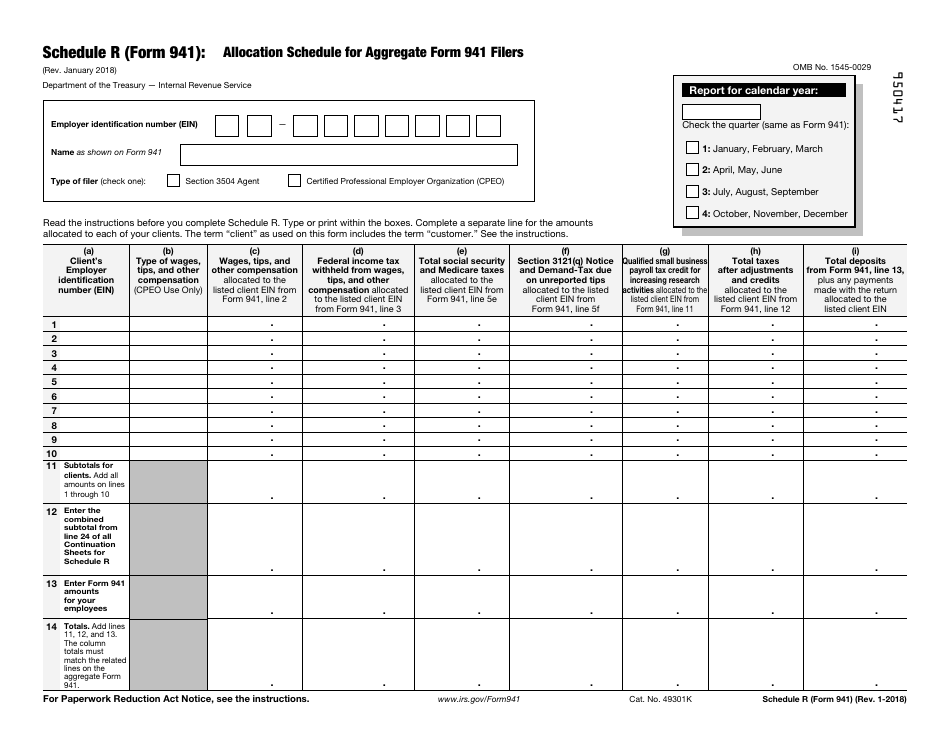

941 Reconciliation Template Excel - Your total payroll expenses must match what you’ve posted in your general ledger. Make sure the amounts reported on. Web ein, “form 941,” and the tax period (“1st quarter 2021,” “2nd quarter 2021,” “3rd quarter 2021,” or “4th quarter 2021”) on your check or money order. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Ad software provides reconciliation from virtually any file source! Web form 941 worksheet for 2022. From the “enter tax return” portal page, click the ri bulk 941 upload template hyperlink select the ‘open’ option. Ad fill out 941 get a payroll tax refund even if you received ppp funds. Web 5d reconciliation included with 5c. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Document the following items on the reconciliation spreadsheet: Type or print within the boxes. Edit, sign or email irs 941 & more fillable forms, register and subscribe now! Web reconciliation templates excel make. If these forms are not in balance, penalties from the irs and/or ssa could result. Use on any account, petty cash, ledger, or. Complete, edit or print tax forms instantly. Type or print within the boxes. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check. Our team of experts determine exactly how much of a payroll tax refund you're entitled to. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Enter deposits made in current year for previous years. From the “enter tax return” portal page, click. At this time, the irs. Ad manage all your business expenses in one place with quickbooks®. Our team of experts determine exactly how much of a payroll tax refund you're entitled to. From the “enter tax return” portal page, click the ri bulk 941 upload template hyperlink select the ‘open’ option. Ad software provides reconciliation from virtually any file source! If these forms are not in balance, penalties from the irs and/or ssa could result. Ad get ready for tax season deadlines by completing any required tax forms today. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Explore the #1 accounting. If these forms are not in balance, penalties from the irs and/or ssa could result. Web ðï ࡱ á> þÿ 1. Enter deposits made in current year for previous years. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web if you need to prepare a ri bulk 941 file, follow. Web if you need to prepare a ri bulk 941 file, follow these steps: Run a report that shows annual payroll amounts. Complete, edit or print tax forms instantly. Ad fill out 941 get a payroll tax refund even if you received ppp funds. Web refer to sample excel reconciliation template. Web refer to sample excel reconciliation template. Use on any account, petty cash, ledger, or. Automated software to quickly perform secure bank reconciliation. Your total payroll expenses must match what you’ve posted in your general ledger. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Ad get ready for tax season deadlines by completing any required tax forms today. Web if you need to prepare a ri bulk 941 file, follow these steps: Annual amounts from payroll records should match the total amounts reported on all forms 941. Complete, edit or print tax forms instantly. Web reconciliation templates excel make reconciliation documents with template.net's free. Web 5d reconciliation included with 5c. Your total payroll expenses must match what you’ve posted in your general ledger. Don't use an earlier revision to report taxes for 2023. Automated software to quickly perform secure bank reconciliation. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Web form 941 worksheet for 2022. Ad software provides reconciliation from virtually any file source! Web read the separate instructions before you complete form 941. Web 941 quarterly report check for variations introduction runbiz recommends reconciling your payroll if not every paycheck, every month and quarterly at the most. This worksheet does not have to be. Your total payroll expenses must match what you’ve posted in your general ledger. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Ad fill out 941 get a payroll tax refund even if you received ppp funds. Answer these questions for this quarter. Document the following items on the reconciliation spreadsheet: Web 5d reconciliation included with 5c. At this time, the irs. Web ðï ࡱ á> þÿ 1. Ad get ready for tax season deadlines by completing any required tax forms today. Run a report that shows annual payroll amounts. Explore the #1 accounting software for small businesses. Automated software to quickly perform secure bank reconciliation. Our team of experts determine exactly how much of a payroll tax refund you're entitled to. Don't use an earlier revision to report taxes for 2023. Web if you’re an aggregate filer that needs to correct the amount reported on form 941, line 13f (13h), include any increase or decrease to the amount in the “total” reported on form. Web ein, “form 941,” and the tax period (“1st quarter 2021,” “2nd quarter 2021,” “3rd quarter 2021,” or “4th quarter 2021”) on your check or money order. Don't use an earlier revision to report taxes for 2023. Make sure the amounts reported on. Web reconciliation templates excel make reconciliation documents with template.net's free reconciliation templates excel. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web form 941 worksheet for 2022. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Our team of experts determine exactly how much of a payroll tax refund you're entitled to. Web if you need to prepare a ri bulk 941 file, follow these steps: Your total payroll expenses must match what you’ve posted in your general ledger. Web 941 quarterly report check for variations introduction runbiz recommends reconciling your payroll if not every paycheck, every month and quarterly at the most. Automated software to quickly perform secure bank reconciliation. Web read the separate instructions before you complete form 941. From the “enter tax return” portal page, click the ri bulk 941 upload template hyperlink select the ‘open’ option. Enter deposits made in current year for previous years. Run a report that shows annual payroll amounts.106 Form 941 Templates free to download in PDF, Word and Excel

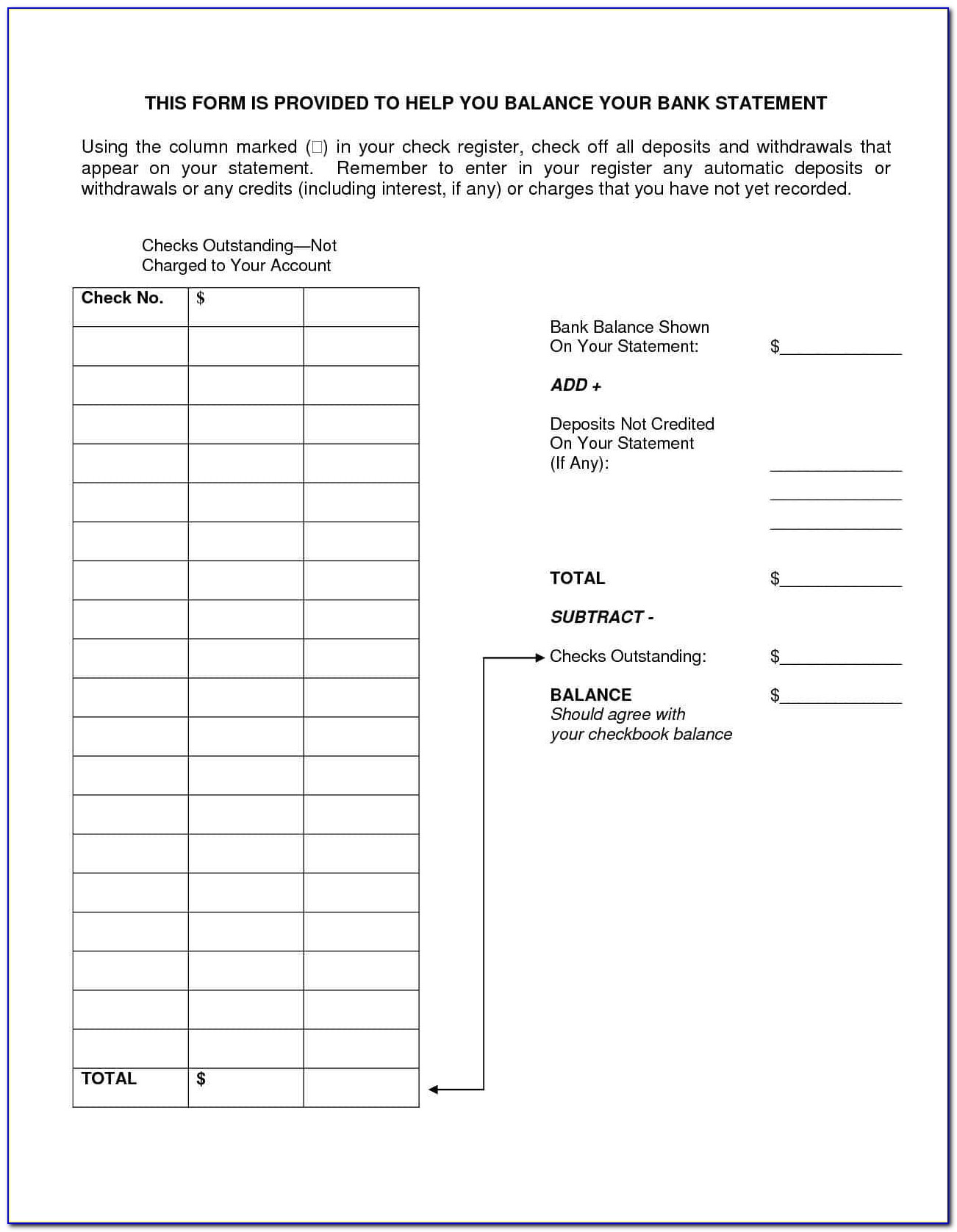

Bank Reconciliation Excel Spreadsheet Google Spreadshee bank

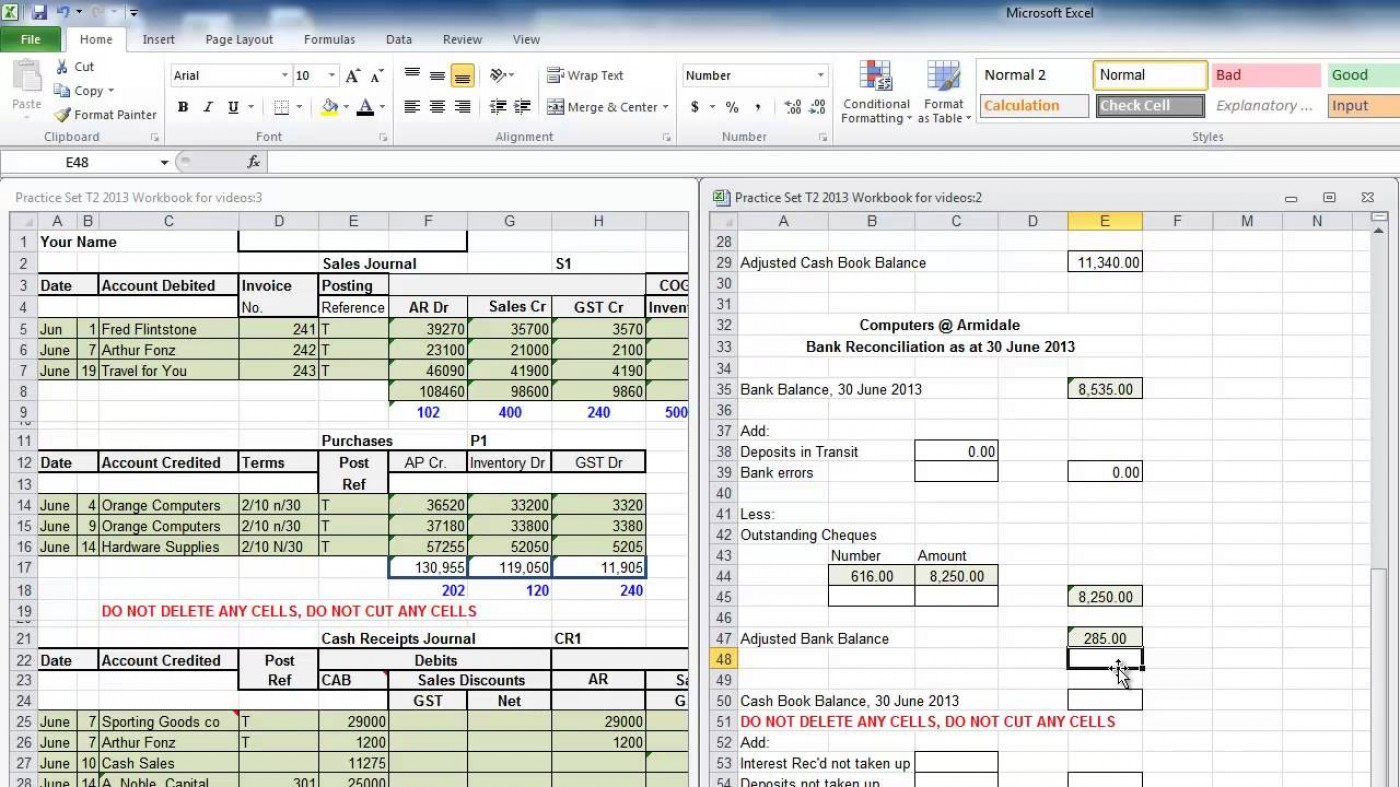

How to File Quarterly Form 941 Payroll in Excel 2017 YouTube

Simplify your US Payroll reconciliation, and save hundreds of hours

IRS Form 941 Schedule R Download Fillable PDF or Fill Online Allocation

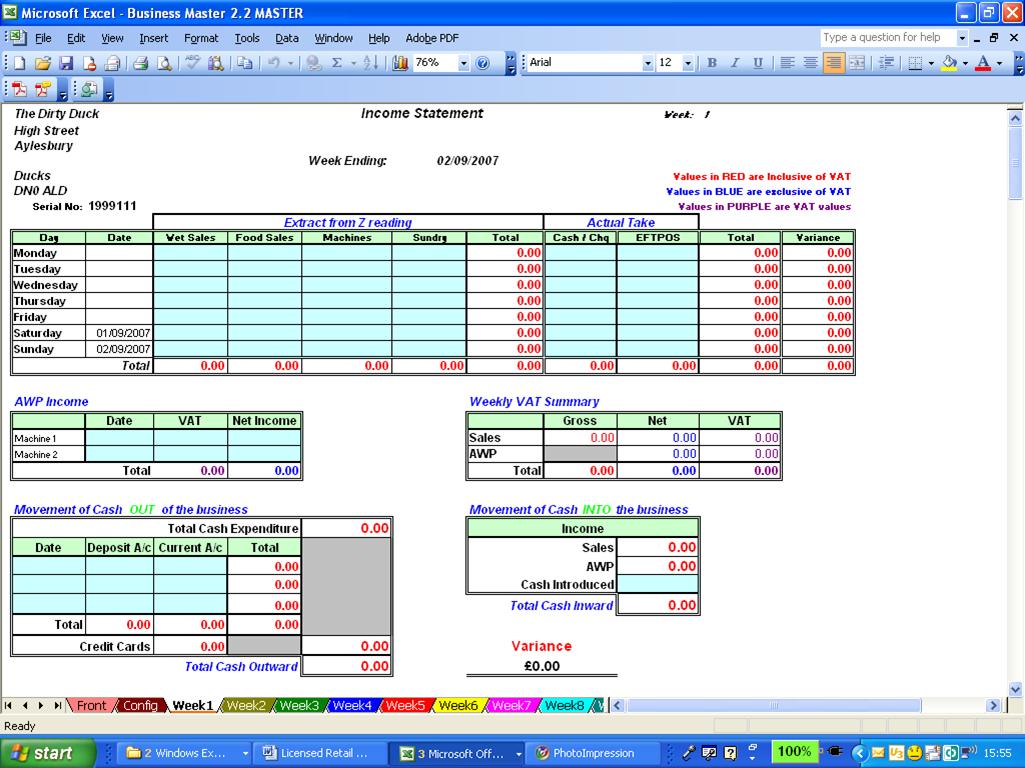

Vat Reconciliation Spreadsheet —

Inventory Reconciliation Format In Excel Excel Templates

Daily Cash Reconciliation Excel Template

QuickBooks Payroll Liability reports and troubleshooting

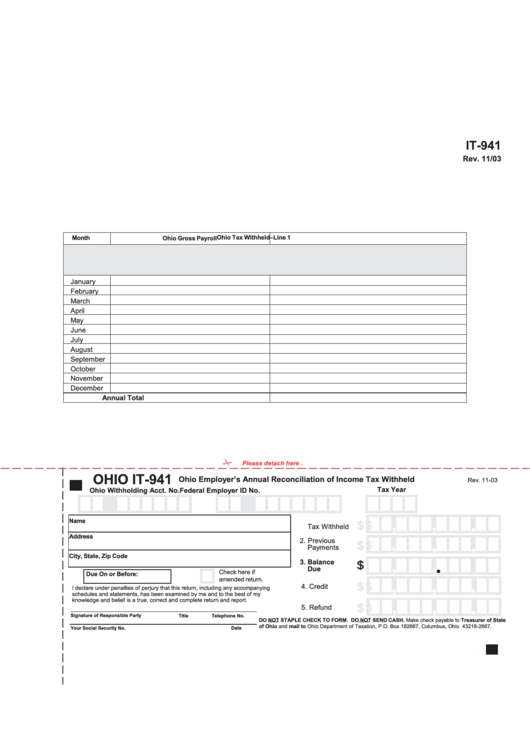

Form It941 Employer'S Annual Reconciliation Of Tax Withheld

Ad Fill Out 941 Get A Payroll Tax Refund Even If You Received Ppp Funds.

Compare Those Figures With The Totals Reported On All Four 941S For The Year.

Document The Following Items On The Reconciliation Spreadsheet:

Web If You’re An Aggregate Filer That Needs To Correct The Amount Reported On Form 941, Line 13F (13H), Include Any Increase Or Decrease To The Amount In The “Total” Reported On Form.

Related Post: