2290 Printable Form

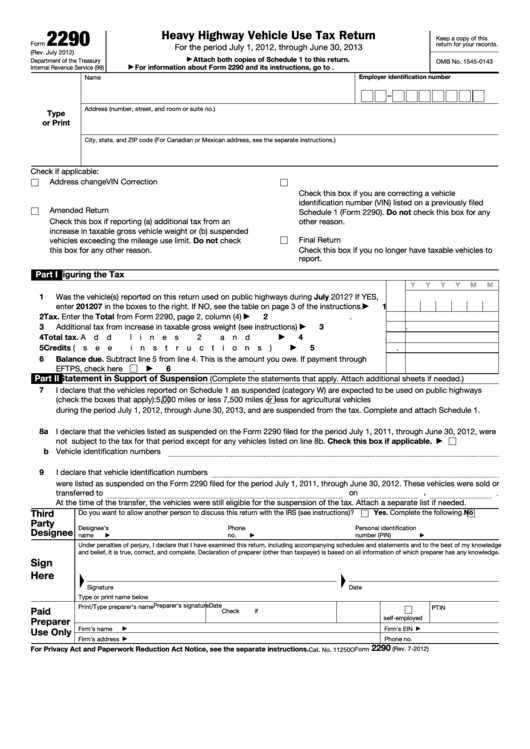

2290 Printable Form - Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 attach both copies of. Web print copies print your form 2290 easily when you choose to file electronically with us. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Form 2290 must be filed for each month a taxable. Easy, fast, secure & free to try. Web the irs gives taxpayers until august 31st to pay the 2290 tax with no penalty. Filling out this form, you have to provide your personal information, including: Web the 2290 tax form printable is essential for reporting the federal excise tax imposed on heavy highway vehicles, ensuring the appropriate taxes amount is paid and the vehicle is. Your full name (as in the. Washington — the internal revenue service today encouraged all those who have registered, or are required to register,. Web up to $40 cash back easily complete a printable irs 2290 form 2022 online. Uslegalforms.com has been visited by 100k+ users in the past month Do your truck tax online & have it efiled to the irs! Web form 2290, heavy highway vehicle use tax return, is generally used by those who own or operate a highway motor vehicle. Web print copies print your form 2290 easily when you choose to file electronically with us. Easy, fast, secure & free to try. Get ready for this year\'s tax season quickly and safely with pdffiller!create a blank & editable 2290 form,. Web up to $40 cash back easily complete a printable irs 2290 form 2022 online. Filling out this form,. Follow examples & samples for a successful taxation process. Web the 2290 form, or the heavy highway vehicle use tax (hvut) form, is a crucial tax document for truckers and heavy vehicle owners in the united states. Get schedule 1 in a few minutes. You can also access your form 2290 and schedule 1 copies at any time. Ad get. Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 attach both copies of. Uslegalforms.com has been visited by 100k+ users in the past month Follow examples & samples for a successful taxation process. Your full name (as in the. Washington — the internal revenue. Filling out this form, you have to provide your personal information, including: Web print copies print your form 2290 easily when you choose to file electronically with us. General instructions purpose of form use form 2290 for the following actions. Form 2290 must be filed for each month a taxable. Web the irs 2290 form printable is designed to make. Web the irs 2290 form printable is designed to make your life easier by providing a simple and organized way to file your heavy vehicle use tax. Web print copies print your form 2290 easily when you choose to file electronically with us. Get schedule 1 in a few minutes. Follow examples & samples for a successful taxation process. To. Get schedule 1 in a few minutes. Get schedule 1 or your money back. Web get a printable tax form 2290 as an alternative to filling out and signing your report online, you can choose to get a printable tax form 2290 from the web and print it out. Web heavy highway vehicle use tax return department of the treasury. Web the 2290 tax form printable is essential for reporting the federal excise tax imposed on heavy highway vehicles, ensuring the appropriate taxes amount is paid and the vehicle is. Web fillable version of irs form 2290. Easy, fast, secure & free to try. Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for. Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 attach both copies of. Web the irs 2290 form printable is designed to make your life easier by providing a simple and organized way to file your heavy vehicle use tax. The current period begins. Do your truck tax online & have it efiled to the irs! When to file for new operations or purchases: Filling out this form, you have to provide your personal information, including: Get schedule 1 in a few minutes. Web the irs gives taxpayers until august 31st to pay the 2290 tax with no penalty. Get schedule 1 or your money back. Web the 2290 form, or the heavy highway vehicle use tax (hvut) form, is a crucial tax document for truckers and heavy vehicle owners in the united states. Follow examples & samples for a successful taxation process. Get schedule 1 in a few minutes. Filling out this form, you have to provide your personal information, including: Web fillable version of irs form 2290. General instructions purpose of form use form 2290 for the following actions. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Get schedule 1 in a few minutes. Your full name (as in the. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Get ready for this year\'s tax season quickly and safely with pdffiller!create a blank & editable 2290 form,. Easy, fast, secure & free to try. Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 attach both copies of. Web form 2290, heavy highway vehicle use tax return, is generally used by those who own or operate a highway motor vehicle with a taxable gross weight of 55,000. Do your truck tax online & have it efiled to the irs! Form 2290 must be filed for each month a taxable. Web the irs 2290 form printable is designed to make your life easier by providing a simple and organized way to file your heavy vehicle use tax. Web get a printable tax form 2290 as an alternative to filling out and signing your report online, you can choose to get a printable tax form 2290 from the web and print it out. You can also access your form 2290 and schedule 1 copies at any time. Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 attach both copies of. When to file for new operations or purchases: Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Form 2290 must be filed for each month a taxable. Web print copies print your form 2290 easily when you choose to file electronically with us. The current period begins july 1, 2023, and ends june 30,. General instructions purpose of form use form 2290 for the following actions. Filling out this form, you have to provide your personal information, including: Follow examples & samples for a successful taxation process. Web fillable version of irs form 2290. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Uslegalforms.com has been visited by 100k+ users in the past month Web the irs gives taxpayers until august 31st to pay the 2290 tax with no penalty. Easy, fast, secure & free to try. Get schedule 1 in a few minutes. Web the 2290 form, or the heavy highway vehicle use tax (hvut) form, is a crucial tax document for truckers and heavy vehicle owners in the united states.Free Printable Form 2290 Printable Templates

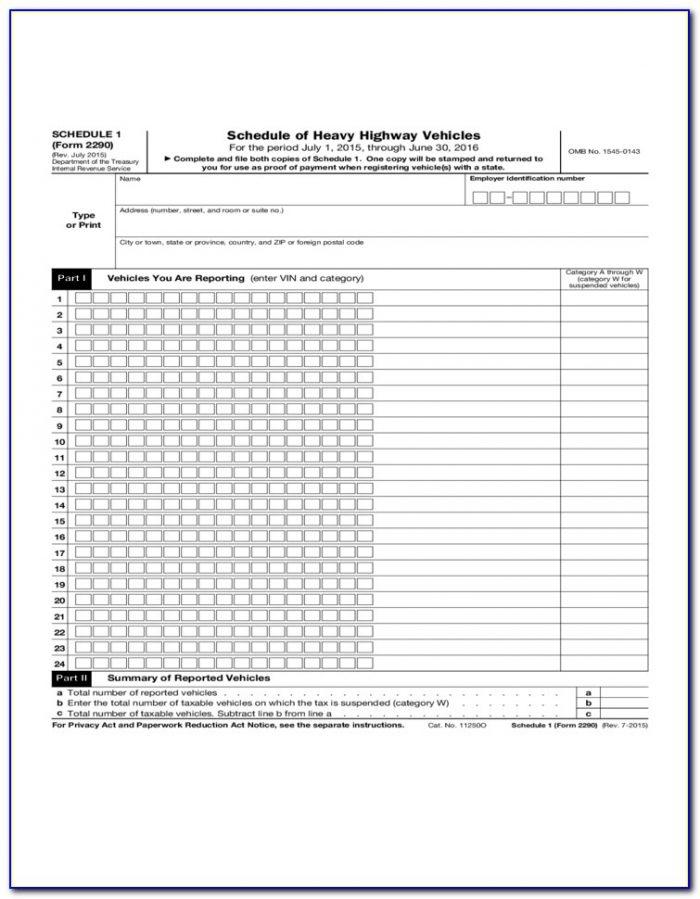

Printable 2290 Form Customize and Print

Free Printable 2290 Tax Form Printable Templates

Printable IRS Form 2290 for 2020 Download 2290 Form

Free Printable 2290 Tax Form Printable Templates

Printable 2290 Form Customize and Print

Fillable Form 2290 Heavy Highway Vehicle Use Tax Return printable pdf

Get Form 2290 Schedule 1 in Minutes HVUT Proof of Payment

Free Printable Form 2290 Printable Templates

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

Washington — The Internal Revenue Service Today Encouraged All Those Who Have Registered, Or Are Required To Register,.

To Open The 2290 Form Online Click The Fill Out Form Button.

Web Form 2290, Heavy Highway Vehicle Use Tax Return, Is Generally Used By Those Who Own Or Operate A Highway Motor Vehicle With A Taxable Gross Weight Of 55,000.

Get Schedule 1 Or Your Money Back.

Related Post: