1040Ez Form Printable

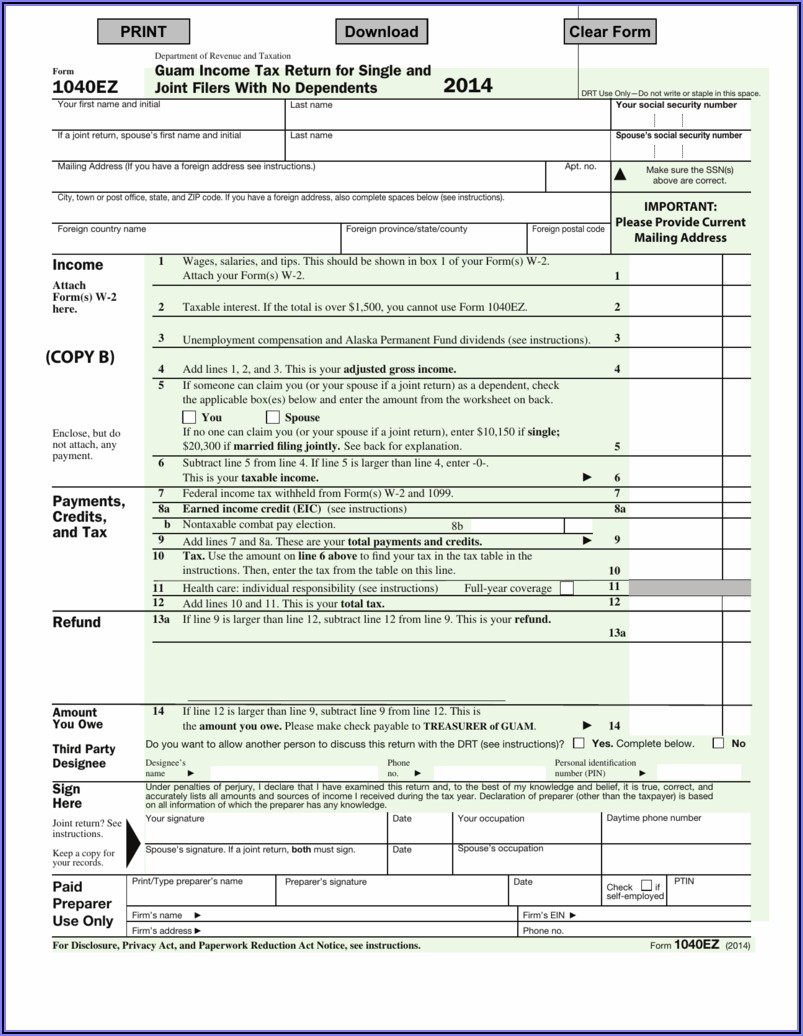

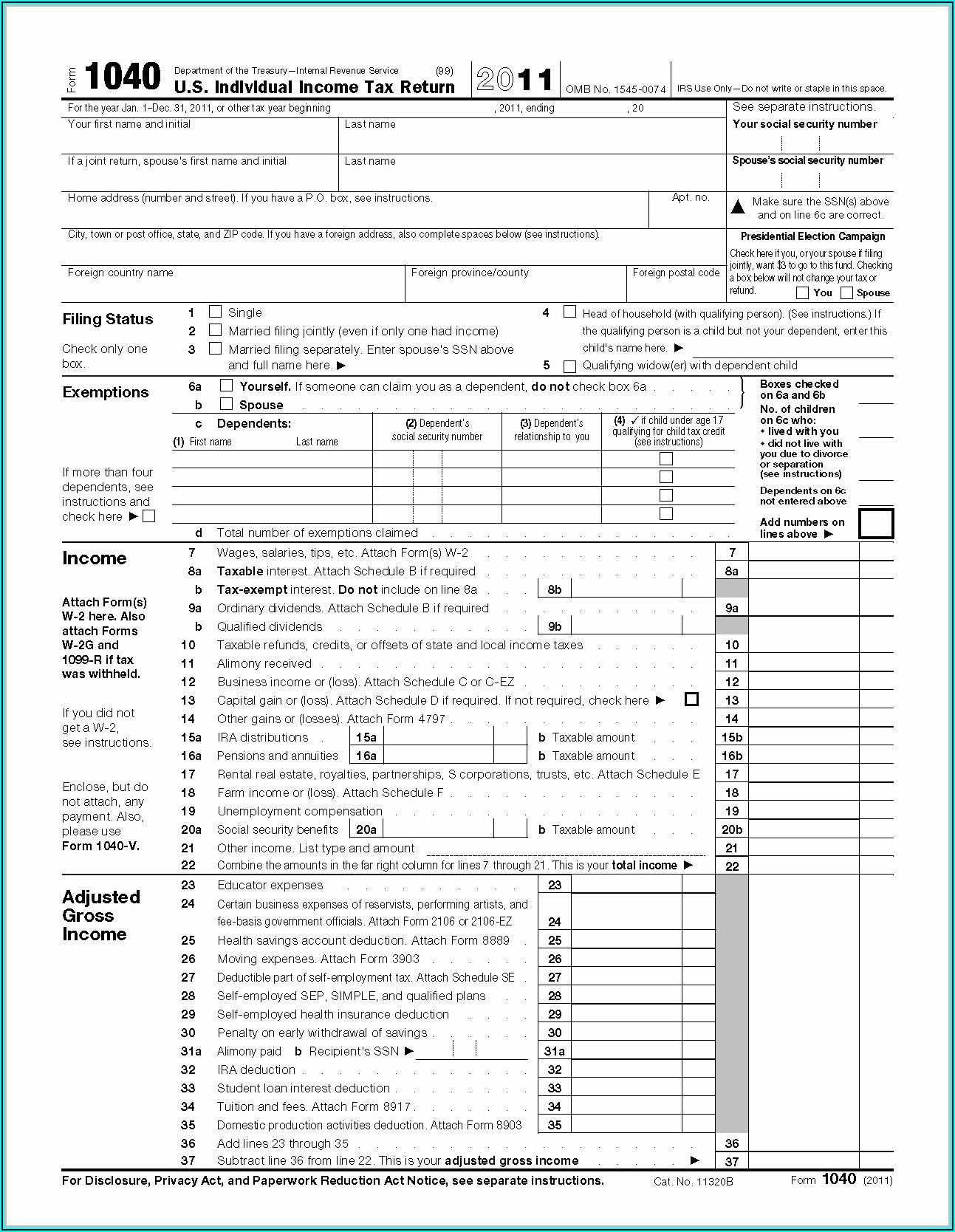

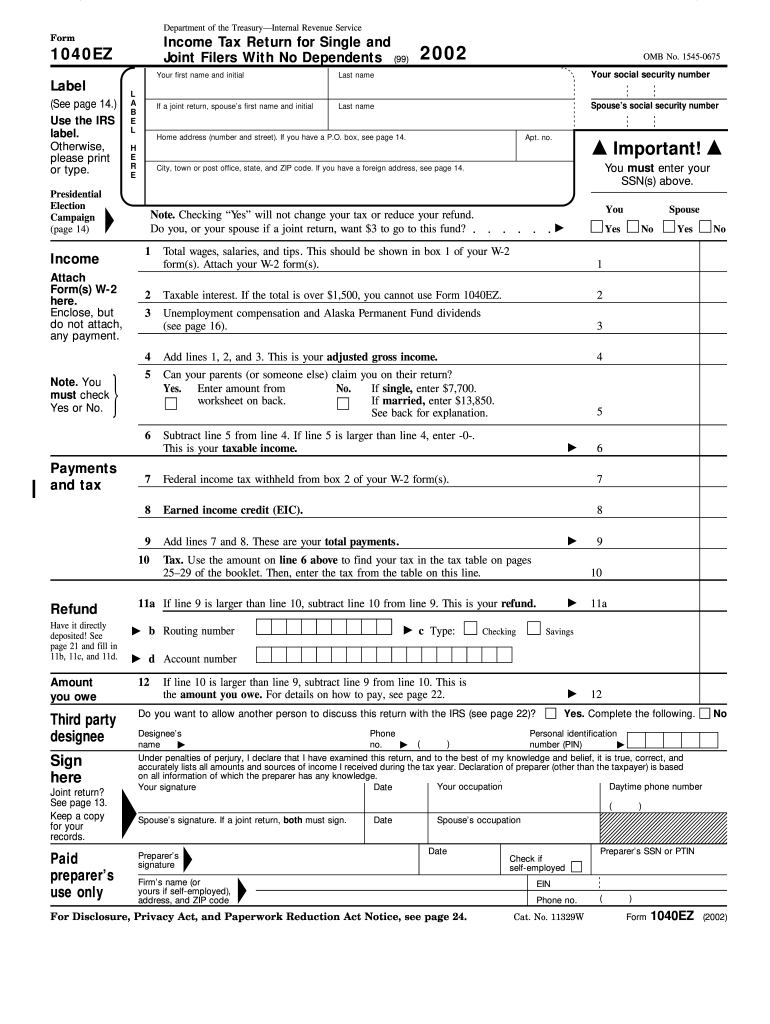

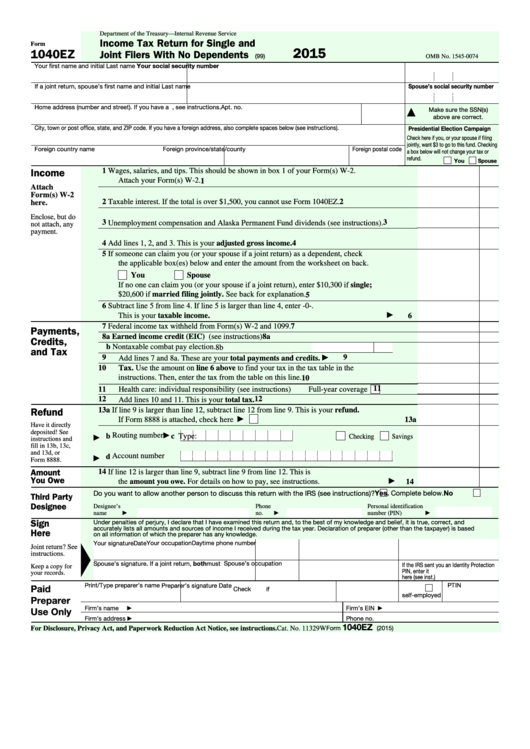

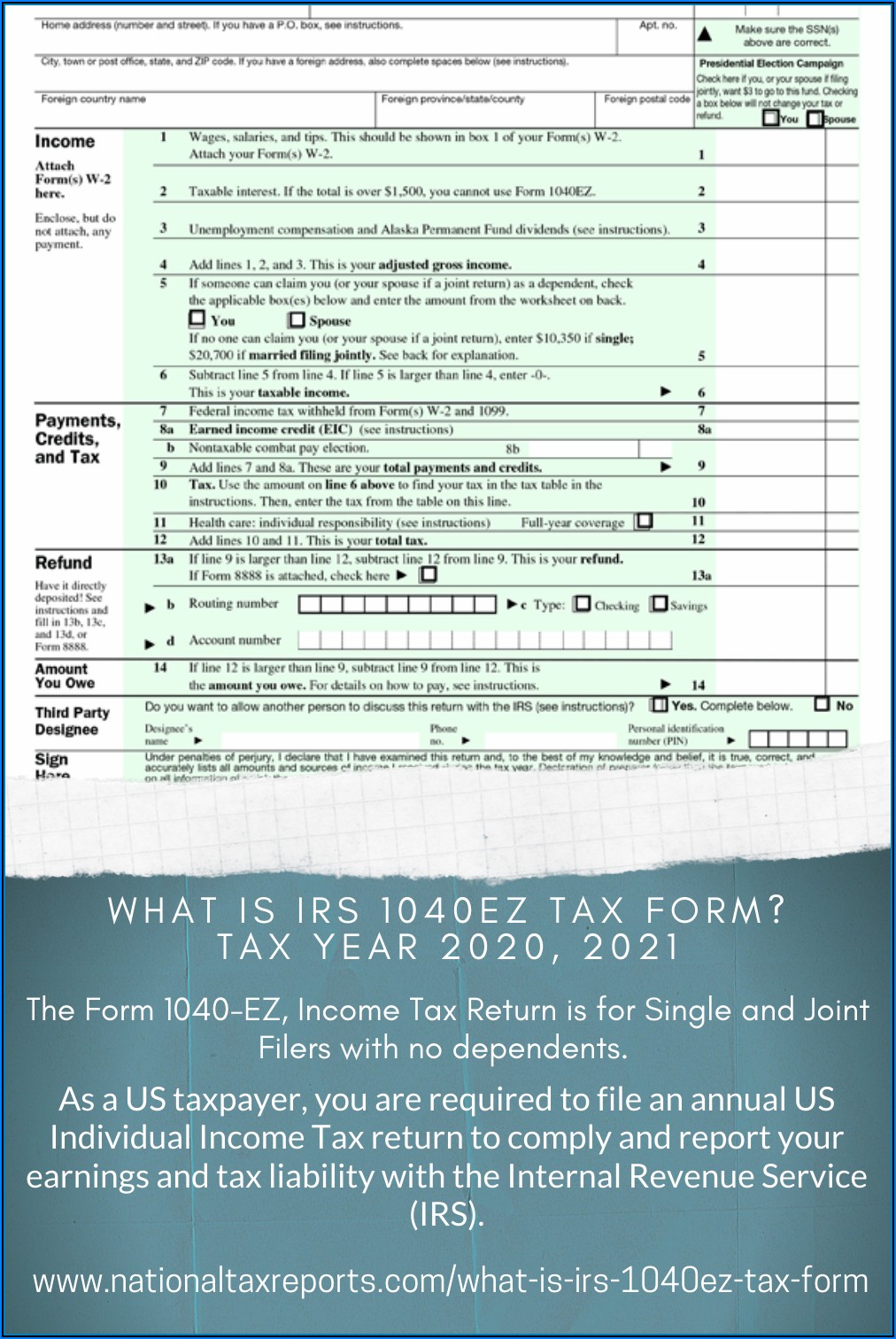

1040Ez Form Printable - Individual tax return form 1040 instructions; The 1040ez is a simplified form used by the irs for income taxpayers that do not require the complexity of the full 1040 tax form. To start the document, utilize the fill & sign online button or tick the preview image of the form. Request for taxpayer identification number (tin) and certification. Web instructions for form 1040. Web form 1040 department of the treasury—internal revenue service (99) u.s. Web get federal tax return forms and file by mail. Web form 1040ez department of the treasury—internal revenue service income tax return for single and joint filers with no dependents (99) 2017 omb no. Web complete printable 1040ez on the web while complying with regulations. Fill out general personal information (first and last name, address, and. Use form 1040ez (quick & easy) if: Ad search for answers from across the web with searchandshopping.org. You only received a w2. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Your taxable income is less than $100,000; Web the way to complete the printable 1040ez online: Annual income tax return filed by citizens or residents of the united states. Otherwise, please print or type. Irs use only—do not write or staple in. Your taxable income is less than $100,000; Otherwise, please print or type. You only received a w2. Ad browse & discover thousands of unique brands. Below is a general guide to what schedule (s) you will need to file. Irs use only—do not write or staple in. Irs use only—do not write or staple in. Individual tax return form 1040 instructions; Web instructions for form 1040. Web complete printable 1040ez on the web while complying with regulations. To open the printable 1040 ez form, you would need to click the fill out form button. Web instructions for form 1040. Ad search for answers from across the web with searchandshopping.org. Web irs form 1040ez was a shortened version of the irs tax form 1040. Download this form print this form more about the. This form is for income earned in tax. Web more about the arizona form 140ez. Request for taxpayer identification number (tin) and certification. Otherwise, please print or type. Request for transcript of tax return. To start the document, utilize the fill & sign online button or tick the preview image of the form. Use form 1040ez (quick & easy) if: Download this form print this form more about the. Request for taxpayer identification number (tin) and. Ad browse & discover thousands of unique brands. Web more about the arizona form 140ez. Otherwise, please print or type. Here's a guide to what is on these. Ad browse & discover thousands of unique brands. Request for transcript of tax return. To start the document, utilize the fill & sign online button or tick the preview image of the form. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Otherwise, please print or type. Ad search for answers from across the web with searchandshopping.org. Annual income tax return filed by citizens or residents of the united states. Find deals and compare prices on turbo tax online at amazon.com Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web more about the arizona form 140ez. Request for taxpayer identification number (tin) and. Web get federal tax return forms and file by mail. Here's a guide to what is on these. Fill out general personal information (first and last name, address, and. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Discover the answers you need here! To start the document, utilize the fill & sign online button or tick the preview image of the form. Individual tax return form 1040 instructions; Use form 1040ez (quick & easy) if: Individual income tax return 2022 department of the treasury—internal revenue service omb no. Web which form to choose: You only received a w2. Web instructions for form 1040. Your taxable income is less than $100,000; Web complete printable 1040ez on the web while complying with regulations. Here's a guide to what is on these. Web form 1040ez department of the treasury—internal revenue service income tax return for single and joint filers with no dependents (99) 2017 omb no. Below is a general guide to what schedule (s) you will need to file. Request for transcript of tax return. The advanced tools of the. We last updated arizona form 140ez in february 2023 from the arizona department of revenue. It allowed single and joint filers with no dependents with basic tax reporting needs to file. This form is for income earned in tax. Web get federal tax return forms and file by mail. Your taxable income is less than $100,000; Web form 1040ez department of the treasury—internal revenue service income tax return for single and joint filers with no dependents (99) 2017 omb no. Request for taxpayer identification number (tin) and certification. February 20, 2023 form 1040ez was a federal tax form used by taxpayers who met certain eligibility requirements. Web form 1040 department of the treasury—internal revenue service (99) u.s. Optimize, standardize, and streamline tax document workflows with airslate. Fill out general personal information (first and last name, address, and. Request for transcript of tax return. Ad browse & discover thousands of unique brands. The 1040ez is a simplified form used by the irs for income taxpayers that do not require the complexity of the full 1040 tax form. Find deals and compare prices on turbo tax online at amazon.com Web irs form 1040ez was a shortened version of the irs tax form 1040. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Ad search for answers from across the web with searchandshopping.org. This form is for income earned in tax.Tax Forms 2015 Printable Trinidad Fillable Form 1040 U.s

1040ez Fillable Form MBM Legal

Fillable Form 1040ez Tax Return For Single And Joint Filers

1040ez Tax Form With Dependents Form Resume Examples

1040ez Tax Form Form Resume Examples ABpV5eV1ZL

Form 1040SR Seniors Get a New Simplified Tax Form

Electronic IRS Form 1040NREZ 2018 2019 Printable PDF Sample

1040ez Tax Form Definition Form Resume Examples GM9OKWM9DL

1040ez Tax Form Form Resume Examples ABpV5eV1ZL

Printable 1040ez Form Fill Out and Sign Printable PDF Template signNow

Web Which Form To Choose:

Web Form 1040 (2021) Us Individual Income Tax Return For Tax Year 2021.

Web The Way To Complete The Printable 1040Ez Online:

To Start The Document, Utilize The Fill & Sign Online Button Or Tick The Preview Image Of The Form.

Related Post:

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png)