1040 Es Printable Form

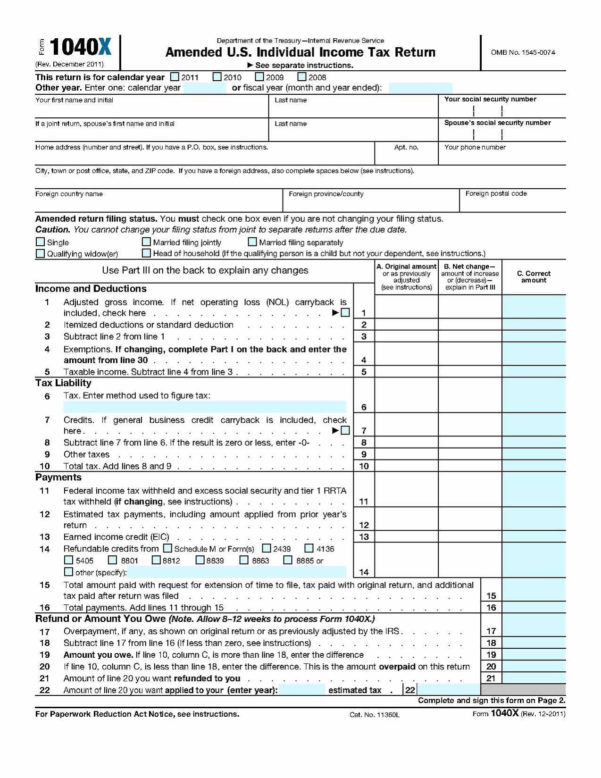

1040 Es Printable Form - Estimated tax is the method used to pay tax on income that isn’t subject to withholding. Web download the data file or print your copy. Your taxable income is less than $100,000. Mail both to the address shown. You claim certain tax credits; Estimate your taxes and refunds easily with this free tax calculator from aarp. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. This form is for income earned in tax year 2022, with tax returns due. Web libraries irs taxpayer assistance centers new 1040 form for older adults the irs has released a new tax filing form for people 65 and older. Estimated tax for nonresident alien individuals department of the treasury internal revenue service future developments. Mail both to the address shown. Sign in to your turbotax account, then open your return by selecting. Web libraries irs taxpayer assistance centers new 1040 form for older adults the irs has released a new tax filing form for people 65 and older. This form is for income earned in tax year 2022, with tax returns due. You claim. Estimated tax for nonresident alien individuals department of the treasury internal revenue service future developments. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. You have capital gain distributions. Complete, edit or print tax forms instantly. Mail both to the address shown. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. Complete, edit or print tax forms instantly. Web download the data file or print your copy. 2021department of the treasury internal revenue servicenow 1040es estimated tax for individualspurpose of this packages form 1040es to. Estimate your taxes and refunds easily with. Web detach the voucher, and enclose it with your payment. Web download the data file or print your copy. Complete, edit or print tax forms instantly. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. This form is for income earned in tax year 2022, with tax returns due. Web download the data file or print your copy. 2021department of the treasury internal revenue servicenow 1040es estimated tax for individualspurpose of this packages form 1040es to. You claim certain tax credits; Ad discover helpful information and resources on taxes from aarp. If paying on behalf of another filer, write the filer’s name and the last four digits of the. Estimate your taxes and refunds easily with this free tax calculator from aarp. Your taxable income is less than $100,000. Sign in to your turbotax account, then open your return by selecting. Web libraries irs taxpayer assistance centers new 1040 form for older adults the irs has released a new tax filing form for people 65 and older. Estimated tax. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. 2021department of the treasury internal revenue servicenow 1040es estimated tax for individualspurpose of this packages form 1040es to. Web form 1040a may. Submit instantly to the receiver. Web detach the voucher, and enclose it with your payment. Ad discover helpful information and resources on taxes from aarp. Web libraries irs taxpayer assistance centers new 1040 form for older adults the irs has released a new tax filing form for people 65 and older. Estimated tax is the method used to pay tax. Estimate your taxes and refunds easily with this free tax calculator from aarp. You have capital gain distributions. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. Ad discover helpful information and resources on taxes from aarp. Estimated tax is the method used to pay tax on income that isn’t. Estimate your taxes and refunds easily with this free tax calculator from aarp. Sign in to your turbotax account, then open your return by selecting. Mail both to the address shown. 2021department of the treasury internal revenue servicenow 1040es estimated tax for individualspurpose of this packages form 1040es to. Your taxable income is less than $100,000. You have capital gain distributions. This form is for income earned in tax year 2022, with tax returns due. Web libraries irs taxpayer assistance centers new 1040 form for older adults the irs has released a new tax filing form for people 65 and older. If paying on behalf of another filer, write the filer’s name and the last four digits of the filer’s ssn on. Estimated tax for nonresident alien individuals department of the treasury internal revenue service future developments. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. Mail both to the address shown. Web detach the voucher, and enclose it with your payment. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. Sign in to your turbotax account, then open your return by selecting. Complete, edit or print tax forms instantly. Web form 1040a may be best for you if: Web download the data file or print your copy. Estimated tax is the method used to pay tax on income that isn’t subject to withholding. Your taxable income is less than $100,000. Web first you need to either download the printable 1040 estimated tax form on the irs website and fill it out manually, or you can fill out the form digitally directly on the irs' website. Estimate your taxes and refunds easily with this free tax calculator from aarp. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. 2021department of the treasury internal revenue servicenow 1040es estimated tax for individualspurpose of this packages form 1040es to. Ad discover helpful information and resources on taxes from aarp. Complete, edit or print tax forms instantly. Estimate your taxes and refunds easily with this free tax calculator from aarp. Complete, edit or print tax forms instantly. Your taxable income is less than $100,000. Web first you need to either download the printable 1040 estimated tax form on the irs website and fill it out manually, or you can fill out the form digitally directly on the irs' website. Estimated tax for nonresident alien individuals department of the treasury internal revenue service future developments. Estimated tax is the method used to pay tax on income that isn’t subject to withholding. Web form 1040a may be best for you if: Ad discover helpful information and resources on taxes from aarp. If paying on behalf of another filer, write the filer’s name and the last four digits of the filer’s ssn on. Submit instantly to the receiver. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. 2021department of the treasury internal revenue servicenow 1040es estimated tax for individualspurpose of this packages form 1040es to. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. Mail both to the address shown. Web libraries irs taxpayer assistance centers new 1040 form for older adults the irs has released a new tax filing form for people 65 and older.Form 1040ES Estimated Tax for Individuals Form (2014) Free Download

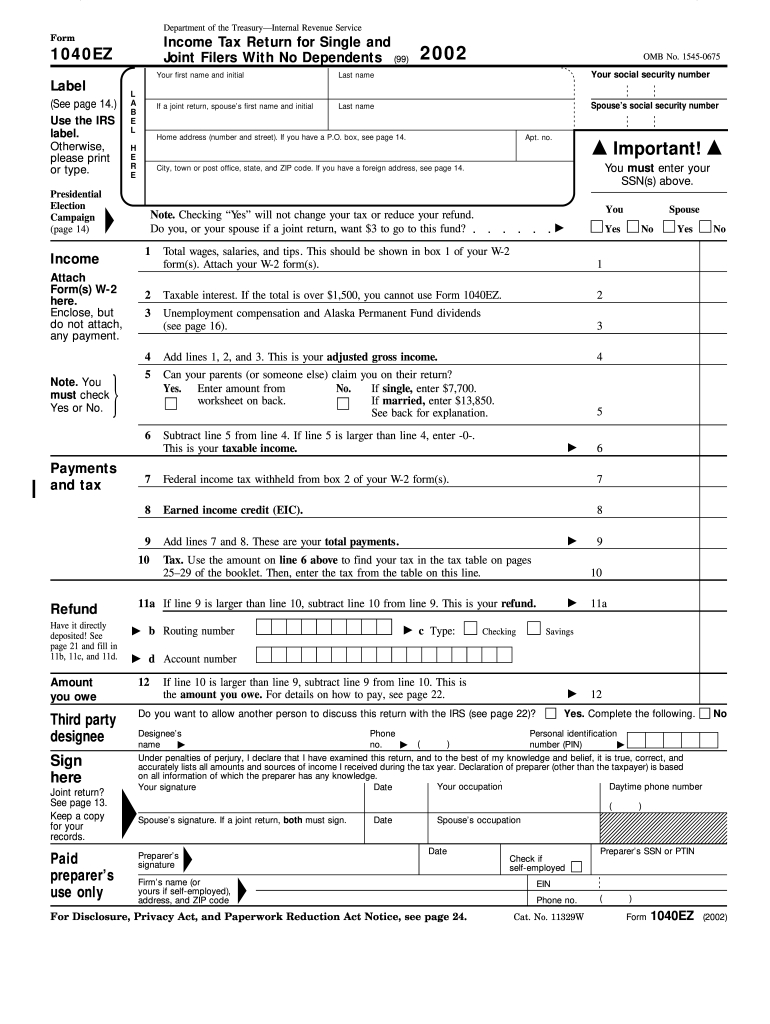

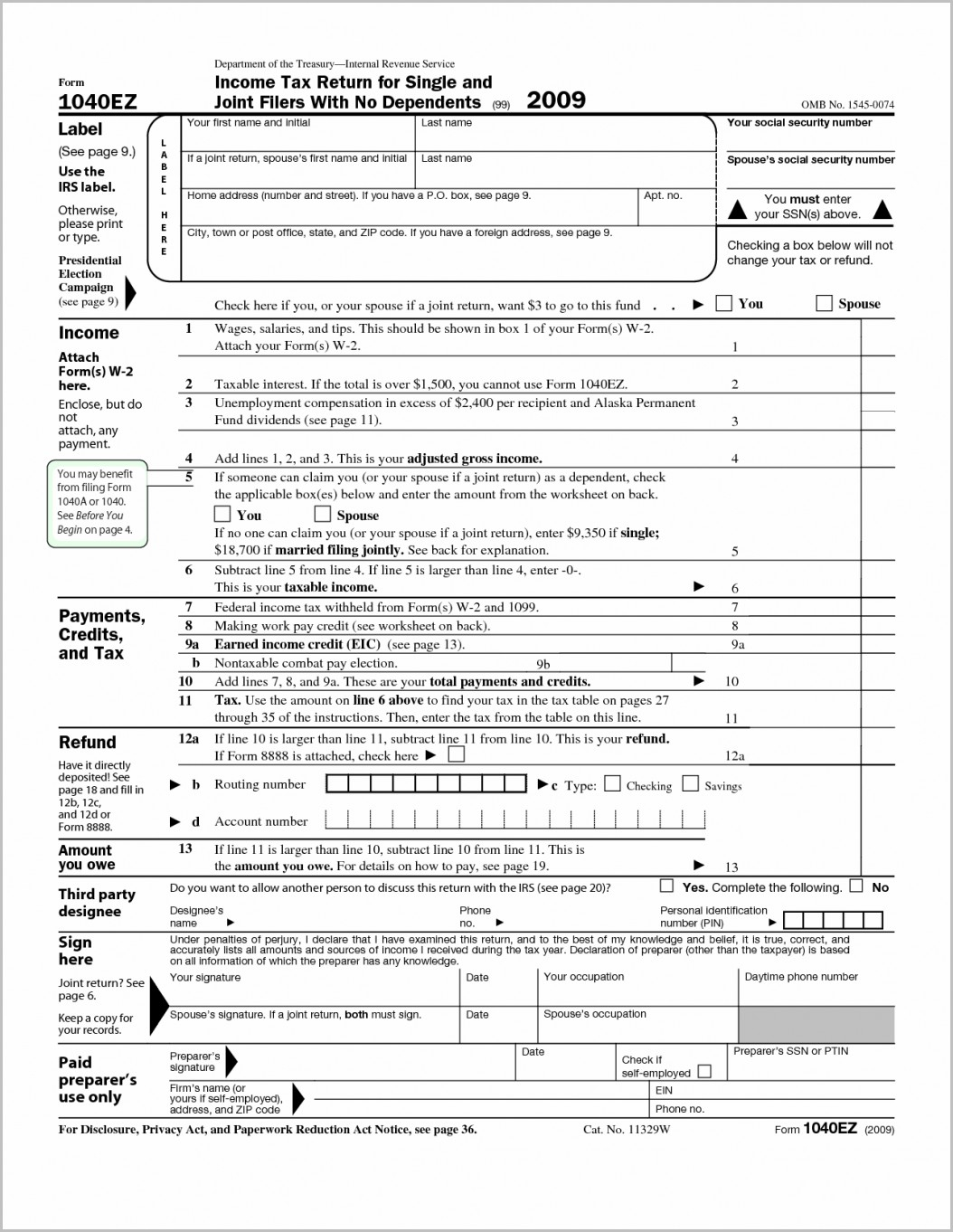

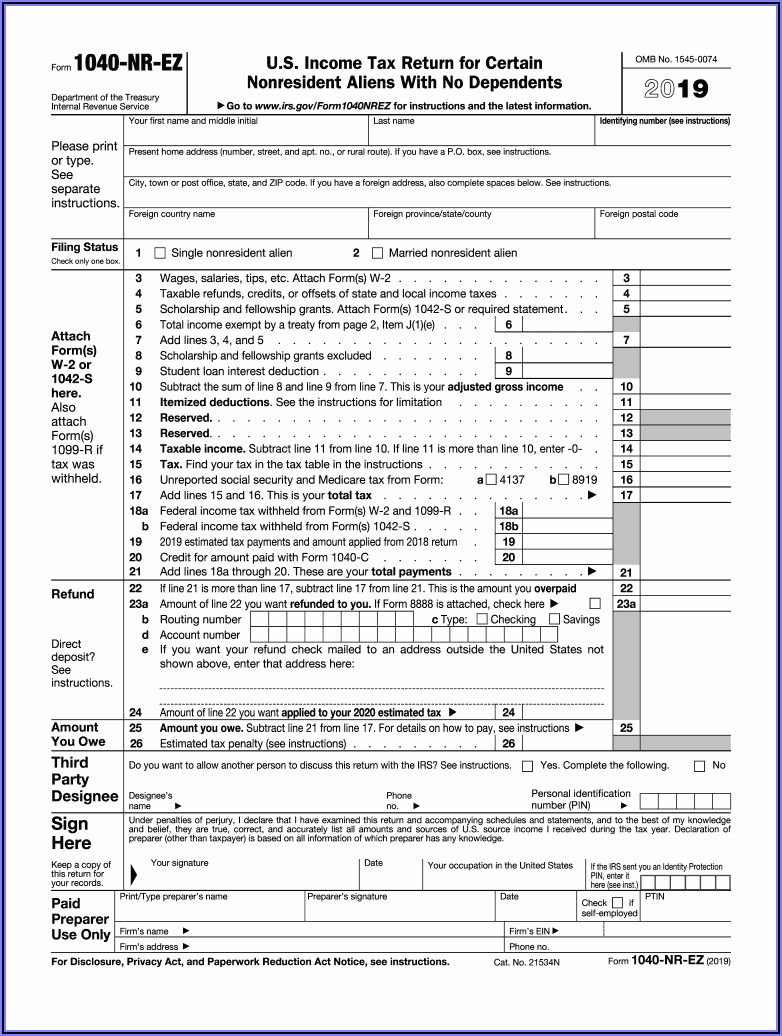

1040 Ez Fill Online, Printable, Fillable, Blank pdfFiller

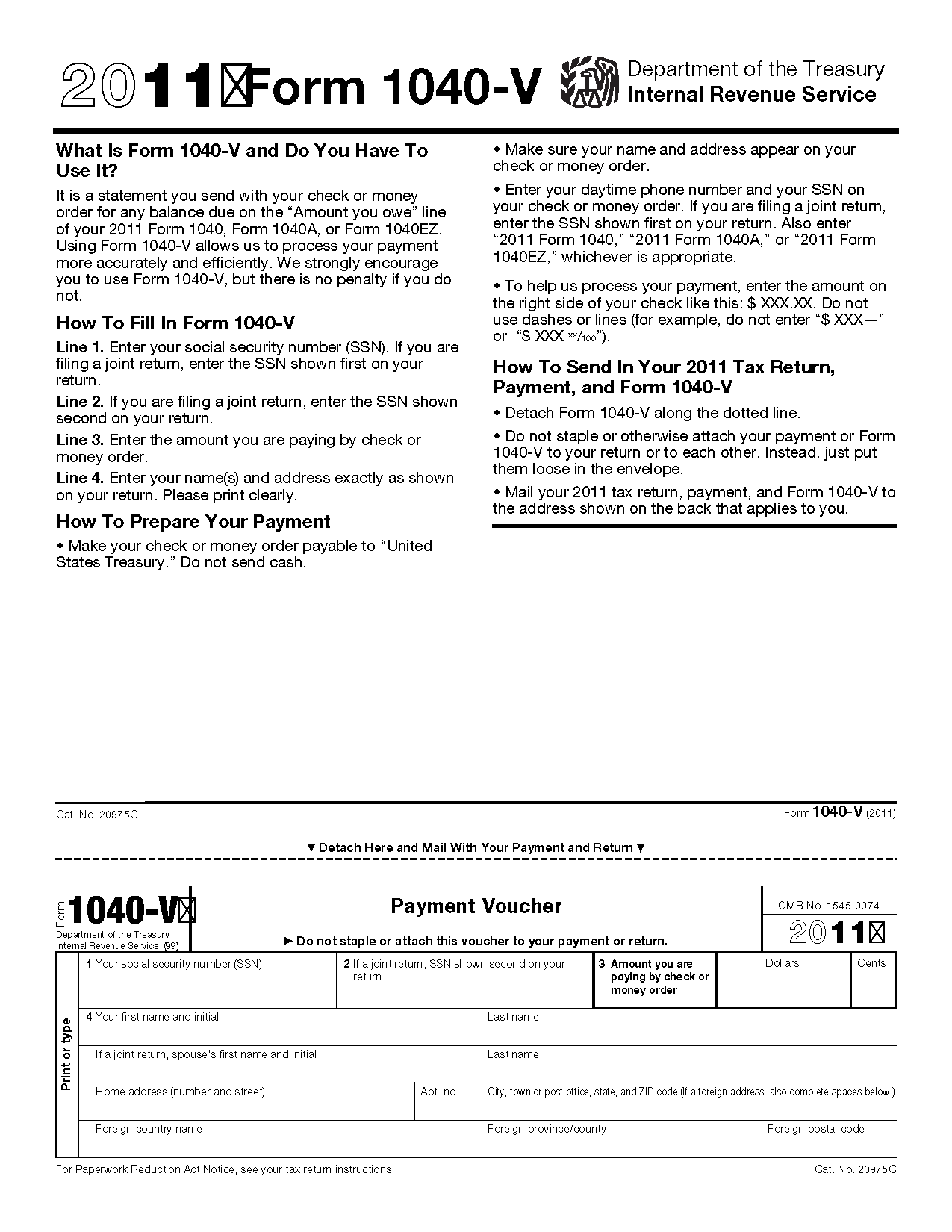

Form 1040 ES V 1040 Form Printable

Irs Fillable Form 1040 il1040es 2019 Fill Online, Printable

Form 1040ES Estimated Tax for Individuals Form (2014) Free Download

Printable Pa 1040 Tax Form Printable Form 2022

1040 Es Spreadsheet 1 Printable Spreadshee 1040es spreadsheet.

Fed Tax Form 1040 Es Form Resume Examples pv9wXJ8oY7

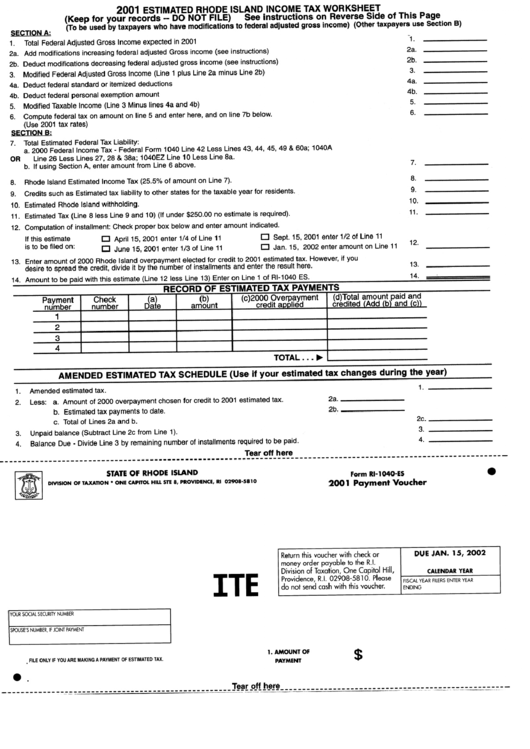

Form Ri1040Es Payment Voucher 2001 printable pdf download

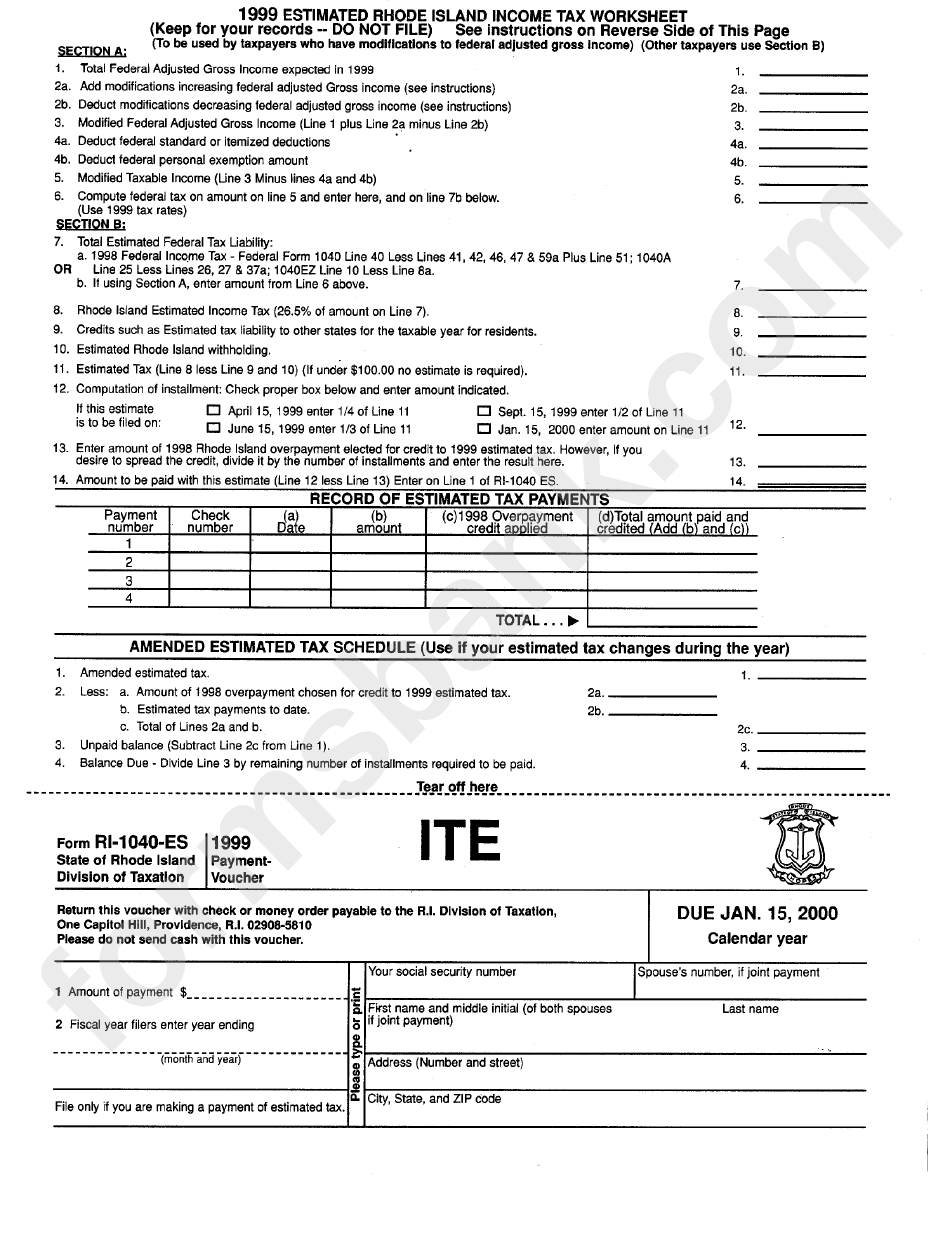

Fillable Form Ri1040Es 1999 Payment Voucher printable pdf download

Calendar Year— Due June 15,.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due.

Web Download The Data File Or Print Your Copy.

Estimated Tax Is The Method Used To Pay Tax On Income That Isn’t Subject To Withholding (For Example, Earnings.

Related Post: