1031 Exchange Template

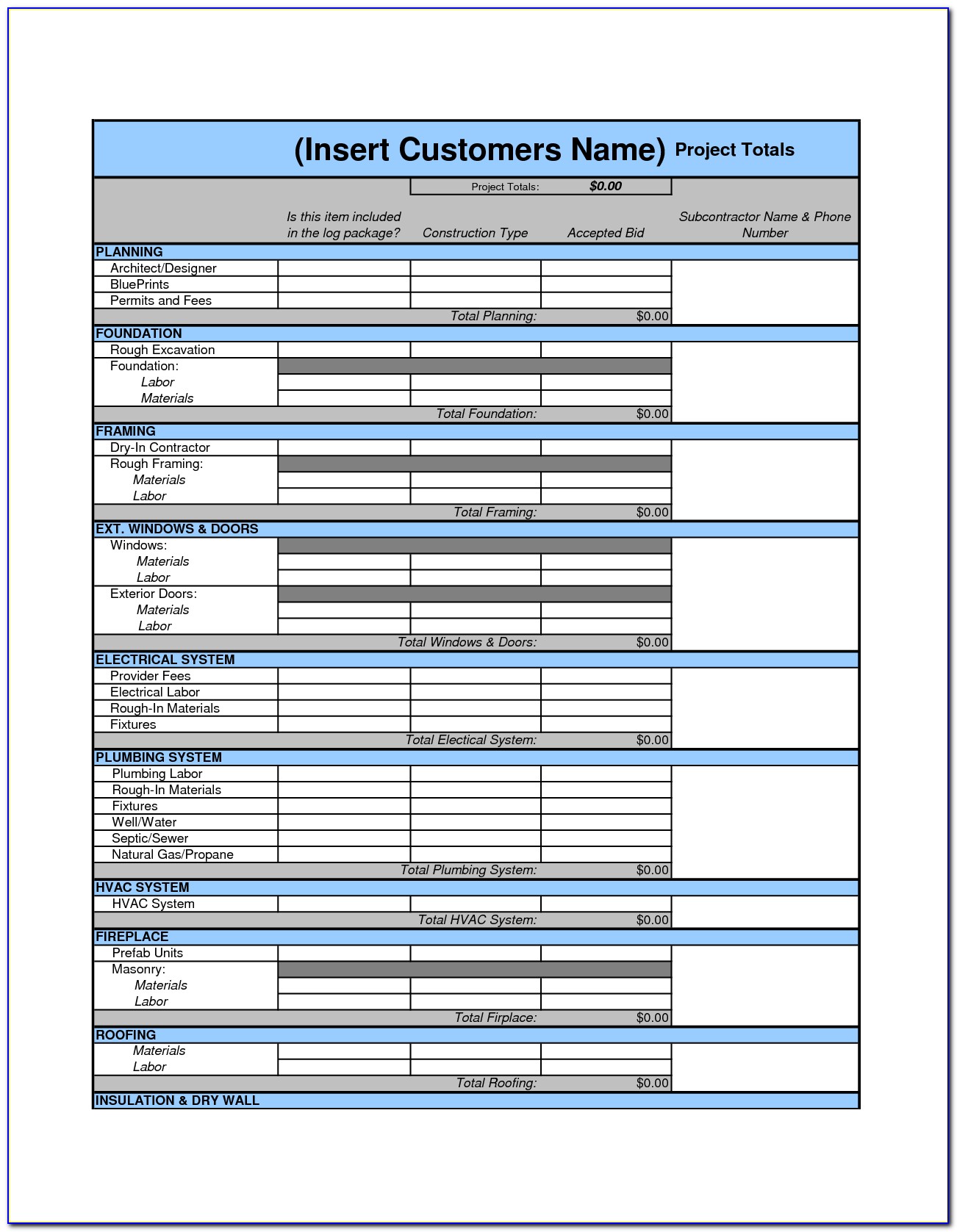

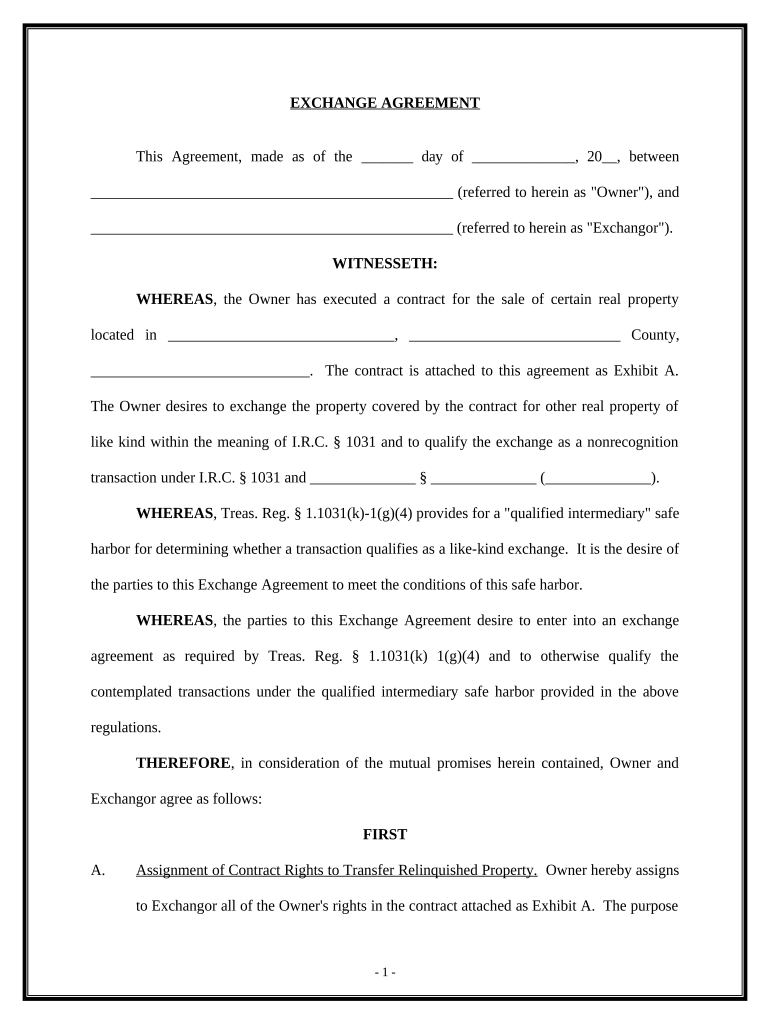

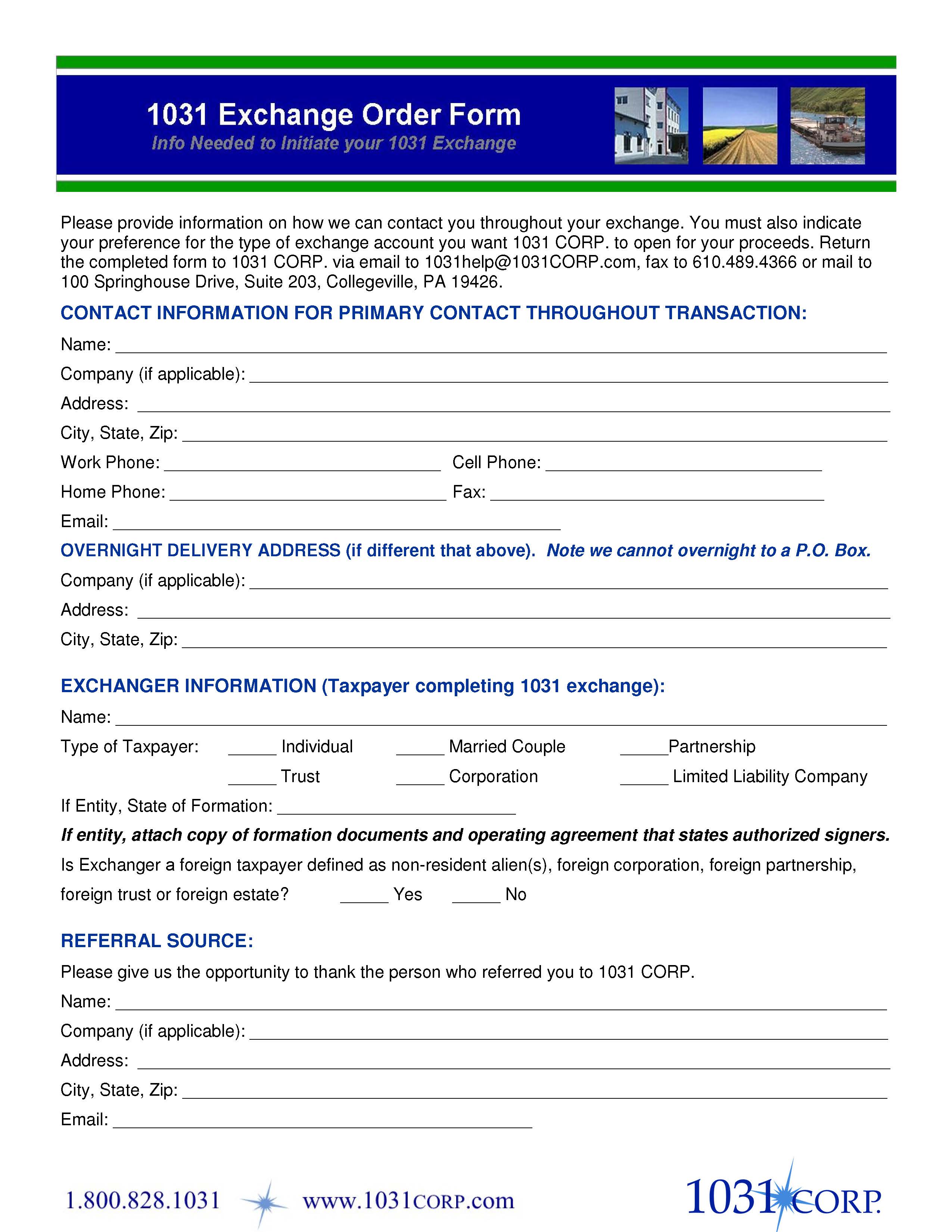

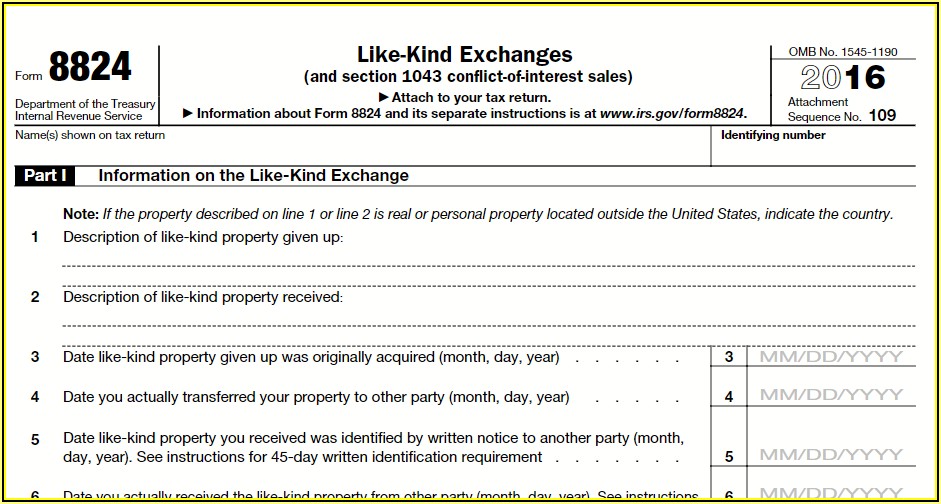

1031 Exchange Template - The pros at equity advantage have provided everything you need in easily downloadable pdf files. To pay no tax when executing a 1031 exchange, you must purchase at least. If you’re considering performing a 1031 tax exchange instead of a taxable sale of a property, this calculator will help you figure out your tax deferment. Web visit our library of important 1031 exchange forms. Intermediary agrees to act as a qualified intermediary within the. Web 1031 exchange transaction) is killed, injured or missing as a result of the federally declared disaster; Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Web the form requires a description of the relinquished and replacement property, acquisition and transfer dates, and other information. Web a 1031 exchange comes with a few advantages, including deferring capital gains tax, expanding your portfolio and more control during the sale of property. Web your 1031 exchange roadmapidentify the property you want to sell.select a qi.add a relinquished property addendum to any contract offer.get a copy of the sales contract to. Web the form requires a description of the relinquished and replacement property, acquisition and transfer dates, and other information. Ad you've worked hard for your money, we work hard to keep it yours. Web 1031 exchange transaction) is killed, injured or missing as a result of the federally declared disaster; Web a 1031 exchange comes with a few advantages, including. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to calculate. To pay no tax when executing a 1031 exchange, you must purchase at least. How to divide the 1031 proceeds after the sale of the relinquished property feb 18,. Each. Web your 1031 exchange roadmapidentify the property you want to sell.select a qi.add a relinquished property addendum to any contract offer.get a copy of the sales contract to. Web the form requires a description of the relinquished and replacement property, acquisition and transfer dates, and other information. (iv) a document prepared in connection with the exchange (for example, the. Exchange. Ad site is updated continuously. Web under section 1031 of the united states internal revenue code (26 u.s.c. The three primary 1031 exchange rules to follow are: Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to calculate. (iv) a document. The pros at equity advantage have provided everything you need in easily downloadable pdf files. If you’re considering performing a 1031 tax exchange instead of a taxable sale of a property, this calculator will help you figure out your tax deferment. To pay no tax when executing a 1031 exchange, you must purchase at least. Web visit our library of. Includes editor's notes written by expert staff. Exchange today and keep your investment property's equity intact! Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Ad you've worked hard for your money, we work hard to keep it yours. Web visit our library. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to calculate. Ad you've worked hard for your money, we work hard to keep it yours. § 1031), a taxpayer may defer recognition of capital gains and related federal income tax liability. The three primary 1031 exchange rules to follow are: Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Web 1031 exchange transaction) is killed, injured or missing as a result of the federally declared disaster; Ad you've worked hard for your money, we work hard to keep it yours. Web a 1031 exchange. Includes editor's notes written by expert staff. Web how 1031 exchanges are different in 2021 feb 23, 2021. To pay no tax when executing a 1031 exchange, you must purchase at least. If you’re considering performing a 1031 tax exchange instead of a taxable sale of a property, this calculator will help you figure out your tax deferment. Under the. Each party shall reasonably cooperate if another party intends to structure the transfer or acquisition of the property as part of an exchange under 26 u.s.c. Web a 1031 exchange comes with a few advantages, including deferring capital gains tax, expanding your portfolio and more control during the sale of property. Web how 1031 exchanges are different in 2021 feb. Web under section 1031 of the united states internal revenue code (26 u.s.c. If you’re considering performing a 1031 tax exchange instead of a taxable sale of a property, this calculator will help you figure out your tax deferment. Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. The pros at equity advantage have provided everything you need in easily downloadable pdf files. Replacement property should be of equal or greater value. Includes editor's notes written by expert staff. Web your 1031 exchange roadmapidentify the property you want to sell.select a qi.add a relinquished property addendum to any contract offer.get a copy of the sales contract to. Ad you've worked hard for your money, we work hard to keep it yours. How to divide the 1031 proceeds after the sale of the relinquished property feb 18,. Web the form requires a description of the relinquished and replacement property, acquisition and transfer dates, and other information. (iv) a document prepared in connection with the exchange (for example, the. Web 1031 exchange transaction) is killed, injured or missing as a result of the federally declared disaster; To pay no tax when executing a 1031 exchange, you must purchase at least. Web how 1031 exchanges are different in 2021 feb 23, 2021. Web a 1031 exchange comes with a few advantages, including deferring capital gains tax, expanding your portfolio and more control during the sale of property. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. The three primary 1031 exchange rules to follow are: Exchange today and keep your investment property's equity intact! Intermediary agrees to act as a qualified intermediary within the. Web visit our library of important 1031 exchange forms. Replacement property should be of equal or greater value. Web visit our library of important 1031 exchange forms. Under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Web 1031 exchange transaction) is killed, injured or missing as a result of the federally declared disaster; Each party shall reasonably cooperate if another party intends to structure the transfer or acquisition of the property as part of an exchange under 26 u.s.c. Web under section 1031 of the united states internal revenue code (26 u.s.c. The three primary 1031 exchange rules to follow are: Web the form requires a description of the relinquished and replacement property, acquisition and transfer dates, and other information. Includes editor's notes written by expert staff. Intermediary agrees to act as a qualified intermediary within the. Web your 1031 exchange roadmapidentify the property you want to sell.select a qi.add a relinquished property addendum to any contract offer.get a copy of the sales contract to. Web david kindness fact checked by marcus reeves a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be. Web a 1031 exchange comes with a few advantages, including deferring capital gains tax, expanding your portfolio and more control during the sale of property. Ad you've worked hard for your money, we work hard to keep it yours. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to calculate. The pros at equity advantage have provided everything you need in easily downloadable pdf files.1031 Exchange Calculation Worksheet CALCULATORVGW

Tax Free Exchange Agreement Section 1031 1031 Exchange Agreement Form

39 1031 like kind exchange worksheet Worksheet Live

️1031 Exchange Worksheet Excel Free Download Goodimg.co

1031 Exchange Worksheet Live Worksheet Online

1031 Exchange Documents Form Fill Out and Sign Printable PDF Template

turbotax entering 1031 exchange Fill Online, Printable, Fillable

1031 Exchange Order Form

1031 Exchange Worksheet Excel Ivuyteq

1031 Exchange Tax Forms Form Resume Examples yKVBEXlYMB

Exchange Today And Keep Your Investment Property's Equity Intact!

How To Divide The 1031 Proceeds After The Sale Of The Relinquished Property Feb 18,.

Web How 1031 Exchanges Are Different In 2021 Feb 23, 2021.

Ad Site Is Updated Continuously.

Related Post: